DSV 3 - what is it

According to current legislation, each citizen can independently increase his future pension, for which additional contributions are transferred to the funded part . The procedure can be performed independently or through an employer.

If, on the basis of an employment contract, the head of the company transfers funds, then he additionally draws up a DSV-3 NSO report, which is submitted to the Pension Fund department at the place of work. Contributions are transferred only if the employee voluntarily decides. To do this, the employee initially draws up a statement submitted to the employer.

Pension contribution difference

The employer makes pension contributions for his employee, and the amount that accumulates over time in his personal account serves as the basis for calculating and accruing the pension.

Not long ago, the state invited employees to create a separate part of their pension, called funded. It is to this part that additional contributions are transferred. The decision to collect the funded pension portion is made directly by the employee, which means that its amount will be formed from his earnings.

It is worth noting that some employers, in order to attract high-quality and highly qualified specialists to their own field, offer their employees to create a funded part for them at their own expense.

In addition, the employee himself decides in which bank his savings will be kept, and can also provide them as investments at a certain interest, which is an excellent way to increase savings and ensure a decent old age or a decent inheritance for legal successors, since in the event of premature death of the insured person, they are the ones who receive the right to dispose of the savings portion. It can be withdrawn from the account and paid or transferred to another account. It was the funded pension part that became the basis for the appearance of DSV-3 in 2022.

Who submits the reporting form and where?

A report in the DSV-3 form is compiled only by employers who pay voluntary contributions to various non-state pension funds or a state fund for their hired specialists. The procedure is carried out on the basis of an application drawn up by employees. The money is taken from the official salaries of employees.

When compiling DSV-3 registers, the following rules are taken into account:

- the document is generated in paper form if the number of employees does not exceed 25 people;

- if the staff employs more than 25 people, then it is allowed to draw up a report in electronic form.

If a paper version is used, then all sheets are stitched and numbered.

Features of filling out DSV-1: instructions from the Pension Fund of Russia

The rules for filling out the DSV-1 form are prescribed in the instructions approved by the above-mentioned Resolution of the Board of the Pension Fund of the Russian Federation.

| Required fields DSV-1 to fill out | Requirements for registration of DSV-1 |

| Name of the territorial body of the Pension Fund of the Russian Federation (addressee where DSV-1 is submitted); initials of the beneficiary (written in full); insurance number of the applicant’s individual personal account, if any; address of the addressee's place of residence; date, year of writing; personal signature of the applicant | The form must be filled out manually or printed; Black and green ink are not used when creating the form; the applicant’s signature must be affixed manually only; it is permissible to draw up an application on blank paper sheets, and not on a standard form, but you must comply with the condition of compliance with the DSV-1 form |

Sample of filling out the DSV-1 form

To submit an electronic version of the application, a data format specially developed for this purpose, approved by the same Resolution of the Pension Fund of Russia, is used.

Formation rules

Compiling a register in the DSV-3 form is quite simple, and the process is usually handled by an accountant or secretary.

The document contains the following information:

- registration number of the organization in the Pension Fund;

- TIN and checkpoint of the company;

- name of the enterprise;

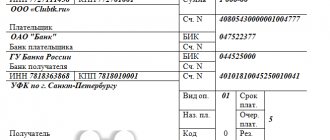

- details of the payment order on the basis of which contributions for employees were transferred;

- the tabular part contains the full names of the insured persons, their SNILS numbers and the amount of contributions paid, and also indicates the period for which the funds were transferred.

Attention! The basic rules for drawing up this document are given in Part 4 of Art. 9 Federal Law No. 56, and this information was approved by PP No. 482p.

A correctly formed register is initially certified by the banking institution through which the funds were transferred. Only after this the report is transferred to the PF representatives. The procedure is performed quarterly within the established time frame. It is allowed, instead of sending documents directly to PF employees, to use the services of MFC employees.

If the average number of employees exceeds 25 people, then it is not allowed to use a paper report form. You will have to use exclusively electronic documentation, which is signed using an enhanced digital signature before sending.

If reporting is submitted on paper, and there is more than one sheet, then the following rules are taken into account:

- all sheets are numbered;

- a brochure is created;

- sheets are stitched using a special thread;

- the ends of the thread are brought out only from the back side of the document, and are also tied tightly and sealed with a small sheet of paper;

- the sheet contains information that the exact number of sheets is stitched and sealed in the register;

- this inscription is certified by the signature of the head of the organization, as well as the chief accountant of the company;

- at the end the company seal is placed on it.

Reference! If the head of a company submits a DSV-3 report quarterly, then he has to issue a similar form to the citizen upon dismissal of any employee for whom insurance contributions for a funded pension are transferred.

The company accountant is responsible for the preparation of this document. It contains information from other primary papers. You can simply fill it out on a computer or use special accounting programs that simplify the process.

