Calculation note upon dismissal (form T-61)

At the same time, it is said that the institution has the right to use a certificate card (f. 0504417) to summarize information about the amounts of remuneration accrued (paid) to an individual performing work (services) under civil contracts concluded by the institution.

Line 10 “Salary for the current month” reflects the salary for the time actually worked in the current month before the onset of vacation on the basis of the Certificate Card (f. 0504417).

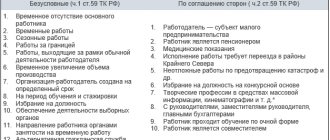

Removal by accounting entities of individual details from the forms of primary accounting documents and accounting registers approved by this order is not allowed. Let's start with calculating vacation pay. For this purpose in gr. 1, 2, 3, factual information is entered for the last 12 months before the month of dismissal. When indicating the amounts of monthly payments, you should focus on paragraphs. 2, 3 of the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. For example, financial assistance, tuition fees and other non-labor payments are not taken into account in the calculations.

Nuances of filling out a note-calculation

In any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary.

The course is based on a process approach, allowing you to fully identify and take into account all the factors influencing the specifics of logistics management processes. Course participants receive theoretical knowledge in the field of organizing logistics management processes and ready-made tools for collecting and formalizing requirements for automating these processes (templates, questionnaires, models).

In the amount of average earnings, severance pay is paid upon dismissal due to staff reduction, joining the army for military service, refusal to move to another area, etc. In these cases, the accrual is carried out on the basis of PP 922 of December 24, 2007.

The calculation note is drawn up by the personnel officer or a person authorized by him, while the calculation of the due salary and other payments is, naturally, carried out by the accountant.

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and 29.3 (average monthly number of calendar days).

The calculation note is filled out based on the manager’s order and consists of 3 sheets. The following information is entered in the title section:

- TIN, KPP, OKPO;

- Date of completion;

- name of the institution;

- structural subdivision;

- name of GRBS or founder;

- type of payment (vacation, business trip, etc.);

- basis (number and date of the order).

The total amount of payments to the employee for each month of the billing period is recorded. If in any month the salary was increased or any allowances were made, then this is all taken into account in the indicated amount.

In lines 7 and 8, column 3 enters the number of days of vacation or absence for any other reason falling on the current and next month. In the calculation note on calculating average earnings upon dismissal, all paid days fall in the month in which the employment contract was terminated.

The total amount of payments due to the departing employee is reflected in the settlement note. We will tell you how to draw up a settlement note upon dismissal in our consultation.

The “Salary by month” table is filled out on the basis of the Certificate Card (f. 0504417). This table is filled out if the calculation period for calculating average earnings is 12 months.

The settlement note upon dismissal is a two-sided form. On the front side (filled out by the personnel officer) information about the organization, the employee and the employment contract in force between them is reflected. On the reverse side (filled out by the accountant) vacation pay is calculated.

In the table for calculating accrued wages, lines 01, 02, 03 are filled in when the payroll period is 3 months. The number of days worked and the amount of accrued wages in a given billing period is filled out on the basis of the Certificate Card (f. 0504417) taking into account the provisions established by labor legislation.

Form T-61 is filled out on the basis of settlement and payment documents, statements that contain information on various charges to the employee (wages, bonuses, allowances, etc.).

The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

The indicator “Average monthly earnings” on line 05 is determined by dividing the amount on line 04 “Total for billing months” by 12 months or by 3 months (depending on the length of the billing period).

As for the bonus, according to clause 15 of Regulation No. 922, when determining average earnings, remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event, are taken into account regardless of time of remuneration.

Under the condition of automated maintenance of accounting registers, the numbering of register sheets is carried out automatically in ascending order from the moment of its opening. The pages of the book printed on paper are bound in chronological order.

This is the primary document that serves as an accounting register for wages (vacation pay and other payments) for government agencies - based on its results, the accounting department makes entries in the debits and credits of the corresponding accounting accounts.

