New in 6-NDFL from 2022

The last time we will fill out the current form 6-NDFL is based on the results of 2022. Starting with reporting for the 1st quarter of 2022, forms 2-NDFL and 6-NDFL are combined into one report. Its form was approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected]

The updated 6-NDFL includes:

- title page, Section 1 “Data on the obligations of the tax agent”;

- Section 2 “Calculation of calculated, withheld and transferred personal income tax amounts”;

- Appendix No. 1 “Certificate of income and tax amounts of an individual” (to be completed only at the end of the year).

From 2022, the procedure for clarifying information reflected in 6-NDFL will change. If you need to make changes to sections 1 or 2 of the calculation, the updated document must be submitted without attachments (without certificates of income and tax amounts of an individual). If you need to correct the information in the certificates, you will have to submit the calculation in full.

From 2022, due to the introduction of a progressive income tax rate in 6-NDFL, it will be necessary to fill out sections 1 and 2 separately for each tax rate if the tax agent paid income taxed at different rates (Letter of the Federal Tax Service dated December 1, 2020 No. BS-4- 11/ [email protected] ).

Why do you need to calculate 6-NDFL?

Individual entrepreneurs and organizations paying remuneration to their employees are required to calculate, withhold and pay income tax (NDFL) to the budget. Until 2022, to monitor the timeliness and correctness of calculation, withholding and payment of personal income tax, tax authorities used information from two reports: 2-NDFL and 6-NDFL.

They differ:

- Frequency of presentation.

6-NDFL is submitted quarterly, and 2-NDFL - once a year.

- Lack of personification.

6-NDFL provides information in general for all employees; it does not contain data separately for each employee.

From 2022, the 2-NDFL certificate as a separate document will cease to exist. The last time the certificates must be submitted to the tax authorities is at the end of 2022. Tax authorities will learn the necessary information about the income of individuals and the amount of income tax from Appendix No. 1 to the updated calculation of 6-NDFL.

When, where and how is 6-NDFL submitted?

If your company has changed its address during the year, by the end of the year you need to submit two 6-NDFL reports with different OKTMO codes to the tax office at the new place of registration:

- In the first calculation, which reflects the income of employees before the change of address, enter the OKTMO that was used previously.

- In the second calculation, which reflects the income from which personal income tax was withheld after a change of address, you need to indicate the new OKTMO.

In this case, in both calculations it is necessary to indicate the company’s new checkpoint (Letters of the Federal Tax Service dated December 27, 2016 No. BS-4-11/25114, dated September 28, 2020 No. BS-4-11 / [email protected] ). Which calculation should reflect the income of individuals must be determined by the date of tax withholding.

Calculation form 6-NDFL

For 2022 you need to report on the same form. It was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

6-NDFL consists of the following sections:

- Title page.

Includes basic information about the employer, the period for which the calculation is submitted and the Federal Tax Service to which it is sent.

- Section 1.

Filled out with a cumulative total from the beginning of the year, includes information about all employee income for the reporting (tax) period.

- Section 2.

Includes information on payments for the last 3 months of the reporting period.

Form 6-NDFL for 2022

Comments

Beketova 10.10.2019 at 11:00 #

Please

mikh 03.25.2020 at 23:04 # Reply

typos

2. You need to calculate 6-NDFL for the twelve months of 2020. According to your local regulations, you will pay wages for December 2022 to employees on January 10, 2022. Accordingly, transfer personal income tax on January 10 or 11, 2022. Despite the fact that this is a salary for 2022, in the calculation of 6-NDFL for 12 months of 2022, data on income and personal income tax are not included, since the payment and transfer of personal income tax will be made in another reporting period. This data must be included in the calculation of 6-personal income tax for the 1st quarter of 2022.

Makar 03/07/2021 at 10:56 am # Reply

Outdated

Old stuff. Forms for 2022. There is no new form in Excel anywhere at all.

Tatyana 04/14/2021 at 11:22 am # Reply

The form and sample are old

Old form and sample for 2022

Methods for submitting 6-NDFL

You can submit a report to the Federal Tax Service:

- On paper.

You can submit it yourself, through a representative, or by sending it by registered mail with a list of attachments.

Be careful: a paper report can be submitted in 2022 only if the number of employees does not exceed 10 people. (Letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11 / [email protected] ).

