This article is devoted to state benefits for pregnant women. Namely, those who registered in the early stages of pregnancy. Let's talk about the timing of early pregnancy so that there is no question of how many weeks early pregnancy is. In addition, we will consider some of the nuances of this payment and its provision to expectant mothers. size n in 2022 an individual registered in the early stages of pregnancy.

Benefit assignments in early pregnancy

Benefits for expectant mothers who are registered with a medical institution in the early stages of pregnancy are assigned and paid in accordance with several regulations:

- Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children” (hereinafter referred to as Law No. 81-F3);

- Order of the Ministry of Labor of Russia dated September 29, 2020 No. 668n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children”;

- Federal Law of 07.08.2000 No. 122-FZ “On the procedure for establishing the amounts of scholarships and social benefits in the Russian Federation”;

- Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance”.

The benefit in the early stages of pregnancy is one-time. It is paid together with maternity benefits.

Benefit amount after indexation from February 2022

From February 1, 2022, child benefits have been indexed by 4.9 percent.

As a result, in 2022, the amount of the benefit for registration in the early stages of pregnancy depends on the date of sick leave for pregnancy and childbirth:

- when the certificate of incapacity for work is issued on February 1, 2021 and later , the benefit is due in the amount of 708.23 rubles. ;

- if the sick leave date is before January 31, 2021 inclusive, the benefit will be paid in the old amount - 675.15 rubles .

Who is eligible for benefits in 2021

In accordance with the current provisions of the laws, the following can apply for benefits for registration in the early stages of pregnancy:

- Women insured in case of temporary disability and in connection with maternity. Simply put, women who work (serve) officially and for whom they pay contributions to compulsory social insurance.

- Women who worked (were insured), but were dismissed due to the liquidation of the employer-organization or upon termination of the activities of the employer-individual entrepreneur, as well as employers-individuals engaged in private practice: notaries, lawyers, etc. - within 12 months preceding the day they were duly recognized as unemployed.

- Women studying full time on a paid or free basis in educational institutions of primary vocational, secondary vocational and higher vocational education, in institutions of postgraduate vocational education.

- Women performing military service under contract, serving as privates and commanding officers in internal affairs bodies, in the State Fire Service, in institutions and bodies of the penal system, in agencies for control of the circulation of narcotic drugs and psychotropic substances, in customs authorities .

- On 01/01/2015, the Treaty on the Eurasian Economic Union dated 05/29/2014 came into force, the parties of which are the Russian Federation, Belarus, Kazakhstan and Armenia (Kyrgyzstan joined on 08/12/2015). According to the terms of the Agreement, citizens of these countries have the right to receive all types of compulsory social insurance benefits in case of temporary disability and in connection with maternity from the first day of work in the Russian Federation. Moreover, this right does not depend on whether they are temporarily staying, temporarily or permanently residing on the territory of the Russian Federation. Employers must pay insurance contributions to the Social Insurance Fund for them in the same amounts as for Russian citizens. Therefore, for the purposes of assigning benefits in the Russian Federation, citizens of the listed states are considered insured persons.

If a woman does not fall into one of the categories mentioned above, she is not eligible for payment.

Certificate required

To receive early pregnancy benefits, you must obtain a certificate from a medical institution. It is drawn up in any form, but certification by the issuing medical institution is required.

You can provide a certificate together with documents for receiving maternity benefits, or you can provide it separately . When submitting documents at the same time, both benefits will be paid at the same time. If the documents were submitted later, the benefit for registration in the early stages of pregnancy must be paid no later than 10 days from the date of registration of a certificate confirming this fact.

Who can receive the new benefit?

The monthly allowance for registration in the early stages of pregnancy was approved by Federal Law No. 151-FZ of May 26, 2021. It will be available to expectant mothers who meet the following conditions:

- gestational age is six weeks or more;

- early pregnancy registration - up to 12 weeks;

- the size of the average per capita family income does not exceed the subsistence level in the constituent entity of the Russian Federation in force on the date of application.

In addition to the average per capita family income, the availability of real estate, transport, and bank deposits will be taken into account when assigning benefits. And the lack of income of one of the family members must be justified, for example, child care, full-time education, unemployment confirmed by the Central Employment Certificate, etc. are considered a valid reason.

The old one-time allowance for early registration has been canceled (RUB 708.23). From July 1, 2022, it cannot be received, even if the pregnant woman does not meet the conditions of the new payment. But if the right to a one-time benefit arose before July 1, it will be paid according to the old rules.

Benefit amount

The one-time benefit for women who registered in the early stages of pregnancy is 675.15 rubles (can be indexed from February 1, 2021).

In regions where increasing regional coefficients have been established, the amount of the benefit should be increased by the amount of the regional coefficient.

In some regions there are additional programs to support motherhood and childhood. For example, if you are registered and live in Moscow, then you have the right to receive an additional increase in benefits - you will pay an additional 634 rubles upon confirmation that you were registered at up to 20 weeks of pregnancy.

If maternity leave was issued before February 1, 2021, the benefit will be assigned in the amount of 675.15 rubles. If the date of sick leave is February 1, 2022 or later, the benefit is paid in a different amount - taking into account the indexation coefficient.

Accrual of maternity benefits

Amount and period of payment of benefits for labor and child care

Maternity benefits and leave

70 days before, 70 days after childbirth

100% of SDZ* Minimum 58,878.4 rubles (according to the minimum wage 2021)

Required documents:

- Statements**

- Sick leave for pregnancy and childbirth

Monthly benefit for a child up to 1.5 years old

from the end of maternity leave until the child reaches the age of 3 years 40% of the SDZ* Minimum 7,082.85 rubles (according to the minimum wage 2021)

Required documents:

- Statements**

- Child's birth certificate

- Certificate from the other parent's place of work

Child care leave up to 3 years

from the end of maternity leave until the child reaches the age of 3 years.

