How to check for account restrictions on the Federal Tax Service website

In general, taxpayers should find out about the blocking of accounts from the tax authorities.

According to paragraph 4 of Article of the Tax Code of the Russian Federation, inspectors are obliged no later than the next working day after the decision to suspend operations on a bank account is made to send the account owner a copy of the relevant document. This can be done via telecommunication channels or through your personal account. Also, a copy can be given to the taxpayer (his representative) in person. Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

However, in practice, the Federal Tax Service often neglects this responsibility. Moreover, there are no negative consequences for failure to comply. The courts refuse decisions about which inspectors did not notify taxpayers in violation of an article of the Tax Code of the Russian Federation (see, for example, resolution of the Federal Antimonopoly Service of the West Siberian District dated June 10, 2010 No. A45-23256/2009). Therefore, in most cases, taxpayers receive information about account blocking from their bank.

You can also check the presence or absence of a tax authorities’ decision to block an account (your own or a counterparty’s) using a special service on the Federal Tax Service website.

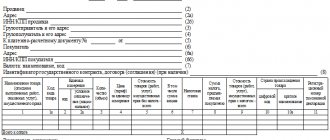

To do this, select the “Request for current suspension decisions” option in the “Request Type” menu. Next, in the fields that appear below, indicate the TIN of the organization, as well as the BIC of the bank in which the account being verified is opened (if you are interested in information about the counterparty’s account, the corresponding TIN and BIC can be found from the agreement concluded with him). After this, you need to click the “Send request” button. The result of the check will appear on the same page. If the Federal Tax Service has decided to block the account, the details of this document will be indicated.

How to file a complaint

A citizen of the Russian Federation can complain to the Federal Tax Service in several ways.

Contact by phone

A citizen of the Russian Federation has the opportunity to call a special contact center phone number in order to consult on any issue of interest, as well as report any violations detected.

It would be more rational to call a specific department of the Federal Tax Service: this will increase the likelihood that measures will be taken in a timely manner.

It is necessary to take into account the fact that such a call will be of an informational nature only. In this case, communication between the client and the specialist must meet the following requirements:

- personalization . Anonymous messages in any form will not be accepted;

- compliance with the scope of activity of the Federal Tax Service;

- justification – specific evidence of the violation must be provided;

- emotional neutrality . Information that offends the dignity of third parties is not permitted.

Personal appeal

A citizen can contact the regional or central office of the Federal Tax Service either in writing or orally. In this case, the client himself will only need to identify himself by presenting his passport . If during the discussion it turns out that a verbal complaint is not enough, the client will be asked to write a complaint in an official form.

Sending a complaint by mail

The Federal Tax Service can accept a complaint from a citizen remotely if he does not want or cannot contact the department by other means. To submit an application, you must:

- send a letter with the application and all attached materials to the central or regional branch of the Federal Tax Service at their official address;

- send the application and all necessary materials by fax.

When using postal services, it is better to send a registered letter with notification: this way the client will know for sure that the complaint has been received.

You can verify that information has been successfully sent by fax by contacting the desired department by phone.

Filing a complaint online

Submitting an application online is the fastest and most convenient way. To do this, just follow this algorithm:

- visit the website nalog.ru;

- in the main menu, select the option corresponding to the person who is filing the complaint (individual, legal entity or individual entrepreneur);

- select the option “Filing a complaint to the tax authorities”;

- select from the list the situation that most closely matches the problem of the complaint;

- fill out the form that appears;

- attach the necessary documents;

- send an application.

This instruction is relevant only for those users who already have their own personal account on the site. Otherwise, you will have to go through a simple registration procedure.

Reasons for introducing account restrictions

The tax office may suspend account transactions in five cases. Three of them are related to “documentary” violations, and two are related to non-payment of taxes and other payments.

Let's start with the first group. The Federal Tax Service has the right to block an account if, within 20 working days after the end of the established period, a declaration based on the results of the tax period, calculation of insurance contributions or 6-personal income tax (subclause 1, clause 3 and clause 3.2 of Art. Tax Code of the Russian Federation) are not submitted. There is a closed list of reasons why reporting on taxes and contributions is not considered submitted (clause 4.1 of Article of the Tax Code of the Russian Federation; see “On what grounds will tax authorities not accept reporting submitted after July 1”).

