Depreciable property

Depreciable property is fixed assets (fixed assets) and intangible assets (IF) owned by enterprises and intended for commercial purposes. Wherein:

- their useful life (USL) is more than 12 months;

- initial cost - more than 100,000 rubles.

Such property also includes capital investments in fixed assets transferred for rent or for free use in the event of inseparable improvements being made by the lessee or the borrower with the consent of the transferring party.

Exceptions:

- for a unitary enterprise (UE), depreciable property will be the property received from the owner of the UE for operational management or economic management;

- property received by the investor from the owner under an investment agreement for the provision of utility services is depreciated from the investor during the period of validity of the investment agreement.

They do not depreciate: land and natural resources (water, subsoil), inventories, goods, unfinished capital construction projects, securities, as well as financial instruments of futures transactions.

The following assets are not recognized as depreciable assets:

- transferred (received) for free use (except for transfer to state and municipal bodies and enterprises in cases stipulated by the laws of the Russian Federation);

- if they are transferred to conservation for more than 3 months;

- if they are being reconstructed or modernized for more than 12 months and are not in use during this time;

- Russian ships for the time they are in the Russian International Register of Ships.

When an asset is re-preserved, depreciation is calculated on it in the same way as it was before its preservation, and its useful life is increased by the time corresponding to the time of preservation.

We’ll figure out how to set up processes in your accounting department if everyone seems to understand everything, but the work is still in chaos: we’ll distribute a recording of our webinar from an expert.

Directions for use and disadvantages of non-linear depreciation methods

| Methods for calculating non-linear depreciation | Target | Disadvantages of the method |

| Declining balance method (accelerated depreciation) | Reduce possible losses associated with wear and tear of equipment and increase the efficiency of use of fixed assets | – impossibility of reducing the entire residual value of fixed assets; – cannot be used for OS with a useful life of less than 3 years; – there is no point in using it to calculate the depreciation of buildings, structures and furniture; it cannot be used for OS of a narrow production focus |

| Write-off method based on the sum of years of useful life (accelerated depreciation) | Faster return of funds spent on the purchase of an object through depreciation charges as part of the proceeds from the sale of goods or provision of services. | – increase in the cost of manufactured products at the very beginning of use, since depreciation amounts will be the highest (the cost is overestimated) |

| A method of reducing the value of depreciable assets in proportion to the volume of work performed | Carry out flexible depreciation of fixed assets in accordance with the volume of production | – inconvenience: the amount of depreciation must be determined monthly, since the volume of production may change; – the method is applicable exclusively for OS objects that can document the expected volume of production; The need for production planning |

Shock absorption groups

To calculate depreciation (or they also say “wear and tear”), all property is combined into separate groups according to SPI, which the company determines in accordance with Art. 258 of the Tax Code of the Russian Federation on the date of putting the facility into operation and taking into account the special OS classifier (it is approved by the Government of the Russian Federation). If any OS is not in the classifier, the SPI for it is installed by the company itself, based on the recommendations of the manufacturers and technical parameters.

After the OS is put into operation, its SPI can be increased if, after reconstruction, modernization or technical re-equipment, the actual period of its use has been extended.

Capital investments, the cost of which is reimbursed to the lessee or borrower by the lessor or lender, are depreciated by the latter persons in accordance with the accounting policies and the Tax Code of the Russian Federation.

Capital investments made with the approval of the lessor or lender, the cost of which is not reimbursed by them, are amortized by the lessee or lender over the term of the lease or gratuitous use.

The SPI of an asset is determined based on the validity period of the patent, certificate and any other restrictions on the terms of use of the asset in accordance with the laws of the Russian Federation or a foreign state (according to the ownership of the asset), as well as taking into account its expected period of use. If it is difficult to determine such a period, it is taken equal to 10 years (but not more than the period of operation of the company).

For such NA as, for example, “know-how”, exclusive rights to inventions, audiovisual works, etc., the company itself can determine their PPI (but it cannot be less than 2 years).

All depreciable assets are divided into 10 groups. The 1st category includes the most short-lived ones - from 1 to 2 years of use. The longest STI for objects of the 10th group is more than 30 years.

For used OS, when using the linear method, the SPI is reduced by the number of years (months) of operation by their former owners. If the period of actual use of such an OS by the former owners turns out to be equal to or longer than its SPI, determined by the OS classifier, then the company can itself determine its SPI, based on safety requirements and other factors.

