If you do not yet use the simplified tax system, we advise you to consider this opportunity for your business. Now about 3.5 million individual entrepreneurs and organizations work using the simplified system, and this is no coincidence. The most important advantage of the simplified tax system is low tax rates, especially when compared with taxes in the general taxation system.

But there is one problem - the transition to a simplified regime is allowed only within the time limits specified by law. And if you want to apply the simplified tax system from 2022, now is the time to prepare and submit a notice of transition. Let's figure out what deadlines for filing an application are established in the Tax Code of the Russian Federation, and when it is too late to contact the tax office.

Free tax consultation

When to inform about the choice of simplified tax system

The simplified tax system is a preferential tax system in which they pay less taxes. Naturally, the initiative to choose this regime does not belong to the Federal Tax Service, but to the businessmen themselves. If you do not inform about the choice of a simplified system, then the general system will automatically be used for an individual entrepreneur or LLC, because it is more profitable for the budget.

Article 346.13 of the Tax Code of the Russian Federation establishes the following deadlines for filing a notification:

- no later than December 31 of the current year for the transition to a simplified system from the beginning of next year;

- within 30 days after registration of an individual entrepreneur or LLC.

The reason for such restrictions is that the tax period under the simplified system is a calendar year. The final calculation of tax liabilities occurs at the end of the period, so the simplified form must be applied throughout the year (or from the moment of registration until the end of the year).

It is also impossible to leave the simplified tax system in the middle of the year, with the exception of the transition to the NAP for individual entrepreneurs. Well, or you can violate the restrictions of the simplified system, then the taxpayer simply does not have the right to apply the simplified tax system.

When can you switch to the simplified tax system?

As already noted, you can switch to the simplified tax system when creating an enterprise or from the beginning of the calendar year. In addition, the transition to a simplified tax system is also possible when a company or entrepreneur was engaged in activities that give the right to UTII (single tax on imputed income). In this case, the transition to a single tax is carried out in accordance with the general procedure. Another situation is also possible. The enterprise was both a UTII payer and a subject of the simplified tax system. When a type of activity ceases to fall within the conditions of application of UTII, it can be transferred to the framework of the simplified tax system.

When switching from OSNO to simplified tax system, there are certain rules for accounting for transferable income, expenses, accounts payable and receivable, as well as nuances regarding VAT. The recommendations of ConsultantPlus experts, who have already explained all the rules in detail, will help you easily go through the transition period. Get trial access to K+ for free and go to the Ready-made solution.

On VAT we also recommend our article .

Deadline for filing an application for the simplified tax system for 2022

So, the transition to the simplified tax system from 2022 is allowed if you submit an application for the use of this regime no later than December 31, 2022.

True, in 2022 an interesting situation occurred with this date: By Decree of the Government of the Russian Federation of October 10, 2022 N 1648, the working day of December 31 was declared a holiday at the federal level.

This means that paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, according to which the deadline for filing an application is postponed to the next working day. This is January 10, 2022, that is, there will be a little more time to switch to the simplified tax system.

Sample notification of transition to the simplified tax system for 2022

How to switch to simplified

To have an idea of how to switch to the simplified tax system, you need to remember the following. The conditions for switching to the simplified tax system require submitting a corresponding notification to the tax office at your location (residence). This must be done no later than December 31 or within 30 days from the date of state registration. This document should contain the following information:

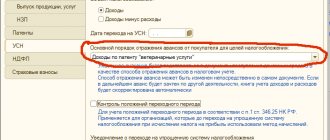

- the planned object of taxation (all income or that which remains after deducting the costs allowed by the code);

- residual value of fixed assets calculated as of October 1;

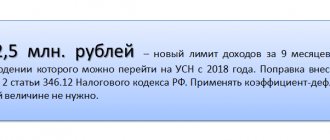

- total income for 9 months.

The transition from OSNO to simplified tax system in 2021-2022, as before, is carried out on the basis of a notification in form 26.2-1.

