Income on which personal income tax is calculated

Personal income tax is charged on all types of income of individuals. They include:

- Salary based on the main position and part-time position.

- Premium payments.

- Payment of basic and additional vacations.

- Payment of sick leave.

- Gifts and winnings.

- Royalties received for intellectual activity.

- Insurance payments.

- Payment for work under civil contracts.

- Proceeds from the sale of property.

- Income of the lessor under the lease agreement.

- Other income of the taxpayer.

For the correct calculation of personal income tax, the citizenship of an individual does not matter, the only important thing is whether he is a resident or not. This is determined by how many days this person spends in a year (the calendar year is the tax period for personal income tax) within the borders of Russia. If a person stays in the country for more than 183 days, he is considered a resident; otherwise, he is considered a non-resident. A resident individual is subject to taxation on all income in accordance with the law. A non-resident pays only on the income he received from a Russian-based source.

The tax base for the income tax of an individual consists of all income issued to him in financial or in kind form, with the exception of amounts that, in accordance with the Tax Code of the Russian Federation, are free from taxation and various types of deductions.

What changed

At first glance, the changes to the new form of the 2-NDFL form in 2018 are not immediately obvious, but they exist.

Reorganization or liquidation and surrender by successor

Firstly, in the new form of the 2-NDFL certificate from 2022, new fields have appeared in case it is submitted by the legal successor of the reorganized entity:

New clause 5 of Art. No. 230 of the Tax Code of the Russian Federation specifies that, regardless of the type of reorganization or liquidation - affiliation \ division \ transformation \ merger \ division - the legal successor will be obliged to submit forms 2-NDFL and 6-NDFL for the reorganized structure to the Federal Tax Service at the place of its registration. This is relevant provided that the reorganized company did not do this. A similar obligation applies to the submission of updated information.

According to the new version of Appendix No. 2 “Codes of forms of reorganization and liquidation of an organization / separate division” to the rules for filling out form 2-NDFL, the following codes are established:

- “0” – liquidation;

- “1” – transformation;

- “2” – merger;

- “3” – separation;

- “5” – accession;

- “6” – separation with simultaneous joining.

According to the new rules, the legal successor indicates the OKTMO code precisely at the location of the reorganized structure or its separate division. In the “Tax Agent” line, the successor also indicates the name of the reorganized company.

There are no more address data of individuals in 2-NDFL

It is also worth noting that the 2-personal income tax form in 2022 has decreased by a whole series. As a result, Section 2 of the certificate became 2 times smaller.

Secondly, the new 2-NDFL declaration form was approved in 2022 without the lines where previously it was necessary to indicate the exact address of each individual income recipient:

Thus, now you no longer need to indicate either your place of residence in Russia or the code and address of your country of residence.

Investment deductions excluded

Section 4 of the new 2-NDFL certificate 2022 no longer contains investment deductions.

What income is not subject to personal income tax?

You need to understand: with regard to income tax, there are no so-called beneficiaries, that is, individuals who are completely exempt from paying it. Only certain types of income are subject to exemption:

- Benefits for women during pregnancy and childbirth.

- Insurance and funded pensions.

- Social supplements to pensions.

- All legally approved compensation related to: compensation for damage to health; with free provision of accommodation and utilities; with the dismissal of an employee, with the exception of payment for unused vacation.

- Payment for donated blood and breast milk to persons who are donors.

- Alimony received by the taxpayer.

- Financial assistance paid to employees within limits not exceeding four thousand rubles.

- Financial assistance paid to employees at the birth or adoption of a child within limits not exceeding 50 thousand rubles.

- Other income listed in the Tax Code of the Russian Federation, Article 217.

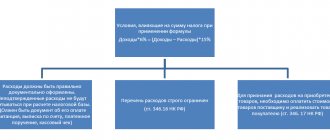

Various types of deductions are subtracted from the tax base when calculating personal income tax. This is an amount determined by law that is not subject to taxation. Deductions are provided to citizens with children, representatives of certain professions, veterans, persons affected by man-made disasters, and others listed in the Tax Code of the Russian Federation.