Rules for drawing up a note-calculation of average earnings

The document is filled out on the basis of the corresponding order, and the numbers of the vacation order and the calculation note must match. The data specified in the administrative document (about the dates of vacation, dismissal, the period for which the vacation is applied, etc.), taken on the basis of personnel documents, is transferred to the form. Since the Appendix to Order No. 52n of the Ministry of Finance speaks only about the mandatory coincidence of the order and calculation note numbers when granting leave, for other cases it is advisable for the personnel service of the institution to establish its own numbering order.

The basis for filling out the lines (tables) of the salary calculation is the “Salary Certificate Card” (form 0504417). If the calculation period is set to 12 months, then the figures are given in Table 1 (“Earnings by month”); if the billing period is 3 months, then they are entered into table 2 (“Accrued”) on lines 01, 02, 03.

It must be remembered that the billing period does not include periods when the employee maintained an average salary, for example:

- sick leave;

- maternity leave;

- business trips;

- downtime due to the employer's fault.

And the amount of earnings includes all income associated with the remuneration system - not only wages, but also bonuses (in proportion to the period), bonuses for class, length of service and others (clause 2 of the Regulations, approved by Resolution No. 922 of December 24, 2007). It does not include social payments (for example, child benefits, sick leave), and other payments not related to work activities are also not taken into account (clause 3 of the Regulations, approved by Resolution 922).

For the calculation, the average monthly number of calendar days is used - 29.3. If the entire month is not worked, then you will have to calculate the average monthly number of days of such a month - dividing 29.3 by the total number of days of the month and then multiplying by the number worked.

For clarity, here is an example of filling:

Maria Ivanovna Kolesova goes on vacation from January 14, 2019 in accordance with the vacation schedule for 28 calendar days. Salary together with all allowances is 20,000 rubles per month. In March 2018, Maria Ivanovna spent 5 days on sick leave; 14,968.55 rubles were accrued for March 2018. The remaining months have been fully worked out.

Average monthly number of days in March: 29.3/31 x (31-5) = 24.57, where 29.3 is the average monthly number of days established by law; 31 – number of calendar days in March; 5 – days of illness.

For 3 working days of January 2022 (from 01/09/2019 to 01/11/2019), the accrued wages will be

20,000/136 x (3 x = 3,529.41 rubles, where 20,000 rubles is the salary, 136 hours is the standard time according to the production calendar for January, 3 is working days before vacation, 8 hours is the number of hours per work shift.

From the accrued amounts, income tax of 13% is withheld.

Let's calculate vacation pay and fill out the form.

Form 0504425 (filling sample):

After filling out, the accuracy of the indicated figures is certified by the signatures of the persons responsible for accrual and verification, with an explanation of their positions and surnames. The date of completion is set. The final stages are the payment of amounts due to the employee and the recording of the results in the accounting registers.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What programs are used to keep timesheets?

The form consists of 3 parts:

- The first (header) indicates the name of the organization and its affiliation, and the personal data of the employee.

- The second part (substantive): section 1 contains information that serves as the basis for further calculations - the number of days, accrued amounts, billing period, and so on; Section 2 - the calculation of average earnings and the derivation of the final amount to be paid to the employee.

- The third (formal) – the signatures of the responsible persons are required; in this form, not only the last sheet of the document is drawn up, but also the data given in section 1 of the second part (since it is from them that the funds due to be paid to the employee will be calculated).

This online course provides an in-depth study of the query language and capabilities of the data composition system, which will be needed when developing reports running on the 1C:Enterprise platform within various application solutions.

In other cases, except for vacations and dismissals, calculations are carried out in working days, so the days worked from the f. card are entered in line 3. 0504417. Line 4 – accrued salary, including the amounts specified in PP No. 922.

The institution has the right to independently supplement the symbols used as part of the formation of its accounting policies.

A note-calculation on calculating average earnings when granting leave, dismissal and other cases (f. 0504425) (hereinafter referred to as the Note-on-calculation (f. 0504425)) is used when calculating average earnings to determine the amount of vacation wages, compensation upon dismissal and other cases in accordance with current legislation.

