Rules for filling out a waybill according to form 3-special

The permit is filled out by the dispatcher or other authorized person in one copy before departure for the flight. One document can be used for one or two customers. If there are more of them during a shift, then additional waybills must be drawn up. Until 2012, it was mandatory to use a unified state form developed by Goskomstat. Starting from 2013, vouchers for special vehicles can be filled out on a form of any type, which, however, must contain all the necessary details and columns. The choice of one type of form or another remains up to the company.

What form can I use?

Since 2013, legislation does not provide for the obligation to use unified forms of documents. Therefore, the waybill can be developed by the organization independently, but with the presence in the form of all the mandatory details approved by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152. The developed form must be fixed in the accounting policy of the organization.

Mandatory details of the waybill for special equipment in 2019:

Many organizations use a waybill for special equipment in the 3-special form, the form of which was approved by Decree of the State Statistics Committee of the Russian Federation dated November 27, 1997 No. 78. It is familiar to both organizations and inspectors, so its use is completely justified.

A sample waybill for special equipment in form 3-special can be downloaded below.

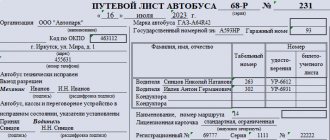

Front side

The document is typed on a computer or can be filled out manually. The driver usually writes his part of the information by hand. Filling out the waybill for a special vehicle on the front side begins with indicating the details of the document itself (series and number). They are also entered into a special journal for recording travel vouchers. Then you need to provide the following information:

- company details (address, official name, ORGNIP or OGRN, telephone number);

- number or name of the column or brigade;

- OKPO code;

- information about the driver (full name, driver's license number, driving category and class;

- information about the special vehicle (state and garage number, make);

- similar information about the trailer (garage and state numbers, make);

- a table containing data on the vehicle’s operation at the beginning and end of the trip (actual departure time, speedometer data, mileage);

- data on tear-off coupons (series and number), which are located in the corresponding tear-off part of the voucher.

Fuel consumption information

In this column you must indicate the code and brand of gasoline. How much was given to the driver before the trip and how much was actually spent. To calculate the actual consumption, we subtract the balance returned after the trip from the originally filled amount. In addition, the duration and performance indicators of the engine and equipment of the special vehicle are displayed.

Driver's task

This column is filled in by the dispatcher. It describes in detail the work of the driver on the flight. Namely, the time when the car should arrive at the site and until what hour it will stay there, as well as at whose disposal the special car with a driver comes. Here you should describe the type of work being performed and, if necessary, indicate details in the “Notes” section.

About waybills

Preparation of a waybill

Unfortunately, the waybill is issued only for one day or shift. You cannot issue a waybill for a week or a month.

Many inexperienced accountants believe that waybills can be compiled not only in a non-unified form, but also for a whole month at once. This popular position is based on numerous confusing letters from the Ministry of Finance of the Russian Federation. However, such a “homemade” waybill actually creates a number of obvious problems.

The first clarification on the possibility of not using the unified form of waybill is contained in the letter of the Ministry of Finance of Russia dated September 20, 2005 No. 03-03-04/1/214. And then this position was supported and developed in other letters from the financial department - dated February 20, 2006 No. 03-03-04/1/129 and dated April 7, 2006 No. 03-03-04/1/327.

However, not all accountants noticed that these explanations from officials only affect the waybill of a passenger car. The tax authorities also reacted with unforgivable inattention to the governing opinion. The Federal Tax Service of Russia for the city of Moscow in letters dated November 14, 2006 No. 20-12/100253 and dated June 19, 2006 No. 20-12/ [email protected] allows independently developed forms of waybills for all cars. That is, it interprets the opinion of the Ministry of Finance more broadly, going beyond its powers (letter of the Ministry of Finance of Russia dated May 6, 2005 No. 03-02-07/1-116).

