Reporting for 2022

The deadline for paying individual entrepreneur taxes for 2022 falls at the beginning of 2022. The table below shows the deadlines for payment of taxes for 2022 by individual entrepreneurs on the simplified tax system, under other special regimes and personal income tax.

How to fill out a declaration under the simplified tax system, read our material .

PSN is not considered here, since a patent can only be issued within a calendar year and must be paid before the end of its validity period. Therefore, conscientious taxpayers have already paid for the patent for 2022.

How an individual entrepreneur fill out the 3-NDFL declaration for 2022 is described in the ready-made solution “ConsultantPlus”. Sign up for a free trial subscription to K+ and stay up to date with the latest accounting news.

Individual entrepreneurs pay their own social insurance contributions until the end of the current year. But a pension contribution in the amount of 1% of the excess income over the amount of 300,000 rubles for 2022 is ordered to be paid by individual entrepreneurs by 07/01/2021.

Let us recall what is meant by income in the context of this contribution, that is, from what amount should the excess be considered:

If an individual entrepreneur has employees, then all tax payments for them - personal income tax and insurance contributions - are made as usual on a monthly basis (contributions) and as income is paid to individuals (personal income tax).

Property taxes for 2022 - transport, property and land - individual entrepreneurs pay as an ordinary individual until December 1, 2022. If IP:

- applies a special regime;

- uses the property in its activities;

- The tax base for property is determined as the average annual value,

then for such real estate the individual entrepreneur is exempt from paying property tax.

Below in the table are the deadlines for payment of atypical taxes for individual entrepreneurs for 2022:

Find out more about individual entrepreneur property tax in our article .

Particular attention should be paid to individual entrepreneurs from affected industries who were granted a deferment in paying taxes for 2022 and for the 1st quarter of 2022. The payment deadline for these debts is precisely at the beginning of 2022.

IMPORTANT! The procedure for paying debts: monthly in equal installments in the amount of 1/12 of the calculated amount no later than the last day of the month, starting from the month following the one in which the new payment deadline occurs until the debt is fully repaid (Resolution of the Government of the Russian Federation dated 04/02/2020 No. 409).

Individual entrepreneur taxes on OSNO (general tax regime)

If an entrepreneur works in a general mode, the list of taxes will look like this:

- Personal income tax for yourself - 13% on business income;

- Personal income tax for employees - 13% or 30%;

- VAT;

- insurance premiums for yourself;

- insurance premiums for employees;

- transport, property, land, water tax, excise taxes, mineral extraction tax (if there are grounds for this).

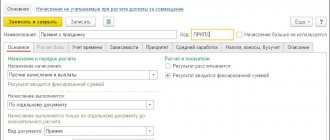

Personal income tax on business income

Personal income tax is calculated using the formula: (Business income - Tax deductions) × 13%. Business income includes proceeds from sales and the cost of property received free of charge. You can understand that income was received from entrepreneurial activity using primary documents, the type of property, and the OKVED code from the Unified State Register of Individual Entrepreneurs. The list of non-taxable personal income tax income is given in Art. 217 Tax Code of the Russian Federation. The date of receipt of income is the day the money is received in the individual entrepreneur’s account or the day the income is transferred in kind (Article 227 of the Tax Code of the Russian Federation).

Tax deductions are amounts that we subtract from income before calculating taxes. Deductions are standard, social, property and professional. A professional deduction is the amount of an entrepreneur’s expenses that are associated with running a business and are confirmed by documents (more about this in Article 221 of the Tax Code of the Russian Federation). If an individual entrepreneur cannot document expenses, then he has the right to apply a professional deduction at the rate of 20%.

If your documented expenses do not exceed 20% of all income received for the year, choose a standard deduction. This way you can pay less taxes. For example, if your income for the year was 300,000 rubles, and expenses were 45,000 rubles, then by using the deduction according to the standard, you will reduce the tax base not by 45, but by 60 thousand rubles.

If the amount of deductions is greater than the amount of income, but in a given tax period the tax base and income tax are equal to zero. In most cases, an individual entrepreneur on OSNO cannot carry forward losses to the next tax period.

Individual entrepreneurs independently calculate advance payments for personal income tax during the year and pay them no later than the 25th day of the month following the reporting period. To calculate the tax to be paid additionally at the end of the year, reduce the tax accrued for the year by the paid trade fee, personal income tax withheld by tax agents, and advance payments. Tax payments for the year must be paid by July 15 of the following year.

