Home • Blog • Blog for entrepreneurs • Electronic signature (ES) for an employee of an organization: how to get it and where to apply it?

Maxim Demesh

February 9, 2022

581

From January 1, 2023, the rules for obtaining an electronic signature (ES, previously EDS) for employees will change. From January 1, 2022, they have changed for heads of organizations. Initially, other deadlines were set, but then they were postponed. As a result, entrepreneurs became completely confused.

We have studied in detail the rules for obtaining electronic signatures for different categories of taxpayers and are ready to provide comprehensive data.

An electronic signature for an employee is a digital analogue of a personal handwritten signature, which is issued to employees of organizations to certify documents. (highlight)

Regulations of the authorized certification center of the Treasury, effective in 2022

To organize auctions and post information on procurement for government needs on the Internet, municipal and state customers, as well as contractors and other tender participants, must certify the sent files with an electronic digital signature (EDS) obtained from the Federal Treasury (FC).

The same digital signature is also used by budgetary organizations to carry out electronic document management with the Federal Treasury. EDS is an analogue of a handwritten signature of an authorized person, which is obtained by cryptographic transformation of information.

ATTENTION! Budgetary institutions can obtain an EDS key verification certificate from an authorized certification center of the Federal Treasury (TC) absolutely free of charge.

The algorithm for obtaining an electronic signature is fixed in the Regulations of the Certification Center of the Federal Treasury, which was approved by Order of the Federal Commission dated September 14, 2018 No. 261.

The Treasury Regulations for obtaining an electronic digital signature with all accepted changes can be downloaded on the official website of the department at roskazna.ru in the “Certifying” section.

ATTENTION! From 01/01/2022, the Federal Tax Service will issue digital signatures for legal entities and individual entrepreneurs free of charge. Tax authorities plan to begin providing the service as early as 07/01/2021. We talked about this in more detail here.

EDS production time

The main time costs for producing an electronic digital signature fall on the following stages:

- collection of documents for submission to the Certification Center;

- filling out an application (in person or via the website);

- receiving an invoice (after reviewing the application) and paying for the service;

- direct production of an electronic digital signature.

After reviewing all the necessary documents and a certificate of payment, the Certification Center begins to produce a signature, which only takes about 1-2 hours. With some efficiency, an electronic digital signature can be obtained even on the day of submitting the application. Significantly saving clients time is the opportunity to submit an application online with the provision of scanned copies of the necessary documentation. With this method of submission, you will need to provide the originals for verification when delivering the prepared digital signature.

Official website for government procurement under 44-FZ

The procurement algorithm for municipal and state needs is regulated by the Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” dated 04/05/2013 No. 44-FZ. All participants in electronic trading should register on the official website of the Unified Information System in the field of procurement www.zakupki.gov.ru.

According to the letter of the Ministry of Economic Development of the Russian Federation dated October 26, 2016 No. D28i-2792, in order to participate in government tenders, you must obtain an electronic signature in accordance with 44-FZ from the Treasury.

Find out how a customer can register in a unified information system for procurement in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

How to obtain an electronic signature from the Treasury for government procurement under 44-FZ

To obtain an electronic signature from the Financial Corporation, you must do the following:

- Conclude an agreement (agreement on accession to the Regulations) with the Treasury (Appendix No. 1 to the Regulations).

- Receive from the CA a USB storage medium with an installation distribution of the electronic signature key tool (ESK) and software for creating a certificate request.

- Generate a request for a certificate in an automated mode using the “Key Generation Workstation” software, using the distribution kit from the removable media issued by the CA, and write the resulting file to a removable media that does not contain CEP. In this case, a request for a certificate and CEP can be created:

- at the workplace in the applicant institution by a person authorized by the institution independently;

- by the applicant’s representative at the Federal Treasury branch in the presence of the CA operator.

- Print out the certificate request generated by the program, certify it with the signature of the manager and the seal of the organization.

- Collect the package of documents required to obtain an electronic signature.

- Provide all of the above files, papers and their copies to the CA.

The submitted documents are checked by the CA, and in case of a positive decision, within 5 working days, the authorized certification center of the Federal Treasury issues a certificate to the applicant on removable media and 2 copies of the certificate on paper. The paper version of the certificate is signed by the owner, 1 copy is returned to the CA operator.

Information about the certificate and its owner is sent by the CA operator to the Unified System of Identification and Authentication (USIA) of participants in state auctions.

Key generation program

The “Key Generation Workstation” software for preparing a file with a certificate request is also available for download on the official website of the Treasury roskazna.ru in the “Documents” section.

