The trading activities of organizations in the retail sector are associated with a variety of emergency situations, some of which can result in serious consequences initiated by regulatory agencies. Thus, when making settlements with clients, there is always the possibility of a technical error associated with the preparation of a fiscal document, a lack of funds from the buyer, a malfunction of the cash register, as well as the occurrence of other circumstances, which result in discrepancies in the accounting of financial transactions. In such a situation, the tax service recommends making adjustments using an adjustment check.

General idea: when and what to register

The list of the most common reasons, in the presence of which there may be a need to correct settlement documentation, includes:

- Incorrectly specified amount or item.

- Return of goods by the buyer.

- Problems with CCP.

- Requests from the Federal Tax Service.

In each of these cases, errors have to be corrected by responsible employees of the organization, or by third-party technical specialists servicing cash register equipment. Let's look at some of the examples given in more detail to form a visual representation and highlight the main features of situations in which a correction check is required.

Entering an incorrect amount into a fiscal document

Selling without a cash register is a serious violation, but it is no secret that many retail customers do not wait to receive documentary evidence of a financial transaction. If the incorrect value entered into the program by the cashier is less than the actual payment received from the customer, an adjustment is applied to reflect the unaccounted money. Surpluses identified at the end of a work shift are processed in compliance with standard requirements, which include the preparation of a memo detailing the circumstances. Before generating and posting a correction check at the online cash register, you should carefully check all receipts and expenses and clarify any discrepancies.

It is important to note that in the opposite situations, when the amount of the fiscal document turns out to be greater than the amount of funds received from the client, the algorithm in question is not applied. From the point of view of law, in this case, nothing indicates the fact that cash register equipment was not used, therefore, there is no violation itself. The problem becomes local in nature - the discrepancy is eliminated using a return operation that eliminates the resulting difference.

The technical error

Loss of connection to the Network automatically switches the cash register to offline mode. All completed actions are recorded on the built-in drive and stored for thirty days. Restoring access to the Internet allows you to download information, while a separate report is provided to track the number of transferred documents.

The procedure for dealing with situations where massive system problems occur was explained in a joint notice from the Federal Tax Service and the Ministry of Finance. Based on the instructions, the operation of retail outlets in such circumstances is permitted, and confirmation of the sale is a sales receipt, a warranty coupon, or any other tangible medium on which the date and cost of the goods are indicated. It is worth noting that regulators did not mention mandatory recording of the fact of a failure, however, practice shows that sellers should prepare such evidence in advance - in the form of an internal memo, witness testimony, photo or video recordings.

After the operating mode is restored, all unaccounted revenue must be reflected in the CRF. Before making a correction check at the online cash register, you should draw up a supporting document in order to eliminate unnecessary questions during possible checks. Organizations and entrepreneurs are not held liable for failure to use cash registers in the specified periods, since they are not related to the occurrence of force majeure circumstances.

The provisions established within the framework of 54-FZ also provide for the possibility of using cash registers in offline mode in situations where the fiscal data operator, with whom the enterprise had a service agreement, was deprived of a license to operate. In these cases, the period for searching and concluding an agreement with a new counterparty is 20 days.

Technical problem

Failure of specific equipment, not caused by a massive system failure, is considered as a valid reason for conducting mutual settlements without a cash register. It is the seller's responsibility to provide customers with documentary evidence to determine the date and price of the purchase.

Troubleshooting requires accounting for all revenue received. In order to correctly make, issue and punch an adjustment check at an online cash register - as determined by legal requirements - you will need to separate all completed transactions and register them sequentially. It is not possible to deposit all receipts as a total amount, as in the previous case. In addition, you need to take into account the likelihood of the tax service identifying the fact that the cash register was not used and make every effort to promptly upload the data.

Failure of the fiscal drive

Another unpleasant situation, the occurrence of which means the impossibility of timely transfer of information about transactions to the Federal Tax Service. Creating a correction check according to the instructions for cash registers involves the use of accounting databases or documents that serve as the basis for the formation of corrective acts.