Adjustment of increasing (decreasing) depreciation rates will entail a reduction (increase) of the SPI. However, this does not affect the selection of the depreciation group.

Regardless of which option you choose, depreciation should be calculated every month.

The procedure for applying the nonlinear method

Art.

259 of the Tax Code of the Russian Federation offers 2 options for determining wear. The choice of one or another option must be specified in the company's accounting policy. The option considered in this article is characterized by calculating depreciation according to a group formed on the basis of the useful life, and not according to each inventory number. However, it cannot be applied to objects from groups 8, 9 and 10 according to:

- buildings;

- NMA;

- structures;

- transfer devices;

- objects used in the search for hydrocarbon raw materials in a new offshore field.

Belonging to one or another category is determined on the basis of clause 3 of Art. 258 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 “On the Classification of fixed assets included in depreciation groups.”

This option for calculating depreciation also allows you to use bonus depreciation to minimize original cost.

For more details, see the material “Procedure for recognizing bonus depreciation in tax accounting”

Straight-line depreciation method

If for tax purposes you have chosen the linear method of calculating depreciation, you must calculate its amount for each object. To do this, its original (replacement) cost is multiplied by the depreciation rate, which is found as follows:

K = 1/n*100%,

Where:

- K is the depreciation rate as a percentage of the original (replacement) cost of the object;

- n — SPI of the object per month. (increasing or decreasing coefficients are not taken into account here).

Calculation of depreciation on capital investments in fixed assets using this method begins with the lessor or tenant (under an agreement for the free use of fixed assets) from the 1st day of the month following the one in which the property was put into operation.

Calculation of depreciation for objects removed from the depreciable list ends on the 1st day of the month following the one in which they were removed.

When returning depreciable objects upon termination of a contract for gratuitous use, as well as when reactivating the operating system and completing the reconstruction (modernization) of the operating system, depreciation is calculated from the 1st day of the next month.

Non-linear depreciation method

If, for tax purposes, you preferred a non-linear method, then on the 1st day of the tax period for each group you will need to determine the total balance (SB), which is considered as the cost of all objects of this group.

Next, the SB of each group is found on the 1st day of the new month. Please note that the SB calculation does not take into account assets for which depreciation is considered exclusively by the linear method (clause 3 of Article 259 of the Tax Code of the Russian Federation).

When a new property is put into operation, its initial cost will increase the SB of the group to which it belongs, from the 1st day of the month following the month the property was put into operation.

In cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of assets, the change in their value is taken into account in the SB of the group to which they are assigned.

The SB of a particular group is reduced every month by the amount of accrued depreciation.

The monthly depreciation amount for the group is:

A = B * k/100,

Where:

- A - depreciation amount (per month);

- B - SB depreciation group;

- k is the depreciation rate.

Now we suggest you familiarize yourself with the monthly depreciation rate for different groups:

- 1st gr. - 14.3;

- 2nd gr. - 8.8;

- 3rd gr. - 5.6;

- 4th gr. - 3.8;

- 5th gr. - 2.7;

- 6th gr. - 1.8;

- 7th gr. - 1.3;

- 8th gr. — 1.0;

- 9th gr. - 0.8;

- 10th gr. - 0.7.

Calculation of depreciation on capital investments in leased fixed assets in a non-linear manner begins with the lessor or tenant (as well as in case of free use of fixed assets from the lender and the borrower) according to the general rules, i.e. from the 1st day of the next month.

When returning property due to termination of gratuitous use, as well as during reactivation, completion of reconstruction (modernization) of the asset, depreciation is calculated in a non-linear manner from the 1st day of the next month, and the asset of a particular group is increased by the residual value.

When assets are disposed of, the group's assets are reduced by their residual value. When, upon disposal of property, the group's safety net is reduced to zero, it is liquidated.

If the group’s SB becomes less than 20,000 rubles, in the month following the month when this happened (if during this time the group’s SB did not increase by putting into operation a new asset), the company can liquidate such a group, and the value of the SB is attributed to non-operating expenses of the current period.

