Minimum wage: decoding the concept

The acronym MROT, widely used since the 1990s, stands for minimum wage.

And today the importance of this indicator is difficult to underestimate, because this is the basis from which the minimum amounts of sick leave and benefits for pregnant women are calculated, as well as mandatory insurance payments of self-employed persons for periods until the end of 2022 (from 2022 this link has been canceled). For information about the amounts in which self-employed persons pay contributions starting from 2022, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?” .

Previously, this universal indicator also served to calculate some taxes, fines and a number of obligations under civil contracts, in which the condition of linking to the minimum wage was introduced. But currently the minimum wage is not applied for these purposes.

Minimum wage from January 1, 2022 and wages

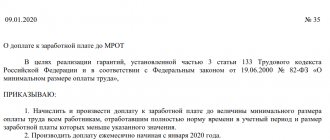

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee may receive less than the minimum wage in person - minus personal income tax and other deductions, for example, alimony. Accordingly, from January 1, 2018, it is impossible to pay less than 9,489 rubles.

It is worth noting that the salary of employees from January 1, 2018 may be less than 9,489 rubles. After all, the total salary, which includes (Article 129 of the Labor Code of the Russian Federation) cannot be less than the minimum wage:

- remuneration for work;

- compensation payments, including additional payments and allowances;

- incentive payments (bonuses).

The total amount of all such payments from January 1, 2022 must be at least 9,489 rubles.

If, from January 1, 2022, the employee’s salary is less than the minimum wage (9,489 rubles), then the employer may be held accountable in the form of fines. The fine for an organization can range from 30,000 to 50,000 rubles, and if detected again - from 50,000 to 70,000 rubles. For a director or chief accountant, the liability may be as follows: for a primary violation, they may issue a warning or a fine of 1,000 to 5,000 rubles, for a repeated violation, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Minimum wage in Russia

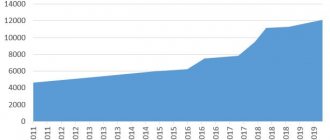

The Federal Law on the minimum wage is adopted by the State Duma of the Russian Federation annually. The essence of each new law comes down to amending Art. 1 and 2 of the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ. So, in Art. 1 indicates the new minimum wage established in the Russian Federation for the current year (for example, for the minimum wage in 2022, in force from May 1, 2018, - 11,163 rubles per month), and in Art. 2 determines the start of the new minimum wage (for example, the start of the 2018 minimum wage is 05/01/2018).

The minimum wage applied from January 1, 2019 is equal to the subsistence level of the working-age population for the 2nd quarter of 2018. Its value is 11,280 rubles.

The minimum wage established by the State Duma of the Russian Federation is called federal. In addition to the federal minimum wage, regional minimum wages may be established in the constituent entities of the Russian Federation.

Read about the dynamics of the federal minimum wage and the relationship between its value and the level of the subsistence level in the Russian Federation here .

Minimum wage from January 1, 2022: new size

The minimum wage has been increased to 9,489 rubles from January 1, 2022. The calculation of many payments depends on the new minimum wage, including temporary disability benefits, maternity benefits, child care benefits for up to 1.5 years, as well as numerous social benefits, the amount of which is tied to the minimum wage.

You can track the latest increase in the minimum wage from our table, which takes into account changes from 2022.

| The period from which the minimum wage is established | Amount of the minimum wage (rub., per month) | Regulatory act establishing the minimum wage |

| From January 1, 2022 | 9489 | |

| from July 1, 2022 | 7 800 | Art. 1 of the Federal Law of December 19, 2016 No. 460-FZ |

| from July 1, 2016 | 7 500 | Art. 1 of Federal Law dated June 2, 2016 No. 164-FZ |

| from January 1, 2016 | 6 204 | Art. 1 of the Federal Law of December 14, 2015 No. 376-FZ |

As you can see, from January 1, 2022, there was a fairly significant increase in the minimum wage. For 1689 rub. (9489 rub. – 7800 rub.). Why did this happen?

What is included in the minimum wage

Art. 133 of the Labor Code of the Russian Federation provides that the salary of an employee who has worked a full month and fulfilled all his job duties cannot be lower than the minimum wage. Therefore, if an employer is checked to ensure that employees’ wages comply with the minimum wage approved for the current year, the inspector will check the level of the salary established for him with the minimum wage in force in the region.

