SZV-STAZH - what kind of reporting is this?

Previously, the functions of the new report were performed by the RSV-1 form, which included data on the employee’s period of work at the enterprise.

This register has been abolished since this year. Since the Pension Fund of Russia remained responsible for recording the length of service of employees in order to calculate their pension, the body introduced a new form SZV-STAZH, which must be submitted at the end of the reporting year. It includes information about the period of a person’s labor activity at the enterprise.

If you look closely at it, you will immediately notice the similarity of this report with SZV-M, a form introduced last year to record working pensioners.

At the same time, SZV-STAZH has more detailed information, recording the start and end dates of work during the year, as well as indicating and deciphering the periods when the employee did not work, but his place at the enterprise was retained.

Attention! In addition, the employer is required to hand over SZV-STAZH upon dismissal of an employee. The accountant must fill out this report only for this employee, print it out, certify it and hand it over.

In addition, the report must contain information about the accrual and payment of contributions. Since this information is currently submitted by employers to the tax office, the Pension Fund of Russia remains without this information.

When an employee retires, the SZV-STAZH form must be sent to the Pension Fund of the Russian Federation so that this body receives all the necessary information to assign a payment.

What kind of SZV-STAZH report is this and who submits it?

Until 2022, the PF received information about the length of service of employees from RSV-1 reports submitted by employers.

In connection with the transfer of management of contributions to the Federal Tax Service and the cancellation of the mentioned report, the fund had a need to approve new forms from which it could obtain the information of interest. The new report is similar to the other new form SZV-M, but includes more detailed information for each employee. But at the same time they do not cancel each other. Based on SZV-M, the fund, first of all, tracks working pensioners to remove the indexation of their pensions. The new report will collect information on length of service and contributions.

All employers will be required to submit the new form only in 2022 with information for the previous calendar year. However, there are exceptions.

Important! If an employee plans to retire, a report on it will need to be sent within 3 days from the date of application, and the resigning employee must now be given a printed form on the day of dismissal. If you do not issue a certificate, you may receive an administrative fine.

The following will be required to submit a report:

- Companies and separate divisions opened by them;

- Individual entrepreneurs, lawyers, private investigators, notaries who have hired employees.

At the same time, they will need to include in the report all their employees with whom they have concluded employment agreements under an employment contract, or have drawn up a GPC agreement, and they receive income subject to contributions to the Pension Fund.

Who should submit the SZV-STAZH form

The legislation establishes a list of persons who must submit the SZV-STAZH report:

- Organizations of all forms of ownership that have employment contracts, fixed-term employment contracts and civil law agreements (GPC) with individuals, including their branches and representative offices.

- Entrepreneurs, as well as lawyers, notaries, licensed detectives who carry out private practice, when they use hired workers.

Attention! Thus, this reporting must be compiled and submitted by all employers for employees and persons in whose favor the payment of remuneration is made, on which insurance premiums must be calculated.

Who should provide SZV-STAZH?

According to the rules, a new report will have to be submitted by:

- All companies, as well as their affiliates in other regions;

- Entrepreneurs, notaries, lawyers and licensed detectives who have employees.

Attention! The report will need to show all registered employees with whom the individual entrepreneur or company has an employment contract or a civil employment agreement, and they receive cash payments for which payments are made to social funds.

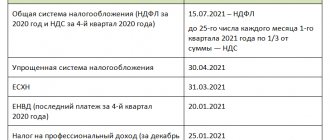

Deadline for passing SZV-STAZH in 2022

The SZV-STAZH form refers to annual reporting, which in general an organization must submit once a year, after its completion. At the same time, the deadline is established at the legislative level by what date to submit for the previous year - until March 1 of the following reporting year.

Attention! Thus, reporting for 2022 must be submitted by March 1, 2022. In addition, this form must be given to employees upon dismissal.

In relation to this report, the rule also applies to postponing the deadline to the next working day if it falls on a weekend or holiday. Therefore, since March 1 falls on a weekend, the due date is postponed to March 2, 2022.

In addition, the deadlines for registration of SZV-STAZH have been determined for:

- When an employment contract with an employee is terminated - on the employee’s final day of work, along with the rest of the required documents.

- When an employee retires, the employer must send the SZV-STAZH to the Pension Fund of Russia within three days from the date of receipt of the request.

Who must submit the SZV-STAZH report in 2022?

SZV-STAZH is a new form used for reporting for 2017, adopted by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. The report reflects information about the periods of work of employees, as well as the fact of accrual and payment of “pension” contributions.