Non-linear depreciation

Linear technique

The straight-line depreciation method, set out in the new Article 259.1 “The procedure for calculating depreciation amounts when applying the linear depreciation method,” introduced into the Tax Code by Law No. 158-FZ of July 22, 2008 (hereinafter referred to as Law No. 158-FZ), has not changed.

The following calculation method will still apply. Depreciation is calculated for each fixed asset item. In this case, calculations are carried out according to the following formula: K = 1/n × 100%,

where K is the depreciation rate as a percentage of the original cost of the fixed asset; n is the useful life of this fixed asset item, in months.

Example 1

The organization purchased a computer. This asset belongs to the second depreciation group with a useful life of more than 2 years up to 3 years inclusive.

The company has established a minimum useful life for this group of 25 months.

The depreciation rate will be: K = 1/25 × 100% = 4% per month.

This method is simple and should not cause any problems for accountants.

Nonlinear accruals

As for the nonlinear method, even before 2009 it was more complex. In this regard, this method was used extremely rarely, although it gave (especially in the first half of its useful life) a noticeable effect.

As practice shows, this method of calculating depreciation was more effective during the first 40 percent of the useful life, and during the remaining 60 percent, depreciation with the non-linear method was less than with the linear method. In other words, if the useful life was set to 10 years (120 months), then depreciation under the non-linear method was higher (especially in the early years) during the first four years and less during the remaining six years compared to the straight-line method.

But, as stated above, almost all organizations stated in their accounting policies: “The linear depreciation method will be used,” although paragraph 2 of Article 259 of the Tax Code, which was in force until the end of 2008, states: “Depreciation is calculated separately for each item of depreciable property.” .

Since 2009, the depreciation procedure has changed dramatically.

First, all depreciable property is subject to either the straight-line or non-linear depreciation method. The taxpayer must confirm his choice in the accounting policy for 2009 (clause 3 of Article 259 of the Tax Code as amended by Law No. 224-FZ of November 26, 2008). The exception is buildings and structures included in the eighth to tenth depreciation groups, that is, fixed assets with a useful life of more than 20 years.

According to the procedure in force until 2009, the depreciation method could not be changed. The rules that came into force in the new year are more liberal: you can switch from a non-linear method to a linear one, although not more than once every five years (clause 1 of Article 259 of the Tax Code).

But there are no restrictions for the transition from the linear method to the nonlinear one, except that this is possible only from the beginning of the tax period, which is the calendar year.

The procedure for applying the nonlinear method is set out in the new Article 259.2 of the Tax Code. Its main difference from the previous non-linear method is that depreciation should be calculated not for each individual fixed asset object, but according to depreciation groups.

Thus, if the organization’s accounting policy stipulates the use of a non-linear method, then at the beginning of 2009 for each depreciation group (except for the eighth to tenth) a total balance is determined, which represents the total residual value of all depreciable property items belonging to this depreciation group.

In the future, the total balance of a particular depreciation group is determined on the 1st day of each month. In this case, the amount of accrued depreciation is calculated monthly.

According to paragraph 4 of Article 259.2 of the Tax Code, the amount of depreciation for a group for a month is made according to the formula:

A = B × K/100,

where A is the amount of accrued depreciation for a given month for the corresponding depreciation group; B is the total balance of the corresponding depreciation group; K is the depreciation rate for the corresponding depreciation group.

In this case, the norms are determined by paragraph 5 of Article 259.2 of the Code (see table).

Table

| Depreciation group | Depreciation rate (monthly) |

| First | 14,3 |

| Second | 8,8 |

| Third | 5,6 |

| Fourth | 3,8 |

| Fifth | 2,7 |

| Sixth | 1,8 |

| Seventh | 1,3 |

| Eighth | 1,0 |

| Ninth | 0,8 |

| Tenth | 0,7 |

For some reason, the legislator defined norms for the nonlinear method for the eighth to tenth groups, although (as mentioned above) exclusively the linear method is used for them.

When it comes to reconstruction, modernization, or additional equipment of a fixed asset, the cost of these improvements must be taken into account, which in turn will lead to an increase in the total balance of the group. If property that was previously exploited is acquired (or appears at the enterprise as a contribution to its statutory activities), then it is included in the depreciation group in which it was registered with the previous owner (clause 12 of Article 258 of the Tax Code).

Thus, for each month the total balance increases by the amount of fixed assets put into operation and decreases by the amount of depreciation.