In case of operational problems, you should contact the manufacturer, which has technical means at its disposal to retrieve data on downloaded and frozen reports. The information received is promptly transferred to the tax office via electronic media, and is accompanied by a statement in which the user explains the specifics of the current circumstances.

It is worth considering that failure of the fiscal drive is also the basis for re-registering the cash register. Installation of new equipment is a prerequisite for the operation of an online cash register - otherwise, any financial transactions will be equated to direct payments, allowing the perpetrators to be brought to legal responsibility.

In what cases is a correction check used when sending data to the OFD?

The correction cash receipt is determined by the provisions of clause 4 of Article 4.3 of Law No. 54-FZ, and is issued in a situation where the user, for some reason, did not use the cash register when making payments. Situations that lead to payment without a cash register may be different. In this article we will analyze specific cases and the user's procedure. The purpose of the correction check is to bring the data on the amount of revenue received, sent to the tax office, into line with the actual calculations made. A correction check is not issued for the return of goods; it does not correct errors in the details of an already punched cash receipt.

Correction receipt and payment method indicator

The correction cash receipt is intended for entering information about the settlement into the online cash register for subsequent transmission to the tax authorities of data that was not sent in a timely manner at the time of settlement.

The correction check is processed any time after the payment is made without an online cash register, but only after the report on the opening of the shift is generated and no later than the report on the closure of the shift is generated. That is, a correction check is not allowed to be issued between work shifts; to issue it, you must first open a shift.

How to technically correct a receipt depends on the model of cash register equipment. Each device has its own procedure for preparing a corrective document using the appropriate buttons.

For accounting and tax accounting purposes, the cash register user should draw up an internal accounting document in any form (memo, explanatory note, act, accounting certificate, etc.), on the basis of which adjustment data on calculations will be entered into the cash register and accounting system of the cash register user (if they are were not reflected in accounting in a timely manner). The explanatory document should describe the current situation, the reason for not using the cash register when making payments, and describe in detail all the calculations that took place without using the cash register.

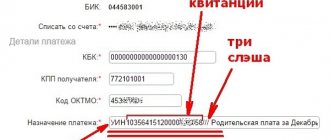

Correction check details*

Details “Calculation Sign” (tables 25 and 30 of Appendix 2 to the Order):

—

“1” (Receipt) – correction of receipt when funds are deposited;

—

“3” (Expense) – adjustment of expense when funds are withdrawn.

Details “Type of correction” (note to table 30 of Appendix 2 to the Order):

—

“0” – independent operation;

—

“1” – operation as prescribed.

Details “Grounds for correction” (Table 31 of Appendix 2 to the Order):

—

description of the correction;

* An example of filling out a cashier’s check for correction in the case where the check has not previously been punched is given in the Draft Methodological Recommendations of the Federal Tax Service Part 8 Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] “On approval of additional details of fiscal documents and formats fiscal documents required for use"

—

document date of the basis for the correction;

—

document number of the basis for correction.

As we can see, the correction check does not contain the name of the product that was posted through the cash register; it reflects only the unaccounted amount.

Example of filling out a correction cash receipt: March 13, 2022 at 12.30 there was a power failure, which led to a temporary failure of the online cash register; at this time, the Romashka store sold goods to the buyer in the amount of 3,000 rubles, but did not issue a receipt to the buyer. The online cash register was restored after the customer left the store. Cashier Kurochkin K.K., who accepted 3,000 rubles from the buyer. in cash, drew up an explanatory note of the current situation (No. 1 dated March 13, 2018) and issued a cash receipt for the correction for the amount of the unaccounted sale.

| Cash receipt details | Meaning (description) |

| Calculation sign | 1 (Parish) |

| Correction type | 0 (On your own) |

| Description of correction | 13.03.2018 |

| Document date of the basis for correction | 13.03.2018 12:30 |

| Document number of the basis for correction | No. 1 from 03/13/2018 |

| Settlement amount indicated on the check | 3 000 |

| Cash check amount | 3 000 |

| Electronic check amount | 0 |

Please keep in mind that changes are planned to be made to the details of the correction check. The draft law “On amendments to Appendix No. 2 to the order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] ” is under discussion, you can follow its progress at the link: https://regulation.gov. ru/projects#npa=68314.