All employers must submit the SZV-STAGE form in 2022, including: organizations and their separate divisions, individual entrepreneurs, private lawyers and notaries. The report includes information about all employees working both under an employment contract and under GPC agreements, the remuneration for which “pension” contributions are accrued. For individuals officially recognized as unemployed, a new SZV-STAZH form is submitted by the employment service.

If individual entrepreneurs, private lawyers and other self-employed persons do not have employees, then they do not have to submit a report on their work experience.

You should submit information about your experience to your territorial unit of the Pension Fund of the Russian Federation at the place of registration. The absence in the reporting period of payments to an employee under a valid employment or GPC contract does not relieve the employer from the need to include this employee in the SZV-STAZH information.

Reporting methods

There are several ways to send this reporting:

- The report on paper can be submitted directly to the Pension Fund representative. To do this, you need to fill it out in two copies. It is best to prepare it on a computer using specialized programs so that you can generate an electronic file, which in this case also needs to be transferred.

- Through an electronic document management system for entities with more than 25 people involved. This method requires the mandatory presence of an electronic digital signature - EDS, as well as the execution of an agreement with a special communications operator. The majority of employers must submit the SZV-STAZH form this way.

Important! Reporting on paper can only be provided if the number of insured persons is no more than 25 people.

Features of filling out the SZV-STAZH form upon dismissal

The current rules of law determine the employer’s obligation to issue the employee the SZV-STAZH form on the day of termination of the agreement. If it is formed by an enterprise based on the results for the year, all employees of the company are included in it.

You might be interested in:

Reporting to statistics: list of forms and deadlines for submission in 2018

In the case when it is compiled upon dismissal, the information included in this report should concern only the dismissed employee in order to prevent the disclosure of personal information of other employees, which is considered a violation.

When compiling this report for a dismissed employee, he is assigned the “Initial” status, and the current year number is entered, which is also the year of dismissal.

The tabular part indicates the start date of work (if the employee has been working since the beginning of the year, then the start day is indicated), and the date of completion of the employee’s work activity at the enterprise.

If the contract with an employee is terminated on December 31, then the corresponding mark is placed in column 14.

When the SZV-STAZH form is drawn up upon dismissal, sections 4 and 5 do not need to be filled out.

SZV-STAZH 2022 – new report form

All employers are required to report annually using the new form SZV-STAZH

08/16/2017Russian tax portal

Author: Tatyana Sufiyanova (tax and duties consultant)

The new obligation appeared after a new form of reporting to the tax authority was introduced: Calculation of insurance premiums. Let us remind you that from January 1, 2022, the tax service is now in charge of the calculation and payment of insurance premiums. The RSV-1 report was cancelled. Namely, it reflected information about the length of service of employees. The new form for calculating insurance premiums does not contain such information.

From March 5, 2022, new reporting forms to the Pension Fund began to operate: SZV-STAZH and EDV-1. The company will be required to submit new forms to the Pension Fund in 2022, reporting for 2022. The deadline for submitting reports is set no later than March 1, 2022.

But cases have been established for submitting a new form of SZV-STAZH already in 2022. These new rules apply to enterprises that:

1) Liquidated this year;

2) Who have employees retiring in 2022. In this case, the information must be submitted to the Pension Fund within three calendar days from the date on which the employee applied for a pension. Simultaneously with the new SZV-STAZH, the accompanying EDV-1 form will be sent.

How to fill out the SZV-STAZH form correctly?

It is easy to fill out, and in it you need to indicate the registration number, the status “Pension Assignment”, and indicate the year for which the information is being submitted.

In the tabular part of the form, you list the company’s employees, noting their SNILS number and period of work. If your employee is retiring in 2022, for example, then you enter the period of service until the retirement date. It is necessary to fill out information on the SZV-STAZH form for all employees with whom you have concluded employment and civil law contracts.

We present an example of filling out such a form and a blank form that you can download. In the example, I made an entry for an employee who retired on March 26, 2022, to show you that the period of work must be indicated before the date of retirement (if you have similar cases).

Based on the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p “On approval of the form “Information on the insurance experience of insured persons (SZV-STAZH)”, the form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV) -1)”, employers fill out incoming documents in ink, with a ballpoint pen in block letters or using computer technology without erasing or corrections. Any colors except red and green can be used.

The SZV-STAZH form has continuous page numbering within each form. The serial number of the page is entered in the field specified for numbering.

The page number indicator (field “Page”), which has 3 familiar places, is written as follows: for the first page - “001”, for the thirty-third - “033”.