ADVICE! To quickly find a software distribution in documents on the Treasury website, use the search bar by entering the query “Key Generation Workstation Distribution.”

After downloading the program, run the setap.exe file and follow the installation instructions:

- We agree to the terms of the agreement - click the “Agree” button.

- Select the directory to install the software.

- Click “Install”.

After successful installation, run the program, after which:

- Select the “Create certificate request” button.

- In the window that opens, fill in all the information about the subscriber and click the “Next” button and in the next window “Run”.

- In the new dialog box, select removable media and click OK.

- In the window that opens, the program will prompt you to set a password to access the key. The selected password will need to be entered each time you sign. You can skip this step by leaving the password fields blank.

- Select a location to save the file for the certificate request and click “OK”.

- In the next window, the program displays the request form on the screen for printing.

- The application for the certificate has been successfully generated, click “Finish”.

Documents for obtaining digital signature at the Treasury

It is necessary to provide documents for digital signature to the Treasury:

- application for a certificate, signed by the head and certified by the seal of the organization;

- a copy of the applicant’s passport and the original for comparison of information;

- the applicant’s consent to the processing of personal data;

- SNILS of the owner of the signature;

- a document confirming the right to own the certificate (an order appointing a manager or a power of attorney for an authorized representative of the company);

- OGRN/INN of the applicant;

- power of attorney to receive digital signature.

Documents for obtaining an electronic signature at the Treasury are certified by the signature of the head and the seal of the applicant organization.

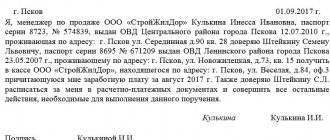

Registration of a qualified electronic signature for public services by individuals

To obtain a qualified electronic signature for government services, you will need to perform several sequential steps described below.

How to create an application and prepare documents to obtain an electronic signature for government services

Before submitting an application for a qualified digital signature, an individual must prepare 3 documents:

- passport,

- SNILS,

- TIN.

Almost all certification centers accept applications for digital signatures in electronic form. That is, to submit an initial application, an electronic application form is filled out on the website of the accredited center. In particular, you must provide the following information:

- region, city;

- your last name, first name, patronymic;

- telephone, email;

- TIN.

Then select the desired type of signature to order and click the “Submit Application” button.

How to order an electronic signature for public services at a certification center

After reviewing the application, the manager of the accredited center calls the customer and discusses the procedure for providing a passport, SNILS and TIN. Typically, the customer, in agreement with the manager, sends scans of these documents to the certification center’s e-mail address, and delivers the originals upon receipt of a qualified digital signature. Thus, he does not have to visit an accredited center several times.

How to obtain an electronic signature key carrier for the public services portal at a certification center

After sending the application, supporting documents and agreeing on their data with the manager of the certification center, the customer is sent an invoice (receipt) for the fee for the electronic signature. The ordered digital signature is produced on average 1–2 days after the customer pays the invoice issued to him.

You need to receive a completed digital signature using the original supporting documents (passport, SNILS) at the office of the certification center. Some centers practice delivery of digital signatures by courier to any address specified by the customer. In this case, the client does not need to visit the accredited center at all.

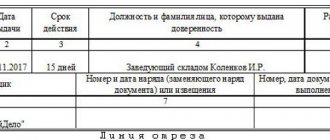

Power of attorney to receive digital signature

A power of attorney to receive an electronic digital signature from the Treasury is issued in accordance with the legally established procedure. The document must display information about the applicant organization, passport details of the person authorized to receive the certificate, granting him the right to sign accompanying documents.

A sample power of attorney for the Federal Treasury Certification Center can be downloaded from our website using the link below:

Documents for obtaining an electronic digital signature

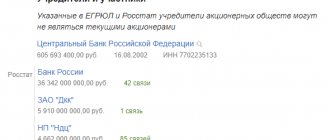

In order for an organization to obtain a digital signature from the Certification Center, it will need to collect a certain package of documents. This:

- certificate of state registration of a legal entity;

- extract from the Unified State Register of Legal Entities (not more than 30 days old);

- tax registration certificate;

- application addressed to the head of the Certification Center;

- if a digital signature is assigned to the director of the company, then an order for the appointment of a manager (general director);

- if the digital signature is issued to another authorized person of the organization, a power of attorney is required listing all the functions assigned to this person;

- passport of the employee who will use the electronic signature.

All documents must have notarized copies. It usually takes several days to process the application.

