Who must report income Composition of the declaration, deadlines for filing and paying tax Types of violations and penalties Who cannot be charged for being late with 3-NDFL

An unpleasant surprise could be a notification of a fine for failure to file a 3-NDFL return or a requirement to pay tax for a person who was unaware of the obligation that had arisen.

We will tell you in what cases it appears, and what the penalties for non-compliance are.

Who must report income

If, according to the labor, brokerage and GPC agreement, the tax is withheld and transferred to the budget by the tax agent, then the remaining income must be paid independently and reported to the tax office.

The list of persons required to file 3-NDFL is indicated in Art. 228 Tax Code of the Russian Federation. It included:

- recipients of income from the sale of their own real estate, car;

- winners of lotteries and other gambling games;

- recipients of funds from rental housing;

- tax residents who received income outside the Russian Federation;

- heirs of the authors of the works receiving compensation;

- an individual from whose income personal income tax was not withheld by tax agents;

- holders of gifts not from close relatives (real estate, vehicles, securities, etc.).

Responsibility for failure to provide and delay

Here is what you face for a 3-NDFL submitted late or submitted with errors and for violating the deadlines for paying personal income tax:

- prosecution in the form of a fine;

- accrual of penalties;

- collection of tax arrears (arrears), penalties and fines through the court.

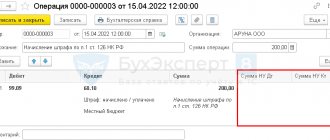

If you do not submit the 3-NDFL declaration on time, you face a fine under paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Liability options depending on the situation:

| Violation | Type of responsibility | Responsibility |

| Declaration not submitted | Fine | The amount of the fine for failure to file 3-NDFL by an individual in 2022 is 5% of the unpaid amount of personal income tax, which is subject to payment (additional payment) according to the declaration. At the same time, the fine cannot be less than 1000 rubles. and more than 30% of the tax amount. Please note how fines are calculated for late filing of 3-NDFL - the amount is taken for each full or partial month from the date established for reporting. |

| Failure to pay personal income tax on time or incomplete payment | Fine | 20% of the amount of unpaid tax, if there are no signs of tax offenses (clause 1 of Article 122 of the Tax Code of the Russian Federation). |

| Penalty | Penalties are accrued on the amount of debt for each calendar day of delay in tax payment and up to and including the day the obligation to pay tax is fulfilled. |

Also in practice there are situations, for example, when an individual did not pay personal income tax on time, but calculated it correctly and submitted a declaration. In this case, no fine is imposed and only penalties are collected (clauses 2-4, 5 of Article 75, clauses 1, 3 of Article 122 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11-09/68364).

Penalties are calculated according to the formula (clauses 1, 3, 4 of Article 75 of the Tax Code of the Russian Federation):

From December 20, 2021, the key rate (refinancing rate) of the Bank of Russia is 8.5% (Instruction of the Bank of Russia dated December 11, 2015 No. 3894-U; information message of the Bank of Russia dated December 17, 2021).

But the liability, if a citizen filed a 3-NDFL declaration on time, but calculated the tax incorrectly, is a fine of 20% of the unpaid tax amount.

The correctness of determining the tax base and calculating the amount of personal income tax payable is carried out during desk tax audits.

So, if a citizen is required to submit a 3-NDFL declaration, but has not done so, he will be fined for late filing of 3-NDFL by an individual, even if he has no financial debt to the budget.

However, the tax authority or court has the right to reduce the minimum amount of the sanction specified in Art. 119 of the Tax Code of the Russian Federation, due to the presence of established Art. 112 of the Tax Code of the Russian Federation of mitigating circumstances.

Comments on the situation when there is untimely submission of 3-NDFL without paying tax are in paragraph 18 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57.

If the deadlines for filing a declaration and paying the tax are missed, the tax authority will send you a demand for payment of tax (arrears), penalties and fines. If the requirement is not fulfilled, the tax authority, within six months from the date of expiration of the deadline for fulfilling the requirement, has the right to apply to the court to collect the debt at the expense of your property, if your debt exceeds 10,000 rubles. If the debt is less than this amount, then the inspectorate will be able to collect it through the court only after three years have passed after the deadline for fulfilling the requirement.

Types of violations and penalties

You must report and pay personal income tax within the established time frame. For late reporting and payment for individuals, penalties are provided, which are regulated by Art. 75, 119, 122 of the Tax Code of the Russian Federation.

What is considered a violation:

The declaration with the declared income was submitted late. Failure to comply with deadlines will result in a fine of 5% of the personal income tax amount for each full and partial month overdue. For a repeated violation, the fine may be increased, but it should not exceed 30% of the personal income tax amount. The minimum fine is 1000 rubles (clause 1 of Article 119 of the Tax Code of the Russian Federation).

Example:

In 2022, you sold a car for RUB 300,000 that you owned for one year. When the Federal Tax Service receives information about the income received, you will be sent a notification about the need to submit 3-NDFL.

Let's say you sent the declaration on June 30, 2022, that is, two months late. For failure to submit a declaration on time, you will be fined in the amount of 3,000 rubles. (300,000 x 5% x 2 months) and send a decision.

The zero declaration is overdue. This is also considered an offence. A fine for failure to submit a declaration is collected even if there is no amount of tax due. The fine is 1000 rubles. If you received income, but documented expenses exceeded it, do not pay anything. But the report must be submitted in the general manner.

The declaration was submitted on time, personal income tax was paid late or not paid at all. The punishment is provided for in paragraphs 1 and 3 of Art. 122 of the Tax Code of the Russian Federation. For payment after the deadline established by law or incomplete payment, an individual may be subject to a fine of 20% of the amount of personal income tax payable.

