When to submit personal income tax reports?

Employers (individual entrepreneurs and organizations) submit personal income tax reports using forms 2-NDFL and 6-NDFL. The deadlines for submitting personal income tax reports are prescribed by law. Failure to timely submit certificates to the regulatory authorities of an organization or individual entrepreneur may result in a fine.

6-NDFL is submitted quarterly in the month following the reporting period. Annual reports 2-NDFL and 6-NDFL are submitted before 01.03 of the year following the reporting year.

Personal income tax reporting schedule for employees:

- until 30.04 – report on 6-NDFL for the 1st quarter;

- until 31.07 – report on 6-NDFL for 6 months;

- until 31.10 – report on 6-NDFL for 9 months;

- until 01.03 – reports on 2-NDFL and 6-NDFL for the year.

If during the reporting period, salaries were not paid to employees and personal income tax was not withheld, then zero reporting 6-NDFL and 2-NDFL does not need to be submitted .

If during the year there has been at least 1 payroll and income tax deduction, then you will have to report personal income tax to the tax office. 6-NDFL begins to be submitted from the quarter in which the accrual took place (salaries are accrued in August: for the 1st quarter and for 6 months there is no need to submit reports for 6-NDFL, you need to report for 9 months and for the year for 6-NDFL and 2-NDFL - in a year).

Where to take it

Certificates in form 2-NDFL must be submitted to the tax inspectorates at the place of registration of tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation). As a rule, organizations submit such certificates to the inspectorate, where they are registered at their location, and entrepreneurs - at their place of residence. This follows from paragraph 1 of Article 83 and Article 11 of the Tax Code of the Russian Federation. However, depending on the status of the organization (entrepreneur) and the source of income payment, the procedure for submitting 2-NDFL certificates may be different. The following table will help you navigate in all situations:

| No. | Source of income | Where to submit 2-NDFL | Base |

| 1 | Head office employees receive income from the head office | To the tax office at the location of the head office | clause 2 art. 230 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated February 11, 2009 No. 03-04-06-01/26, dated December 3, 2008 No. 03-04-07-01/244 and the Federal Tax Service of Russia dated October 14, 2010 No. ShS-37-3/13344 |

| 2 | Employees of separate divisions receive income from separate divisions | To the tax inspectorates at the location of separate divisions | para. 4 paragraphs 2 art. 230 Tax Code of the Russian Federation |

| 3 | Employees simultaneously receive income both in the head office and in separate divisions | Letters of the Ministry of Finance of Russia dated March 29, 2010 No. 03-04-06/55 and the Federal Tax Service of Russia dated October 14, 2010 No. ShS-37-3/13344 | |

| To the inspectorate at the location of the organization’s head office (indicating the checkpoint and OKTMO code of the head office) | ||

| To the inspectorate at the location of each separate unit (indicating the checkpoint and OKTMO code of the corresponding separate unit) | ||

| 4 | Employees of separate divisions receive income from separate divisions that are located in the same municipality, but in the territories of different tax inspectorates | To the inspectorate at the place of registration. You can register at any inspection office on the territory of the municipality. Submit certificates to this inspection for all separate divisions located on the territory of the municipality | para. 3 p. 4 art. 83, para. 4 paragraphs 2 art. 230 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 28, 2009 No. 03-04-06-01/224, dated February 11, 2009 No. 03-04-06-01/26, dated December 3, 2008 No. 03- 04-07-01/244 |

| 5 | Employees of separate divisions of organizations - the largest taxpayers who receive income from separate divisions | Choose your own inspection:

| Letter of the Federal Tax Service of Russia dated December 26, 2012 No. ED-4-3/22280, agreed with the Ministry of Finance of Russia. The document is posted on the official website of the Federal Tax Service of Russia |

| 6 | Employees working for entrepreneurs in activities on UTII or the patent taxation system | In the inspectorate at the place of business on UTII or the patent taxation system | para. 6 paragraph 2 art. 230 Tax Code of the Russian Federation |

If at the time of submitting certificates of income paid by a separate division, this division was closed (liquidated), submit the certificates to the tax office at the location of the parent organization (letter of the Federal Tax Service of Russia dated February 7, 2012 No. ED-4-3/1838).

Situation: do I need to send a certificate in Form 2-NDFL to the tax office at the employee’s place of residence? The employee is registered in another subject of the Russian Federation.

No no need.

