How to provide an employee with a social deduction

To provide a social deduction, the accountant must receive from the employee:

1. Application in free form.

Example of a statement text:

“Based on clause 2 of Art. 219 of the Tax Code of the Russian Federation, I ask you to provide me with a social tax deduction for personal income tax in the amount of 60,000 rubles.

I am attaching to the application the notification received from the tax authority confirming the taxpayer’s right to a social tax deduction dated November 1, 2021 No. 8527-u.”

2. Notification from the tax authority.

Important: from January 1, 2022, the rules for issuing notifications will change. The employee will apply to the tax office to issue a notice of deduction, and the tax authorities will send the notice itself to the employer directly through TKS channels or by mail.

From the same date, new notification forms will come into force (order of the Federal Tax Service of Russia dated August 17, 2021 No. ED-7-11 / [email protected] ).

For now, until the end of 2022, tax authorities issue notifications in the form given in the letter of the Federal Tax Service of Russia dated January 16, 2017 No. BS-4-11 / [email protected]

An accountant does not need to check documents confirming the right to deduction. This work has already been completed by the tax office.

We talked in detail about the size of the social deduction, its types and other nuances in this article.

Receiving a deduction when changing jobs

Example 2

In February 2022 from Romanov I.I. a daughter was born. From January to July 2022 he worked at YuG LLC, and in August 2022. got a new job at Zvezda LLC.

At his first place of work, he was not provided with a child benefit. In order to receive a deduction for a second place of work, he needs to provide a 2-NDFL certificate from LLC “YUG” confirming that he has not received deductions, as well as an application for a deduction and a copy of the child’s birth certificate. Accordingly, from August 2022, an employee can receive a monthly deduction from the Zvezda LLC organization, and for the period from February to July 2022, subject to an income limit of 350,000 rubles. receive a deduction from the Federal Tax Service at the end of 2022.

Also, do not forget that when providing deductions, it is important for a new employer to take into account the receipt of deductions and the employee’s income limit in the 2-NDFL certificate from the previous place of work. This will avoid errors and all kinds of recalculations.

From what date should the deduction be provided?

Social deductions are always provided from the month in which the employee submitted the application and notification from the tax authorities.

Example: employee’s salary is 50,000 rubles. In November 2022, he submitted documents to the accounting department for a social deduction in the amount of 60,000 rubles. That is, the employee needs to reimburse 7,800 rubles (60,000 rubles * 13%).

Consequently, for November, the employee will receive his entire salary - 50,000 rubles. The accountant will not withhold personal income tax from income. This means that for November the employee will receive 6,500 rubles more than usual (50,000 rubles * 13%).

For December, the employee will receive 44,800 rubles. (50,000 - ((50,000 rubles - 10,000 rubles) * 13%)). Since part of the income in the amount of 10,000 rubles will not be subject to personal income tax, the employee will receive 1,300 rubles more.

As a result, by the end of the year the deduction will be received in full: 6,500 rubles + 1,300 rubles = 7,800 rubles.

General rules for receiving a deduction

To apply for a tax deduction for children, the following prerequisites must be met:

1. The parent (guardian, trustee, adoptive parent, adoptive parent) must be a citizen of the Russian Federation and receive income taxed at a personal income tax rate of 13%.

The income of an individual must be subject to personal income tax. If an individual is an individual entrepreneur who applies special tax regimes, or belongs to the category of officially unemployed, or receives only state benefits, a pension, etc. as income, then, accordingly, the right to a deduction in such situations does not arise.

2. The presence of supported children, namely: minor children under the age of 18, children under the age of 24 who are studying full-time, disabled children under the age of 18 and disabled children of groups I, II in under 24 years of age, full-time students.

3. The cumulative amount of income from the beginning of the calendar year should not exceed 350,000 rubles. (for each parent separately), after exceeding this limit during the year, the deduction stops from the month in which the income exceeded the limit of 350,000 rubles.

The tax deduction for children is devoted to Art. 218 Tax Code of the Russian Federation. A deduction is nothing more than a reduction in the taxable base - the official income of an individual subject to personal income tax. In other words, this is the part of your income on which personal income tax is not paid to the budget (or is returned). That is, in essence, less tax will be withheld from you, and you will nominally receive more money.

IMPORTANT!

- The child tax credit is provided for each calendar month from the date of eligibility.

- Deductions for children are summed up, that is, they are provided for each child separately.

- Both parents (guardians, trustees, etc.) have the same right to receive a deduction for each of their children.

What to do if the deduction is not fully selected

If by the end of the year the employee does not have time to select the entire amount of social deduction, then this is his concern; the accountant has fulfilled his duties. The employee will have to apply to the Federal Tax Service independently for the remainder of the deduction at the end of the tax period (calendar year).

If filling out the declaration yourself causes you difficulties, contact SberResolutions - we will help you prepare and send documents to the tax office right from home.

Apply for a deduction

Termination of deduction

The justifications for ending the provision of the deduction are briefly reflected in Table 1.