Income codes in 2-NDFL from 2710 to 2790

| Revenue codes | Decoding |

| 2710 | Financial assistance for the birth/adoption of a child (exception: financial assistance provided by the employer to its employees, as well as to its former employees who resigned due to retirement due to disability or age; material assistance provided to disabled people by public organizations of disabled people, and one-time financial assistance paid by employers to employees) |

| 2720 | Cost of gifts |

| 2730 | The cost of prizes in cash and in kind, which are received at competitions and competitions held in accordance with decisions of the Government of the Russian Federation, legislative bodies of state power and representative bodies of local government |

| 2740 | The cost of prizes and winnings received in games, competitions and other events for the purpose of advertising services or goods |

| 2750 | The cost of prizes in cash and in kind received at competitions and competitions that are not held in accordance with decisions of the Government of the Russian Federation, legislative/representative bodies of state power or representative bodies of local government and not for the purpose of advertising goods/works/services |

| 2760 | Financial assistance provided by an employer to its employees or former employees who quit due to retirement due to disability or age |

| 2761 | Financial assistance provided to disabled people by public organizations of disabled people |

| 2762 | One-time financial assistance provided by the employer to employees (parents/adoptive parents/guardians) upon the birth/adoption of a child |

| 2770 | Payment/reimbursement by employers to their employees, their spouses, parents and children, former employees/retirees, as well as disabled people for the cost of medications purchased by them or for them, which were prescribed to them by their attending physician |

| 2780 | Payment/reimbursement of the cost of medications purchased by the taxpayer or for him, prescribed by his attending physician, as well as in other cases not falling under clause 28 of Article 117 of the Tax Code of the Russian Federation |

| 2790 | Assistance in kind or cash, as well as the value of gifts received by WWII veterans, WWII disabled people, widows of military personnel who died during the war with Finland, Japan, WWII, widows of deceased WWII disabled people and former prisoners of Nazi prisons, ghettos and concentration camps, also former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War |

Provision of information by the tax agent to the Federal Tax Service

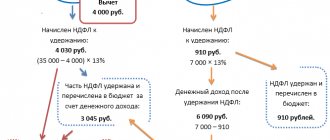

All organizations and individual entrepreneurs with employees become tax agents for personal income tax. What are their responsibilities? First, income taxes must be withheld on all income paid by an employer to an individual. Secondly, the withheld amounts must be transferred to the account of the Federal Tax Service within the time limits specified by law. Thirdly, after the end of the calendar year (which is the tax period for personal income tax), the agent is obliged to provide data to the inspectorate about all amounts of income tax withheld and transferred for each employee. The employer provides a certificate for each employee in Form 2-NDFL within the time limits specified in the Tax Code of the Russian Federation.

Late or missing submission of a certificate will result in penalties. The codes in 2-NDFL in 2016 were slightly different from those currently in force.

The meaning of code 2300 in the income certificate in form 2-NDFL

First, let's figure out what this certificate is. Personal Income Tax stands for Personal Income Tax.

Certificate 2 Personal income tax is a special type of document issued by the accounting department at the place of work. In accordance with the Tax Code of the Russian Federation, the employer is obliged to issue this certificate upon request of the employee.

The certificate is filled out according to the official form developed by the Federal Tax Service.

The certificate indicates the last name, first name, patronymic of the employee, and details of the employer.

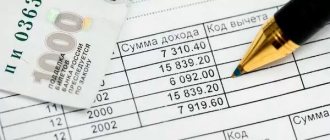

And in the main field the items and amounts of income for each month for the last reporting year are indicated. The number of tax and other deductions, as well as tax deductions, is indicated at the bottom of the certificate.

Special requirements for the certificate

- The certificate is issued strictly according to the form approved by the Tax Service;

- The data specified in the certificate received should not differ from the passport data;

- All types of any citizen’s income must have code values;

- All numeric codes for any citizen's income must be updated to the latest edition.

Since the certificate contains the most complete and reliable information about the sources and amount of income, as well as the amount of tax deductions, a certificate in Form 2 of personal income tax is a document confirming the citizen’s income.

Help using this form may be needed in several life situations. Eg:

- When receiving a loan;

- When receiving a mortgage;

- When applying for benefits and financial assistance from the state;

- When calculating holiday pay;

- When calculating sick leave benefits;

- When calculating vacation pay;

- When calculating other benefits;

- When calculating pension contributions and other things.

Most often, the average citizen needs this certificate to apply for a mortgage loan. Banking and credit organizations, as a rule, require the client to confirm his income. And they require you to provide a certificate 2 personal income tax. Most credit institutions require this certificate.