For clarity, let's look at some situations when a seller has to work without using an online cash register, and determine the correct procedure for processing a correction check.

The cashier did not punch the check or the check amount is less

If the cashier did not use the cash register during the sale, and the client has already left, it is necessary to generate a correction check to take into account the unrecorded settlement amount. It is possible that the cashier generated a receipt for a purchase, but for a smaller amount than the buyer paid.

As a result, at the end of the shift, unaccounted revenue was generated, the amount of which must be entered into the correction check. Before you create it, you need to draw up a memo describing the situation, and based on it, enter the payment information into the cash desk.

In the opposite situation, when the original check was punched for an amount greater than actually received from the buyer, a correction check is not issued. Indeed, in such a situation, there is no fact that cash registers are not used in the calculation, even for part of the purchase. To correct this type of error, a regular check is generated with the calculation attribute “Return of receipt” for the overstated amount.

If the cashier discovered an error before the customer left, then there is no need to generate a correction receipt. In this case, the incorrectly entered amount is first “reversed” by a regular check with the payment attribute “Return of Receipt”, after which a regular check is punched indicating the correct purchase amount.

Technical glitch in the online cash registers

If the cash register for some reason loses connection to the Internet, it will work offline. This is not critical; in all cash registers, payment information is stored for 30 calendar days and will be transferred to the tax office as soon as the Internet connection is restored. The number of untransferred fiscal documents can be found in the report on the current state of settlements.

At the end of last year, users encountered a massive technical failure in the operation of cash registers; online cash registers from a number of major suppliers suddenly stopped working, and cashiers could not punch cash receipts.

In response to this incident, the Federal Tax Service and the Ministry of Finance of Russia issued clarifications, according to which sellers are allowed to work without an online cash register in the event of incidents of this kind. In this case, the buyer must be issued a sales receipt, warranty card or other paper document confirming the date and price of calculation (Letter of the Ministry of Finance of Russia dated May 30, 2017 No. 03-01-15/33121, sent by Letter of the Federal Tax Service of Russia dated June 8, 2017 No. ED-4- 20/10927, Information from Rospotrebnadzor “On the protection of consumer rights in the event of a failure of cash register equipment”).

The need and method for recording the fact of a technical failure in the operation of the online cash register have not been determined, but it is better for the seller to prepare documents confirming the failure in operation and the impossibility of using the online cash register for payment (memo, witness testimony, photo and video recording, etc. .).

After the online cash register is restored, the cash register user must generate a correction cash receipt with the total amount of unaccounted revenue. Responsibility for non-use of CCP in this case is removed from the user, since there is no fault of his own.

In addition to the massive technical failure, Law No. 54-FZ provides for the operation of the cash register in offline mode; if the user’s OFD license is revoked, it will be possible to work without transferring data to the tax office for 20 days, during which it is necessary to conclude an agreement with a new operator.

If the cash register is broken

If a specific cash register breaks down, and not a massive system failure, the user also has the right to make payments to customers without a cash register until its functionality is restored. In this case, the seller issues the buyer a paper document confirming the date and price of payment (sales receipt, warranty card, etc.). In letter dated December 7, 2017 No. ED-4-20/24899, the Federal Tax Service of Russia recommends purchasing a spare cash register to protect your business in case of cash equipment breakdowns.