A sample from ConsultantPlus will help you fill it out, which you can download for free by signing up for a trial access:

Read more about filing a notification here.

It should be remembered that the procedure for switching to the simplified tax system does not provide for the provision by tax authorities of any documents (certificates, etc.) indicating that the company applies the simplified tax system. However, you can always request written confirmation from your tax office that the company or entrepreneur pays a single tax. Application of the simplified tax system can be refused only if the applicant does not meet the criteria established by the Tax Code of the Russian Federation.

For information on how to request a tax document confirming the application of the simplified tax system, see the publication “Certificate of the simplified taxation system” .

The transition from the OSN to the simplified tax system involves choosing one of two bases for taxation with a single tax. This can be all the income received, or part of it minus the costs incurred. Accordingly, in these two cases there will be different rates for the single tax. If all income is taken as a basis, you will have to pay a single tax on it at a rate of 6% (subjects of the Russian Federation can reduce the rate to 1%). When the base for the single tax is net income, it is paid in the amount of 5 to 15% (the rate also depends on the specific region of the Russian Federation).

Important! ConsultantPlus warns. For a number of cases, increased rates are provided: 8% for “income” and 20% for “income minus expenses”. They apply if (clauses 1.1, 2.1 of Article 346.20 of the Tax Code of the Russian Federation): Read more in K+. Trial access is free.

“Which object under the simplified tax system is more profitable – “income” or “income minus expenses”?” will help you choose the appropriate option for paying a single tax. .

What to do if the notification deadline is missed

Unfortunately, the Tax Code of the Russian Federation does not provide for any way to extend or restore the deadlines for the transition to the simplified tax system.

However, some entrepreneurs try to bypass the system by closing their sole proprietorship and registering again some time later in the same year. After all, then they again have a period of 30 days, during which they can switch to the simplified tax system, if this choice was not made earlier.

The method is risky, although it is not directly prohibited by law. If the tax office is interested in this, it will most likely return the entrepreneur to the same regime that he used before deregistration. A similar case was considered by the Supreme Court (Determination dated June 30, 2015 No. 301-KG15-6512).

Another option with a high tax risk is to pay advance payments and submit declarations under the simplified system, although the notification of the transition to the simplified tax system was not submitted on time.

Some courts believe that if the Federal Tax Service accepted declarations under the simplified tax system without notification of the transition, it thereby recognized the application of the simplified regime as legitimate. The Federal Tax Service itself provided several examples of such judicial acts in a letter dated July 30, 2018 No. KCh-4-7/14643.

The courts proceeded from the fact that the transition to the simplified tax system is of a notification nature. The inspectorate cannot prohibit the use of a simplified tax regime if the taxpayer complies with the conditions of this regime. At the same time, the Federal Tax Service must check which tax reports are submitted by the organization or individual entrepreneur, and what taxes they pay. If no objections were received from the inspectorate, then the taxpayer has the right to work on a simplified basis.

However, do not forget about Article 346.12 of the Tax Code of the Russian Federation, which lists the signs prohibiting the use of the simplified tax system. Among them is this: “organizations and individual entrepreneurs who did not notify about the transition to a simplified taxation system within the time limits established by paragraphs of Article 346.13 of the Tax Code of the Russian Federation.”

Therefore, notification of the transition to the simplified tax system is mandatory and must be submitted on time. And in the ruling dated December 7, 2020 No. 302-ES20-12677, the Supreme Court noted that even if the Federal Tax Service did not respond in a timely manner to the unreasonable filing of a declaration or transfer of taxes under the simplified tax system, this does not mean that the organization or individual entrepreneur has the right to apply this preferential mode.

