Who must submit Form 57-T in 2022

All companies included in the statistical sample must report in Form No. 57-T. Any organization has the right to be included in it, regardless of its field of activity, with the exception of representatives of small businesses. Employers who are public organizations or operate in the following areas do not submit this form:

- finance;

- insurance business;

- government controlled;

- ensuring military security.

Rosstat is obliged to send an official notification to all legal entities included in the statistical sample about the need to submit a report and instructions for filling out statistical form 57-T in 2022. But just in case, check for yourself whether your company will have to submit this report: find out who submits it directly on the Rosstat website using a special service.

Who to report to and when?

Order No. 457 states who will submit Form 57-T in 2022. These are only legal entities and separate divisions of legal entities that will be selected by Rosstat. Specific lists of “lucky” employers are posted on the department’s website.

All organizations included in the sample are notified by letters, but sometimes they do not arrive and you need to independently check the lists of respondents on the Rosstat website. Thus, report 57-T to statistics for a school, preschool educational institution or any other organization will be needed only if they are included in the sample of the statistical department.

At the legislative level, a list of organizations has been defined that will not need 57-T reporting (they report according to other rules). It's about:

- on public sector institutions;

- organizations providing military security;

- insurers;

- financial and credit structures;

- legal entities related to small businesses;

- public organizations.

Check whether your organization is included in the statistical selection on the official website. We advise you to regularly check the approved lists, as officials make additions to the list of organizations at any time. Large fines are provided for failure to provide statistical data.

Let us remind you how often to submit 57-T for statistics: the report is generated once every 2 years. Based on the results of October 2022, the report is submitted no later than November 29.

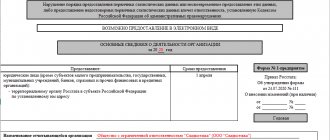

Form form No. 57-T

The new report form is practically no different from the one that many employers have already submitted in 2022; it has undergone only minor changes: in column 6, primary vocational education was excluded, all other tables remained the same. Therefore, if the organization already has experience in filling out the report, there will be no difficulties with the updated form.

The reporting form consists of a title page and two sections:

- Section I contains general information on the organization (number of employees and their wages for October 2022).

- Section II contains data on individual employees.

From this report, Rosstat wants to learn about the professional composition of the organization’s employees and the level of remuneration for each specialist. The appendix to the Rosstat order contains instructions on report 57-T to statistics: officials took care of the sample respondents.

Responsibility for late reporting

Organizations that failed to submit a report on time or included false information in it will be subject to sanctions under Article 13.19 of the Administrative Code.

| Entity | Supervisor | |

| First violation | from 20 to 70 thousand rubles | from 10 to 20 thousand rubles |

| Repeated violation | from 100 to 150 thousand rubles | from 30 to 50 thousand rubles |

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Report 57-T: deadlines and procedure for submission

Before filling out the report and conducting the necessary analysis, the management of the organization appoints an official authorized to provide statistical information on behalf of the legal entity (paragraph 2, clause 1 of the Instructions for filling out the form). This is an accountant or personnel officer.

Please send the completed form to the territorial office of Rosstat at your location. Please note that if an organization has a legal address in one area, but is actually located in another, Form 57-T must be submitted at the actual location of the company. If a legal entity has separate divisions, then they are required to submit separate reports at their location if they are included in the Rosstat sample. The parent organization has the right to submit reports for branches if management deems it appropriate.

The report may be submitted both in paper and electronic form. The current deadline for submitting report 57-T in 2022 is November 30.

When and how to take 57-T

The report must be submitted within a clearly stated time frame. It can be changed every two years. The current deadline is November 29, 2022. The next date has not yet been set. The rule for transferring from weekends and holidays continues to apply, so in exceptional cases you can submit the form later.

The form must be submitted to Rosstat at your location. If the company actually conducts business in another location, then the report must be submitted to the branch that coincides with the actual place of business.

It is important to note that when Rosstat’s sample includes only an individual enterprise, and not the entire legal entity, two delivery options are possible:

- the legal entity itself submits a report to Rosstat at the location of the OP;

- the legal entity selects an official who gives the authority to submit the form to Rosstat.

Instructions for filling out 57-T for October 2022

Section I

In this section of the report, it is necessary to provide general information about the average number of employees and accrued wages for October 2022. Rosstat's order provides detailed instructions for filling out Form 57-T in statistics, which states that the data on page 01 of Table 1 must coincide with similar data in Form No. P-4 for October. Provide information only for the organization, without separate divisions.

Please note that we indicate the average number of employees. Determined by the formula:

Divide the sum of the number of all employees in the organization for each day of the month (including weekends) by 31.

In this case, the following are excluded from the total number of persons employed in the organization:

- women on maternity leave;

- everyone who is on parental leave for up to 1.5 years;

- students (entrants) in educational institutions who were on leave without pay.

It is important that the average number of employees is determined in conventional units in full-time equivalent, based on the actual time worked by employees in the reporting month. The employer will have to calculate man-hours in order to correctly indicate the data. For example, for a 40-hour, 5-day work week, divide the total number of man-hours worked by these employees in October by 8 hours, and from the last working day, subtract all the man-hours that were missed.

These data are calculated separately for men and women.

Column 4 “Accrued wages” of Form 57-T includes all amounts accrued to employees for October 2022. These include:

- salary for the main position;

- wages for work on internal or external part-time basis;

- bonuses and allowances;

- compensation payments related to working conditions and working hours;

- one-time incentive payments;

- payment for food and accommodation, which is systematic.