*Letters of the Federal Tax Service of Russia dated December 20, 2017 N ED-4-20/25867, Ministry of Finance of Russia dated December 28, 2022 N 03-01-15/88042

After the cash register is restored, the user needs to enter correction checks for each operation carried out without using a cash register. In this case, it will not be possible to get by with one correction check for the entire amount of unaccounted revenue, as in the case of a massive failure. You need to transfer the data of correction checks to the tax office promptly in order to be in time before the inspection discovers the fact that the user has not used the cash register, and to avoid liability.

The fiscal drive has failed

The correction cash receipt is also used in the event of a breakdown of the fiscal drive, when fiscal data cannot be downloaded and transferred to the tax service. Data on the calculations made are taken from accounting systems or accounting documents (for example, from a cash book), on the basis of which a correction check is generated. If a problem arises with the operation of the fiscal drive, the user needs to contact its manufacturer, who can extract data with a note indicating which cash receipts were sent by the OFD (they have appropriate confirmation) and which were not. Data on unsent checks must be transferred to the tax service on electronic media along with a statement from the cash register user describing the current situation in free form.

A breakdown of the fiscal drive leads to the need to re-register the cash register, since it is necessary to install a new fiscal drive on it. The online cash register cannot operate without it; such calculations will be equated to calculations without the use of a cash register, for which administrative liability is provided.

How to avoid falling under administrative liability if you do not use a cash register

The generation of a correction check means that the user previously made a payment without using a cash register, and automatically leads to the question of liability provided for in Article 14.5 of the Administrative Code. Therefore, whatever the reason that prompted the user to generate a correction check, it would be better to inform the tax authority about the calculation without using cash registers and correcting the error before the inspectorate itself discovers this fact. If the user admits to the offense and eliminates it with a correction check, this will help him avoid the imposition of an administrative fine.

You can independently declare the non-use of a cash register or violations when using it only in your personal account on the official website of the Federal Tax Service of Russia*. An application for an action (inaction) containing elements of an administrative offense is submitted no later than 3 business days following the day the user voluntarily eliminates the violation. The application must be accompanied by an act or memo containing the date, time and reason for the payment without cash register, as well as the correction check or its details.

To avoid a fine, the user must report the non-use of cash register systems before the tax authority itself learns about this fact from other sources, for example, from buyers. If the tax office already has information about the violation, it will not be possible to avoid a fine, but this will not free the user from the need to generate a correction check. It’s just that in this case, the correction check indicates: the basis for the correction is the details of the order, and the type of correction is the operation as prescribed.

*Order of the Federal Tax Service of Russia dated May 29, 2017. No. ММВ-7-20/ [email protected]

More information about the transition to a new procedure for using cash register equipment, answers to frequently asked questions, a schedule of seminars and webinars with experts in the field of cash register systems and representatives of the Federal Tax Service, as well as terms of cooperation, can be found on the website of the OFD Taxcom.

Cash register equipment

Send

Stammer

Tweet

Share

Share

Registration procedure

There are two main reasons for making adjustments: independent discovery of an error made during the work process, or the presence of an order from the Federal Tax Service based on the identified violation. The procedure is carried out from any cash register of the enterprise, but not all employees - and even managers - know what a correction check is, what it looks like and when it is used. To prepare a fiscal document correcting financial statements, you will need:

- Draw up an act or memo indicating the reason for not using cash register equipment, the date and number, as well as a detailed list of completed mutual settlements - with a breakdown by nomenclature items.

- Perform a technical operation by creating a basis for the FID, with details, or transferring it to the tax service - in situations where illegal actions were identified during the audit.

Having understood why an online cash register correction check is needed and how it is done, entrepreneurs have the opportunity to quickly eliminate errors that occur, preventing more serious consequences from occurring.