If there are more employees, you will have to report electronically. You may be fined for submitting a report on paper when you are required to submit it in electronic format.

- In electronic form.

Where is 6-NDFL submitted?

6-NDFL is submitted to the Federal Tax Service:

- organizations - at the place of their registration;

- Individual entrepreneur - at the place of registration (except for special UTII and PSN regimes);

- separate subdivisions (SS) - at the place of registration of each separate unit;

In 2022, companies with OPs are given the right to choose a tax office for filing reports if the parent organization and OPs are located in different municipalities. To do this, you need to notify all the Federal Tax Service Inspectors with which the parent company and the OP are registered about this decision. The notification form was approved by Order of the Federal Tax Service dated December 6, 2019 No. ММВ-7-11/ [email protected] It must be submitted no later than the 1st day of the tax period for which you will report according to the new procedure.

- the largest taxpayers and their OP - at the place of registration of the “head”;

- Individual entrepreneur on UTII and PSN - at the place of registration as a payer of imputation or patent.

What is it about

Personal income tax (NDFL) is paid by both Russian citizens and foreigners who permanently reside in the Russian Federation. Today, the scale of personal income tax rates varies from 9 to 35% and depends on a number of factors.

The 6-NDFL calculation began for the first time in the 1st quarter of 2016, and it is generated for the entire institution - for the entire amount of the transferred payment. The form and instructions for filling out 6-NDFL in 2022 are presented in the Federal Tax Service order No. ED-7-11/ dated September 28, 2021.

IMPORTANT!

From 01/01/2022, a new form for calculating personal income tax amounts is in effect - from Order No. ED-7-11/ That is, for the 4th quarter of 2021 we are reporting in a new way.

This is what the 6-NDFL template looks like for the year - 2022 (4th quarter of 2021).

The form is prepared by all tax agents - legal entities and individual entrepreneurs who make payments to individuals and contribute personal income tax to the budget. The calculation is submitted to the tax office at the place of registration or location and at the location of each of its separate divisions.

The delivery format directly depends on the number of staff. If the number of individuals who received remuneration in the tax period does not exceed 10 people, then KND form 1151099 can be submitted on paper (in person or by a valuable letter with a list of attachments). In all other cases, the calculation is provided only electronically via the Internet through EDI operators or the service on the website of the tax service (clause 2 of Article 230 of the Tax Code of the Russian Federation).

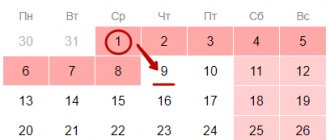

The calculation is submitted to the tax authority quarterly, no later than the last day of the month following the corresponding period (clause 2 of Article 230 of the Tax Code of the Russian Federation). For a year - no later than March 1 of the following year. What are the deadlines for submitting 6-NDFL reports in 2022:

- for 2022 - until 03/01/2022;

- for the 1st quarter - until 05/04/2022 (postponement due to weekends);

- for half a year - until 08/01/2022 (postponement due to weekends);

- 9 months - until 10/31/2022;

- for 2022 - until 03/01/2023.

Requirements for filling out 6-NDFL for 2020

Requirements for drawing up and filling out the 6-NDFL report are given in Order No. ММВ-7-11/ [email protected] :

- We enter information from left to right, starting from the first familiarity. We put a dash in empty cells.

- We always fill in the details and total indicators, but if there is no value for the total indicators, we put “0”.

- Page numbering is continuous and starts from the title page.

- When filling out the report, you cannot use correction tools.

- Each page must be printed on a separate sheet; duplex printing is not permitted.

- We fasten the sheets so as not to damage the paper, so you cannot use a stapler.

- When filling out the report by hand, we use only black, blue or purple ink.

- When filling out on the computer, set the Courier New font to a height of 16-18 points.

- We fill out the report separately for each OKTMO.

Fill out the title page 6-NDFL

On the title page please include:

- TIN and checkpoint.

We indicate them according to the tax registration certificate. Individual entrepreneurs do not have a checkpoint; they do not indicate it in the report.

- Correction number.

If 6-NDFL is submitted for the first time during the reporting period, the value “000” is indicated, indicating the initial calculation. If a clarification is submitted, indicate its number: 001, 002, etc.

- Presentation period.