Attention! The complete list of documents for obtaining an electronic digital signature for each individual case must be clarified at the Certification Center.

Roskazna CA root certificate 2022

After receiving the certificate from the Treasury, you should install the CryptoPro software on the contractor’s workstation by downloading the distribution kit from the official website.

Installation of an electronic signature tool is documented by an installation act (Appendix No. 2 to the Treasury Regulations), 1 copy of which is transferred to the CA within 10 working days from the date of installation of the electronic signature tool.

After installing the program and the digital signature verification key certificate, you need to download and install the root certificate of the certification authority in the certificate store. It is needed so that the operating system “trusts” all certificates issued by the Roskazna CA.

To download the root certificate, go to the official website of the Treasury - the “Certification Authority” tab - and select the “Root Certificates” section.

Procedure for filing an application for revocation of an electronic digital signature certificate

An application for a new file must be submitted 20 days before the expiration date of the certificate. The old certificate and digital signature facility are removed from the workplace, and removable media are liquidated by the commission of the organization of the digital signature owner. In this case, an act of destruction of the digital signature is drawn up (Appendix No. 6 to the Treasury Regulations). 1 copy of the document should be sent to the territorial department of the CA within 10 days.

The authorized certification center of the Federal Treasury is obliged to enter information about the invalid certificate into the list of canceled certificates within 12 hours.

An application to change the status of a certificate is drawn up in accordance with Appendix No. 4 to the FC Regulations in the following cases:

- changes to the data recorded in the certificate;

- loss of the digital signature verification key carrier;

- violation of the rules for storage and (or) disposal of digital signatures;

- reorganization (liquidation) of the organization that owns the certificate;

- failure of the key certificate carrier;

- dismissal of the owner of the digital signature certificate;

- in other situations at the discretion of the certificate holder.

The application is certified by the signature and seal of the organization that owns the certificate and is provided to the CA on paper or via electronic communication channels.

Find out what will change in the procedure for obtaining an enhanced qualified electronic signature from 01/01/2022 in the ConsultantPlus Ready Solution by receiving a free trial access.

Is an electronic digital signature required for the government services portal?

To understand whether an electronic signature is needed for a government services portal, you must first form a general idea of the purpose of this signature.

The Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ established 3 types of digital signatures, the characteristics of which are given below in the form of a diagram:

It turns out that for government services you need to issue an electronic signature:

- or simple, in order to:

- request (receive) background information (for example, about debts on taxes, fines, courts or the amount of pension savings);

- sign up for services in educational or medical institutions;

- pay for services (housing and communal services, government services, taxes, fines, etc.), etc.;

- obtaining (replacement) identification documents (passport, driver’s license, etc.);

- registration of transport, organization, individual entrepreneur;

- filing 3-NDFL;

- registration of certificates, licenses, permits, etc.

For more information about a qualified signature and its application, read our introductory material “Strengthened qualified electronic signature - what is it?” .

Thus, we have decided which government services require a simple signature and which require a qualified signature. Now let’s move on to explanations about where and how to obtain an electronic signature for government services and whether it can be issued for free.

Results

The Federal Treasury obliges the receipt of an electronic signature for 44-FZ to be carried out in accordance with the Regulations for issuing a key certificate. The procedure for obtaining a certificate has its own peculiarities and is discussed in detail in this article.

For information on the types of digital signatures and the procedure for obtaining them, read the articles:

- “How to make a simple electronic signature?”;

- «What is the difference between the two main types of electronic signatures?.

Sources: Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” dated 04/05/2013 No. 44-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Creating a simple electronic signature for government services

In order to create a simple digital signature, you need to go to the main page of the government services portal, find the “Login to government services” window on the right side and click on the “Register” button (as shown in the figure below). Next, enter your last name, first name, phone number (or email) and register. A confirmation code (or link) will be sent to the specified phone number (or mailbox address). Enter the received code (or follow the link sent) and click the “Confirm” button. We indicate a personal password that will be used when logging into government services in the future.

Next, fill in all the standard personal identification information (passport data, INN, SNILS), and select a method to confirm the entered data:

- through the Service Center;

- through Russian Post;

- online through the web versions of the Internet banks Sberbank Online and Tinkoff, as well as the Internet and mobile bank Pochta Bank Online (provided that you are a client of one of the banks).

After the information entered in your personal account is confirmed by the Service Center or Russian Post, a simple digital signature for the public services portal will be considered created.

For precautions related to creating a simple signature, read our article “How to create a simple electronic signature?” .