Example 2

The organization decided to use the non-linear method since 2009 and consolidated it in its accounting policy. For all depreciation groups, the total balance is determined, in particular for the third group it will be 1,000,000 rubles. Then depreciation for this group will be for January 2009: 1,000,000 rubles. × 5.6 /100 = 56,000 rub.

Accordingly, depreciation for February will be calculated based on the balance as of February 1, etc.

In January, a fixed asset worth 100,000 rubles was purchased and put into operation. The value of this asset will be reflected on February 1st. As a result, the total balance for the third group as of February 1, 2009 will be: RUB 1,000,000. + 100,000 rub. — 56,000 rub. = 1,044,000 rub.

In situations where the total balance for any group becomes less than 20,000 rubles, you must wait until the next month. However, if the situation has not changed on the 1st day of the next month, that is, the balance again turned out to be less than the specified limit, then the under-depreciated cost can be written off as non-operating expenses of the current period (clause 12 of Article 259.2 of the Tax Code).

It should be noted that the likelihood of such a situation occurring is much higher in small organizations. If we are talking about medium or large enterprises, then it is quite difficult to imagine circumstances in which the balance for any of the groups would be less than 20,000 rubles.

Choosing the best option

A comparison of the linear and nonlinear methods shows that, as before, more depreciation occurs during the first 35 to 40 percent of the useful life.

So, for example, calculating depreciation of a fixed asset using the straight-line method (provided that the useful life is assumed to be 25 months), the depreciation rate will be 4 percent (1/25 × 100%). If the cost of fixed assets is 100,000 rubles, the amount of depreciation will be 4,000 rubles. Under the same conditions, but using a non-linear method, the depreciation rate established by the legislator is 8.8 percent.

Calculations show that depreciation during the first nine months of using the non-linear method will be more than 4,000 rubles, and during the remaining period - less than this amount. If the residual value in the 18th month reaches 19,000 rubles, depreciation will continue in the 19th month, and the balance in the amount of 17,400 rubles will be written off as non-operating expenses.

Thus, the benefit in terms of higher depreciation is achieved during the first nine months, or 36 percent of the useful life. During this time, 44 percent of the cost of the fixed asset will be depreciated, and 56 percent in the remaining period. Using the linear method, 36,000 rubles (4,000 rubles × 9 months) will be depreciated in the first nine months, which is 36 percent of the cost of the fixed asset, and in the remaining months - 64 percent.

For those organizations that strive for accelerated depreciation, the non-linear method will certainly be more effective.

Residual value

Since when using the non-linear method the residual value is determined not for each fixed asset, but for the group as a whole, in some cases it becomes necessary to calculate the residual value for individual fixed assets. In particular, this is the situation when selling a fixed asset, because based on the sale price of this asset, it will be possible to draw a conclusion about the taxation of this operation in accordance with Article 268 of the Code.

According to paragraph 1 of Article 257 of the Tax Code, as amended since the beginning of this year, the residual value of property depreciated by the non-linear method is determined by the formula:

Sn = S × (1 – 0.01 × k)n,

where Sn is the residual value of the specified objects after n months after their inclusion in the corresponding depreciation group;

S is the initial (replacement) cost of the specified objects; n - the number of full months that have passed from the date of inclusion of the specified objects in the corresponding depreciation group until the day of their exclusion from this group; k is the depreciation rate (including taking into account the increasing (decreasing) coefficient) applied to the corresponding depreciation group.

Example 3

Let us determine the residual value of a fixed asset from the sixth group, the cost of which is 1,000,000 rubles. The depreciation rate for this group is 1.8% per month. The number of full months of stay in the group is 10.

Then: S10 = 1,000,000 rub. × (1 - 0.01 × 1.8)10, or S10 = 1,000,000 rub. × (0.982)10 = 1,000,000 rub. × 0.834 = 834,000 rub.

Paragraph 1 of Article 258 of the Tax Code requires the establishment of a useful life for each fixed asset item. When using the straight-line depreciation method, the useful life has an important function, since it forms the depreciation rate. As for the nonlinear method, the situation is different.

When depreciable property is put into operation, the total balance increases by the initial cost of such objects. The total balance is reduced by the amount of accrued depreciation. This value depends on the total balance and the depreciation rate for the group.