How to correct an error on a check

Let's assume that the buyer paid cash for the purchase, and the cashier punched the receipt, as if paying with a plastic card. In this case, it is necessary to punch out a new document, but not a correction check. The online cash register has already transmitted information about the completed transaction to the tax authorities, and the data has been recorded on the fiscal drive. Therefore, the cashier needs to cancel the operation with a new check; it will essentially be returnable. It is necessary to indicate the calculation attribute “receipt return”. This fiscal document must contain the same data as the primary one, including the incorrect form of “electronic” payment, as well as its fiscal attribute. This allows you to undo an invalid operation. After which the cashier will be able to issue a new correct check with the “receipt” calculation sign. In this case, the buyer must receive both documents: return and corrected. However, there is no need to ask for an old, erroneous check back.

In an interview with the General Ledger, a Federal Tax Service specialist explained that the correction check can only contain calculation signs of “receipt” and “expense”. The signs “return of receipt” and “return of expense” can only be indicated on receipts for the return of goods. By the way, if the cashier made a mistake in the cost of the goods and sold the buyer an item more expensive than it costs, for example, 300 rubles instead of 200, he must issue a fiscal document for return with the “return of receipt” sign, and then re-sell the goods at the correct price. This is what you should do if an inaccuracy is discovered immediately. If excess money in the cash register and an incorrect amount in the check are discovered at the end of the shift, then he will have to draw up a corrective document with the sign “receipt”, and also write an explanatory note regarding the excess in the cash register.

However, any kind of correction may be required not only on the day of purchase, but also several days later. After all, a mistake may be discovered later if the buyer brings an incorrect document. By opening a new shift for, an online cash register user can enter a correction or refund check for any date (for example, if a shift was opened on August 20, but the error needs to be corrected on March 3). In this case, the date does not play a role and you need to issue a refund of the receipt through a correction check in the same way. When online CCT is used, this makes it possible to correct any inaccuracy or oversight.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What to write in an explanatory note

The explanatory note addressed to the director reflects:

1. Information about the addressee of the explanatory note (as a rule, this is the name of the employing company, full name of the immediate supervisor of the cashier or director of the company).

2. The name of the document is “Explanatory note about an incorrectly punched cash receipt.”

3. First-person explanations containing:

- information about the action taken, indicating the date and time;

- information about the cash register on which erroneous actions were performed (model, serial number, information about the fiscal drive);

- statements about the reasons that prompted the cashier to make mistakes when punching a cash receipt.

The document is marked with a date and the cashier's signature. It would also be useful to include a column indicating receipt of the document by the addressee.

You can download a sample explanatory note about an incorrectly punched check in the structure we considered from the link below:

If you incorrectly entered the amount on the cash receipt, the wording in the explanatory note will be different. The explanatory note template can be viewed in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

When to make adjustments

The earlier the better. The regulations allow the registration of such documents on any day, so if surpluses or shortages are discovered during the next shift, it is recommended not to put them off for a long time. It is worth noting that from a technical point of view, there are practically no differences between standard and unscheduled types - if you look at what a sample cash receipt for adjusting a return, receipt or expense looks like, the details will be similar:

- TIN and device number.

- Fiscal sign.

- Tax system.

- Operation execution address.

The only difference is a detailed nomenclature list, indicating the volume and cost of goods, the presence of which is determined by the requirements of the tax department and OFD. In addition, the standard form does not include the printing of a QR code, which usually allows buyers to verify the authenticity of the paper medium. However, in this situation it is not required, since such documentation is relevant only for internal circulation.

Results

The purpose of the correction cash receipt is to record changes in calculations made previously. The “Settlement attribute” attribute in the correction check can contain only one of the values: receipt or withdrawal. For the purpose of control by tax authorities, the adjustment must be accompanied by a supporting document.

If you trade or plan to do so via the Internet, read the article “Do you need an online cash register for an online store?”

See also: “How to cancel a check at an online cash register?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to issue a correction check

If you use autonomous cash register equipment, all necessary actions are carried out through the main menu. The algorithm provides for the following sequential stages:

- Select the “Return” section by income or expense, based on the specifics of the task.

- Carry out a return transaction through the OFD, indicating the same data as in the incorrectly executed fiscal document.

- Issue a receipt or debit order by entering the correct details.

