Application on form No. Р13014

The application form P13014 was accepted by order of the Federal Tax Service of the Russian Federation dated August 31, 2020 N ED-7-14/ [email protected] The form is quite voluminous - in addition to the title page, it includes several dozen pages, but only those of them that reflect the changes should be filled out intelligence.

The form can be downloaded from the Federal Tax Service website in .pdf (requires the use of Adobe Acrobat Reader) or .tif formats (software for this format is downloaded from the Federal Tax Service website). Both formats allow you to either print the form and fill it out by hand, or fill out the form on your computer.

Manual filling is permitted only in accordance with the rules approved by the Federal Tax Service and nothing else:

- blue, black or purple ink,

- in capital block letters,

- without additions, erasures, corrections.

The most convenient way to fill out the form on a computer is in a program that can be downloaded for free from the Federal Tax Service website. You just need to enter the required data in the empty lines - and the program itself will fill out the application, and it is trained to mark errors and writes a red signal about them at the bottom of the screen.

Link to the page where you can download the program for filling out P 13014: program for filling out an application to replace the director of an LLC.

Submitting form P14001 to the tax office

Changes in form P14001 must be registered with the tax office. However, you can submit an application not only directly to the Federal Tax Service, but also through the MFC. There are several ways to send an application to the tax office.

- Personal visit

. This can only be done by the applicant indicated in form P14001 as the new head of the LLC. - With the help of a representative

. In this case, it is necessary to issue a notarized power of attorney for him. - Sending by mail

. The application must be sent by registered mail with the declared value and a description of the attachment. - Electronic

. This option is only possible through a notary, since the new director does not yet have a strengthened digital signature as the head of the organization.

In order to submit an application to the Federal Tax Service, prepare the following documents:

- Applicant's passport

- Minutes of the general meeting or the decision of the sole founder of the company to appoint a new director,

- Completed form P14001 with a certified signature.

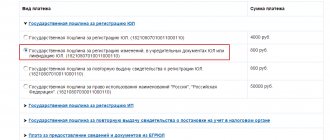

After receiving the application in form No. P14001, the Federal Tax Service will conduct state registration of changes within 5 working days. This procedure is free of charge.

More details: R 14001. Notarization

Procedure and form for changing the director

The director is the sole executive body acting on behalf and in the interests of the organization. The procedure for changing a director includes:

- holding a general meeting of participants with the preparation of a protocol on the change of director;

- dismissal of the director and then hiring of a new director;

- preparation of an application for a change of director (form 14001) - filling out and notarization;

- submitting an application form 14001 to the Federal Tax Service, within three days from the date of the decision, to make changes to the Unified State Register of Legal Entities. In this case, the inspection may, in addition to the form for changing the general director, request a decision of the general meeting on changing the director, an order on the appointment of a new director, etc.

Changes to the Unified State Register of Legal Entities are made within 5 working days after receipt of tax documents.

The founder's decision to change the director of the LLC

Although the LLC form was originally intended for a group of people to conduct business, many Russian LLCs have only one founder. This is not prohibited by law. Is a general meeting of participants necessary in this case? According to Article 39 of the LLC Law, on issues falling within the competence of the general meeting of company participants, decisions are made by the sole founder individually and are drawn up on paper.

In addition, it has been established that when the sole founder of an LLC makes decisions on issues within the competence of the general meeting of LLC participants, certain provisions of the law on limited liability companies do not apply: Art. 34 and 35 on meetings of the founders of the company, Art. 36 and 37 - on the procedure for convening and holding a meeting, Art. 38 on decision-making by the general meeting through absentee approval and Art. 43 - on appealing decisions of the company’s management bodies.

Thus, if there is only one founder in the organization, then only his written decision is needed to change the general director.