The essence of the recommendations of official bodies is that it is not necessary to use the unified forms of waybills approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 (hereinafter referred to as Resolution No. 78) for tax accounting purposes. Accountants can limit themselves to independently developed forms of primary accounting documents, approving them in the accounting policy of the enterprise.

note

Paragraph 15 of the instruction dated November 30, 1983 of the USSR Ministry of Finance No. 156, the USSR State Bank No. 30, the USSR Central Statistical Service No. 354/7, the RSFSR Ministry of Autotransport No. 10/998 states: “All organizations that have both their own and leased trucks are obliged to when the vehicle is released onto the line, issue the driver with a waybill in the appropriate form. Releasing a truck onto the line without a waybill in an approved form is strictly prohibited.”

“Homemade” waybills can be issued monthly. True, such “amateur activities” are allowed only to organizations that are not motor transport organizations.

The first law enforcement problem of “homemade” waybills is that the concept of motor transport organizations is not normatively defined. But the Charter of Motor Transport of the RSFSR (approved by Resolution of the Council of Ministers of the RSFSR dated January 8, 1969 No. 12) equates non-specialized enterprises with cars to motor transport. In addition, the unified forms indicate that waybills for all vehicles are standard interindustry forms.

The second problem is that the waybill is a document provided for by the Road Traffic Rules of the Russian Federation (approved by Decree of the Government of the Russian Federation of October 23, 1993 No. 1090, hereinafter referred to as the Traffic Regulations). And it is unlikely that the traffic police inspector will be satisfied with the abbreviated form developed by the enterprise. Agree, who on the highway will delve into the individual features of accounting policies.

On the road - only with a waybill

The desire of accountants to simplify the maintenance of waybills is explained by the fact that in small firms the responsibilities for filling out these forms fall on their shoulders. Well, Resolution No. 78 states that the waybill is issued by the dispatcher or an authorized person.

This means that the corresponding powers of the accountant must be approved by the administrative document of the organization. However, we must not forget that the purpose of the waybill is not limited to accounting for fuel consumption. After registering the waybills in the logbook (according to the unified form No.), it is issued to the driver against signature and accompanies him on the trip.

In addition to tax inspectors, traffic police inspectors are interested in waybills. According to paragraph 2.1.1 of the traffic rules, the driver is required to have a waybill with him and hand it over to police officers for verification upon their request.

True, the traffic rules contain a vague clause: the sheet is required “in specified cases.” And which ones exactly? First of all, a waybill is needed if the driver does not have a power of attorney to drive a vehicle. This means that when operating a passenger car under a power of attorney from an organization, you can indeed do without a waybill on the road. But a power of attorney will not replace a homemade “accounting” waybill. And then the driver faces an administrative fine under Article 12.3 of the Code of Administrative Offenses of the Russian Federation in the amount of 500 rubles.

But for cargo transportation, a unified waybill is indispensable. Paragraph 2.1.1 of the traffic rules states that the driver, in cases expressly provided for by current legislation, must have a waybill and hand it over for verification to employees of the Federal Service for Supervision of Transport.

The obligatory nature of a waybill when transporting goods of a commercial nature is established by paragraphs 47 and 50 of the Charter of Road Transport of the RSFSR. In this case, uniform forms of waybills are used and general rules for filling them out apply, but not the options approved by the head of the company.

Do you need to do double work?

The Russian Ministry of Finance unequivocally answered the question about the use of homemade monthly travel vouchers in a letter dated November 15, 2005 No. 03-03-04/1/363. They are allowed for a passenger car driven by an employee under a power of attorney and not transporting goods or passengers. Moreover, such sheets are intended to confirm fuel expenses for income tax purposes. And there are no grounds for using these documents outside of this specific situation.

Please note that Resolution No. 78 requires that truck waybills be stored together with waybills so that they can be checked at the same time. The numbers of shipping documents are entered in the waybill according to form No. 4-p. We must also not forget that the waybills keep records of the driver’s work. This means that they may be subject to inspection by the labor inspectorate.

Well, no one has canceled the requirement to undergo pre-trip medical examinations for drivers (clause 1 of article 20 and clause 1 of article 23 of the Federal Law of December 10, 1995 No. 196-FZ). According to the letter of the Ministry of Health of Russia dated August 21, 2005 No. 2510/9468-03-32, drivers undergo a medical examination with presentation of a waybill before each trip, that is, daily.