Organizations paying benefits to employees are recognized as tax agents for personal income tax. This follows from paragraph 1 of Article 226 of the Tax Code of the Russian Federation. Tax agents must provide the inspectorate with information about the income paid and the tax withheld from it. However, you need to report and pay tax to the inspectorate where the organization is registered. This requirement is stated in paragraph 2 of Article 230 of the Tax Code of the Russian Federation. At the same time, tax legislation does not oblige agents to report on the employee’s place of residence.

6-NDFL: procedure for filling out the certificate

6-NDFL is the calculation of the amounts of personal income tax calculated and withheld by the tax agent. The certificate is submitted to the Federal Tax Service quarterly. 6-NDFL indicates the total income and tax deductions for all employees. The data in the form is entered on an accrual basis from the beginning of the reporting year. Total income indicators are recorded in rubles and kopecks, and tax amounts are rounded to the nearest ruble. If there are no values, then the value “zero” is written in the cells. All sheets of the document must be completed. In order to report personal income tax without penalties, you must correctly fill out form 6-NDFL.

for free.

Title page 6-NDFL: filling out

- adjustment number: 000 – initial report. If updated versions of the document are submitted, the code is assigned according to the number series: 001, 002, etc.

- Reporting period (code) - indicate the code of the period for which the certificate is provided: 21 - report on 6-NDFL for the 1st quarter; 31 – report on 6-NDFL for 6 months; 33 – report on 6-NDFL for 9 months; 34 – report on 6-NDFL for the year.

- Tax period (year) – indicates the year for which the report is submitted.

- Tax authority code - each Federal Tax Service is assigned its own code.

- Location (accounting) code - depends on the form of ownership of the business: for example, 120 - for individual entrepreneurs at the place of registration, 320 - for individual entrepreneurs at the place of business, 213 - at the place of registration for the largest taxpayer, 214 - for organizations that are not the largest taxpayers .

- The name of the organization or full name of the individual entrepreneur is indicated on the title page.

- Form 6-NDFL is signed by the head of the organization/individual entrepreneur (code 1) or an authorized representative (code 2).

Section 1 6-NDFL: how to fill out the lines

- Stock 010 – tax rate. The most commonly used rate is 13%. If several rates are used, then several sheets are drawn up under Section 1. In this case, lines 060-090 are filled in only on the first sheet.

- Line 020 – employee income; filled with an increasing total.

- Line 025 – accrued dividends are indicated.

- Lines 030 and 040 – amounts of deductions and calculated tax.

- Stock 045 – calculated tax from dividends.

- Line 050 – the amount paid to a foreign employee for a patent to work in the Russian Federation. This amount reduces the accrued personal income tax, which is calculated from the income of these employees.

- Line 060 – the number of employees to whom income was paid for the reporting period.

- Line 070 – the total amount of taxes withheld in the reporting period.

- Line 080 – the amount of tax that was not withheld from material benefits or employee income that were paid in kind.

- Line 090 – the amount of tax that is returned to the individual by the employer (for example, in the event of an overpayment of personal income tax).

Section 2 6-NDFL: how to fill out the lines

The second section reflects the amounts that the employer transferred for the employee in the reporting period.

- Line 100 – date of actual receipt of income (Article 223 of the Tax Code).

- Line 110 – date of tax withholding (Article 226 of the Tax Code of the Russian Federation). On the day of payment, tax is withheld from wages, financial assistance, vacation pay and sick leave, and on the day of actual transfer of income - on income received in kind or on income of material benefit.

- Line 120 – the date no later than which the tax must be transferred. The next day, personal income tax is transferred from wages and other payments; for vacation and sick leave payments - on the last day of the month in which payments were made (clause 6 of Article 226 of the Tax Code). If the transfer period coincides with a weekend or holiday, then set the date of the next working day.

- Line 130 – income including personal income tax, which corresponds to the date indicated in line 100.

- Line 140 – the amount of personal income tax withheld from the income indicated in line 130.

2-NDFL: procedure for filling out the certificate

To report personal income tax for the year for each employee, you need to fill out 2-NDFL certificates separately.

for free.

2-NDFL – certificate of income and calculated taxes of an individual. The tax agent must report personal income tax to the Federal Tax Service at the end of the year for each employee separately . Filling out 2-NDFL begins from the beginning of the reporting year. Data is entered monthly. Different types of income have different deduction rates, so the income of individuals is entered at each rate separately. The certificate must be filled out in capital letters, with dashes placed in the empty cells of the form. If the amount indicator is not specified, then the value “zero” is written in the cells. Double-sided printing of a document and stapling several sheets of it with a stapler are not allowed.