The page number indicator (field “Page”), which has 5 acquaintances, is written as follows: for the first page - “00001”, for the thirty-third - “00033”.

It should be noted that for unemployed citizens, information in the SZV-STAZH form is provided by the employment service authorities.

SZV-STAZH for dismissed employees

Please note that all employees who quit in 2017 (regardless of their age) must be given a completed SZV-STAZH form on the day of dismissal. And information about dismissed employees will be submitted to the Pension Fund in 2022 in the form SZV-STAZH for 2022. The fine for the fact that the employer does not hand over the SZV-STAZH upon dismissal is 50,000 rubles (based on Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

If an employee of retirement age resigns from a company, then he needs to be issued with SZV-STAZH and at the same time submit a report to the Pension Fund of the Russian Federation in the current 2022 (without waiting for 2022).

Post:

Comments

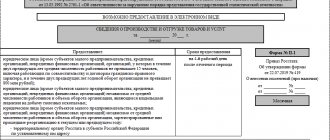

Report submission form

The SZV-STAZH form combines information about the business entity itself, as well as information about each employee or individual in whose favor the amounts for which insurance premiums need to be calculated were accrued during the year.

Attention! A mandatory appendix to the annual report is an inventory in the EDV-1 format, which is a document also containing basic information about the policyholder, as well as general data on calculated and transferred contributions, as well as the number of insured persons.

New form

Starting from 2022, all employers must submit a new SZV-STAZH report to the Pension Fund. This form discloses information about the pension experience of employees of the organization (individual entrepreneur). SZV-STAZH is an annual report and must be submitted for the first time for 2022. Everything new raises questions, and this form is no exception. Therefore, employees responsible for submitting these reports need a sample of filling out the SZV STAZH for 2022.

Let us remind you that this form must be submitted by all employers (organizations and entrepreneurs) who pay remuneration to individuals (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p):

- within the framework of employment contracts;

- under civil law contracts;

- under copyright contracts and licensing agreements.

The universal obligation to submit new reports makes it necessary to have in front of your eyes a sample of filling out the SZV STAZH.

In general, legal entities submit the SZV-STAZH form to the territorial divisions of the Pension Fund of the Russian Federation at the place of their state registration. As for businessmen, individual entrepreneurs submit a report at their place of residence (Clause 1, Article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

Sample of filling out SZV-STAZH

Let's take a closer look at how SZV-STAGE is issued.

Section No. 1 - Information about the policyholder

In the line with the registration number, you should enter the number assigned by the Pension Fund to the employer at the time of registration with this department.

Next, information about the TIN and KPP of the business entity is reflected. If the employer is an individual entrepreneur, his number must consist of 12 characters, and there is no checkpoint code. If the policyholder is an organization, its TIN includes 10 digits, and two empty cells are crossed out.

Below is the abbreviated name of the company, and for an individual entrepreneur - his full personal data (full name). This information must correspond to the constituent documents of the entity.

In the “Type of information” column you should reflect:

- “Initial” - when SZV-STAZH is sent by the subject for the first time;

- “Additional” - in the case when the original report is supplemented with a new one.

- “Pension assignment” - when SZV-STAZH is issued for an employee retiring.

Section No. 2 - Reporting period

There is only one column in which you need to enter the year number of the report.

Section No. 3 - Information about the period of work of the insured persons

This section has a tabular form, and it is necessary to record line by line information about employees with whom the organization had labor agreements or civil contracts during the reporting period.

In the columns “Last name”, “First name” and “Patronymic” personal information about the employee is indicated.

Next comes the “SNILS” column, where the insurance number assigned to the employee in the Pension Fund is recorded.

The column “Work period” includes two separate columns - the start date and end date of the work period. If the employee worked the entire year, then the first and final days of the year are entered here.

If one of the employees needs to show several working periods (for example, he quit and was hired several times during the year), then they are recorded in separate lines below each other. However, the columns with personal data and SNILS are indicated only once - in the first line, and then they are left empty.

When an employee retires, the end date is the expected date of this event.

If work was carried out under a civil contract, then the period of its validity is entered. If payment for the work has been made in full, then the code “AGREEMENT” is written in column 11; if not, “NEOPLDOG”, “NEOPLAVT” must be entered here.

A code is written in the “Territorial conditions” column if the work was performed in special environmental conditions. All possible codes can be found in Appendix 1.

A code is written in the “Special conditions” column if the employee worked in dangerous or harmful conditions that entitle him to receive an early retirement pension. Possible codes can be seen in Appendix 2.

Important! If work was carried out under special conditions, but there are no correctly executed supporting documents, then you cannot enter any codes here.