Since there is no connection between the useful life of depreciable property and the total balance in the group, legislators determined that this object can be excluded from the depreciation group without changing its total balance. A similar maneuver is carried out on the date of withdrawal of this asset from the group (clause 13 of Article 259.2 of the Tax Code). Thus, the possible removal of an object from the group does not in any way affect the calculation of depreciation for it.

The situation is similar with the useful life in the event of liquidation or sale of fixed assets: this value does not affect the calculation of residual value.

Yuri Donin, Candidate of Economic Sciences, certified tax consultant

Methods for calculating depreciation of fixed assets

Fixed assets (FA) include property used for the production and sale of goods (work, services) or for the management needs of the company, the initial cost of which is more than 100,000 rubles.

To calculate OS wear, the law allows you to choose both linear and nonlinear methods.

The initial cost of an asset is defined as the sum of expenses for its purchase, construction, production, delivery and bringing it to a state in which it can be used (excluding VAT and excise taxes). Or as market value, if the OS is transferred free of charge or discovered during inventory.

The residual value of an asset is the difference between its original cost and the amount of depreciation accrued over the period of its operation.

For OS of own production, the cost is determined as the cost of the finished product, increased by excise tax (if the OS relates to excisable goods).

As a general rule, the residual value of fixed assets, for which depreciation is found in a non-linear way, is determined as follows:

Sn = S * (1 - 0.01 * k)n,

Where:

- Sn is the residual value of objects after n months after their inclusion in a particular group;

- S is the initial (replacement) cost of the asset;

- n is the number of full months that the asset was in a particular group, excluding months when the asset was not depreciable;

- k is the depreciation rate (taking into account the increasing or decreasing coefficient).

The initial cost of an asset may change in cases of its modernization, completion, additional equipment, reconstruction, technical re-equipment, partial liquidation and other significant changes.

Video: How to calculate depreciation

Candidate of Economic Sciences, N.D. Klikunov, analyzed two methods for calculating depreciation - the compound interest method and the linear method, and showed that the linear method is not perfect.

Depreciation charges are the main way to compensate for the costs of purchasing certain equipment used in production. This amount is calculated in two ways - linear and nonlinear. Depreciation deductions occur throughout the entire service life of the equipment specified in the documents and begin immediately after it is placed on the balance sheet.

Depreciation and income tax

Depreciation allows you to write off the cost of property according to norms determined by law as expenses for income tax purposes. In this case, as already mentioned, it is calculated separately for each depreciation group (this is in the non-linear method) or separately for each object of the depreciable asset (linear option).

When selling a depreciable asset, the resulting profit is included in the income tax base in the same reporting period, and the loss is included in other expenses in accordance with Art. 268 NK.

The company can take into account the costs of capital investments in the following amounts in the costs of the reporting period: no more than 30% of the initial cost of fixed assets from groups 3–7 and no more than 10% of the initial cost of fixed assets from other groups. The same rules apply to the costs of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of fixed assets, the amounts of which are determined in accordance with Art. 257 Tax Code of the Russian Federation.

If the company decides to use these opportunities, the fixed assets, after they are put into operation, must be included in depreciation groups at their original cost minus the amounts previously allocated to expenses.

Step-by-step instruction

To calculate depreciation in a non-linear way in tax accounting, you must perform the following steps on the first day of each month:

Step 1. Calculation of the total balance for each depreciation group - the residual value of all fixed assets from the group is summed up, those fixed assets for which the linear method is applied according to the Tax Code of the Russian Federation are excluded.

The total balance will change if in the previous month the fixed assets:

- put into operation;

- sold or written off;

- sent for conservation;

- partially liquidated;

- changed its value as a result of revaluation, modernization, reconstruction.

Step 2. A suitable rate is selected depending on the depreciation group for which deductions are calculated.

Step 3. Depreciation is calculated as the product of the total balance by the rate divided by 100.

To determine the total amount of depreciation for a month for all fixed assets, you need to add up the deductions for each depreciation group.

Formulas for calculation

Features of calculations for tax purposes are as follows:

- Depreciation charges are calculated monthly - on the first day of each month.

- Calculations are carried out separately for each depreciation group.

- Deductions are calculated from the total cost of all fixed assets included in the depreciation group minus the already accrued depreciation, that is, the residual value is taken.