Certificate 2 of personal income tax must be submitted to the social protection department in order to receive various types of benefits and material assistance to the poor.

A certificate is provided to a kindergarten in case of low family income in order to receive benefits such as free meals.

According to its structure, the certificate includes all items of a citizen’s income, which in turn are indicated by numerical codes.

Income code 2300 in this certificate indicates that this type of income was received by the citizen as a benefit. In this case, code 2300 confirms the payment of benefits to the employee in the form of monetary compensation for temporary disability.

And in this certificate you will have a new numeric code for the citizen’s income item by number - 2300.

In the Russian Federation, most types of items of income of citizens are subject to mandatory tax deduction. Such contributions are sent to the Mandatory Pension Insurance Fund for Citizens and the Social Fund. protection of citizens.

The employer makes all deductions on the basis of reporting documents provided by the accounting department confirming employee income items.

Detailed instructions for correctly and competently drawing up the required certificate can be found in a publicly available resource, on the official website of the Federal Tax Service and can be viewed for free.

What does code No. 2300 contain in the income certificate of a citizen - an individual?

As indicated earlier, code 2300 will indicate data on payments to employees of an operating organization, which were calculated by it as temporary or total disability benefits.

In this situation, the Code of the Russian Federation (tax) states that this type of benefit will be considered income and, of course, must be subject to mandatory tax deduction.

The amount of earned – “net” income is displayed in the certificate with the income tax of the citizen as an individual already deducted.

In conclusion, I would like to note once again that when filling out the certificate, if the employee was awarded temporary (or total) disability benefits, then this type of income should, in accordance with the code, be designated by the numerical code 2300.

We also recommend:

How to fill out the 2-NDFL certificate

In 2022, Form 2-NDFL is in effect, the form of which was approved in Order MMV 7-11/485 dated October 30, 2015.

How to fill out 2-NDFL so that the form is verified and accepted by the tax inspector? First of all, let's pay attention to the sections of which it consists:

- Section 1. The name, address, telephone, INN, KPP, OKTMO code of the tax agent are indicated.

- Section 2. Fill in the taxpayer identification number, full name, status, date of birth, citizenship, passport details and address of the taxpayer.

- Section 3. All accrued taxable amounts are entered monthly, broken down in accordance with the income code, and professional deductions are entered.

- Section 4. Codes and amounts of social deductions, as well as property and investment deductions, are filled in.

- Section 5. Income for the entire year is summed up, the taxable base is calculated, the tax payable is calculated, the withheld and transferred personal income tax is indicated.

Before filling out 2-NDFL, it is necessary to check the relevance of the address and passport details of the taxpayer. If the data has changed during the past year, corrections must be made. When an employee applies for an income tax refund when purchasing housing or paid training and treatment, the Federal Tax Service will detect discrepancies in the data in the certificate and the documents presented. A sample of the new form 2-NDFL is presented in this material.

What do personal income tax codes mean?

In certificate 2 of personal income tax, regardless of the purpose for which it is drawn up - for reporting to the Federal Tax Service or an individual, all types of remuneration subject to taxation and tax deductions due to a citizen are recorded.

For the convenience of reflecting and processing information, tax accounts received by the budget, data is indicated in the form of appropriate codes approved by Order of the Federal Tax Service No. MMB-7-11 / [email protected] dated September 10, 2015.

According to the regulatory document, types of remuneration are displayed as a four-digit code, starting from 1010 and ending with 4800.

The first digit also matters in encryption.

The group that begins with “1” includes types of remuneration that are not related to work activity. This could be government payments, loan income (in the form of interest), etc.

The second group, which begins with “2,” includes all types of profit paid by the employer to its employees: wages, vacation pay, bonuses, compensation, etc.

A small subgroup designated “3” reflects income in the form of interest on own investments, as well as winnings.

Since the adoption of the Order, changes have been made, new codes have been added, for example, 2013 - compensation for unused vacation, which previously fit the universal code 4800, which will be discussed. Other incomes were also included, 2002, 2003, etc. And some that were initially accepted were also excluded, for example, 2791, under which remuneration in kind from agricultural production was indicated.