If an individual entrepreneur does not have a hired accountant, then he can use one-time services. You can figure out the rules for drawing up the form yourself, since samples are freely available on the Internet.

DSV PFR NSO decryption in Sberbank online KBC

After performing these manipulations, it is necessary to ensure the creation of an appropriate signature stating that everything is stitched, numbered and confirmed by a seal.

State support for the formation of funds: features

State support is aimed at protecting and rationally forming pension savings of citizens, and it is carried out on the basis of several principles.

- It is carried out for 10 years from the moment that follows the year when additional insurance premiums were paid, as well as the funded part.

- If an additional amount of more than 2,000 rubles was paid over the past year, then the insured person has the right to count on government support.

- The amount of the contribution made is determined by the amount of insurance premiums for the funded part of the pension.

Is it required to submit zero certificates?

The legislation does not contain the concept of a “zero” form of DSV-3, so if an employer does not have employees who make a voluntary decision to increase their future pension, then he does not submit such a report to the Pension Fund.

Reporting begins on the first day of the month following the time when the employee submits an application to transfer funds to a fund.

As soon as a citizen resigns or completely refuses voluntary contributions, submitting a corresponding application to the head of the enterprise, then from the next month not only the transfer of funds, but also the submission of reports stops. However, there is no need to warn Pension Fund specialists about such changes.

Important! If an individual entrepreneur does not have employees, then he does not need to submit any reports to PF representatives for hired employees.

Deadlines for submitting form RV-3

The fact is that, according to the Laws on Additional Social Security, insurers must report on accrued “additional” contributions by the 1st day of the second calendar month following the reporting period, and at the same time within the time limits established by Article 15 of Law 212-FZ (Article 4 of the Law of November 27, 2001 N 155-FZ, Part 2 of Article 7 of the Law of May 10, 2010 N 84-FZ). That is, in the same time frame as the RSV-1.

The deadline for submitting the RSV-1 depends on the form in which the calculation is submitted - on paper or in electronic form (clause 1, part 9, article 15 of the Law of July 24, 2009 N 212-FZ).

| Calculation form RSV-1 | Deadline for submitting calculations RSV-1 |

| paper | no later than the 15th day of the second calendar month following the reporting period |

| electronic | no later than the 20th day of the second calendar month following the reporting period |

As you can see, these are later dates compared to the 1st day of the second calendar month. And at the beginning of 2015, the Pension Fund of the Russian Federation announced that it plans to make proposals to amend the Laws on Additional Social Security (Letter of the Pension Fund of the Russian Federation dated January 28, 2015 N P-23932-19/25758). True, there are no changes in the current versions of the Laws.

Therefore, the safest option is to check the deadline for submitting the RV-3 form directly at your Pension Fund office and submit it no later than the date that the Fund tells you.

Is it mandatory to issue certificates to employees upon dismissal?

DSV-3 contains information about all insured persons in the company, and also provides the amount of the transferred contributions. Since the funds are transferred by the head of the organization, he has to report not only to the Pension Fund, but also to the direct insured persons.

Upon dismissal, the director is obliged to hand over to the employee a large package of documents, which includes an extract from DSV-3. It is issued exclusively to specialists for whom the employer paid insurance contributions for a funded pension. The basic rules for transferring this document are given in the provisions of Federal Law No. 56.

The statement contains information about all transferred funds for the entire period of work in the company. The head of the company must issue this documentation to the employee on the last day of employment. For this purpose, you cannot require any statement from a specialist. If an employer does not provide a citizen with the required documents, he may be subject to disciplinary or administrative liability.

How to correctly calculate DSV?

For individual entrepreneurs, there is an income limit for which fixed insurance payments are extended, amounting to 300,000 rubles per year. Income exceeding the specified limit is subject to calculation for additional insurance premiums according to the following formula:

DSV = (GD – 300000) x 1%

DSV – amount of additional social contributions

GD – annual income

Important! Additional payments do not exclude the payment of fixed (constant) insurance premiums.

Example #1. Calculation of daily allowance for individual entrepreneurs.

Annual income of individual entrepreneur M.M. Matveev in 2022 will be 672,000 rubles.

The amount of additional insurance premiums will be (672,000-300,000) x 1% = 2,460 rubles.

The total amount of insurance premiums will be 29354 + 3720 = 33074 rubles.

According to Art. 427 of the Tax Code of the Russian Federation, an individual entrepreneur has the right to count on a reduced rate of insurance premiums in the following cases:

- entered into an agreement with the management bodies of special economic zones on the implementation of technology-innovation activities and makes payments to individuals working in a technology-innovation special economic zone or industrial-production special economic zone;

- entered into an agreement on the implementation of tourism and recreational activities and makes payments to individuals working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster.

Reporting form and when additional contributions are paid

DSV-3 is a register that is formed by the employer at the moment when he transfers additional pension contributions for his employees. It is for this purpose that this reporting form was developed, which was last adjusted in 2020.