To calculate depreciation using the nonlinear method in tax accounting, you need to know the following indicators:

- The total balance is the sum of the residual value of all fixed assets from one depreciation group minus those fixed assets for which the straight-line method is applied.

- The depreciation rate is an indicator established by Article 259.2 of the Tax Code of the Russian Federation depending on the number of the depreciation group: varies from 0.7 to 14.3.

The formula for calculation is:

A = Total balance * Norm / 100,

The total balance is taken for a specific group and represents the difference between the cost of fixed assets and the depreciation accrued on them at the time of calculation.

The depreciation rate is also taken for the corresponding group.

A company can purchase new fixed assets, sell or write off existing ones, upgrade old operating systems, all this leads to a change in the total balance, so this indicator must be calculated every month separately.

The need to calculate deductions disappears when the depreciation group is liquidated; this is possible in two cases:

- All fixed assets from the group have been retired or written off.

- The residual value of the depreciation group last month turned out to be less than 20,000 rubles, while on the first day of the current month it did not increase.

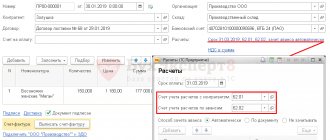

Example

Initial data:

The organization has 10 computers with an initial cost of RUB 1,500,000. For this equipment, as of June 1, 2022, depreciation of RUB 500,000 was accrued. These computers belong to depreciation group 2 and have a useful life of 3 years.

In May 2022, the organization bought 2 more computers - each was accepted at a cost of 120,000 rubles.

The norm for group 2 is 8.8%.

It is required to calculate depreciation as of June 1, 2022 for the second depreciation group.

Calculation:

Total balance 06/01/2019 = (1500000 – 500000) + 240000 = 1240000.

Depreciation as of 06/01/2019 = 1240000 * 8.8 / 100 = 109120.

Basic methods of calculating depreciation in accounting policies

You can choose the method of calculating depreciation for the next tax period, reflecting it in your UP. True, this is not always possible: this rule does not apply to assets that, according to the Tax Code of the Russian Federation, are depreciated exclusively using the straight-line method and no other way. In addition, it is even allowed to change the method of calculating depreciation - this can be done from the beginning of the next tax period. However, it is allowed to switch from a non-linear option to a linear one no more than once every 5 years.

When changing the depreciation method in the UP, you will need to determine the SB by the residual value of your depreciable property (or the residual value of the asset) as of the 1st day of the tax period from the beginning of which you made changes to the UP. Then the depreciation rate for each object will be determined based on its remaining SPI, calculated on the 1st day of the tax period, from the beginning of which the use of the linear method is fixed in the UE.

Transition to the linear method

For fixed assets that are depreciated using the non-linear method, from the beginning of the next tax period the organization has the right to switch to the linear method of calculating depreciation. However, this is possible no earlier than five years after the start of using the nonlinear method. This procedure is provided for in paragraph 1 of Article 259 of the Tax Code of the Russian Federation.

During the transition, you need to establish the residual value of each fixed asset. This indicator should be determined as of January 1 of the year, starting from which the organization will calculate depreciation using the straight-line method. Calculate the depreciation rate based on the remaining useful life of each asset. If, after the end of its useful life, the fixed asset is not fully depreciated, the organization has the right to continue accruing depreciation until its cost is completely written off. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated July 21, 2014 No. 03-03-RZ/35549.

Which method should you choose?

Let's analyze the features of each method using a specific example. Let's assume we have an OS worth 110,000 rubles. and SPI 9 years (108 months). Then the coefficient K for the linear method will be 0.925926, and depreciation will be accrued in equal amounts over 9 years and will amount to 1,018.52 rubles. per month.

With the nonlinear method, our OS will fall into the 5th group with a coefficient K equal to 2.7. For him, depreciation in the first month will be 2,970 rubles, after a year - 2,138.51 rubles, after 4 years - 798.31, and after 5 years and 3 months the residual value in the amount of 19,611.09 can generally be written off to one-time expenses. Thus, the nonlinear method is characterized by a more accelerated write-off of the value of property as expenses than the linear one.

If a company plans to receive stable income over a long period of time, the straight-line depreciation method will be more optimal for it. If a company was created for a specific transaction or the prospects for its activities are vague, then it is quite logical to choose a non-linear method.