As a result, we see that a “homemade” waybill does not exhaust the variety of situations related to the operation of vehicles. And the accountant’s thoughtless desire to “simplify” unified forms can not only result in useless double work, but also entail financial sanctions.

back side

On the reverse side of the document, information about the slingers is recorded (license numbers, full names), as well as persons responsible for the safety of the movement of cargo from the contractor to the customer. In addition, it contains a table detailing the progress of the driver’s task. The following data is entered into it:

- title and code of works;

- detailed route;

- object of work;

- time frames when you need to arrive at the site and leave it;

- speedometer data at the time of arrival and departure from the site.

At the bottom of the reverse side of the form, the accountant fills in the columns, on the basis of which the driver is then paid a salary. Here you should indicate the total duration of the flight, standard and actual gasoline consumption, and mileage. If there were downtimes during the voyage, you need to write the beginning, end of each of them and their total number. Then the amount that the driver earned per shift is indicated. The accountant signs this information.

Who signs the ticket?

The form of the waybill for a special vehicle is considered to be filled out incorrectly if it does not bear the signatures of the responsible persons. They are installed after checking the driver’s health and inspecting the technical condition of the special vehicle. The voucher must be endorsed by:

- The paramedic who performs the pre-trip medical examination decides that the driver’s health condition allows him to drive the vehicle and that he is not under the influence of psychotropic substances or alcohol. A breathalyzer is used to check this.

- The mechanic carries out a technical inspection of the car and makes a decision regarding the possibility of releasing it on a trip, records the standard and actual amount of fuel used in the waybill for a special car, Form 3.

- The driver must sign for accepting and returning the car in working condition.

The tear-off coupon is filled out by the carrier company. It is intended to issue an invoice to the customer. It contains general information about the waybill (number, date of preparation, details of the organization, information about the car). Here is a detailed list of services provided by the carrier and the amount to be paid. The taxi driver signs the tear-off coupon. Used waybills are closed, information about this is entered into a special journal. According to the law, these documents must be stored at the enterprise for 5 years.

Changes 2022

It was allowed to issue one waybill for 2 drivers, but medical examination marks must be given for two drivers (letter from the Ministry of Transport dated 04/04/2019 No. DZ-514-PG).

From March 1, 2022, new details have appeared for pre-shift monitoring of the technical condition of a vehicle.

As of March 1, 2022, the stamp is no longer required on medical examination notes and odometer readings.

From March 1, 2022, odometer readings need to be entered only if the car leaves the parking lot or if several tickets have been issued for different drivers.

From December 21, 2022, it is necessary to undergo not only a pre-trip inspection, but also a pre-shift inspection (if the driver makes more than one trip per shift).

From December 15, 2022, two new details have appeared in travel sheets, see them below.

From February 26, 2022, a stamp is no longer required on waybills (Order of the Ministry of Transport dated January 18, 2022 No. 17).

From February 26, 2022, waybills must display information about the pre-trip condition of the car, otherwise a fine of up to 30,000 rubles is possible (Part 3 of Article 12.31.1 of the Code of Administrative Offenses of the Russian Federation).

From June 1, 2022, it is prohibited to hire drivers or individual entrepreneurs with foreign licenses (Federal Law of December 10, 1995 No. 196-FZ “On Road Safety”). This rule does not apply to personal travel.

Waybill for a special vehicle form and sample

Waybill for a special vehicle, form 3-special.

Waybill for a special car, sample form 3-special.

Attention! The Ministry of Transport, by order No. 368 of September 11, 2020, added new requirements for filling out waybills. The document came into force on 01/01/2021 and is valid until 01/01/2027.

Who needs a waybill?

Waybill

needed to justify expenses for fuels and lubricants (gasoline, motor oil, etc.) on the simplified tax system for income-expenses and OSNO. Individual entrepreneurs and organizations using the simplified tax system for income, UTII and Patent do not keep track of expenses and a waybill is simply not needed. It is also not needed if you do not want or need to enter such expenses in any tax regime.

It is prohibited to transport passengers and luggage, cargo by buses, trams, trolleybuses, cars, trucks without issuing a waybill for the corresponding vehicle (here we mean, first of all, transportation for money, otherwise it’s absurd - an individual entrepreneur is taking his wife to the theater and must have waybill).