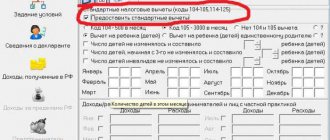

In addition to income codes, the reporting forms also use deduction codes, which are also approved by law, in Appendix 2. They are three-digit characters from 104 to 620.

Deductions are divided into groups, depending on the basis for providing a personal income tax refund:

- property;

- social;

- standard;

- professional;

- investment.

We recommend additional reading: Personal Income Tax Declaration 3: how to find out the budget classification code and where to get it

Certain deductions are provided for children, and some for the taxpayer himself.

Income and deduction codes in personal income tax certificate 2 are reflected in two sections: the third and fourth. Each type of remuneration and, accordingly, the required deduction is posted by month, in the form of a table.

The fourth section is intended to reflect property, social and standard deductions.

In connection with the latest changes in reporting forms adopted by law, a certificate in Form 2 of personal income tax is generated in two different versions for the Federal Tax Service and for individuals. In the first option, the tax agent is supposed to fill out an Appendix to the document, which deciphers all types of remuneration received by the taxpayer for the year and the deductions provided to him. In the second case, the information in blocks 3 and 4 of the form is sufficient.

The accepted designations are used not only to generate a form for a certificate of income of an individual, they are used in other forms of financial and accounting reporting.

What is an income code and how is it determined?

Income codes for the 2-NDFL certificate must be selected from Appendix No. 1 to Order No. ММВ-7-11/387 dated September 10, 2015. In it, each type of income that an individual can receive in cash or in kind is assigned a unique four-digit code .

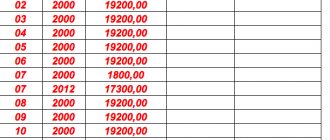

It is very important for the employer to determine which code the income belongs to and correctly indicate it in the certificate. Changes are constantly being made to the list approved by the Ministry of Finance. An example is the calculation of wages and benefits. This operation is performed by every employer. In 2015, after the approval of the new list, income was distributed as follows:

- Accrued wages (including bonuses) - code 2000.

- Accrued vacation pay (including payment for unused vacation upon dismissal) - code 2012.

- Temporary disability certificates have been paid for - code 2300.

In 2016, changes were made to the list of codes in 2-NDFL: bonuses were allocated from the amount of wages, and they were divided depending on the source of payments. In 2022, from the amount of payment for vacations due to the employee, a separate compensation code for the remaining days of vacation upon dismissal was allocated and assigned. In the report for 2017, the income of employees as a result of calculating wages and benefits will be distributed according to income codes in 2-NDFL as follows:

- Salary accrued - code 2000.

- A bonus has been accrued for production results and other indicators, paid from the wage fund not at the expense of net profit or designated funds - code 2002.

- A bonus was awarded for the same indicators at the expense of profits and targeted financing - code 2003.

- Vacation pay accrued - code 2012.

- Payment has been accrued for the remaining days of vacation upon dismissal - code 2013.

- Temporary disability certificates have been paid for - code 2300.

When accounting for wages, benefits and compensation is carried out in special programs, such as 1C:Enterprise, it is enough to make appropriate additions to the program once at the time the next change in the list is put into effect. When calculating salaries manually, the accountant will need to carefully distribute the income of individuals. According to Article 126.1 of the Tax Code of the Russian Federation, for the provision by a tax agent of certificates containing false information, a fine of five hundred rubles per document is threatened. If there are many employees, the amount of the fine in case of an incorrectly chosen income code will be sensitive.

Code 4800 value - what is it?

When faced with code 4800 in their certificate in form 2-NDFL received at their place of work, people do not immediately understand what we are talking about. Let's figure this out together.

On this issue, it is paramount to know what this certificate actually is, what it contains and why it is needed.

What is 2-NDFL

A certificate in form 2-NDFL is a standard A4 paper document, which displays financial income and payment of income tax on it in the format specified by law.

The document has an individual character and is drawn up for each individual separately. Simply put, the compiler of the certificate, and most often this is the accounting or economic department, records in the document all officially received wages, bonuses and other income on a monthly basis.

Why do you need a 2-NDFL certificate?

The certificate is the main basis for performing a number of banking, tax and other documentary operations. For example, according to its data, a 3-NDFL certificate is drawn up to provide annual reporting to the tax authority or to process a refund of overpaid tax.