When submitting 2-NDFL in paper form, the tax agent must additionally provide the Register of 2-NDFL certificates (Appendix 1 of the order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated 08/02/2018) - a summary table with a list of taxpayers and numbers 2-NDFL certificates for them.

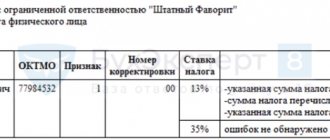

Title page 2-NDFL: how to fill out the lines

The title page of form 2-NDFL reflects the data of the employer , who is the tax agent.

- Field “Attribute”: attribute 1 is set in cases where the certificate contains information about paid income and transferred taxes of an individual (clause 2 of Article 230 of the Tax Code of the Russian Federation);

- sign 2 – if the tax on paid income could not be withheld (clause 14 of Article 226.1 of the Tax Code of the Russian Federation);

- sign 3 indicates that information about the withholding of personal income tax from payments to the employee is provided to the tax service by the legal successor (2 articles 230 of the Tax Code of the Russian Federation);

- Sign 4 – the successor was unable to withhold personal income tax from the income transferred to the employee (clause 5 of Article 226 and clause 14 of Article 226.1 of the Tax Code of the Russian Federation).

Section 1 2-NDFL: how to fill out the lines

The first section contains the data of the individual from whose income the tax agent transfers personal income tax: full name (full name), date of birth, etc.

- Taxpayer status is assigned from 1 to 6 (Order of the Federal Tax Service of Russia dated October 2, 2018 N ММВ-7-11 / [email protected] ) status 1 – to residents of the Russian Federation (except for individuals who work in the territory of the Russian Federation on the basis of a patent);

- status 2 - non-residents of the Russian Federation;

- status 3 – highly qualified non-residents of the Russian Federation;

- status 4 – participants of the State program to promote voluntary resettlement in the Russian Federation for compatriots who live abroad and are not tax residents of the Russian Federation;

- status 5 – to foreign citizens (stateless persons) who are recognized as refugees or have received temporary asylum in the territory of the Russian Federation and are not tax residents of the Russian Federation;

- status 6 – to non-residents of the Russian Federation who are employed in the Russian Federation on the basis of a patent.

A complete list of codes for the types of documents that are prescribed in Appendix No. 1 to the Filling Out Procedure, approved. By order of the Federal Tax Service of Russia dated October 2, 2018 N ММВ-7-11/ [email protected] :

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on the merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 15 | Temporary residence permit in the Russian Federation |

| 19 | Certificate of provision of temporary asylum on the territory of the Russian Federation |

| 21 | Passport of a citizen of the Russian Federation |

| 22 | Foreign passport of a citizen of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a Russian military personnel |

| 27 | Reserve officer's military ID |

| 91 | Other documents* |

*Other documents that are recognized as identification in accordance with the legislation of the Russian Federation or in accordance with international treaties of Russia.

Section 2 2-NDFL: how to fill out the lines

The first line of the section indicates the interest rate at which income tax was calculated (the most commonly used rate is 13%). If an employee received income at different tax rates during the reporting period, then it is necessary to issue a 2-NDFL certificate for each rate separately . In this case, you need to report personal income tax for the employee using several certificates.

The second section of the report indicates the total amounts of income and personal income tax at the end of the reporting period . In this case, the “total tax amount” and “tax base” are indicated in kopecks, and the amounts of tax deductions are rounded to whole rubles.

How to fill out section 2 of 2-NDFL with signs 1 and 3?

- Total income – including tax deductions.

- Tax base is the amount from which personal income tax is calculated without taking into account tax deductions.

- Tax calculation amount.

- Withholding tax amount.

- The amount of tax transferred to the state budget (the amounts of calculation, withholding and transfer must be equal).

How to fill out section 2 of 2-NDFL with signs 2 and 4?

- Total amount of income: this indicates the amount of accrued and actually paid income from which the tax agent did not withhold personal income tax.

- Tax calculation amount: the calculated but not withheld tax amount is recorded.

- Tax calculation amount: assigned the value “zero”.

- Withholding tax amount: assigned the value “zero”.

- Transfer tax amount: assigned the value “zero”.

- Amount of tax not withheld by the tax agent: indicates the amount of personal income tax that was calculated but was not withheld by the tax agent from the taxpayer.

Section 3 2-NDFL: how to fill out the lines

The third section of 2-NDFL indicates standard social and property deductions. These amounts are used to calculate the “Tax Base” in the second section of the certificate. The table contains the deduction code and the amount of personal income tax deduction. The number of completed lines is equal to the number of tax deductions due to the employee. If deductions are not used when calculating personal income tax for a taxpayer, then this section is not completed.