- Draw up a memo or act on adjusting the cash receipt, indicating the item, cost of items and total amount.

- Submit the completed documentation to the tax office at your place of registration.

What is a correction check and in what cases is it punched?

A fiscal correction check on a cash register is a document that is generated to correct discrepancies between the balance on the report and the actual balance at the cash desk.

An important rule: adjustments are allowed only in the case of cash surpluses. If at the end of the shift the cashier discovers a shortage, correction is prohibited. When the cashier adjusts the surplus, he generates an adjustment cash document, draws up an act and writes an explanatory note. Copies of these papers must be submitted to the tax office to clarify cash discrepancies, the formation of surpluses and their further adjustment.

IMPORTANT!

If there is a cash surplus at the cash desk, generating a refund check is not allowed.

Operational correction of a check at an online cash register is carried out only in two cases:

- cashier's error (typo);

- mechanical failure of the cash register or massive disruptions in the operation of the system.

If the cashier was distracted and entered the wrong amount (for example, 1000 instead of 100 rubles) or forgot to knock out a receipt document upon purchase, such actions must be corrected - immediately upon detection or at the end of the day, when closing the shift.

Penalties

A change in data in the reporting implies that a situation has arisen in which the organization made settlements with clients without using cash registers. Such violations are classified under Article 14.5 of the Administrative Code and are grounds for prosecution. In this regard, it is recommended to promptly notify the regulatory authorities, notifying them that the error has been corrected. As a rule, a conscientious approach to compliance with the rules allows you to avoid punishment in the form of a monetary fine. Information on how to run a correction check at the online cash register and examples of cases when a receipt or return certificate is used is additional confidence that the employees of a retail outlet will be able to quickly navigate a problematic situation.

To submit applications, use the user's personal account, available on the official website of the Federal Tax Service. In accordance with the current regulations, the notification period should not exceed three working days from the moment the adjustments are completed independently. A prerequisite is the presence of an accompanying act or explanatory memo, as well as details of the created document.

Current legislative norms regulating cases of non-use of online cash registers provide for the possibility of applying penalties against violators. The size directly depends on the legal status of the organization, as well as the amount of revenue that was not properly accounted for. Thus, for individual entrepreneurs, the amount of punishment varies from 25 to 50% of the total “gray” trade turnover, but cannot be less than 10 thousand rubles. Legal entities are punished more severely - fines reach up to 100%, and the minimum permissible value is set at 30,000. In cases where the total amount of unaccounted expenses, determined based on the OFD data, is more than one million, or when a similar violation is repeatedly detected in within a year, temporary suspension of activities is allowed for up to 90 days.

At the same time, the legislator reserves the right to cancel previously imposed sanctions - if the cash register correction check was issued in the OFD voluntarily, with accompanying notification of the authorized bodies of the Federal Tax Service about the problem that has arisen. In addition to making changes, certain conditions must also be met:

- The basis for mutual settlements is the sale of goods or provision of services.

- The error was not detected by the regulatory authorities, that is, the entrepreneur or organization independently and voluntarily announced adjustments.

- The violation was eliminated by the user in a legal manner.

- Similar precedents have not been recorded before, or were identified a year after the payment of the previous similar fine.

- The payer provided all the necessary information confirming both the fact of the violation and its elimination.

To avoid the massive application of penalties, the Federal Tax Service has published additional clarifications regarding the last of these points. In accordance with the notification of the tax service, when assessing any case of calculation without using cash registers, the following are taken into account:

- Detailed reflection of transactions in the document - starting with format 1.1, since in new online cash register correction checks there is no need to make a special division of the total amount.

- Providing an official report indicating all calculations - for older versions of equipment that do not provide for the automatic generation of the required template.

- Availability of explanatory notes drawn up within three working days from the date of the adjustment, and before the violation was identified by the regulatory authorities.