Table 1. When the receipt of the deduction stops

| Rationale | The period from which the deduction ceases to be received |

| Exceeding the income of an individual of the established threshold of 350,000 rubles. | The month in which the individual’s income exceeded the limit |

| Coming of age of the child | From January of the year following the year in which the child turns 18 years old |

| A full-time student is 24 years old, provided that the child has not stopped studying by the end of the year | From January of the year following the year in which the child turns 24 years old |

| A full-time student has turned 24 years old (or before reaching 24 years old), provided that the child has stopped studying by the end of the year | The month following the month in which training is terminated |

From what date should the deduction be provided?

But here the accountant faces certain difficulties. Property deductions are provided from the beginning of the calendar year, provided that the employee has already worked at the enterprise during this period. The date of submission of the application with notification does not matter.

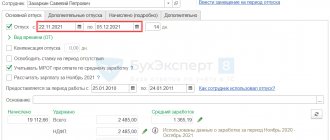

For example, an employee who has been working for the company for a long time applied for a property deduction in November. It turns out that for the period from January to October, the employer excessively withheld and transferred personal income tax from his salary to the budget. Now the employee needs to return this money.

Moreover, you need to act according to the algorithm given in paragraph 1 of Art. 231 Tax Code of the Russian Federation:

- Within 10 days from the date of receipt of the application and notification from the employee, inform him about the fact of excessively withheld personal income tax.

- Receive an application from the employee indicating his account details for transferring funds by bank transfer.

- Transfer money to the employee within three months.

The money for the refund can be taken from the total amount of personal income tax that is due to be transferred to the budget for the coming periods, both for this employee and for other employees of the enterprise. Thus, it is possible to make a refund, for example, in the case when the amount of personal income tax to be withheld from the employee is less than the amount that needs to be returned.

Please note that if an employee pays alimony for minor children under a writ of execution, the accountant must withhold alimony from it before transferring the amount of the returned personal income tax to the employee's bank account. This requirement was approved by Decree of the Government of the Russian Federation dated November 2, 2021 No. 1908 and applies from November 11, 2022.

The process of returning personal income tax when using a property deduction

There are three ways to get a tax deduction when buying an apartment, house or land:

- through the tax office at the end of the year, when the withheld personal income tax is returned by the tax office immediately for the whole year;

- through the employer in the current year, when personal income tax is not withheld from your salary until the amount of property deduction ends;

- in a simplified manner for the previous year, without collecting documents and in a shortened time frame.

Receiving a deduction through the tax office

After the calendar year in which you are eligible for the property deduction has passed, gather the documents and information needed to claim the deduction. These include:

- Certificate of income and tax amounts of an individual (formerly 2-NDFL). Get it from your employer or accountant. If you worked in several places during the year, take certificates from each place of work. After March 1, they will appear in the taxpayer’s personal account automatically, then they will not have to be collected by employer.

- Sales and purchase agreement, share participation agreement, transfer and acceptance certificate if necessary.

- Extract from the Unified State Register confirming ownership.

- Documents that will confirm the purchase costs: loan agreement, buyer’s receipt, payment receipt, payment order, etc.

Based on the collected documents, prepare a tax return in form 3-NDFL. The declaration form can be downloaded and filled out yourself or filled out online on the Federal Tax Service website. When income certificates from employers are uploaded into the system, it is possible to generate a declaration automatically - this method is suitable when you do not have additional income. Along with the declaration, submit an application for a tax refund and, in some cases, additional documents, for example, an application for the distribution of deductions. The application indicates the desired deduction amount and account details where the tax office should transfer the money.

Submit a package of documents to the tax office - in person or online. The tax office will conduct a desk (non-visit) audit of them. By law, the audit must be completed within three months (Article of the Tax Code of the Russian Federation), and then the tax office is obliged to send you a written notification of its results (granting or refusing to provide a tax deduction) within 10 working days. Within one month after the end of the desk audit, if the application was submitted initially, the tax office will transfer the money to you (Clause 6 of Article of the Tax Code of the Russian Federation).

If the tax inspectorate violates the deadlines for returning personal income tax, then for being late they will be forced to pay interest accrued based on the refinancing rate.

The declaration and application must be sent to the Federal Tax Service every year until the entire personal income tax amount is returned.

This option is suitable for those who want to return personal income tax for previous periods or do not work under an employment contract.

What to do if the deduction is not fully selected

A property deduction is a large sum of money, and it is not always possible to return it within a year. But the notice from the tax service is valid only until the end of the year in which it is issued.

If an employee plans to receive a deduction at the enterprise next year, he needs to contact the Federal Tax Service again and request a new notification.

Thus, to resume providing the deduction next year, the accountant will need:

- New notification from the Federal Tax Service (remember that in 2022 the tax authorities will send it directly to the company).

- A new application from the employee, which must indicate the amount of the remaining deduction.

What social deductions can you get from your employer in 2022?

You can get almost all types of social deductions from your employer. An exception is the deduction for charitable expenses.

Please note that the new social deduction for expenses on physical education and health services in 2022 can only be obtained from the employer. It can be declared to the Federal Tax Service in 2023 after the end of 2022.

The essence of the deduction from the employer is that the employer will not withhold personal income tax from the employee on the amount of income.

To receive a deduction, the employee must provide the necessary documents to the accounting department.

Read in the berator “Practical Encyclopedia of an Accountant” Social deductions