In case of deliberate understatement or concealment of income and, accordingly, tax - 40% of its amount. Personal income tax not paid to the budget will be listed as arrears. It is subject to penalties in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each calendar day of delay (clause 4 of Article 75 of the Tax Code of the Russian Federation).

Example:

In 2022, you sold a car that you owned for one year and declared an income of 300,000 rubles on time.

But you paid personal income tax in the amount of 13% (39,000 rubles) not on July 15, 2021, but on July 25. That is, they were 10 days late.

The tax inspector will charge:

- 20% fine of the tax amount: 7,800 rubles (39,000 x 20%);

- penalties for 10 days: 71.5 rubles (39,000 x 10 x 5.5%/300), where 5.5% is the Central Bank refinancing rate in effect in that period.

On a note. If you filed 3-NDFL with an inflated tax amount, for example, you did not indicate expenses or deductions, you have the right to submit an updated return. Penalties will not be applied in this case.

If, on the contrary, you underestimated the amount to be paid by improperly including expenses, you will have to resubmit the updated declaration and pay additional tax. Penalties for late payment of part of the personal income tax are accrued, but fines are not (clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court No. 57 of July 30, 2013).

The declaration was not submitted, personal income tax was not paid. Failure to declare income, coupled with non-payment, entails liability in the form of a fine (Articles 119, 122 of the Tax Code of the Russian Federation) and penalties for late payment (Article 75 of the Tax Code of the Russian Federation).

Example:

In 2022, you sold a car for 300 thousand rubles, did not file a declaration and did not pay personal income tax in the amount of 39,000 rubles. After receiving the letters from the Federal Tax Service, you reported and paid the tax on July 25, 2021, that is, 10 days late.

The fine will be:

- 1,950 rubles (39,000 x 5%);

- RUB 7,800 (39,000 x 20%);

- penalties for 10 days: 71.5 rubles (39,000 x 10 x 5.5%/300), where 5.5% is the Central Bank refinancing rate in effect in that period.

On a note. Tax authorities have the right to apply penalties only if they have sent a demand. If you reported and paid the tax yourself, there will only be a fine for failure to submit your personal income tax return on time.

When paying a fine, be sure to indicate the Federal Tax Service decision number on the payment slip. Otherwise, it may hang on your personal account, since the tax authorities will not count its payment. In this case, you will have to write an application to search for payment, attach a receipt for payment and send it to the tax authority.

If, based on the results of the declaration, you have tax to pay

If, based on the results of the declaration, you have tax to pay, but you have not filed a declaration, then:

1. According to Article 119 of the Tax Code of the Russian Federation (“Failure to submit a tax return”), you face a fine of 5% of the tax amount for each month of delay (starting from May 1), but not more than 30% of the total amount.

2. If you have not filed a declaration and also have not paid the tax by July 15, then you face a fine of 20% of the tax amount under Article 122 of the Tax Code of the Russian Federation (“Non-payment or incomplete payment of tax amounts (fees)”).

It is important to note here that this penalty can only be applied if the tax office has discovered non-payment of tax. If, before notifying the tax authority, you discovered it yourself, paid the tax and penalties, then the tax authority does not have the right to apply this fine to you.

Note: this same article of the tax code may entail a fine of 40% of the tax amount (instead of 20%) if the failure to pay was committed intentionally. However, in practice, it will be quite difficult to prove the intentionality of non-payment to the tax authority.

Please note that this fine can only be issued if the tax authority itself discovers that you have not filed a return. If you filed a declaration and paid the tax and penalties before he sent you a notice, he has no right to issue a fine for concealing income.

3. If you did not file a declaration and also did not pay the tax by July 15, then you will also have to pay an income tax penalty in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each overdue day (after July 15).

4. If you had to pay tax in the amount of more than 900 thousand rubles. (for example, you sold an apartment received as an inheritance), but did not file a declaration and did not pay the tax by July 15, then you may also fall under Article 198 of the Criminal Code of the Russian Federation (Evasion of taxes and (or) fees from an individual).

Example: in 2022 Muromtsev A.I. inherited an apartment and immediately sold it for 3 million rubles. The amount of tax that Muromtsev had to pay upon sale: 3 million rubles x 13% = 390 thousand rubles. Muromtsev did not know that he had to file a return with the tax authority and pay income tax and, accordingly, did nothing.

At the end of July 2022, Muromtsev received a notification from the tax office that he must declare the sale of the apartment.

If Muromtsev immediately after receiving the notification files a declaration and pays the tax and penalties, then he only faces a fine of 5% of the tax for each overdue month after filing the declaration: 3 months (May, June, July) x 5% x 390 thousand rubles = 58,500 rubles.

If Muromtsev does not submit a declaration, then the tax authority will have the right to hold him accountable under Article 122 of the Tax Code of the Russian Federation and collect an additional fine of 20% of the tax amount (78 thousand rubles).

Responsibility for shortcomings with tax reporting

In case of failure to fulfill the obligation to disclose and declare the amounts of one’s income, liability arises on the basis of the Tax Code of the Russian Federation.

It states that the penalty for failure to file 3-NDFL by an individual in 2022 is 5% of the amount specified therein. Additionally, tax officials are held administratively liable for failure to submit reports on time in accordance with the norms of the Code of the Russian Federation on Administrative Offences. Ordinary citizens who have an obligation to report on personal income tax are not in danger of this. Punishment in the form of a fine occurs for violation of the deadlines for submitting this document by individual entrepreneurs and making mistakes that led to underpayment of tax to the budget.

ConsultantPlus experts sorted out when to submit 3-NDFL and how to do it correctly. Use these instructions for free so you don't break anything or pay a fine.