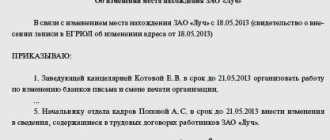

The decision of the sole founder to replace the current general director of the LLC and to select a new one is formalized in writing, like other decisions of the sole founder (Article 39 of the LLC Law). The form of the decision to change the general director is not provided for by law, but, based on practice, it is recommended to formalize the decision on your own form, indicating the following information:

- full name of the LLC, its OGRN, INN and legal address;

- place, date and time of making the decision to change the head of the LLC;

- FULL NAME. and passport data of the sole participant, as well as data on the size of his share in the authorized capital of the company. If the only participant is a legal entity, then you need to indicate the details of this legal entity;

- decision to terminate the powers of the former general director of the LLC - his passport details;

- decision to appoint a new head of the LLC (if he is already known). Here you should indicate his passport details and TIN;

- date of termination of powers of the previous director;

- the start date of the powers of the new director and the term of these powers, which must be fixed in the charter of the LLC;

The document must be personally signed by the sole founder. According to the latest clarifications of the Supreme Court of the Russian Federation, the requirement for notarization of LLC decisions, established by paragraphs. 3 p. 3 art. 67.1 of the Civil Code of the Russian Federation, also applies to the decision of the sole founder (clause 3 of the “Review of judicial practice on certain issues of application of legislation on business companies”, approved by the Presidium of the Supreme Court of the Russian Federation on December 25, 2019).

Please note that previously the Federal Notary Chamber took a different position: the requirement of paragraph 3 of Art. 67.1 of the Civil Code of the Russian Federation does not apply to companies with a single founder (clause 2.3 of the letter of the Federal Tax Service dated September 1, 2014 No. 2405/03-16-3).

Change of director: form P13014 (previously - 14001) - which sheets should be filled out?

When submitting information for inclusion in the Unified State Register of Legal Entities, it is mandatory to fill out the title page of the application in form P13014 (change of director). What sheets should I fill out next?

Form 13014 is not submitted in full, but only in the part that reflects information about the manager. This is Sheet I, consisting of two pages, and including information about an individual who can act on behalf of the company without a power of attorney. The details of both the old and new director are indicated here.

In addition, you need to fill out Sheet P “Information about the applicant.”

All completed pages are numbered consecutively; there is no need to submit blank sheets.

What sheets to fill out?

Form P14001 consists of 51 sheets, providing for all types of changes. If the director of the LLC changes, you only need to fill out sheets 001, K and R.

Sample of the first page of application P14001

Sample of the first page of the application P14001 - Create an application

- Generate an application automatically Enter your data in the form, download the already completed documents and instructions for submission Generate an application

- PDF, 31 MB

- XLS, 1.5 MB

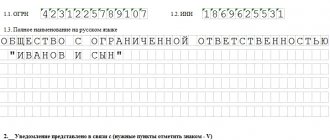

To fill out sheet 001, you will need information from the Unified State Register of Legal Entities. The extract can be obtained free of charge on the Federal Tax Service website. This usually takes a few minutes. Indicate the name of the LLC, INN and OGRN of the company. In section 2 of sheet 001 you need to put the code “1”. It will mean that the application is being submitted in connection with changes in information about the legal entity.

Sheet K page 1

Sheet K page 2

Sheet K

you need to fill out two copies: one with the details of the old director, the other with the new director.

Sheet K for the former manager

filled in as follows. On page 1 of sheet “K” in the section “Reason for entering information” you need to write the number “2”, which means “Termination of authority”. After this, enter the data of the old director in section 2 entitled “Information contained in the Unified State Register of Legal Entities.” In this case, you do not need to fill out section 3.

Sheet K for the new director

you need to fill it out a little differently. On page 1 of sheet “K” in the “Reason for entering information” section, indicate the number “1”. It means "Designation of Authority". After this, fill in the details of the new director in section 3 “Information to be entered into the Unified State Register of Legal Entities.” When filling out this sheet, you do not need to fill out section 2.