Personal income tax on employee salaries

Individual entrepreneurs withhold personal income tax from payments to employees who work under an employment or civil contract. The following are exempt from personal income tax (according to Article 217 of the Tax Code of the Russian Federation):

- gifts and financial assistance up to 4,000 rubles;

- government benefits;

- compensation;

- reimbursement of interest on loans for the purchase or construction of housing;

- And so on.

Income tax on an employee's salary is calculated as follows: (Employee's income - Tax deductions) × Tax rate.

The tax rate for residents of the Russian Federation is 13%, for foreign citizens - 30%. Tax on accrued wages must be paid no later than the next working day. It is important that personal income tax is paid precisely from the salaries of employees, and not from the organization’s funds. For example, if an employee’s salary is 20,000 rubles, 2,600 rubles will go to the budget, and the employee will receive 17,400 rubles.

VAT

IP on OSNO pays VAT. The standard tax rate is 20%, but in some cases it is reduced to 10% or 0%. For example, a reduced rate of 10% is applied to individual entrepreneurs selling medicines, children's products, food products, printed publications, etc. The 0% rate is used by individual exporters.

The rules for calculation and payment are prescribed in Chapter. 21 Tax Code of the Russian Federation. VAT for payment to the budget is calculated at the end of the tax period - quarter: Amount of input VAT - amount of output VAT. Input VAT is included in the cost of goods and services purchased from suppliers. Output VAT is included in the cost of goods sold and services provided; it has already been paid by buyers.

To correctly calculate VAT, you need to carefully enter all invoices into the book of purchases and sales in order to make calculations based on them at the end of the quarter. VAT for deduction is reflected in the purchase book, for accrual - in the sales book.

Individual entrepreneurs who earned less than 2 million rubles (excluding VAT) over the previous three calendar months are exempt from paying VAT. This rule does not apply to those who sell excisable goods: tobacco, alcohol, fuel.

Insurance premiums for yourself

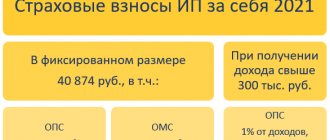

Individual entrepreneurs must also take care of their future pension and treatment. To do this, each entrepreneur pays insurance premiums for himself annually. In 2022, the amount of contributions is 40,874 rubles, including 32,448 rubles to the Pension Fund and 8,426 rubles to the FFOMS. From 2022 these amounts will not change.

Individual entrepreneurs pay contributions for themselves for pension and health insurance one-time or in installments until December 31 of the current year. If the last day of the year falls on a weekend, the tax office will allow you to pay contributions on the first working day of the next year.

The amount of contributions does not depend on the income of the individual entrepreneur and is paid even if the business is not running. If the annual income exceeds 300 thousand rubles, then we pay the Pension Fund an amount of 1% of the excess, but not more than 259,584 rubles. This must be done before July 1 of the following year.

Insurance premiums for employees

The individual entrepreneur pays monthly insurance premiums to the Federal Tax Service for each employee at the established tariff rate until the 15th. Insurance premiums differ from personal income tax in that they are paid in excess of wages at the expense of the employer. In general, the amount of contributions is 30% of the salary - 22% for pension, 2.9% for social and 5.1% for health insurance. It turns out that if an employee’s salary is 20,000 rubles, you must transfer 6,000 rubles to the tax office.

When tariffs decrease, the contribution amount becomes less. Here we talked about changes in the payment of insurance premiums from 2020.

It is also necessary to make monthly contributions to the Social Insurance Fund in case of work-related injuries and occupational diseases. Their size depends on the hazard class assigned to the main activity of the entrepreneur. The contribution rate is from 0.2 to 8.5%. To ensure that your contributions are calculated at the correct rate, submit your application and certificate to the Social Insurance Fund on time—no later than April 15.

Other taxes if warranted

Entrepreneurs pay personal property tax, transport tax and land tax if they have a taxable object used in business. The tax office calculates the tax and sends a notification for payment. Before making a payment, check the details of the taxable item and the tax rate. Pay once a year - no later than December 1 of the year following the reporting year.

All property taxes can be paid in a single payment in advance and without waiting for a notification from the inspectorate. But in this case you will have to calculate them yourself. If during the month you had transactions with excisable goods, you need to independently calculate and transfer the tax no later than the 25th day of the next month.

You calculate the water tax yourself and pay it based on the results of each quarter. Deadline: no later than the 20th of the next month.

Payment deadlines for major tax systems in 2021

The main adjustment to activities in 2022 in the context of paying taxes for individual entrepreneurs was the abolition of UTII and the expansion of the conditions for applying a patent. In addition, many individual entrepreneurs are switching to NAP due to the spread of this type of taxation to all regions of the Russian Federation.