A mark is made in the column “Information about the dismissal of the insured person” only if the date of dismissal falls on December 31.

You might be interested in:

Form 6-NDFL: deadlines, instructions for filling

Section No. 4 - Information on accrued (paid) insurance contributions for compulsory pension insurance

This section is filled out only if the report is submitted to persons retiring. It includes two questions and must be answered by checking a box.

Section No. 5 - Information on paid pension contributions in accordance with pension agreements for early non-state pension provision

Information must also be entered into this section only when an employee retires. Here you need to record the periods for which accruals were made, and also answer the question by checking whether contributions were transferred for the specified periods.

How to fill out SZV-STAZH for 2022

Information on insurance experience consists of five sections, which are filled out in accordance with the instructions for filling out the SZV-STAZH form, adopted, like the form itself, by PFR Resolution No. 3p.

Section 1 contains information about the employer:

- registration number in the Pension Fund of the Russian Federation, assigned upon registration of the employer as an insurer;

- Employer's TIN, as well as checkpoint for organizations and their separate divisions;

- briefly indicate the name of the organization (for example, Alpha LLC), or full name. entrepreneur;

It should also be noted what type of information the submitted form SZV-STAZH belongs to:

- “initial” - the report initially submitted,

- “supplementary” - if errors were found in the original form and data on individuals were not taken into account on personal accounts because of them,

- “assignment of a pension” - for those who, in order to receive a pension, need to take into account the period of work of the current year for which the reporting deadline has not yet arrived.

Section 2 reflects the reporting period for which information is submitted. Unlike the monthly SZV-M form, the length of service in the information is reflected for the entire year: 2022.

Section 3 includes information about the period of work of employees:

- Full name is entered. and SNILS of each employee,

- the period of work (columns 6-7) is indicated within the reporting year, that is, the report for 2022 needs to reflect only dates included in this year. If one employee has several periods of work in the reporting year, then his full name. and SNILS are filled out once, and each period is entered on a separate line.

Although SZV-STAZH is a new reporting for all employers, its completion is in many ways similar to section 6 of the RSV-1 form used previously.

When assigning a pension, the period of work is indicated up to the date of expected retirement specified in the employee’s application.

The codes that must be indicated in columns 8-13 of section 3 are contained in the Classifier of parameters for preparing persuance accounting information attached to the Procedure for filling out the SZV-STAZH form.

Information about dismissal in column 14 only if the employee was dismissed on December 31 of the reporting year.

Sections 4 and 5 with information on accrued and paid contributions need to be filled out only when submitting information with the “pension assignment” type. Section 4 indicates whether “pension” contributions were accrued and paid for the periods of work specified in section 3, and section 5 indicates whether contributions were paid under early non-state pension agreements.

The completed SZV-STAZH 2022 form is signed by the responsible person, dated and stamped by the employer.

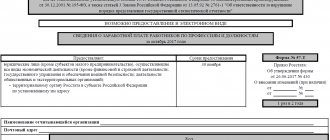

Sample of filling out the EDV-1 inventory

Directly together with the fully completed SZV-STAZH form, the organization is also required to draw up and send an inventory to it in the EDV-1 form. There a summary of all the information offered is made.

The compiled inventory can be assigned one of three types:

- "Original".

- "Corrective".

- "Canceler."

To do this, you need to mark the empty box with an “X” next to the selected type.

Section 1 - it contains the details of the organization. Filling out is carried out according to the same principle as Section 1 in the SZV-STAZH form itself.

Section 2 - the “Reporting period” field should always contain “0”, but in the “Year” field the four-digit report year number is written.

Section 3 - the total number of employees for whom information is transmitted in the SZV-STAZH form is entered here;

Section-4 - information must be entered here only when information is submitted with the types SZV-ISKH and SZV-KORR and marked “Special”. The data specified here must contain information for the entire period for which the report is issued.

Section 5 - information is entered in this section if data of the SZV-STAZH or SZV-ISKH types is transferred to employees who, due to work in difficult or harmful conditions, have earned the right to receive pension payments ahead of schedule.

At the end, the form must be signed by the director in the appropriate field and the date on which this was done.

Filling procedure

The report consists of five sections, which must be filled out sequentially, in accordance with Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

Read more: how to fill out the EFA-1 form

Brief instructions for filling out the SZV-STAZH are as follows:

- Fill out section No. 1 “Information about the policyholder”: PFR registration number, TIN, KPP and short name of the person submitting the report.

- Select the type of information to be submitted.

- Specify the reporting period - calendar year.