Certificate 2-NDFL on paper in 2022

From January 1, 2022, a tax agent with 10 or fewer employees can submit information on form 2-NDFL on paper.

But if there are 11 or more employees, then the certificates need to be submitted only electronically (Federal Law of September 29, 2022 No. 325-FZ).

Let us recall that until 2022, tax agents could submit 2-NDFL in paper form if the number of individuals who received income in the past year was up to 25 people.

In addition to the certificates, you need to draw up two forms of a special register (a list of all certificates). The register form is given in Appendix 1 to the order of the Federal Tax Service of Russia dated October 2, 2022 No. ММВ-7-11/ [email protected]

When you bring the certificates to the tax office, the inspector will check whether they are filled out correctly. If everything is in order, he will draw up two copies of the protocol for receiving information on the income of individuals on paper. After the inspection, the inspector will give you one copy of the register and one copy of the protocol.

Personal income tax deduction codes

Standard deductions (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation)

Deduction for a child under the age of 18, as well as for a full-time student under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child:

| 126 | Deduction for the first child |

| 127 | Deduction for the second child |

| 128 | Deduction for the third and each subsequent child |

| 129 | Deduction for a disabled child of group 1 or 2 |

A double deduction for a child under the age of 18, as well as for a full-time student under the age of 24 for a single parent, adoptive parent:

| 134 | Deduction for the first child |

| 136 | Deduction for the second child |

| 138 | Deduction for the third and each subsequent child |

| 140 | Deduction for a disabled child of group 1 or 2 |

A double deduction for a child under the age of 18, as well as for a full-time student under the age of 24 for one of the parents, if the other parent refused to receive his “child” deduction:

| 142 | Deduction for the first child |

| 144 | Deduction for the second child |

| 146 | Deduction for the third and each subsequent child |

| 148 | Deduction for a disabled child of group 1 or 2 |

Property deductions (Article 220 of the Tax Code of the Russian Federation)

| 311 | Expenses for the construction/purchase of housing on the territory of the Russian Federation, acquisition of land plots for individual housing construction, land plots on which the purchased residential buildings are located |

| 312 | Interest expenses on targeted loans received for the construction/purchase of housing in the Russian Federation, acquisition of land plots for individual housing construction, land plots on which the purchased residential buildings are located |

Social deductions (clauses 2, 3, clause 1, article 219 of the Tax Code of the Russian Federation)

| 320 | Expenses of the taxpayer for his own education, full-time education of a brother or sister under the age of 24 in educational institutions within the established limit |

| 321 | Expenses of a taxpayer-parent (guardian, trustee) for full-time education of their children (wards, former wards) under the age of 24 in educational institutions within the established limit |

| 324 | Expenses for medical services provided to the taxpayer himself, his spouse, parents, children (including adopted children), wards under the age of 18, as well as expenses for medications prescribed by the attending physician and purchased by the taxpayer at his own expense within the limits established limit |

Professional deductions (Article 221 of the Tax Code of the Russian Federation)

| 403 | Documented expenses incurred during the performance of work (provision of services) under civil contracts |

| 404 | Documented expenses associated with receiving royalties |

| 405 | Amount within the limits of cost standards associated with receiving royalties (as a percentage of the amount of income) |

Deductions for income not subject to personal income tax within certain amounts (clauses 8, 28, article 217 of the Tax Code of the Russian Federation):

| 501 | Deduction from the value of gifts received from organizations and individual entrepreneurs |

| 503 | Deduction from financial assistance provided to employees, as well as former employees who quit due to retirement |

| 505 | Deduction from the value of winnings and prizes issued as a result of competitions, games and other events held for advertising purposes |

| 508 | Deduction from one-time financial assistance to employee-parents (adoptive parents, guardians) at the birth (adoption) of a child |

The “Notification type code” field is assigned a value from 1 to 3:

- “1” – the employee provided a Notice of granting him a property tax deduction;

- “2” – the employee provided a Notice of provision of a social tax deduction;

- “3” – the employee provided a Notice of provision of a social tax deduction.

The details of the notification are also indicated: number, date of issue and the tax authority that issued the notification. If an employee has provided several notifications for tax deductions , then you need to report to personal income tax on all deductions. To do this, you need to fill out several lines and enter all notifications.

Certificate 2-NDFL is signed by the tax agent (code 1) or his representative (code 2).