When submitted to a bank - for loan approval, as well as to other organizations - to confirm wealth.

What does a 2-NDFL certificate look like?

Certificate 2-NDFL looks like this:

- Information about the tax agent (address, telephone, TIN, KPP)

- Information about the taxpayer (full passport data, TIN and address)

- Income (listed monthly in coded form and with final amounts)

- Deductions (also coded data with final amounts of VAT payments)

- Total amounts (total amounts of income and deductions for the entire financial period)

- Document details: number, signature, seal, barcode and reporting year.

Where to get a 2-NDFL certificate

One of the main features of the 2-NDFL certificate is compliance with the provision of a report only for the past financial year. Or the last three. This means that it is not possible to draw up a certificate for an unfinished year, since it is impossible to summarize general figures on income and taxes paid.

The chief accountant is responsible for drawing up the certificate and bears full responsibility for the accuracy of the data specified in it, be it at the place of work or as an individual entrepreneur.

As a rule, you can receive a certificate after one or two months from the beginning of the new year. This is due to the submission of the chief accountant’s annual report to the tax authority.

Encoding of information in the 2-NDFL certificate

All information related specifically to monthly income and tax deductions are digital codes. In accordance with the order of the Russian Tax Service dated September 10, 2015 No. ММВ-7-11/387, the income of individuals in the 2-NDFL certificate is subject to four-digit coding, and tax deductions in the form of 13% of income amounts are subject to three-digit coding.

Income codes are distributed in a digital range starting from number 1010 and ending with 4800, without taking into account the ordinal sequence. Here are some examples:

- 1010 – dividends;

- 2000 – salary;

- 2300 – payment of sick leave;

- 3020 – income from interest-bearing deposits in the bank.

You can find deduction codes from numbers 114 to 508. Also without serial sequence. In particular, these are:

- 114 – deduction for the first child;

- 501 – deduction from the total value of the gift;

- 508 – deduction for one-time financial assistance.

Code 4800 – what does it mean?

Judging by the number of digits in code 4800 in the 2-NDFL certificate, the conclusion immediately suggests itself that this is an income code. It should also be noted that it is the last in the list of existing codes.

Based on the analysis of the Appendix to the above order of the tax service, code 4800 has the legislator’s comment as “other income.”

The wording is extremely comprehensive. This means that this type of income includes any other type of official income not described by other codes.

More specifically, “other income” most often includes:

- prizes;

- branded clothing;

- present;

- monetary tokens of attention expressed by the team, etc.

In this regard, code 4800 has a separate characteristic. If income is generated in kind, it is not subject to declaration and payment of 13% VAT. It does not seem appropriate to find out the cost of this type of income.

In rare cases, code 4800 may indicate amounts. If an employee finds this code in his certificate, without having an exact answer as to what the accountant included in it, then alternatively it could be amounts paid in excess of what was required.

For example, with pre-accrued travel allowances, vacation pay, and sick leave. This means a kind of small overpayment that the accountant noticed when reporting.

When drawing up a certificate and reading all income, the accountant focuses on all cases of income presented to legislators. If the available income is not comparable to more than one code, then accordingly it will be recorded in the certificate as “4800”.

What is the income code 4800 for?

The decoding of income code 4800 in the appendix to the order of the Ministry of Finance sounds like this: “other income.” No further explanation was provided. This means that when paying or issuing in kind (prizes, gifts, uniforms) to an individual income that is not included in the list of those exempt from taxation on the basis of the Tax Code of the Russian Federation, Article 217, it is necessary to withhold and transfer income tax to the state income.

What to do if income is not indicated in the current list? It is assigned to income code 4800, the decoding of which means “other income.” It must be remembered that in the case when the issuance was made in kind, its value is determined, but the tax cannot be withheld, because in monetary terms in the tax period after this issuance, the individual is not entitled to anything. The duties of the tax agent include reporting this to the Federal Tax Service.

Taxation of daily allowances on business trips

Most often, code 4800 is used to reflect an employee’s income in the form of daily allowances paid while on a business trip. The amount of travel expenses is determined in the “Regulations on Business Travel”, which is an annex to the collective agreement. This is an optional document; you can specify all the necessary points in the “Internal Rules” or in the order of the manager. But many organizations accept the Regulations; it can be created in personnel management programs with automated accounting. The amount of daily allowance is set by decision of management and is not limited by an upper limit. It must be remembered that Article 217 specifies the maximum amounts of daily allowance that are not subject to income tax:

- On business trips within Russia – 700 rubles.