For the annual report, enter code 34. If you are submitting the report during liquidation or reorganization, enter the value “90.” Codes for other periods, including during liquidation (reorganization), are given in Appendix No. 1 to the Filling Out Procedure, approved. Order No. ММВ-7-11/ [email protected] .

- Taxable period.

The year during which the report is submitted is entered. When submitting 6-personal income tax for the periods of 2022 (including at the end of the year), we indicate “2020”.

- Submitted to the tax authority.

We put the code of the Federal Tax Service to which the report is submitted.

- At the location of the account.

We take the value for filling this line from Appendix No. 2 to the Procedure. For example, individual entrepreneurs (who do not use PSN or UTII) indicate the code “120”; organizations, if they are not the largest taxpayers, enter code “214”, etc.

- Tax agent.

Organizations indicate here their short name, which is reflected in the charter. If there is no short one, write the full one. Individual tax agents indicate their full names without abbreviations.

- OKTMO code.

Since 6-NDFL is compiled separately for each OKTMO and KPP code, you need to generate the number of calculations that corresponds to the number of your OKTMO/KPP.

- Contact phone number.

Here, please enter a current telephone number so that the inspection inspector, if necessary, can contact you and clarify any questions he may have.

- Reliability and completeness of information...

If the tax agent submits the report personally, enter “1”, if his representative – “2”. The lines below indicate the full name of the representative or the name of the representative organization.

Filling out Section 1

In this section we transfer information about all income, including allowances, bonuses and cumulative payments from the beginning of the year ─ for the period from January to December. It also needs to reflect data on other income paid to “physicists”, for example, dividends. Section 1 is completed separately for each tax rate applied.

- Line 020.

We indicate the total amount of income accrued to employees since the beginning of 2020.

- Line 025.

If dividends were not paid in 2022, enter “0” in the line.

- Line 030.

We indicate the amount of deductions provided to employees that reduce taxable income.

- Line 040.

We display the amount of calculated tax from the beginning of the year, calculated using the formula: (line 020 – line 030) * line 010.

- Line 045.

We fill in if dividends were paid to the employee, personal income tax was accrued on them and subsequently paid to the budget. Otherwise, put “0” in the line.

- Line 050.

We indicate the total amount of fixed advances paid for foreigners working under a patent. If no such payments were made, enter “0”.

- Line 060.

We enter the total number of employees who received taxable income in 2022.

- Line 070.

We indicate the total amount of personal income tax withheld since the beginning of 2022.

- Line 080.

We reflect personal income tax not withheld by the employer.

- Line 090.

We indicate the amount of personal income tax excessively withheld by the employer from the employee’s income (in accordance with Article 231 of the Tax Code of the Russian Federation).

Filling out Section 2

In this section, include payments for the last 3 months of the reporting period ─ in the report for 2022, it is necessary to reflect data for October, November and December.

- Line 100.

We indicate the date of actual receipt of income reflected on page 130. When filling out this line, you must take into account that for some payments the timing of actual receipt of income is different.

The date of receipt of salary and monthly bonus is the last day of the month for which it is assigned, even if it falls on a weekend. When paying bonuses for a year, quarter or for a specific event, the date of receipt of income is considered the day of its payment (Letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

The date of receipt of income under a civil contract, sick leave and vacation pay, financial assistance, vacation compensation and dividends is the day the income is paid to the employee.

- Line 110.

- We reflect the date of actual deduction of personal income tax from the income paid. Tax on all types of payments is withheld on the day the income is paid.

- Line 120.

We indicate the deadline for transferring personal income tax to the budget. The deadline for paying personal income tax on wages and other income, with the exception of vacation pay and benefits, is the day following the day the tax was withheld. And for vacation and sick leave - the last day of the month.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

- Line 130.

We enter the total amount of income received (without subtracting personal income tax) as of the date indicated in line 100.

- Line 140.

We indicate the total amount of personal income tax withheld.

Sample 6-NDFL for 2022

Rules for filling out the form

The basic rules and requirements for filling out the 6-NDFL calculation are as follows:

1. The document is filled out based on the information contained in the tax registers:

- on income accrued (paid) by a tax agent to individuals;

- about calculated and withheld personal income tax;

- about tax deductions provided to individuals.

2. If the section indicators cannot be placed on one page, then the required number of pages should be filled out.

3. When filling out the form you cannot:

- correct errors with a corrective agent;

- do double-sided printing of a document;

- fasten calculation sheets (this may lead to damage to the paper).