- The main thing is data on the insurance experience of the insured persons. This is section No. 3, a table intended for information about employees:

- column 1 - record number in order;

- columns 2-4 - last name, first name and patronymic of the person;

- column 5 - SNILS;

- columns 6 and 7 - periods of work, the start and end dates of the periods are indicated in the format DD.MM.YYYY;

- columns 8-10, 12 and 13 are filled in if the working conditions of the person in respect of whom the corresponding line is filled out allow him to count on early retirement; the columns indicate codes of circumstances giving this right;

- column 11 - additional information, for example, about vacations or sick leave;

- Column 14 is filled in if the date of dismissal of the employee falls on December 31 of the reporting year, in this case an “X” is placed in the column.

- Section No. 4 of the form is filled out only if its type is “Pension assignment”. In this case, the sign “X” indicates the accrual of insurance premiums for the periods specified in section 3.

- Section No. 5 is intended for cases where there are pension agreements for early non-state pension provision and only with the “Pension Assignment” report type.

- In conclusion, the head of the organization or the person authorized to sign the appropriate power of attorney signs the document, puts the date of preparation and the seal of the company, if any.

ConsultantPlus experts examined what forms and deadlines exist for submitting reports on personalized accounting in 2022. Use these instructions for free.

Zero reporting on the SZV-STAZH form?

According to the approved rules for submitting a report, it must be sent to the Pension Fund in the case when an organization or entrepreneur has a valid employment agreement with at least one hired employee. In the case when a self-employed citizen, entrepreneur, lawyer, notary and other persons do not have employees, then they do not need to draw up and submit a document.

This decision is also supported by the fact that the very structure of the report implies the presence in it of at least one line with information about the employee, and if there is none, then such a form will no longer be able to pass error control.

In relation to companies, this cannot be determined unambiguously. The thing is that the company initially has one employee - a director, information about whom is specified in the Charter. It follows that if the company has not signed a single employment contract, even with the director himself, then there is no need to draw up a report and send it, as well as to include the manager there.

Attention! On the other hand, if there is a signed agreement between the director and the company, but there is no activity, a report must be drawn up. In this case, the only person listed there will be the manager.

Problems of this kind also arose when entering the SZV-M form, but in that situation the Pension Fund quickly issued clarifications on how to act in such a situation. As for the new report, there have been no official comments yet.

Fines for failure to submit a report or for failure to issue upon dismissal

The law provides for several types of fines, depending on the circumstances under which the violation was recorded:

- The report was sent in full, but after the set date - 500 rubles each. according to information for each employee whose deadline was violated;

- The report was sent on time, but it did not include data on individual employees - 500 rubles each. according to information for each employee for whom information was not submitted;

- The report was sent in full, and within the time limits established by law, but upon inspection it turned out that for some employees false information was provided - 500 rubles each. according to information for each employee for whom the data was submitted incorrectly.

There are also several other fines associated with this reporting:

- If the report was submitted in paper form, while the organization is obliged to submit it only electronically - 1000 rubles;

- When an employee was dismissed, he was not given a report with his information on contributions, or when the employee retired, the report was not sent to the Pension Fund within 3 days - 50,000 rubles.

Due dates

The form must be submitted no later than March 1 of the year following the billing period. Since in 2022 March 1 is a Tuesday, a working day, the deadline for submitting the report will not be postponed. The report must be submitted no later than 03/01/2022.

We recommend preparing and sending information to the Pension Fund in advance. This will protect the institution from penalties. If an error is discovered in the reporting, there is time to correct it and submit an adjustment report. Otherwise, the organization will be punished with a ruble.

| Employee category | Deadline and where to apply |

| Current employees | Until 03/01/2022 - to the Pension Fund of Russia (*within five days from the date the request was received by the employee) |

| Those working under civil contracts (in case of calculation of insurance premiums) | |

| Fired in 2021 | |

| Those leaving in 2022 | In the hands of the resigning employee on the day of dismissal + to the Pension Fund of the Russian Federation in the next reporting period (until 03/01/2023) |

| All employees during liquidation and reorganization of the enterprise | In the hands of those dismissed on the day of dismissal + to the Pension Fund of the Russian Federation within one month from the date of the interim liquidation balance sheet or transfer act |

| Retiring | To the Pension Fund of the Russian Federation within three calendar days from the date of the employee’s application for a pension |

| Individual entrepreneur without employees | They don't rent |

Submission of the SZV-STAZH report to the Pension Fund of the Russian Federation is possible only together with the EDV-1 form, which contains information on the policyholder.