- On business trips abroad – 2500 rubles.

Daily allowances exceeding this limit are subject to 2-personal income tax. For example, if the daily allowance for an internal business trip is 1,000 rubles, the employee traveled for five days, he is credited with 5,000 rubles. Of these, 700 x 5 = 3500 rubles. are not subject to personal income tax. Amount 1500 rub. must be included in the 2-NDFL certificate in the month when the daily allowance was accrued and issued, with income code 4800.

The situation is similar with the amount of travel expenses for accommodation. The organization has the right to provide in its Regulations for full reimbursement of living expenses based on the documents provided. In the absence of documents, the employee may be reimbursed in a fixed amount. In Article 217, the maximum amounts of non-taxable compensation for accommodation without supporting documents are:

- On business trips within Russia – 700 rubles.

- On business trips abroad – 2500 rubles.

Amounts in excess of those specified in article 217 are subject to income tax and are displayed with income code 4800. The decoding of all amounts that relate to this code must be kept in the accounting department in order to avoid misunderstandings during tax audits.

Income

The most commonly used income code is 2000. This is money that was received during the reporting period as salary. In some cases, it is customary to give employees bonuses in addition to this. They can be divided into two large groups.

- Some refer to the fact that the employee has shown excellent results in his work activity. They belong to the 2002 code.

- Other types of incentives may have different reasons. They are usually paid by the enterprise out of profits. Their code is 2003.

Some other codes are often used along with salaries. Income code 2012 in personal income tax certificate 2 - what is it? They denote vacation pay payments. It should be noted that there is vacation pay, designated differently (4800). Here we are talking about the payment of vacation pay for unused vacation upon dismissal.

Payment does not always take the form of a salary. Another well-known payment option is payment under civil contracts. Its designation is code 2010. Income code 2300 in personal income tax certificate 2 corresponds to the income received by the employee in the form of sick leave payments. Since this type of income is subject to income tax, it must be mentioned in the certificate.

It is known that an individual who owns a vehicle can rent it out. Income received in this way is designated by code 2400. The same is designated when pipelines, communication lines and other similar objects are leased.

Sometimes, for some reason, an enterprise is settled not with money, but with some commodity values, using payment in kind. If this was the case, then the value 2530 will be used here.

When a company wants to interest a valuable employee, and also where this is provided for by the norms of Russian legislation, it is quite acceptable to pay for the employee the benefits due to him or compensate for the expenses he has made. One example might be paying for your employee's utilities, vacation, or food. This is one of the types of income of an individual and should be displayed in this certificate under number 2510.

Income code 4800 in personal income tax certificate 2 - what is it? What to do if the benefit received is not taken into account in the classification specified in the tax code? All such income is indicated by the specified value. The question arises: what are some examples of these types of income? One of them is the payment of part of travel allowances. As you know, the legislation provides for payment of travel expenses within certain limits. However, the head of the enterprise has the right to increase them. The corresponding excess amount refers to code 4800.

An employee may receive financial assistance. Its designation is 2760. Such support can be provided not only to employees, but also to those. Who no longer works at the company. Financial assistance, indicated by this code, can be issued to those who have retired, as well as due to disability or age.

Withholding personal income tax from additional payments up to the average monthly salary when paying certain types of benefits

Organizations have the right to pay their employees extra during periods when they do not work and receive benefits from the social insurance fund. This could be payment for sick leave or maternity leave.

If social benefits calculated in accordance with the rules established by law are less than the employee’s average monthly earnings, an additional payment may be made to compensate for this difference. This is an optional payment. The order of the organization establishes a list of employees (it may not include all personnel) who receive additional benefits, and the calculation procedure.

If payment for sick leaves is fully subject to income tax, then the additional payment to it is also included in the base and is taken into account in 2-NDFL using code 2300. Payment for maternity leave is exempt from tax, but the additional payment made is not a state benefit. On this basis, it is included in taxable income and is taken into account in the 2-NDFL certificate at the time of payment using code 4800.