Read about which of the components of the salary cannot be set less than the minimum wage in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

A course has been taken to move closer to the living wage

The minimum wage should not be less than the subsistence level of the working population (Article 133 of the Labor Code of the Russian Federation). However, the cost of living for the second quarter of 2017 is 11,163 rubles, and the federal minimum wage is only 7,800 rubles. A special law should determine the procedure and period during which the authorities are obliged to increase the minimum wage (Article 421 of the Labor Code of the Russian Federation). And they finally decided to pass this law.

The matter has reached the final stage of raising the minimum wage to the minimum subsistence level established in Russia. For these purposes, Federal Law No. 421-FZ dated December 28, 2017 was signed and entered into force on January 1, 2022:

- from January 1, 2022 – up to 85% of the subsistence level of the working-age population;

- from January 1, 2022 – up to 100%.

According to the bill, starting from 2022, each year the minimum wage will be set in the amount of the federal subsistence level for the 2nd quarter of the previous year. At the same time, the minimum wage for the next year cannot be less than the established minimum wage.

The subsistence minimum is the cost of a conditional consumer basket, which includes a minimum set of food products, non-food products and services that are necessary to ensure human life. The cost of living also includes mandatory payments and fees.

The cost of living is approved at the end of each quarter, using numerous statistical data, including the inflation rate, to determine it. The federal subsistence minimum is set by the Government of Russia, and regional minimums are set by regional governments.

Minimum wage in 2018–2019 in the regions

The minimum wage established in the region cannot be less than the federal minimum wage. It is determined by an agreement between representatives of the government of a constituent entity of the Russian Federation, trade unions and employers. Employers in the region who have not submitted to the government of a constituent entity of the Russian Federation compelling reasons for not joining this agreement are required to apply the regional minimum wage when setting wages (Article 133.1 of the Labor Code of the Russian Federation).

To learn about the cases in which additional payment is made up to the minimum wage, read the article “Additional payment up to the minimum wage for external and internal part-time workers .

About the minimum wage in the region

Every worker has the right to receive decent pay. But how can we set boundaries wisely if we exist in a market economy? Only the state can intervene by setting tariff rates, dismissal rules, etc., incl. and the lower salary limit. At the federal level this is the minimum wage, at the regional level it is the minimum wage. It would seem that they are the same thing, but there are differences.

The minimum wage is set by the Government of the Russian Federation. It is used to determine the amount of social benefits and assistance to low-income citizens. The minimum wage (MW) is established by the Agreement of the tripartite regional commission.

Its activities are carried out in the Kirov region according to the law of November 6, 2003 No. 202-ZO “On social partnership in KOs”. The composition of the Commission is formed as necessary by the Decree of the Regional Government. 9 people from each side participate in meetings on establishing a new minimum salary in the region. And only if all 3 parties vote with a majority of votes “for”, the Agreement will be accepted.

The subsistence minimum for determining the minimum wage and minimum wage is calculated by the statistical authorities quarterly for different categories of citizens. According to Article 133 of the Labor Code of the Russian Federation, the minimum wage cannot be below the subsistence level. This means that regional companies cannot pay wages less than the minimum wage established in the Kirov region. For violation there is a fine or criminal liability.

Minimum wage in Moscow

In Moscow, the minimum wage is also established by signing a regional agreement between the capital government, local trade union associations and Moscow employers' associations. Currently, the agreement dated December 15, 2015, relating to the period 2016–2018, is in force. It stipulates that the minimum wage for Moscow is revised quarterly and brought to the subsistence level of the working population. However, if the cost of living decreases, then the minimum wage is not subject to reduction, but remains equal to that in force in the previous quarter.

In all other aspects, the minimum wage in Moscow is subject to the general requirements of the minimum wage legislation.

Application of the regional minimum wage

The minimum wage in Moscow in 2022 is regulated by a tripartite agreement dated December 15, 2015, the participants of which are the City Government, the association of trade union organizations of Moscow and the association of employers. The document establishes a rule according to which the minimum wage should not be lower than the fixed subsistence level for Moscow residents. Data is updated quarterly.