4. Form 6-NDFL 2022 contains two fields separated by a dot, which are intended for decimal fractions. The first field, which consists of 15 cells, is for the whole part of the decimal fraction, and the second field, which consists of 2 cells, is for the fractional part. Dashes are placed in empty cells.

5. Continuous numbering is placed on the pages of the form, starting from the title page (in the “Page” field indicate: 001, 002, 003).

6. When filling out the form, you can use black (blue, purple) ink. When printing characters, use Courier New font (16-18 point height).

7. Numeric and text fields should be filled out from left to right (starting from the left edge of the field or from the leftmost cell).

8. The form is filled out separately for each OKTMO code:

- individual entrepreneurs, as well as notaries, lawyers and other persons engaged in private practice, recognized as tax agents, indicate OKTMO at their place of residence;

- Individual entrepreneurs who are tax agents, registered at the place of activity on UTII (for certain types of activities) or on a patent, indicate OKTMO at the place of their registration;

- organizations that are tax agents indicate OKTMO of the municipality in whose territory the organization (or its separate division) is located.

If an individual entrepreneur or LLC has changed their address during the year, then it is necessary to submit two 6-NDFL calculations quarterly to the inspectorate at the new place of registration (clause 2 of Article 230 of the Tax Code of the Russian Federation):

- with the old OKTMO - for the period before registration at the new location;

- with a new OKTMO - with data for the period after registration at the new location.

9. Dashes are placed in empty cells of the fields (for example, 12 cells are allocated for the TIN, and the code itself consists of 10 digits, which means the entry will look like this: “1357924680-”).

10. In form 6-NDFL, on each page in the field “I confirm the accuracy and completeness of the information indicated on this page,” you must put a date and a personal signature.

How to reflect wages paid in December 2022 in 6-NDFL

The December salary paid at the end of December is reflected in 6-NDFL in the following order (clause 2 of Article 223, clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation, clauses 3.1, 3.3, 4.1, 4.2 of the Procedure for filling out the 6-NDFL calculation, Letter of the Federal Tax Service dated November 1, 2017 No. GD-4-11/ [email protected] ):

- In 6-NDFL for 2022, in December of which the salary was paid, the salary amounts and personal income tax amounts calculated and withheld from this salary are included in the indicators of lines 020, 040, 070 of section 1. This operation is not reflected in section 2.

- In 6-NDFL for the 1st quarter of 2022 - in section 1 of the new form (in the previous form this is section 2) the date of income actually received (12/31/2020), the date of tax withholding and the deadline for tax transfer (the first working day of January 2022), salary amounts for December and the corresponding amounts of personal income tax withheld.

Personal income tax accrued from the December salary, which was not withheld in December, is not reflected in line 80 of the 6-NDFL calculation (Letters of the Federal Tax Service dated November 29, 2016 No. BS-4-11 / [email protected] , dated May 24, 2016 No. BS-4 -11/9194).

SECTION 1. “Data on the obligations of the tax agent.”

In Section 1, reflect information about the tax withheld in the last three months of the reporting period, as well as about the tax returned during the specified period. Fill out the information separately for each BCC.

Field 010 “Budget classification code” of section 1: indicate the BCC to which you are transferring the tax (for example, if the organization has employees whose income is taxed at a progressive rate of 15 percent, you will need to fill out a separate sheet of section 1.

Fields 020–022 (previously lines 120 and 140). Here, indicate the personal income tax withheld in the last three months of the reporting period, broken down by payment deadlines. Focus on the date of personal income tax withholding. For example, in section 1 of the calculation for the first quarter of 2022, you need to reflect information about the tax withheld during the period from January 1 to March 31, 2022. For example, financial assistance was paid in cash on March 31, the deadline for paying personal income tax on it will be April 1, despite this, such tax must be included in section 1 of the calculation for the first quarter.

Next, fill in the fields indicating the deadlines for paying personal income tax to the budget.

Group the withheld personal income tax amounts by the date of payment to the budget. Specify the date no later than which the personal income tax must be transferred in field 021 “Tax transfer deadline”, and the amount of tax withheld on this date in field 022 “Tax amount”. Please indicate dates in accordance with clause 6 of Article 226 and clause 9 of Article 226.1 of the Tax Code. Typically, this is the day following the day the income is paid. However, for sick leave and vacation pay, the deadline for transferring personal income tax is different: the last day of the month in which such payments were made (Tax Code of the Russian Federation, Art. 226, paragraph 6, paragraph 2).