Sheet R page 1

Sheet P

fill in information about the new manager. He will be the applicant. On page 1 in section 1, indicate code “1” - “the applicant is the head of a permanent executive body.” After this, enter the LLC data in accordance with the extract from the Unified State Register of Legal Entities.

Sheet R page 2

Sheet R page 3

Sheet R page 4

On pages 2-4 of sheet P, you must indicate the full name, passport and contact information of the applicant.

Please note that the TIN of both the old and new directors must be indicated on sheets K and R. If this is not done, the Federal Tax Service may refuse to register the changes. If you do not know your TIN, you can find it on the website of the Federal Tax Service of Russia. If the TIN is not indicated there, you can leave this field blank.

In section 5, you must choose the method of receiving documents after registration: number “1” means issuance to the applicant, “2” – issuance to another person by proxy, “3” – sending by mail.

You do not need to complete Section 6 on page 4. This is a notary field.

Who fills out Form 13014 when there is a change of director?

This question may naturally arise when filling out an application. Indeed, at the time of its submission to the Federal Tax Service, the powers of the previous director have already been terminated, and the new director has not yet been entered into the Unified State Register of Legal Entities, then who signs Form 14001 when changing the director?

In this situation, it must be taken into account that as soon as the general meeting decided to replace the director, his powers are terminated (this is determined by the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Therefore, he no longer has the right to fill out and sign an application for a change of director, but the new director of the organization must do this.

Filling out form P13014 (P14001): nuances

When filling out the form in question, please keep in mind that:

1. The information reflected on the title page must exactly correspond to those given in the Unified State Register of Legal Entities. To do this, you need to order a fresh extract from the register.

2. You may also need to show the latest extract to the notary. To do this, it is advisable to have a paper version certified by the Federal Tax Service.

3. In section 1 of sheet N, code 1 is entered, reflecting the fact that the applicant is the current head of the business company, despite the fact that there is no data about this in the state register at that time.

The fact is that the signing of the order to appoint a new director is preceded by a decision to dismiss the previous one from his position, after which his powers are terminated (determination of the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13).

In corporate relations, situations may arise when form P13014 (P14001) is in practice submitted not by the new manager, but by the former manager. For example, if he resigns of his own free will without the consent of the business owners.

You can learn more about such legal relations in the article “How can a director resign without the consent of the founders?”

Notarization of Form 13014 (Change of Director)

Notarization of application P13014 (formerly 14001) is not always required.

You need to go to a notary and have your signature certified:

- if documents are submitted to the Federal Tax Service on purpose by the director’s authorized representative or the director himself;

- if the documents are transferred to the Federal Tax Service electronically by a notary;

- if the documents are sent to the Federal Tax Service by mail.

There is no need to go to a notary if the legal entity has an electronic signature and a personal account on the Federal Tax Service website (this allows you to submit application P13014 electronically).

Possible questions

In this part, we will consider individual issues that may arise when preparing a document for delivery and, directly, an example of filling out form p14001 when changing management.

Should I hand in blank sheets?

Form P14001 is a rather voluminous document designed to provide for all possible changes that, by law, must be notified to the Federal Tax Service.

Organizations are all different, and everything in them rarely , so it’s unlikely that anyone will have the opportunity to completely fill out one document.

There is no need to print or number blank sheets of paper .

How to avoid inaccuracy

When starting to fill out application P14001 to replace the previous general director with a new one, you need to have information at hand

- about the newcomer’s passport details;

- about the TIN of both directors;

- about postal codes;

- about the designations of streets, avenues, boulevards, buildings and similar names used when writing addresses, exactly according to KLADR

(Classifier of Addresses of the Russian Federation); - on codification of types of documents;

- about codes of subjects of the Russian Federation.

Experts advise you to first check all the information on the extract from the Register.

If suddenly the data of the outgoing boss contains errors, then the new application will not be accepted due to a discrepancy. It is better to correct inaccuracies and then announce changes.