Appendix (page 2) to 2-NDFL: how to fill out the lines

The appendix to the 2-NDFL certificate contains data on income and tax deductions by month for the reporting period . It does not need to indicate standard, social and property deductions. They should be indicated only in section 3. But if, for example, an employee was paid financial assistance (deduction code 503) in the amount of 4,000 rubles during the reporting period, then its non-taxable minimum must be reflected in the report in the month when the amount was paid .

How to fill out Appendix to 2-NDFL with features 1 and 3?

When filling out a certificate with characteristics 1 or 3 in the fields of the Appendix, you must indicate the serial numbers of the months, income codes, and the amounts of income accrued and paid to the employee. If accruals were made for several types of income, then they must be entered separately for each code.

How to fill out the Appendix to 2-NDFL with signs 2 and 4?

If you need to report on personal income tax with sign 2 or 4, then the Appendix indicates the amount of income actually received from which personal income tax was not withheld.

The tax rate indicated is the same as in section 2 of the 2-NDFL certificate.

Individual income codes used in the 2-NDFL report

It is necessary to report on personal income tax in the Appendix to the 2-NDFL certificate by month using special income codes for individuals. The table shows the main and frequently used codes.

| 1010 | Dividends |

| 1400 | Income received from the rental or other use of property (except for similar income from the rental of any vehicles and communications equipment, computer networks) |

| 2000* | Remuneration for performing labor or other duties; salary, allowance not subject to paragraph 29 of Article 217 of the Tax Code of the Russian Federation and other taxable payments to military personnel and equivalent categories of individuals. In addition to payments under civil contracts |

| 2001 | Directors' remuneration and other similar payments received by members of the organization's governing body (board of directors or other similar body) |

| 2002 | Amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues) |

| 2003 | Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues |

| 2010 | Payments under civil contracts (except for royalties) |

| 2012 | Vacation pay |

| 2013 | Compensation for unused vacation |

| 2014 | Payments in the form of: severance pay; average monthly earnings for the period of employment; compensation to the manager, deputy managers and chief accountant of the organization in a part that generally exceeds three times the average monthly earnings or six times the average monthly earnings for dismissed workers from organizations in the Far North and similar areas |

| 2300 | Temporary disability benefits |

| 2400 | Income from: – rental or other use of any vehicles (including sea, river, aircraft and cars) for transportation; – fines and other sanctions for idle time (delay) of vehicles at loading (unloading) points; – leasing or other use of pipelines, power lines (power lines), fiber-optic, wireless communication lines, and other means of communication, including computer networks |

| 2510 | Payment by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training for an individual |

| 2530 | Payment in kind |

| 2610 | Material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs |

| 2720 | Cost of gifts |

| 2740 | The cost of winnings and prizes received at competitions, games and other events for the purpose of advertising goods, works and services |

| 2760 | Financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age |

| 2762 | Amounts of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) upon the birth (adoption) of a child |

| 4800 | Other income. For example: scholarships; compensation for delayed wages (in part exceeding the minimum amount) |

* An exception is the salary of a deceased employee paid to his relatives. Such income is not subject to personal income tax (letter of the Ministry of Finance of the Russian Federation dated June 10, 2015 No. 03-04-05/33652). Consequently, a certificate in form 2-NDFL for heirs is not filled out. It is also not filled out for a deceased employee, since after his death the obligation to pay tax ceases (clause 3, clause 3, article 44 of the Tax Code of the Russian Federation). In this case, you need to report on personal income tax for the period when the person paid taxes.

What should a tax agent do if, while filling out reports, personal income tax was discovered to be overly withheld and transferred to the state budget?

Responsibility

If you do not submit a certificate on time in Form 2-NDFL, the inspectorate may fine you under Article 126 of the Tax Code of the Russian Federation. The fine is 200 rubles. for each document that is not submitted on time.

In addition, for failure to submit or untimely submission of a 2-NDFL certificate at the request of the tax inspectorate, the court may impose administrative liability in the form of a fine in the amount of:

- for citizens – from 100 to 300 rubles;

- for officials – from 300 to 500 rubles.

Such liability applies to officials of the organization, for example to its head (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Important: from January 1, 2016, a new type of liability has been established for tax agents - a fine for false information in submitted documents. Therefore, if the inspectorate finds errors in the 2-NDFL forms received, it may fine the tax agent. The fine will be 500 rubles. for each document that contains an inaccuracy.

There will be no fine only if the tax agent himself discovers the error and promptly (before the inspection finds the error) clarifies the information. The new responsibility will also apply to 2-NDFL forms that organizations submit for 2015. This procedure is provided for in paragraph 1 of Article 126.1 of the Tax Code of the Russian Federation.