If the deadline for personal income tax payment falls on a weekend, holiday or non-working day by decree of the President, in field 021 indicate the next working day - the rule for postponing the tax payment deadline applies.

Field 020 “The amount of personal income tax withheld in the last three months of the reporting period.” This indicates the aggregated amount of tax withheld in the last three months of the reporting period. This indicator must be equal to the sum of all completed fields 022.

Fields 030–032. In fields 030-032, reflect information about the tax amounts returned to the individual. In field 031 “Tax refund date”, indicate the date of transfer of over-withheld personal income tax to the individual’s account, and in field 032 “Tax amount” – the amount of the tax refunded. In field 030 “Amount of personal income tax returned in the last three months of the reporting period,” indicate the total amount of tax returned to individuals for the last three months of the reporting period. This indicator must be equal to the sum of all completed fields 032.

If the page does not have enough fields 021–022 or 031–032, you should go to a new page. In this case, generalizing indicators in fields 020 and 030 must be filled in for each BCC only on the first page.

If tax was not withheld from the payment, do not fill in fields 021 and 022. There is no need to indicate “00.00.0000” in field 021. A similar requirement was in effect when filling out section 2 of the old form 6-NDFL.

Do I need to submit a zero 6-NDFL report in 2020?

If you did not have duties as a tax agent during the reporting period, and you did not pay income to individuals either under employment or civil law contracts, there is no need to submit Form 6-NDFL, even “zero” form.

But if you have a desire to submit a zero 6-NDFL, the Federal Tax Service is obliged to accept it.

To avoid additional questions from tax authorities, you can provide an explanatory letter to the Federal Tax Service instead of zero. It should indicate that in the reporting period the organization (or individual entrepreneur) was not a tax agent, did not pay income to individuals, and did not have valid agreements with individuals. As a rule, this happens in the absence of financial and economic activities. You can indicate this in the letter. The letter is certified in the same way as a zero calculation of 6-NDFL would be certified.

Download for free the new form of form 6-NDFL for the 4th quarter of 2021

Form 6-NDFL for the 4th quarter of 2022 - download the new form for free from the link below:

Form 6 personal income tax for the 4th quarter of 2021

We recommend that you familiarize yourself with the sample of filling out 6 personal income tax

Who should submit the calculation?

The following are required to submit the form:

- All legal entities and their separate divisions.

- Individual entrepreneurs.

- Individuals who conduct business without hiring hired personnel. These include, for example, lawyers and notaries engaged in private practice, arbitration managers, etc. The exception is self-employed citizens who pay tax on professional income.

The obligation to submit Form 6-NDFL arises when legal entities or individuals, as well as individual entrepreneurs, paid remuneration in the form of cash or things:

- employees with whom employment contracts have been signed;

- to individuals who are not in the state, but who provided them with services or performed work in accordance with concluded civil contracts;

- owners of exclusive rights to intellectual property in accordance with concluded license agreements, agreements for the alienation of rights, etc.

Where should the payment be submitted?

The place of submission of 6-NDFL is determined by the category of the tax agent and the place of payment of income to the individual:

- legal entities must report to the Federal Tax Service at the place of registration. Their separate units must report at the location of the separate unit;

- Individual entrepreneurs and individuals who do not have employees submit the Calculation at the place of registration.

However, if individual entrepreneurs combine modes, then there are some peculiarities.

Income that does not need to be reflected in 6-NDFL

6-NDFL is filled out on the basis of accounting data for income accrued and paid to individuals. However, not all income should be reflected in this report:

| Type of income | To include or not in 6-NDFL | Rationale | Standard |

| Cash prize given to an employee as part of a promotion | No | From cash prizes that the organization awarded to an individual as part of an advertising campaign and which amount to 4,000 rubles. per year, no personal income tax required | clause 28 art. 217 of the Tax Code of the Russian Federation, question 1 from Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11/14329 |

| Monthly allowance for caring for a child up to 1.5 years old, payment for days off for caring for a disabled child | No | These types of benefits are included in the list of income completely exempt from personal income tax. | clause 1, 8 art. 217 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated December 11, 2018 No. BS-3-11/9358, dated April 11, 2019 No. BS-4-11/6839 |