Only for children born before the beginning of 2022 50 monthly At the expense of the employer Required documents:

- Statements**

- Child's birth certificate

- Certificate from the other parent's place of work

Monthly allowance for women registered in the early stages of pregnancy

from the month of registration with a medical organization or submission of an application, 50% of the regional subsistence level for able-bodied citizens.

Required documents:

- Statements**

- Certificate from the antenatal clinic

- Income certificates

One-time benefit for the birth of a child

after registering the child in the registry office 18,886.32 (from 02/01/2021)

Required documents:

- Statements**

- Child's birth certificate

- Certificate from the other parent's place of work

* SDZ - average daily earnings for benefits

** Applications for:

- Holiday to care for the child

- one-time benefit for women registered in the early stages of pregnancy

- maternity leave

- monthly allowance for child care up to 1.5 years

- lump sum benefit for the birth of a child

The given amounts are indicated without taking into account regional coefficients and are valid for 2022

Documents for applying for benefits and places of payments

As a general rule, there is no need to write an application for early pregnancy benefits. All you need is a certificate that confirms that you are registered at the required date.

The woman applies this certificate and document confirming her incapacity for work during pregnancy and childbirth:

- to an educational institution - if a student;

- at the place of work (service) - if the working (employee) woman;

- to the territorial social security authority at the place of residence - if you are unemployed and entitled to benefits.

Note!

A woman who is unemployed at the time of applying for maternity benefits is entitled to only one type of benefits - either maternity benefits and an additional payment for early registration, or unemployment benefits. You can't have both. You need to choose what exactly should be paid and notify the social security authority about it.

In principle, at the stage of transferring documents to the person who will assign the benefit, the registration process on the part of the expectant mother is completed . All that remains is to wait for the benefits to be paid.

Let's consider an exception: if a woman is an individual entrepreneur and before pregnancy regularly paid contributions to the Social Insurance Fund for a year or more, a certificate from the antenatal clinic must be submitted to the same Fund for the calculation of state payments.

Possible benefit situation

So, the benefit for registration in the early stages of pregnancy from February 1, 2022 is supposed to be paid in a new amount - 708.23 rubles . However, a controversial situation is possible. Let's give an example.

The employee goes on maternity leave from February 4, 2021. On January 25, 2022, the woman submitted to the accounting department a certificate from the antenatal clinic stating that in 2022 she registered in the early stages of pregnancy (up to 12 weeks). How much benefits should I pay for early registration?

The benefit for registration in the early stages of pregnancy is paid in addition to the maternity benefit (Article 9 of Law No. 81-FZ). Therefore, benefits for registration in the early stages of pregnancy are transferred in the amount that is established on the start date of maternity leave.

In our case, the woman went on maternity leave on February 4, 2022. Therefore, the registration allowance should be paid in the amount of 708.23 rubles. (taking into account indexation from February 1). If the start of maternity leave was in January 2022, the benefit would be in a smaller amount - 675.15 rubles .

The benefit is paid from the Social Insurance Fund simultaneously with maternity benefits. If the employee brings a certificate after paying for sick leave for pregnancy, the benefit is paid within 10 calendar days (clause 24 of the Procedure for paying child benefits).

Innovations for 2022 when paying benefits through the Social Insurance Fund

From 01/01/2021, all regions of Russia switched to direct payments of benefits from the Social Insurance Fund. The corresponding law has been adopted - Federal Law No. 478-FZ dated December 29, 2020.

Read more about this in the article “What happened to the FSS pilot project “Direct Payments” in 2022: regions.”

Thus, from 2022, the rules of direct payments are applied throughout Russia for the assignment and payment of benefits.

In order for the employee to receive the benefits due to her, she now submits all the necessary documents to her employer.

The employer transfers the documents received from the employee within 5 calendar days to the Social Insurance Fund branch at the place of its registration. They are accompanied by an inventory of the documents being transferred. The inventory form was approved by order of the Social Insurance Fund dated November 24, 2017 No. 578.

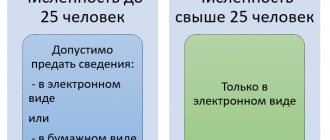

The method of transferring a set of documents depends on the average number of employees of the organization. So, if it does not exceed 25 people , documents can be submitted on paper . When the average number of employees is 26 or more , only electronic communication channels are used. In this case, the information necessary for calculating benefits is submitted in the form of an electronic register. The form of this register and the procedure for filling it out were approved by Order No. 579 of the Social Insurance Fund dated November 24, 2017.

Results

- Payments are due not only for the birth of a child, but also in the event that you register with an antenatal clinic during pregnancy up to 12 weeks.

- Of course, the amount of payments is small, but any funds will be useful.

- Payments for registration up to 12 weeks of pregnancy are usually made simultaneously with the payment of maternity benefits. However, if you submitted documents for the first benefit later, then the payment will be later.

- From 2022, benefits will be paid through the Social Insurance Fund.

Eligibility for benefits

When a woman finds out about pregnancy, she must register with a gynecologist at a antenatal clinic or clinic.

To encourage early requests from pregnant women for medical help, legislators introduced a special allowance for women registered before 12 weeks (Article 9 of Federal Law No. 81-FZ of May 19, 1995). The benefit for early pregnancy is a one-time benefit and is intended for women who consult a doctor and register with a medical institution for up to 12 weeks. In case of later registration, payment is not assigned.

IMPORTANT!

Whether a woman works or not plays a decisive role in receiving social benefits for up to 12 weeks. It is only available to working people and students. This type of social support is not provided for the unemployed.