Submit reports free of charge to all regulatory authorities through the EDF operator

IMPORTANT

For failure to submit interim reporting, even if it is called a declaration (for example, for income tax), as well as financial statements, accounts are not blocked. This was repeatedly stated by officials of the Ministry of Finance (letters dated 04.07.13 No. 03-02-07/1/25590 and dated 19.08.16 No. 03-11-03/2/48777) and the Federal Tax Service (clause 20 of the appendix to the letter dated 17.04. 17 No. SA-4-7/ [email protected] ).

We also note that the Federal Tax Service has the right to inform the taxpayer in advance about the risk of seizure of a bank account in connection with failure to submit reports (clause 3.3 of Art. Tax Code of the Russian Federation). Notification is sent no later than 14 days before the decision to block is made. You can read it in the taxpayer’s personal account on the Federal Tax Service website (for more details, see “Accounts for unsubmitted reports will be blocked according to the new rules”).

The next reason for “freezing” an account concerns persons who are required to submit reports in electronic form via telecommunication channels through an EDF operator. If, within 10 working days from the date of occurrence of this obligation, the taxpayer has not concluded an agreement necessary for electronic document management with the Federal Tax Service, his account may be blocked (clause 5.1 of article 23 and subclause 1.1 of clause 3 of article 3 of the Tax Code of the Russian Federation).

REFERENCE

Persons required to report electronically include the largest taxpayers, as well as organizations and individual entrepreneurs whose average number of employees for the previous year exceeded 100 people.

In addition, these are newly created organizations with an average number of employees of more than 100 people (clause 3 of Article 80 of the Tax Code of the Russian Federation). Also, these are almost all organizations and individual entrepreneurs that submit VAT returns (clause 5 of Article 174 of the Tax Code of the Russian Federation). And those who paid income for the year to more than 10 individuals (clause 2 of Article 230 and clause 10 of Article 431 of the Tax Code of the Russian Federation) must send electronic payments for contributions and personal income tax reporting. For more details, see “Electronic reporting: who is obliged to report to regulatory authorities via the Internet.” Another “documentary” violation is related to non-compliance with the regulations on electronic document flow with the inspection. The account may be blocked if the taxpayer delays sending to the Federal Tax Service for more than 10 working days an electronic receipt for receipt of the TCS request for the submission of documents, explanations or a notice of summons to the inspectorate (subclause 2, clause 3, article 3 of the Tax Code of the Russian Federation).

Receive requirements and send requests to the Federal Tax Service via the Internet

The second group of grounds for arresting an account includes two situations. The first is the inspection making a decision on the collection of taxes, fees, and contributions from money in bank accounts (clause 2 of Article 2 of the Tax Code of the Russian Federation). Let us remind you that the Federal Tax Service can make such a decision only after the deadline for voluntary payment, which is indicated in the requirement addressed to the taxpayer, has expired. The second situation is to ensure the recovery of the amounts specified in the decision based on the results of the audit. This is possible if the Federal Tax Service has already imposed a ban on the alienation (pledge) of other property, but its “accounting” value is less than the additional accrued arrears (subclause 2, clause 10, article 101 of the Tax Code of the Russian Federation).

Procedure and terms of consideration

For the convenience of taxpayers, two additional services have been developed to obtain information about submitted applications from individuals and legal entities to the central office of the Federal Tax Service or the Administration for the constituent entities of the Russian Federation.

"Find out about the complaint"

Using such a service, which is available on the website https://service.nalog.ru/complaints.do, you can find out:

- date of receipt and incoming number of the document being considered by the service;

- the result of the consideration (a final decision was made or the appeal was sent to another territorial unit);

- the time period allotted for making a decision and whether it has been extended;

- status of the request (completed, under consideration).

To obtain information about a pending claim, you must fill out an electronic form indicating the available information. First of all, this concerns:

- tax authority that was the addressee of the request (select from the drop-down menu);

- the type of person from whom the complaint was received (individual or legal entity);

- name of company;

- incoming claim number.

All other fields of the form are optional. After entering the security code (captcha), you will be able to obtain the necessary information about the decision made or the current stage of consideration.

"Resolutions on complaints"

This online service can be used to obtain information about the results of consideration of applications from other taxpayers by the Federal Tax Service. This information is absolutely public, since it excludes data whose access is limited in accordance with the requirements of the legislation of the Russian Federation.

Using this service, you can find out what decisions are made on similar claims, for which you need to fill out a short form https://www.nalog.ru/rn77/service/complaint_decision/, indicating the tax authority, taxpayer category, type and topic of the dispute, and also an article of the tax code.

In response to a request, the system will issue a whole set of decisions made in a given period of time.