| Alimony | No | Alimony is not the income of the recipient from which personal income tax is required to be paid. | clause 5 art. 217 Tax Code of the Russian Federation, clause 7 Letter of the Federal Tax Service dated November 1, 2017 No. GD-4-11/22216 |

| Financial assistance for the birth of a child, paid in installments | No | Personal income tax is not calculated on this payment if two conditions are met:

| clause 7 Letters of the Federal Tax Service dated November 1, 2017 No. GD-4-11/22216, letters of the Ministry of Finance dated August 27, 2012 No. 03-04-05/6-1006, dated October 31, 2013 No. 03-04-06/46587, dated August 22 .2013 No. 03-04-06/34374 |

| Maternity benefit | No | The benefit is included in the list of incomes completely exempt from personal income tax. | clause 1 art. 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 09.16.2014 No. 03-04-09/46390, paragraph 7 Letter of the Federal Tax Service dated 01.11.2017 No. GD-4-11/22216, question 4 from Letter of the Federal Tax Service dated 01.08.2016 No. BS-4 -11/13984 |

| Over-limit daily allowance | Yes | Excess daily allowance is taxable income. Daily allowances within the norms are not included in 6-NDFL, since they are not subject to personal income tax | subp. 6 clause 1 art. 223, paragraphs 3, 4 and 6 of Art. 226 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated April 11, 2019 No. BS-4-11/6839 |

SECTION 2. “Calculation of calculated, withheld and transferred personal income tax amounts.”

In Section 2, indicate the generalized amounts of income, calculated and withheld tax. Section 2 should be filled out with cumulative totals for the first quarter, half a year, nine months and a year. For each tax rate and BCC, fill out a separate section 2.

Field 100 “Calculation of personal income tax amounts taxed at the rate.” The tax rate at which the tax was calculated is indicated here

Field 105 “Budget classification code”. The BCC to which the tax is transferred is indicated here. The BSCs required in these cases are shown in the table:

| KBK obligatory payment | penalties | fine | |

| Personal income tax on incomes up to 5 million rubles. rate 13 percent, over 5 million - rate 15 percent: - for income no more than 5 million rubles. | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| – from income over 5 million rubles. (from excess) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on other income, including income of non-residents with a personal income tax rate of 30 percent (income within and above 5 million rubles) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Fields 110–115 “Amount of income accrued to individuals.” Here you should indicate the amount of accrued income for all individuals on an accrual basis from the beginning of the year. That is, this field reflects only those incomes the date of actual accrual of which falls on the reporting period for which the calculation is being prepared. For example, income in the form of wages is indicated in the period for which it is accrued, and sick leave benefits are indicated in the period in which it is paid.

Include in 6-NDFL all income for the payment of which an individual entrepreneur or LLC is a tax agent. When calculating for a separate division, enter only those incomes accrued by these divisions.

From the total amount of accrued income reflected in field 110, it is necessary to highlight the following:

- in field 111 (previously line 025) – dividends;

- field 112 - salary, bonuses, vacation pay, compensation for unused vacation, social payments, sick leave at the expense of the employer and other payments subject to personal income tax provided for by an employment or collective agreement;

- field 113 – income under the GPA, the subject of which is the performance of work, provision of services;

- field 115 – income of highly qualified specialists under employment contracts and GAP. These amounts are included in fields 112 and 113.

How to reflect the various payments in section 2:

- in fields 110,113,115 - vacation pay, sick leave at the expense of the employer, meals for employees at the initiative of the employer, housing for employees at the initiative of the employer, excess daily allowance are reflected.

The sum of fields 111, 112, 113 and 115 may not coincide with the indicator in field 110. For example, payments under lease agreements do not count as income under the GPA from the performance of work or provision of services, therefore there is no need to highlight these payments in fields 113 and 115.

Field 120 “Number of individuals who received income” is used to indicate the number of employees who during the reporting (tax) period received income taxed at the appropriate rate.

In field 121 the number of highly qualified specialists is entered. If you fired and rehired the same person within a year, it is reflected once.

Field 130 “Amount of deductions”. The total amount of deductions for all employees is indicated here. This includes all deductions that reduce an employee’s income when calculating personal income tax: standard, property, social, professional, investment.