The regional minimum wage in Moscow in 2022 must be adhered to by all business entities operating on the territory of a city of federal significance. The use of the federal minimum wage, as an exception, is possible in the following situations:

- the regional minimum wage may not be taken into account by enterprises financed from the federal budget;

- The federal minimum wage is applied by companies or individual entrepreneurs who have officially formalized their refusal to join the agreement establishing a new minimum in the region (the refusal must be motivated, the deadline for filing it is limited).

What is the minimum wage in 2018–2019 in Moscow

The minimum wage (Moscow) from 10/01/2017 was increased to 18,742 rubles. in accordance with the increase in the cost of living in the region (Resolution of the Moscow Government dated September 12, 2017 No. 663-PP).

Based on the results of the 3rd quarter of 2022, the cost of living in Moscow turned out to be lower than in the 2nd quarter of 2022, therefore the minimum wage has not changed since 01/01/2018 and amounted to 18,742 rubles. Since November 1, 2018, the cost of living in Moscow has increased slightly and amounted to 18,781 rubles. (Decree of the Moscow Government dated September 19, 2018 No. 1114-PP).

Minimum wage in the regions from January 1, 2018

From January 1, 2022, regional authorities can establish in a special agreement their own minimum wage, which exceeds the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). However, the regional minimum wage can be abandoned. For these purposes, you will need to issue a reasoned refusal and send it to the local branch of the Committee on Labor and Employment.

In accordance with Part 1 of Art. 133.1 of the Labor Code of the Russian Federation in a constituent entity of the Russian Federation, a regional agreement may establish a different minimum wage. It should not be lower than the minimum wage approved by federal law (Part 4 of Article 133.1 of the Labor Code of the Russian Federation). Employers are considered to have acceded to the regional agreement on the minimum wage if, within 30 calendar days from the date of its publication, they have not sent a written reasoned refusal to join it to the Ministry of Labor of Russia. In this case, the organization is obliged to comply with all provisions of the regional agreement (Part 8 of Article 133.1 of the Labor Code of the Russian Federation). This means that the minimum wage established by the regional agreement is mandatory for the employer.

Note that Moscow, as the capital, is traditionally famous for its more expensive life than other subjects of the Russian Federation. Therefore, the minimum wage in the capital is higher than the federal one. Now in Moscow for the 2nd quarter of 2022, the minimum wage is 18,742 rubles. Currently, there is no information on the minimum wage for 2018 in Moscow. However, most likely, in the next month the Moscow Government will set a living wage for the 3rd quarter of 2022. It is this indicator that will be used as the Moscow minimum wage from January 1, 2022.

As for the minimum wage from January 1, 2022 in the Moscow region, its size has not changed since December 1, 2016 and is 13,750 rubles. (clause 1 of the Agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Union “Moscow Regional Association of Trade Union Organizations” and associations of employers of the Moscow region, concluded on November 30, 2016 No. 118).

It is this indicator that will continue to be applied in 2022, provided, of course, that a new regional Agreement is not adopted.

You can see the size of the minimum wage from January 1, 2022 in Russia in the table by region 2022. However, at present there is practically no new data on the minimum regional wage.

Compared to other constituent entities of the Russian Federation, the federal city of St. Petersburg and the Leningrad Region stand apart. These regions have already decided on the minimum wage for 2022. From January 1 it is:

- 17,000 rub. – in St. Petersburg (Regional agreement on the minimum wage in St. Petersburg for 2022 dated September 20, 2017 No. 323/17-C;

- 11,400 rub. – in the Leningrad region (Regional agreement on the minimum wage in the Leningrad region for 2022 dated September 21, 2017 No. 10/C-17).

Results

The abbreviation MROT stands for minimum wage.

It is installed at both the federal and regional levels. The federal minimum wage increases 1–2 times a year. The regional minimum wage may be revised more often, but in any case cannot be less than the federal minimum wage. The size of this parameter determines the minimum salary level and the minimum amount of sick leave payments and child benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Minimum wage and Moscow salary: dependence

Moscow employers (organizations and individual entrepreneurs) must set a salary no less than the Moscow minimum wage (RUB 18,742) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If your refusal has been sent, then the salary in Moscow from January 1, 2022 can be compared with the federal minimum wage (9489 rubles). For many employers, the difference is noticeable: 9253 rubles. = (RUR 18,742 – RUR 9,489).

The Moscow minimum wage, applied from January 1, 2022, already includes a tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow minimum wage. This procedure follows from clause 3.1.3 of the Tripartite Agreement.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.