In situations where the fact of illegal sales without the use of cash registers is established during an audit, it will not be possible to avoid penalties, so you should pay careful attention to record keeping.

Erroneous non-use of cash registers and fines

Organizations and individual entrepreneurs are liable under Part 2 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation for non-use of cash registers. The fine for individual entrepreneurs, according to this norm, is at least 10,000 rubles, and for legal entities - at least 30,000 rubles. The specific amount of the fine can reach up to one size of the amount of the settlement carried out without the use of a cash register.

Such fines are explained by the fact that the non-use of cash registers simultaneously violates both the rights of consumers (for example, in the absence of receipts, buyers cannot prove the fact of payment for goods) and the interests of the state (part of the income received by a business is diverted from taxation).

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. Organizations and individual entrepreneurs bear responsibility under Part 2 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation for non-use of cash registers.

2. Users of cash register systems can avoid liability for failure to use online cash registers if they correct the violation in a timely manner.

3. To do this, you need to prepare a correction check, and also inform the Federal Tax Service about the non-use of the cash register.

4. The schemes for using a cash register correction receipt are different when using an online cash register with the fiscal data format version 1.1 and a cash register with the fiscal data format versions 1.05 and 1.0.

5. To find out the version of the fiscal data format at the checkout, you need to print the “Shift Opening Report”.

But in a number of cases, the non-use of cash registers is not the result of deliberate actions by cash register users. Failure to use cash registers may be due to cashier error, technical failure, or simple misconception. In particular, when the user mistakenly believes that he should not use the cash register, although such an obligation exists.

For example, with non-cash remote payment for goods, it is not always clear whether it is necessary to use cash register systems and issue checks. By law, when paying for goods through Internet banking and other electronic means of payment, sellers are required to use cash registers and issue checks (Clause 5, Article 1.2 of Federal Law No. 54-FZ dated May 22, 2003).

When payment is made, say, through a payment order/receipt at a bank branch, such an obligation does not yet arise. The obligation to use cash registers in relation to such payments is introduced only from July 1, 2022 (clause 4 of article 4 of the Federal Law of July 3, 2018 No. 192-FZ).

When paying for goods remotely, the payment method is not obvious to the seller. Therefore, when paying through the same Internet banking, the seller may not apply the cash register, believing that the payment came from a bank branch through a current account. Is it possible to avoid liability for not using the cash register in such cases? The law answers this question in the affirmative.

Who should use the online cash register and OFD

Equipment that allows you to control the volume of trade turnover and tax accruals is mandatory for installation for the vast majority of legal entities and individual entrepreneurs. There are not many exceptions:

- Individual entrepreneurs specializing in the sale of theater tickets, leasing residential real estate, and also selling shoe covers for medical institutions.

- Enterprises operating in the fields of education, physical culture and sports, organizing cultural and leisure events.

Understanding the specifics of legislative regulation allows you to avoid many problems - knowing how to create a correction check, you will be able to promptly eliminate any shortcomings that may be classified as an offense.

The mobile solutions offered also help save time and money - automation of routine tasks eliminates accounting errors and allows you to control key business processes. Number of impressions: 1451

Shortage or excess goods

The situation when the cashier made a mistake with the amount of the goods and took less from the buyer than required, no corrective check is issued. In this case, a shortage arises, the cause of which must be determined by official proceedings. After all, if in fact there was less money in the cash register than on the check, the management of the organization must understand whether this is a cashier’s error or illegal actions.

Another situation may arise if a cashier accidentally pushes an extra item onto a customer. In this case, he also does not need to issue a correction check. The online checkout allows you to simply issue a fiscal return document, as in the situation when the buyer decided to return the goods himself. A similar situation arises when an erroneously completed purchase that did not exist in reality. For example, if this happened during staff training or setting up a cash register. Here you also need to use the “receipt return” attribute.

By the way, “expense return” is not usually used in trading. It should only be used in consignment stores, when the client wants to get back an item that belongs to him, and in return returns the money.