Field 130 is filled in with a cumulative total from the beginning of the year. If the deduction is greater than the employee’s salary, indicate it in 6-NDFL in an amount not exceeding income.

Field 140 “Calculated tax amount” is used to reflect the amount of calculated tax at the rate from field 100 on a cumulative basis from the beginning of the year. To determine the size of this indicator, add up the personal income tax amounts accrued from the income of all employees.

Field 141 “including the amount of tax calculated on income in the form of dividends” is necessary to highlight the amount of personal income tax accrued on dividends paid for all individuals since the beginning of the year.

Field 142 is used to highlight personal income tax calculated on the income of highly qualified specialists.

Field 150 “Amount of fixed advance payment”. This includes the amount of fixed advance payments, which are offset against personal income tax on the income of foreigners working under a patent. This amount should not exceed the total amount of calculated tax.

Field 155 “Amount of corporate income tax subject to offset.” Here it is necessary to indicate the income tax on dividends in favor of the organization - tax agent, which is offset against personal income tax. Organizations that in the current or previous year received dividends from participation in other organizations can offset their income tax.

Field 160 “Tax amount withheld” is used to indicate the amount of tax withheld since the beginning of the year.

The amounts of calculated and withheld personal income tax in fields 140 and 160 may not coincide. If field 110 of the calculation reflects the amount of income, but its actual payment has not yet been made in the reporting period, then field 160 does not reflect tax on such income, since it will be withheld in another period. For example, personal income tax, which is withheld on wages for March in April, is not reflected in field 160 of the 6-NDFL form for the first quarter, but is included in the value of the indicator in field 160 of the calculation for the half-year.

Field 170 “Amount of tax not withheld by the tax agent” is necessary to reflect personal income tax that could not be withheld in the current reporting period.

Field 180 “Amount of tax, excessively withheld” of the 6-NDFL calculation is used to enter the amount of excessively withheld personal income tax from the beginning of the year. For example, if you mistakenly withheld tax at a higher rate or did not provide a deduction.

Field 190 “Tax amount returned by the tax agent.” This indicates the amount of tax refunded under Article 231 of the Tax Code of the Russian Federation on an accrual basis from the beginning of the year.

note

If you, as a tax agent, perform an operation in one reporting period and complete it in another reporting period, then this operation must be reflected in the reporting period in which it was completed.

For example:

1. Provided that the salary for September 2022 was issued on October 5, 2022, in Section 1 of the Calculation for 9 months of 2022, the advance and salary amounts will be reflected, but in Section 2 of form 6-NDFL they do not need to be reflected, because, Although the tax calculation date will fall in the 3rd quarter of 2022, the tax will actually be withheld only in October 2022, i.e. in the 4th quarter. In this case, between the indicators of lines 140 “Amount of calculated tax” and 160 “Amount of withheld tax” of Section 1 there will be a difference in the amount of personal income tax calculated but not withheld as of September 30, 2022.

2. You need to calculate 6-NDFL for the twelve months of 2022. According to your local regulations, you will pay wages for December 2022 to employees on January 10, 2022. Accordingly, transfer personal income tax on January 10 or 11, 2022. Despite the fact that this is a salary for 2022, in the calculation of 6-NDFL for 12 months of 2022, data on income and personal income tax are not included, since the payment and transfer of personal income tax will be made in another reporting period. This data must be included in the calculation of 6-personal income tax for the 1st quarter of 2022.

Another important point: the date of withholding tax may differ from the date of transfer of personal income tax. This is due to the fact that the deadlines for paying personal income tax for different incomes differ:

- according to paragraph 6 of Article 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day the income is paid to the taxpayer;

- When paying temporary disability benefits (including benefits for caring for a sick child), as well as paying vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which the above payments were made.

For example:

The employee received vacation pay on December 11, 2022, in this case the employer is obliged to pay personal income tax to the budget no later than December 31, 2022 and reflect this date in form 6-NDFL for 2022:

Section 2

- column 110 - indicate the total amount of vacation pay paid;

- columns 140 and 160 – indicate the total amount of tax.

Section 1

- columns 021 – indicate the actual payment dates;

- Column 022 – indicate the amount of personal income tax withheld.