Errors after switching to special mode

To conclude the article, let’s look at examples of violations after the transition to a special regime:

After the transition to the simplified tax system, payments received from buyers for goods, works, services sold on the simplified tax system were included in income

Based on paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation , organizations that, before the transition to a simplified taxation system when calculating corporate income tax, used the accrual method, when transitioning to the simplified tax system, follow the following rules:

— on the date of transition to the simplified tax system, the tax base includes amounts of funds received before the transition to the simplified tax system in payment under contracts, the execution of which the taxpayer carries out after the transition to the simplified tax system ( subparagraph 1 of paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation ).

At the same time subparagraph 3 of paragraph 1 of Article 346.25 Code of the Russian Federation provides that funds received after the transition to the simplified tax system are not included in the tax base if, according to the rules of tax accounting using the accrual method, these amounts were included in income when calculating the tax base for corporate income tax .

Thus, after switching to the simplified tax system, do not count payments received from buyers for goods, works, services sold on the simplified tax system as income.

Example.

The organization, within the framework of the simplified tax system, shipped goods to the buyer, payment for which will be received by the organization after the transition to the simplified tax system.

Since, on the basis of paragraph 1 of Article 271 of the Tax Code of the Russian Federation , the organization took into account the income from the sale of these goods as part of the application of the OSN, when receiving payment for the goods from the buyer, funds from their sale are not included in the tax base for the “simplified” tax.

How to confirm the transition to the simplified tax system

After we have found out by what date it is necessary to submit an application to switch to the simplified tax system this year, it is worth understanding one more question: what document confirms the use of the simplified system?

The Federal Tax Service does not issue special confirmation of the transition to a simplified system, which is why it is so important to save a second copy of the notification, which should bear a mark of acceptance.

But you can only get this copy by visiting the tax office in person. If the notification of the transition to the simplified tax system is sent by mail, then the letter must contain a description of the attachment and the opportunity to receive confirmation of its receipt.

Additionally, it is also worth contacting your tax office with a free-form request to receive information letter No. 26.2-7. The Federal Tax Service must send this document within 30 days of the request. In the information letter, the tax office must confirm that it accepted a simplified tax notice from you, and on what date this happened. In addition, in the letter, the Federal Tax Service confirms the submission of declarations under the simplified tax system if you have worked in this mode for at least a year.

A copy of the second copy of the notice or letter in Form No. 26.2-7 will confirm your use of the simplified tax system for counterparties or the bank. Therefore, it is worth preparing several such documents in advance and issuing them upon request.

The period of restoration of VAT, previously legally claimed for deduction, on fixed assets and inventory balances

Restoration of VAT amounts paid to suppliers of materials, goods and fixed assets and previously legally accepted for deduction is made in the last tax period before the transition to the simplified tax system.

In the situation under consideration, in December of the current period, the organization must make an entry on the credit of account 68 “Calculations for taxes and duties” in correspondence with account 19 “Value added tax on acquired assets” (Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n ).

Is it possible to close and reopen within a year to switch to the simplified tax system?

Some individual entrepreneurs are trying to find a workaround to switch to a simplified system within a year.

If the notification to the simplified tax system was not submitted within 30 days after registration, you must close the individual entrepreneur and register again. And already on the second attempt, be careful and not miss the 30-day deadline for switching to the simplified version. Is it possible to do this?

Formally, this situation does not violate the law, because repeated registration of individual entrepreneurs by the same person within a year is not prohibited. And Article 346.13 of the Tax Code of the Russian Federation does not contain any special conditions for the transition to the simplified tax system for such re-registered entrepreneurs. This means that the general procedure for submitting a notification for simplified registration applies to them - 30 days after registration of an individual entrepreneur. And it doesn’t matter what the score is throughout the year.

However, the Federal Tax Service does not agree with this, believing that if the entrepreneur re-registers within a year, he has no real intention to stop the business. He has one goal - to reduce the tax burden, bypassing the provisions of the Tax Code of the Russian Federation.

Here, of course, one can argue. It’s one thing when several days passed between the closure and subsequent opening of an individual enterprise. What if six months have passed? Or did the first attempt to start a business fail, and literally 2-3 months later a new idea appeared and the person decided to try again?