Received applications are considered within 30 days, but in some cases this period may be extended (for a maximum of another 30 days). Notification of the extension of the deadline is sent to the taxpayer in writing (by email or regular mail).

What are the consequences of blocking a current account?

“Freezing” a current account means that it is impossible to make payments for transactions with counterparties, since debit transactions on the account will be unavailable. This may lead to delays in relevant obligations and, as a consequence, to the emergence of demands for payment of penalties and fines established by the contract. Also, violation of the payment deadline under contracts may give the counterparty the right to withdraw from the contract and recover damages from the violator.

Difficulties in work will also arise if the account of the supplier, contractor or performer is blocked. Although income transactions are not “frozen,” the taxpayer will not be able to dispose of incoming funds.

Find out about the taxes paid by the counterparty and the violations committed by him Start an audit

Seizing an account can also put the company's employees at risk. After all, in order to pay wages (including in cash through the cash register), it is also necessary to make an expense transaction. And the requirements for payment of wages are in the same queue with the requirements of the Federal Tax Service for the payment of taxes (clause 2 of Article 855 of the Civil Code of the Russian Federation; see “The order of payments in the payment order in 2022”). Therefore, wages can be paid from a “frozen” account only on the basis of a special document: a writ of execution, a court order, a decision of the labor inspectorate or a certificate from the labor dispute commission.

What to do if your current account is blocked

If operations on the account are suspended based on a decision of the Federal Tax Service, you need to contact the inspectorate to find out the reason for the blocking. As already mentioned, the tax authority is obliged to send the taxpayer a copy of the relevant document no later than the next day after the account is blocked (clause 4 of Art. Tax Code of the Russian Federation). Also, the right to receive copies of decisions of the Federal Tax Service is fixed in subparagraph 9 of paragraph 1 of article of the Tax Code of the Russian Federation.

In addition, the servicing bank has information about the reason for the blocking. Therefore, perhaps a faster way to obtain this information is to contact the managers of the credit institution. Unless, of course, the bank itself notified the client about the suspension of operations on the account (see “Banks were recommended to immediately notify clients about the blocking of accounts”).

Once the reason for the arrest has been determined, measures can be taken to unblock the account.

How to unblock a current account

In most cases, the easiest way is to perform those actions, the failure of which caused the “freezing”. So, if the account is blocked for failure to submit a declaration, RSV or 6-NDFL, then the necessary report should be sent. And if the reason for the arrest is failure to pay a tax or contribution, then you need to transfer payments (including from third party accounts; see: “How to fill out a payment slip when paying tax for another person: explanations from the Federal Tax Service”), and transfer the relevant information to the Federal Tax Service .

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

As a general rule, the decision to cancel the seizure of an account is made by the inspectorate within the next day after receiving documents confirming the elimination of the reason for the blocking. Another day is required to transmit this decision to the bank. Thus, restrictions on the account must be lifted two business days after the taxpayer has completed the necessary actions (clauses 3.1, 3.2 and 4 of Article of the Tax Code of the Russian Federation).

But in some cases, it will not be possible to release the account from seizure using the above method. This may be a consequence of both the specific reason for the blocking and the illegality of the actions of the Federal Tax Service. In these situations, you need to do the following.

If the reason for blocking is to secure an audit decision, the taxpayer can access the account without appealing the relevant decision. To do this, you need to top up your account balance so that it exceeds the additional accrued amounts. And then the inspection will be obliged to “unfreeze” the account in terms of excess (clause 9 of Art. Tax Code of the Russian Federation, letter of the Ministry of Finance dated January 16, 2013 No. 03-02-07/1-10). After this, you can proceed to appeal the decision of the Federal Tax Service, if there are reasons for this.

If the arrest of the account was the result of errors or unlawful actions of the inspectorate, then the only way to remove the restrictions is to appeal the relevant decision.

Where to contact?

A citizen of the Russian Federation has the right to file a complaint against illegal actions on the part of the tax service authorities or the actions of a specific employee within one year. In accordance with Article 139 of the Tax Code of the Russian Federation, the mentioned period is counted from the moment of the violation. Once the application has been accepted, the service must forward it to the main governing body.

You can write a statement:

- Head of the Federal Tax Service branch;

- to the higher authority of the Federal Tax Service . He is authorized to cancel all actions and orders of subordinates;

- to court . If even the higher authorities of the Federal Tax Service failed to achieve a positive decision, you need to contact the courts - they will help restore justice, although the risk of delaying the process is quite high;

- to the prosecutor's office . If the case has a criminal bias, the prosecutor's office will be the most effective option.