When paying a premium, 6-NDFL is filled out in the following order:

The date of receipt of income in the form of bonuses is considered to be the last day of the month (as well as when paying vacation pay). Therefore, if the order for the payment of bonuses is dated the 20th, then in column 100 of Section 2 it is necessary to indicate the date 30 or 31 depending on the number of days in the month, and in line 110 reflect the date of actual payment of the bonus, for example, 06/25/2022.

Features of filling out 6-NDFL when paying sick leave benefits

Form 6-NDFL reflects only payments subject to taxation. Maternity benefits are not subject to personal income tax, so they are not included in form 6-NDFL.

Report sick leave benefits in 6-NDFL in the same manner as vacation pay.

You cannot indicate negative amounts in 6-NDFL. The procedure approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450 does not provide for amounts with a minus sign in 6-NDFL.

Please note that in Form 6 personal income tax there cannot be negative income or tax.

Include the benefit and personal income tax on it in sections 1 and 2 in the payment period. In field 021, indicate the last day of the month in which the benefit was paid. If benefits were paid several times during the month, then include all personal income tax amounts from these benefits in one field 022.

In section 2, include the benefit amount in fields 110,112,115, and the accrued and withheld personal income tax - in fields 140, 142, 160.

Sick leave should also be reflected in the income certificate for 6-NDFL (replacement of 2-NDFL).

If the Federal Tax Service Inspectorate asks you to explain why personal income tax was not withheld if you had income, send an explanation to the inspectorate.

To check the calculation, we recommend using the control ratios that are established by letters of the Federal Tax Service dated March 10, 2016 No. BS-4-11/3852, dated March 20, 2019 No. BS-4-11/4943, dated October 17, 2019 No. BS-4-11/ 21381, dated January 17, 2020 No. BS-4-11/529.

Also use the new control ratios for the DAM regarding the relationship with 6-NDFL from the Federal Tax Service letter No. BS-4-11 / [email protected] dated 02/19/2021. With their help it is possible:

- independently check whether he made the calculation correctly;

- find out what inconsistencies will raise questions during a desk audit;

- find out what the Federal Tax Service will do if it discovers an error.

Fines for 6-NDFL

For violations committed during the registration and submission of 6-NDFL, fines may follow:

- For late submission of the calculation.

The fine will be 1,000 rubles. for each full or partial month from the day established for the submission of the calculation to the day on which it was submitted (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). The employee responsible for submitting 6-NDFL may be fined from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

For late reporting, tax authorities have the right to block the company’s accounts if the payment is not received by the inspectorate within 10 working days after the end of the legally established deadline for submission (clause 6 of article 6.1, clause 3.2 of article 76 of the Tax Code of the Russian Federation).

- For inaccurate information and mistakes made.

The fine for such a violation is 500 rubles. (clause 1 of article 126.1 of the Tax Code of the Russian Federation). You can be fined for errors in the taxpayer’s personal data or total indicators (clause 3 of the Federal Tax Service Letter No. GD-4-11/14515 dated 08/09/2016).

If errors or inaccuracies do not lead to a reduction in personal income tax subject to transfer to the budget, or a violation of the rights of citizens, tax authorities can reduce the amount of the fine (clause 1, clause 1, clause 4, article 112 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 08/09/2016 No. GD -4-11/14515).

- For submitting a paper 6-NDFL instead of an electronic one.

If your company is required to submit a calculation in electronic form, but you submitted it to the tax office on paper, the fine will be 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Useful information from ConsultantPlus

See a ready-made solution on how to fill out form 6-NDFL (it's free).

Let's sum it up

- Calculation of 6-NDFL for 2022 must be submitted no later than 03/01/2021.

- For the report for 2022, we use the previous form 6-NDFL, approved by Federal Tax Service Order No. ММВ-7-11 dated October 14, 2015/ [email protected] Using the updated form, for the first time we will report for the 1st quarter of 2022 (Federal Tax Order No. ED dated October 15, 2020 -7-11/ [email protected] ).

- If in 2022 you did not have duties as a tax agent (income was not accrued or paid to individuals), you do not have to submit the zero 6-NDFL. But it is better to inform the tax authorities about this with an explanatory letter within the same time frame as the 6-NDFL.

This might also be useful:

- New form of the RSV 2022

- Form and rules for filling out form 4-FSS

- Application for leave at your own expense

- Payment of 1% on income over 300,000 rubles

- Property tax for organizations and individuals

- Trade fee in Moscow in 2022

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!