We wrote about individual entrepreneur tax holidays here .

There are no changes in the deadlines for paying taxes for individual entrepreneurs in 2022. No additional payments for entrepreneurs were introduced in 2022.

Let us dwell in more detail on the deadlines for paying taxes for individual entrepreneurs in 2022 in relation to the main taxation systems that entrepreneurs can use:

How to calculate VAT on imports? The answer is in the article .

Any individual entrepreneur must pay insurance premiums for himself. Only individual entrepreneurs on NAP and some other categories of individual entrepreneurs who were forced to suspend their activities are exempt from paying contributions.

The individual entrepreneur worked in the period from 03/30/2020 to 05/11/2020

Mandatory payments for individual entrepreneurs

If the entrepreneur worked during the pandemic, then the timing

Insurance payments of individual entrepreneurs intended for the Pension Fund and the Compulsory Medical Insurance Fund in 2020 are divided into two parts and paid to the Federal Tax Service:

- First, before July 1, 2022, the variable part of contributions for 2022 is paid from income exceeding RUB 300,000.

- Then, by December 31, 2022, you need to pay the fixed part of the contributions to the Pension Fund and the Compulsory Medical Insurance Fund for 2022.

Property payments for 2022 (real estate for personal use, transport, land) are paid by individual entrepreneurs if such property is available until December 2, 2022 based on a notification from the Federal Tax Service.

Excise taxes, mineral extraction tax, water, payments for the use of wildlife objects are paid by individual entrepreneurs only if there are grounds for such payments. In this case, the payment deadlines for them during the year are as follows:

- Excise taxes, mineral extraction tax - until the 25th day of the month following the reporting month.

- Water tax - until the 20th day of the month following the reporting quarter.

- Trade fee - until the 25th day of the month following the reporting quarter.

- The fee for the use of wildlife objects is monthly until the 20th day of the current month and the first 10% payment upon receipt of a permit.

Payment of taxes and contributions on payments to employees is made within the following terms:

- Personal income tax - no later than the first working day following the day of actual payment of income (except for vacation and sick pay - the tax on them must be paid no later than the last day of the month of issuance of these payments);

- insurance premiums for compulsory health insurance, compulsory medical insurance and compulsory health insurance from VNiM - no later than the 15th day of the month following the month of income accrual;

- insurance premiums for injuries to the Social Insurance Fund - no later than the 15th day of the month following the month of income accrual.

Taxes paid by individual entrepreneurs under OSNO

The tax payment deadlines for individual entrepreneurs who have chosen the OSNO tax system are as follows:

- Personal income tax. For 2022, the tax must be paid by July 15, 2020. Advance payments for 2022 are paid in 3 payments on new dates: until April 27, 2022 for the 1st quarter, until July 27, 2020 for the half-year, until October 26, 2022 for 9 months.

- VAT is paid monthly until the 25th.

- The tax on property used in business activities for 2022 is paid within the same period established for payment of tax on personal property of individual entrepreneurs (December 2, 2020), based on a notification received from the Federal Tax Service.

Features of individual entrepreneur payments in special modes

The use of any of the special regimes (STS, UTII, PSN, Unified Agricultural Tax) exempts individual entrepreneurs from paying personal income tax, VAT and property tax used for business purposes (except for those assessed at cadastral value). These taxes under each of the special regimes are replaced by one payment (single tax), which has its own payment deadlines:

- Simplified tax system - during the year, advance payments for the previous quarter are paid by the 25th day of the next month. In 2022, taking into account weekend transfers, these will be: April 27, July 27 and October 26. The deadline for paying tax for 2022 is April 30, 2020; 2022 - April 30, 2022. If during the year the activity on the simplified tax system is terminated, then the final payment must be made before the 25th day of the month following the month of termination of the application of the simplified tax system.

- UTII - payments are made quarterly based on the results of the quarter by the 25th day of the next month. For the 4th quarter of 2019, payment must be made by January 25, 2022. For payments for 2020, these dates will be: April 27, July 27, October 26, 2020, January 25, 2022.

- Unified Agricultural Tax - payments in 2022 and according to its results there will be three. Payments for 2019 must be made by March 31, 2022. And for 2022 you have to pay twice: an advance payment (until July 27, 2022) and a final payment (until March 31, 2022). If during the year the activity on the Unified Agricultural Tax is terminated, then the final payment must be made before the 25th day of the month following the month of termination of the use of the Unified Agricultural Tax.