Read other materials about the P14001 form, namely how to correctly fill out the document when adding OKVED and withdrawing a participant.

Who should be the applicant

The application is submitted on behalf of the newly appointed manager.

He takes it to the notary and, in his presence, for notarial confirmation, he enters his full name and signature on sheet P (information about the applicant) (these items must be filled out manually in black ink).

Participation of LLC members

Participants are not required to be present when completing, certifying and submitting Form P14001.

However, their participation may be needed to create a protocol indicating the need for changes.

According to the law, when changing genes. The director should only need the form P14001, but notaries often also require minutes of the meeting of LLC members. It's better to prepare it.

How to fill out P13014 when changing director

The requirements for filling out an application in form P13014 when changing the director (see sample below) are contained in Section VI of Appendix No. 13 to Order of the Federal Tax Service of Russia dated August 31, 2020 N ED-7-14 / [email protected] .

Title page

On the title page (page 001 of the application) in column 2 (“Reason for submitting the application”) we indicate the number “2”.

Sheet I of form 13014: change of director

You will have to fill out 2 sheets I - for the old and new directors.

Take the first sheet of I.

- In column 1 “reason for entering information” indicate the number “2”,

- In column 2, fill in the full name and TIN of the dismissed director, who needs to be excluded from the Unified State Register of Legal Entities,

- We don’t write anything in column 3.

We take another sheet and now fill it in for the new director, in a different way:

- In column “1” “reason for entering information” indicate the number “1”,

- In column 2 we do not write anything,

- In column 3, fill in the full name and tax identification number of the dismissed director, who must be excluded from the Unified State Register of Legal Entities, as well as his gender, date and place of birth, citizenship, and passport details.

At the end of column 3 there is a field “Position” - indicate in it the exact name of the position “director”, “general director”.

Sheet P – information about the applicant

In Section 1 of Sheet P we indicate the number 1.

Section 2 is filled in with information about the applicant (for example, a new director or founder).

In section 3, we indicate your email, phone number and determine whether a paper extract from the Unified State Register of Legal Entities is needed or whether an electronic one will suffice.

At the bottom, the new director puts his signature, the authenticity of which is certified by a notary in section 6 of Sheet R.

Rules for filling out application P14001

The Federal Tax Service has strict requirements for filling out form P14001. Failure to comply will result in a refusal of state registration. The completed form must not contain any corrections, errors, erasures or writing in pencil. Number all completed pages in order, starting with 001.

You can fill out the application either on a PC or manually:

- When filling out on a computer,

use Courier New font size 18. All letters must be capitalized. Each sheet must be printed on a new page. Printing is one-sided only. - When filling by hand,

use only a black pen. Letters must be capitalized. It is allowed to put only one letter, symbol or number in each cell.

Use our help to fill out application P14001 for a change of director

Our automated service will help you quickly, free and correctly fill out form P14001. You won’t have to figure out which pages to fill out and how. This way you will eliminate errors and receive a completed application. You will only need to enter data in the form fields. After this, the application will be generated automatically and you can download it.

Prepare an application

Prepare an application

Form P14001 requires notarization. The signature of the new director must be certified. This will have to be done even if the manager plans to submit an application to the Federal Tax Service in person. The new director must come to the notary's office and sign the form P14001 in the presence of a notary. After that it will be certified. This cannot be done with the help of a representative by proxy. The personal presence of the new director is required.

It is also not allowed to submit an application electronically in form No. P14001. This is explained by the fact that the new director does not yet have an electronic digital signature in the status of the head of the organization.

In order to sign and notarize the signature, the director must take the following documents with him to the notary office:

- Passport,

- Completed but not stapled application P14001,

- Original charter of the limited liability company,

- Minutes of the general meeting or the decision of the sole participant of the LLC to change the director.

The notary may require additional documents. For example, a fresh extract from the Unified State Register of Legal Entities. We recommend that you check with the notary before your visit which documents should be prepared.