The number of calendar days in the billing period. The average number of days in one month is taken to be 29.3 days.

In accordance with Art. 5.27 of the Code of the Russian Federation on Administrative Offenses, failure to comply with labor law norms is punishable by a fine of 1,000 to 50,000 rubles. - depending on the status of the guilty person.

Appendix No. 1. List of unified forms of primary accounting documents used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions Appendix No. 2.

conclusions

When dismissing an employee, the employer must pay him in full and in a timely manner. In this case, the outgoing employee is issued the necessary documents confirming his work activity and provided for by the Labor Code.

In addition, the employer himself fills out form T-61 - a special calculation note reflecting the amount of payments due to the employee upon dismissal.

This form is filled out by the accountant and HR officer of the employing company; it is not intended to be issued to a resigning person (that is, it is an internal document of the enterprise).

Form note-calculation upon dismissal according to form T-61

• Download the current T-61 form (Excel format).

• filling T-61.

A settlement note in form T-61 is drawn up upon dismissal of an employee in order to make the final calculation of wages, as well as other payments.

Form T-61 is filled out on the basis of settlement and payment documents, statements that contain information on various charges to the employee (wages, bonuses, allowances, etc.).

In what cases is it necessary to fill out a calculation note?

The indicator “Average monthly earnings” on line 05 is determined by dividing the amount on line 04 “Total for billing months” by 12 months or by 3 months (depending on the length of the billing period).

The table “Salaries by month” is filled out, as a rule, by the relevant accounting employee on the basis of the Certificate Card (f. 0504417). This table is filled out if the calculation period for calculating average earnings is 12 months.

In column 3 “Payments taken into account when calculating average earnings, rubles.” shows the total amount of payments accrued to the employee for the billing period in accordance with the rules for calculating average earnings. Columns 4 and 5 indicate the number of calendar (working) days and hours per hour worked in the billing period.

As a rule, this information is filled in by employees of the HR department on the basis of the corresponding order granting leave to the employee.

Form 0504082 sample filling

The unified T-61 form is used exclusively upon dismissal. It is used when it is necessary to pay an employee for time worked and unpaid vacation. After use, it is stored in both accounting and personnel documents, so it is better to make it in 2 copies.

Note! To reflect analytical indicators formed in accordance with the accounting policy, the institution has the right to enter additional details and indicators into the accounting registers. However, deleting individual details from the forms of primary accounting documents and accounting registers approved by Order of the Ministry of Finance of Russia N 52n is not allowed.

And the amount of earnings includes all income associated with the remuneration system - not only wages, but also bonuses (in proportion to the period), bonuses for class, length of service and others (clause 2 of the Regulations, approved by Resolution No. 922 of December 24, 2007).

Part 3. Calculation of payments due to the employee

Here, too, everything needs to be filled out step by step, taking into account all the information from payment and settlement documents. In columns 10 to 19, data is entered to calculate the amount that must be paid to the employee.

Attention! The final amount of payments due to the employee upon dismissal must be entered at the end of the T-61 form, both in numerical form and in words. Here you also need to enter payroll data, which serves as justification for the issuance of cash from the organization’s cash desk.

After completing the last section, the accountant who filled out the document must put his signature under it with a transcript and the date of completion.

After the entire procedure described above for drawing up the T-61 calculation note, it is necessary to make a corresponding entry in the employee’s work book about the termination of the employment contract. To properly maintain personnel records, the necessary mark must be placed on the personal card of the resigned employee.

Payroll 0504402 instructions for filling out

Unified document forms (UFD) are developed using the names of details and their corresponding codes in accordance with all-Russian classifiers (classifications) of technical and economic information for automated processing and exchange of information.

In this article, we will consider such a document as the Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases (f. 0504425). After this, in the Print list you will have a new printable form “Form 0504425 (with base and signatures)”.