What amounts should definitely not be included in code 4800

Only amounts subject to taxation are included in the income certificate. Even if they are partially exempt from tax. Payments that are not subject to personal income tax at all do not need to be included in this report. So, for example, you will never see maternity benefits in 2-NDFL. After all, the entire amount of this payment is completely exempt from taxation.

Accordingly, amounts from which income does not arise will never fall into the lines with code 4800.

Please note: amounts that are not taxed only up to a certain threshold are safer to include in the certificate in any case. If you do not do this, you can distort the real picture of income in relation to a specific individual.

In what cases is personal income tax withheld from compensation upon dismissal?

In cases of reorganization or change of owner of an enterprise, sometimes the management team is replaced - the chief, deputy chiefs, and chief accountant. When dismissing these employees, the law provides for a number of payments:

- Severance benefits.

- Maintained salary for the duration of employment.

- Compensation.

Article 217 exempts these payments from taxation in an amount not exceeding three times the average monthly salary, or six times the amount in the case when employees leave an enterprise located in the Far North or equivalent areas. Payments to these employees exceeding the non-taxable maximum are taxable income and will be indicated in the 2-NDFL certificate by income code 4800 and in decoding.

What is included in “other income” code 4800

What exactly is included in the “set” is not stated in the document. There is no transcript.

You should act according to the residual principle. If you did not find a special code for the payment made in the general list, enter 4800 (letter of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537). In particular, scholarships and compensation for delayed wages will fall under this code in 2022.

- Electronic extract from the Unified State Register for registration

- Forms of non-cash payments 2020

- OKOF data collection terminal

- Structure of the Russian pension fund scheme 2020

- College teacher salary in 2022

- Tool life before write-off

- Disposal of furniture in a budget institution

The last time the list was edited, five new revenue codes were added to the list. One of the new ones - 2013 “the amount of compensation for unused vacation” - can theoretically be available to every employer. So, the Federal Tax Service introduced new values specifically to provide more detail to employees’ incomes. After all, previously there was no separate code for such payments. And they set the total - 4800 “Other income”. Now, in the appropriate situation, a detailed cipher is needed.

Here is a list of payments (we present them along with the current codes) that no longer need to be included in the 4800 code. Check yourself to see if you are mistakenly attributing these amounts to the general code:

- 2013 - compensation for unused vacation.

- 2014 - severance pay, average monthly earnings for the period of employment, compensation to the manager, his deputies and the chief accountant in a part that generally exceeds three times the average monthly earnings - for ordinary employers and six times - in the regions of the Far North and equivalent areas.

- 2611 - bad debts written off in accordance with the established procedure from the company’s balance sheet.

- 3021 - interest (coupon) received on circulating bonds of Russian companies denominated in rubles and issued after January 1, 2022.

What other income could there be?

An organization in need of qualified personnel is ready to hire specialists living in other areas. At the same time, managers often even pay candidates for the position travel to the interview and other expenses associated with it. An employee's move to a new place of work is not subject to tax. But the candidate is not an employee, so the reimbursement for the presented travel documents and hotel bill is taxable income. There is no code for it in the list, so the amount should be displayed in the certificate as other income under code 4800. The organization is obliged to withhold and remit income tax on other income. There are two options here:

- The candidate himself bought travel tickets, paid for accommodation, and submitted documents to the organization for reimbursement.

- Travel tickets were purchased and the hotel was paid for by the organization itself.

In the first case, there should be no problems: having calculated the compensation, the accountant will withhold personal income tax from it and transfer it to the budget. In the second case, there is nothing to withhold tax from. Although income has undoubtedly been received, it is in such a form that deduction is impossible. In this case, no later than February of the next year, the organization, based on the requirements of the Tax Code, must notify the inspectorate of the obstacle to tax withholding.

There are situations when, during a tax audit, inspectors assign certain amounts to code 4800. This is income that should not be included in the taxable base in accordance with Article 217, but due to the absence or incorrect execution of relevant documents (no agreement, no certificates confirming taxpayer status, etc.) are not accepted by inspectors in this capacity. They can be classified as other income (income code for 2-NDFL - 4800) and tax withheld, as well as a penalty or fine.

The base on which income tax is calculated is very diverse. It includes many different accruals, rewards, benefits, compensation, payments, etc. In order to correctly classify all this variety by income codes, thoughtfulness and attention are needed. The correctness of tax calculation will ultimately depend on these qualities.