- PSN - for a patent issued for a period of less than 6 months, you can make 1 payment (until the expiration of the patent). If the patent is valid from 6 to 12 months, then it is paid in two payments: 1/3 of the amount - no later than 90 calendar days from the start of the patent, the balance - no later than the end of its validity.

How to choose a special regime for individual entrepreneurs, read the material “UTII or simplified tax system: which is better – imputed or simplified?”

When combining regimes, taxes must be paid within the time limits corresponding to each tax payable.

How to combine UTII and simplified taxation system as an individual entrepreneur, read the article “Features of combining the UTII and simplified taxation system modes at the same time .

Voluntary payments to individual entrepreneurs

An individual entrepreneur can voluntarily pay contributions to the Social Insurance Fund, subject to appropriate registration with the fund. The payment to the Social Insurance Fund will be calculated depending on the minimum wage, but at a rate of 2.9%. Payment for 2022 is also made no later than December 31, 2022 for the current year.

Payment deadlines for individual entrepreneurs with employees

The presence of employees adds a lot of worries to entrepreneurs in terms of paying additional taxes and submitting reports related to working with individuals under employment contracts, civil contracts, and copyright agreements.

When working with individuals who do not have self-employed or individual entrepreneur status, the entrepreneur becomes a tax agent for personal income tax. That is, he must calculate, withhold and transfer tax for an individual to the budget. This applies to both employees under the GPA and employees under employment contracts.

In addition, there is an obligation to transfer contributions for compulsory insurance not only for yourself, but also for employees. Pension and medical contributions are accrued on GPA and employment contracts, social insurance contributions and on NS and PZ - only under employment contracts.

In what time frames should individual entrepreneurs and employees pay off their debts to the budget in 2022, look in the table:

A sample employment contract with a sales employee can be found here .

here how to conclude a GPA with an individual .

Find out how to fill out the new form 6-NDFL for the 1st quarter of 2022 in the ready-made solution “ConsultantPlus”. Trial access to the system is provided free of charge.

Dates of transfer to the budget of other taxes of individual entrepreneurs

The use of special regimes, and especially OSNO, does not exempt individual entrepreneurs from paying other taxes if the entrepreneur has an object of taxation.

Property taxes

The deadline for paying property ownership taxes for individual entrepreneurs in 2022 coincides with the date of transfer of these taxes established for individuals.

Even individual entrepreneurs using special regimes are not exempt from transport and land taxes. That is, if there is transport and land subject to tax, entrepreneurs pay the corresponding taxes for 2022 until 12/01/2022.

Property tax may not be paid by the special regime if it is assessed at the average annual value and is used in business activities. If an individual entrepreneur’s real estate is taxed at cadastral value, then the tax payment deadline for individual entrepreneurs on the simplified tax system for 2022 also falls on 12/01/2022.

Other taxes

If an individual entrepreneur has a taxable object, then he must pay the following taxes and fees in 2022:

When to pay simplified taxes

To switch to the simplified tax system, an individual entrepreneur must submit a notification before December 31, 2020, in which the selected tax object must be reflected:

- “income” - the tax rate will be from 1 to 6 percent depending on the region;

- “income minus expenses” - tax rate from 5 to 15 percent depending on the region.

From 2022, new restrictions are in force for the use of the simplified tax system: no more than 130 employees and no more than 200 million rubles, respectively.

Entrepreneurs using the simplified tax system pay the following mandatory payments to the budget:

- simplified tax system;

- personal income tax for your employees;

- insurance premiums for your employees and for yourself;

- property tax for individuals;

- transport tax;

- land tax.

Advance payments of the simplified tax system must be transferred to the budget quarterly, no later than the 25th day of the month following the reporting period (Q1, half a year and 9 months) (Clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

The budget must be paid no later than April 30 of the following year.

In this regard, in 2022, individual entrepreneurs using the simplified tax system will pay a “simplified” tax within the following terms:

- for 2022 - 04/30/2021;

- for the first quarter of 2022 - 04/26/2021;

- for the first half of 2022 - 07/26/2021;

- for 9 months of 2022 - 10/25/2021;

- for 2022 - 05/02/2022.

Results

The dates for transferring mandatory payments to the budget in 2022 have not undergone significant adjustments. Basically, entrepreneurs must make quarterly advance payments for basic taxes. The presence of employees obliges the individual entrepreneur to pay monthly insurance premiums and be a tax agent for personal income tax. In addition to the main taxes, individual entrepreneurs also pay others related to the presence of property or the conduct of certain types of activities.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated April 2, 2020 No. 409

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.