But, for example, there is a ruling of the Supreme Court dated June 30, 2015 No. 301-KG15-6512, which considered the following case. The individual entrepreneur closed and reopened within a year with the goal of not even switching to the simplified tax system, but only to change the object of taxation: from Income to Income minus expenses.

At the request of the Federal Tax Service, the court saw signs of tax evasion here, because under the simplified tax system for income this entrepreneur would have paid more to the budget than under the simplified tax system for income minus expenses. Therefore, the individual entrepreneur was left in the same regime that he used before the closure, that is, the simplified tax system for income.

So switching to a simplified system through closing and opening individual entrepreneurs within a year is a risky option. And if the Federal Tax Service suspects tax evasion here, fines cannot be avoided. But, of course, everything is very individual, so it cannot be denied that in practice such a situation may go unnoticed.

But this option is suitable, even purely theoretically, only for individual entrepreneurs. If you have registered an LLC, then it cannot be closed so easily. Liquidation of a company that has no debts and problems with reporting will take more than two months. And there are even more problematic companies. In this case, it is easier to wait until the beginning of the new year to switch to the simplified tax system.

Of course, you can open another LLC and immediately switch to the simplified tax system. Just don’t use it in dubious schemes to generally reduce the tax burden of a business, because the Federal Tax Service is well aware of all these methods.

Loss of the right to use the simplified tax system

Switching to a simplified system is not so difficult, but not every business can survive on the simplified tax system. If your activity no longer meets the criteria that allow you to apply the simplification, you will be forced to switch to OSNO. This can happen if the number of employees has grown or revenue has increased beyond acceptable limits. The taxpayer is obliged to track this event himself and notify the Federal Tax Service. The transition to OSNO will occur from the quarter when the activity ceased to meet the criteria of the simplified tax system. The taxpayer will have to take a number of actions:

- Notify the Federal Tax Service of the violation of the rules of the simplified tax system and the forced transition to OSNO. This is done within 15 days after the end of the quarter in which the violation of the requirements occurred.

- Submit the declaration within 25 days after the end of the quarter in which the requirements were violated. The tax calculated according to the declaration is paid within the same period.

Communication with the Federal Tax Service when changing the tax regime is of a notification nature. The most important thing is to carefully approach the issue of translating accounting and tax reporting in order to avoid mistakes and fines based on a more advantageous simplified translation.

Kontur.Accounting is a comfortable online service for organizations and entrepreneurs on the simplified tax system, OSNO and UTII. Get acquainted with the capabilities of the service for free for 14 days, keep records, pay taxes and send reports using Kontur.Accounting.

Try for free

The procedure for switching from the simplified tax system 6% to the simplified tax system 15%

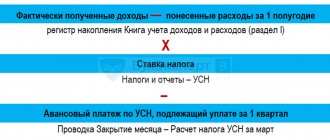

The tax period for the simplified tax system is a year during which it is not possible to change the system and object of taxation.

To switch from a simplified tax system of 6% to a simplified tax system of 15%, you must submit to the Federal Tax Service a notification of your desire to change the tax object before December 31. However, it will change only from next year. The document is drawn up by the taxpayer in accordance with Form 26.2-6 (preferably in 2 copies) and sent to the Federal Tax Service by mail or submitted in person. In addition, you can send a notification to the tax authorities in electronic form, for example, via TKS.

You can also view notifications using the link below.

K+ experts have prepared a line-by-line commentary on filling out the notification of changing the object of taxation to the simplified tax system. Get free trial access to the ConsultantPlus system.

When changing the object of taxation according to the simplified tax system, it is important not only to fill out the notification correctly and submit it on time. Certain actions will also be required to reflect transitional moments in accounting.

Important! Recommendation from ConsultantPlus In tax accounting after moving to a new facility, follow the following rules: take into account income in the usual manner. Their accounting does not depend on the object of taxation (Article 346.15, paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation); expenses... Read more about the complexities of expense accounting in K+.