If we talk about the deadlines for paying contributions of an additional type, then they correspond to all other contributions and are paid before the 15th day of the month that follows the reporting month, at the same time a reporting form is generated for additionally insured persons.

Those who submit the DSV-3 form should understand that it is generated at the end of each month, but is submitted to the Pension Fund only once a quarter. The deadline for submitting the reporting document is the 20th day of the month following the reporting quarter.

This reporting document contains information:

- By employer, including full name and TIN.

- By employee: full name, SNILS.

- Amounts of additional contributions, dates of their transfer.

- Numbers of payment orders through which the transfer was made.

Based on this information, we can conclude who takes the DSV-3 - these are employers who are the insurers of their employees and make cash transfers on their behalf to form the funded part of the pension.

So, those who take DSV-3 for 2022 are required to report by January 20. The reporting will take the format of three samples, which can be compiled in paper form if the number of employees is up to 25 people or in electronic form if this number is exceeded. In the case of paper media, the form must be stitched, numbered and sealed indicating the date and authenticity, as well as the signature of an authorized person, and in the second version, supported by an enhanced electronic signature.

DSV - additional insurance contributions, a program of state co-financing of pensions, implemented by Federal Law No. 56-FZ of April 30, 2008 “On additional insurance contributions for the funded part of the labor pension and state support for the formation of pension savings.”

This Program was created with the aim of encouraging citizens to independently pay additional insurance contributions (ASC) for their funded part of the pension, thereby increasing their future pension. At the same time, the main source of formation of a funded pension is compulsory insurance payments from employers to the Pension Fund of the Russian Federation.

As an incentive, the state adds the amount of their payment to the individual personal accounts of citizens participating in the Program (doubles the payment, but not more than 12 thousand rubles per year).

Entry of new participants into the Program was stopped on October 1, 2013 (since 2008, almost 16 million people joined the Program - more than 10% of our vast population).

With the entry into force of Federal Law No. 345-FZ of November 4, 2014, entry into the Program of new participants was extended until December 31, 2014. However, in accordance with this Law, co-financing by the state is carried out only if newly entering (in 2014) program participants are not pension recipients (with the exception of military pensioners).

So.

Basic principles of the state co-financing program:

– additional insurance premiums can be paid by all citizens who have joined the Program

– the state co-finances the contributions of citizens who joined the program in 2014 (in accordance with Federal Law 345-FZ), only on the condition that at the time of joining the Program they were not recipients of a civil pension. This rule does not apply to citizens who entered the Program before October 1, 2013.

– the state co-finances the contributions of any of the Program participants only on the condition that he has made the first contribution under the Program before January 31, 2015 (amendments to 345-FZ)

– the state co-finances the personal contributions of each Program participant for 10 years from the moment the citizen pays the first contribution

– the Program participant independently determines the size and frequency of DSA payments

– a citizen has the right to stop, suspend and resume payment of additional insurance premiums at any time

– the state annually co-finances the personal contributions of each Program participant in the amount of 2,000 to 12,000 rubles per year

– pension savings formed by paying additional insurance contributions are inheritable. That is, in the event of the death of the payer, his successors can receive this money.

How to pay additional insurance premiums (DSI):

– Independently through credit institutions (i.e. banks). KBK 39210202041061100160. Be sure to indicate your SNILS when specifying the payment. Sberbank accepts these payments without commission. Do not forget to submit copies of payment documents to your Pension Fund office within 20 days from the end of the quarter in which you made the payment. It is in your interests - it is better to make sure that the money goes to your personal account.

- Through the employer. To do this, you need to submit an application to the accounting department, which will deduct your contributions from your salary every month and transfer them to the Pension Fund. The application indicates the amount of monthly DSA paid. Their size can be changed by the insured person based on a personal application.

Tax deduction

Please note that DSA contributions are not subject to personal income tax, that is, on the amount of funds transferred under the program, you can annually receive a tax deduction of 13%. Thus, if the payment amount is from 2,000 to 12,000 rubles per year, you can return from 260 to 1,560 rubles the next year.

To receive a refund of the tax deduction amount, you must submit a declaration and an application about the desire to receive a social tax deduction at the tax office at your place of residence. This can be done within three years from the year the payment was made.

In addition to the declaration and application, supporting documents are submitted, which are: payment receipt - in case of paying the DSA yourself; a certificate from the employer about the paid amounts of DS - in case of payments made through the employer (approved by Order of the Federal Tax Service dated December 12, 2008 No. MM-3-3/634a “On the form of the certificate”).

As practice shows, tax specialists may require other documents besides those listed above. For example, a notice of entry into the state pension co-financing program is sent by the Pension Fund by mail to the insured person after he submits an application to join the program.

You may be interested in the article “Who benefits from paying DSV”

(empty)

for the 1st quarter of 2022