This information must be taken from the accounting registers in accordance with payment documents.

Reference information is necessary to compile a list of employees from which selection is made for an individual description in section II.

To fill out this table, it is necessary to distribute employees by personnel categories in accordance with the All-Russian Classifier of worker professions, employee positions and tariff categories, approved by Resolution of the State Standard of Russia dated December 26, 1994 No. 367.

Paragraph 9 of the Completion Instructions states that column 3 of Table 2 should include permanent, temporary and seasonal employees from the company’s staff who worked at full time (official salary) all working days in October 2022, to whom wages were accrued for October. Do not include in this list:

- persons hired part-time from other organizations (external part-time workers);

- persons who performed work under civil contracts;

- those hired and fired during October;

- employees who were on sick leave in October;

- women who are on maternity leave or parental leave;

- persons who have undergone vocational training, advanced training or acquisition of a new profession (specialty);

- persons working in an organization under an apprenticeship contract for the purpose of acquiring a profession;

- persons working in accordance with an employment agreement (contract) on a part-time basis;

- persons who worked part-time on the initiative of management or by agreement of the parties;

- workers who were idle;

- homeworkers;

- employees on annual and other leaves (without pay, educational leave, etc.);

- persons who committed absenteeism;

- all other employees who were absent from work for 1 day or more for reasons not related to the functioning of the organization, for example, performing government or public duties.

Section II

This section of the form is intended for summary information about the salaries of individual employees by position and profession. Rosstat indicates that initially each employee is provided with a non-zero probability of being included in the sample. To select individuals who will fall into this section, it is recommended to use a special technique:

- Make a numbered list of workers who meet the sampling conditions in the following sequence: managers, specialists, other employees, workers. The total number of individuals on the list must correspond to the number indicated in line 04 of Section I of Table 2.

- Determine the selection interval based on the number of individuals using the formula: IO = Mi / mi (Mi is the number of workers shown on line 04 of Section I of Table 2; mi is the number of individuals to be surveyed).

- Using random sampling, determine the first employee included in the sample. This is done in the range from 1 to IR by drawing lots, selecting random numbers, etc.

- Next, the resulting selection interval value should be added to the number of the employee determined in this way (second number = BUT + IO, third = (BUT + IO) + IO, etc.). The number of persons included in the sample ends when the resulting number is greater than the last item in the list. If the result is a fractional number, then it should be rounded arithmetically.

The resulting series is indicated in the table:

When filling out Section II, personal data of employees (full name, etc.) does not need to be provided. In the table, indicate the name of the position, the five-digit code of the profession (position) in accordance with the All-Russian Classifier of Worker Professions, Employee Positions and Tariff Classes. In the following columns, write the code designation of the employee’s education from 1 to 5 (for example, higher education - 1, basic general education - 4).

In column 7 of section II of the Rosstat report in form No. 57-T, write down the employee’s length of service in the company as of 10/31/2021. The length of service is calculated in full years with a decimal place after the decimal point (months are converted to the fractional part of the number, days are discarded). When determining wages, it is necessary to take into account the division of the total amount of payments in favor of the employee by:

- tariff rate (salary) - column 9;

- payments under district regulation - column 10;

- other payments that are not included in columns 9 and 10 - column 11.

Enter all data in the table in whole rubles without kopecks. Table 3 is not filled out; it is necessary to determine the number of workers to be studied.

Procedure for filling out the report

To fill out report forms 57-T, the following documents may be useful:

- company staffing table;

- production calendar;

- report form P-4 for October 2022;

- payroll for October.

Separate divisions of the organization, if any, are not indicated in this report.

Filling out begins with the title page, on which you must indicate the full name of the organization, address and OKPO code.

Section I

The first table indicates the average number of employees and wages for October.

The average number of employees is determined as follows: the number of all employees at the enterprise for each day of October, including weekends, divided by 31.

Salary includes:

- salary for the main position;

- payments on a part-time basis;

- compensation paid for October;

- bonuses;

- compensation.

The information must coincide with the P-4 report for the same period.

Table 2 of the first section indicates the reference data that is needed to compile the list of employees in the second section.

Rosstat suggests using the following methodology to fill out Table 3:

- Make a list of employees in accordance with Table 2 from the first section.

- Calculate the selection interval using the formula: where Mi is the number of employees indicated in line 04 of Table 2 of the first section; mi is the number of individuals who are subject to research.

- The first employee is selected using random sampling to be included in the sample. The selection is carried out by drawing lots in the range from 1 to the selection interval (SI).

- Afterwards, the selection interval is added to the number of this employee, etc. The calculation ends when the resulting number is greater than the last item on the list.

Table 3 shows the resulting series.

Section II

In the table of the second section, you must indicate the position, profession code in accordance with the classifier, the employee’s date of birth, and gender. Next, the code indicates the education of employees from 1 to 6 (for example, higher education - 1, general secondary - 4).

Column 7 indicates the employee’s length of service at the end of the period under study. The following columns 9-11 describe the components of the total wages for October.

Column 12 indicates the actual time worked in hours.

This is how you can easily fill out form 57-T. It is worth noting that if you do not submit or delay the submission of this reporting documentation, the company will be fined in accordance with the Code of Administrative Offenses of the Russian Federation.