Payer category code in the declaration: why is it needed and where is it indicated?

The taxpayer category code in 3-NDFL is an identifier of the declarant’s status (whether he is an economic entity or not, and if so, in what status).

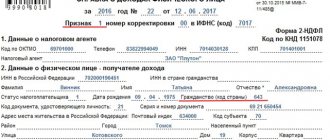

Using the code allows tax authorities (who, based on the declarant’s full name and TIN, know who he is) to speed up the processing of submitted declarations, as well as properly classify them in the internal document flow. The three-digit taxpayer category code is entered in the field of the same name on the title page of the personal income tax return. Both entrepreneurs (as well as persons with a similar status, such as lawyers and farmers) and ordinary individuals use the same report form, so they must fill out the appropriate field.

Let's consider which sources provide the correct taxpayer category codes for 3-NDFL, and also what will happen if the taxpayer indicates them incorrectly in different cases.

Correction number

Also, on the title page of the declaration form, the applicant for a personal income tax refund is required to indicate the adjustment number. This is the very first cell, consisting of three cells, immediately after the document title, which is indicated in bold.

The adjustment number exists so that tax agents can immediately see what type of return it is, filed by the same individual during the tax period indicated in it.

How to indicate the number

This number usually consists of one digit. First of all, write down the required number, and then put two dashes. You must fill out the cell in which you want to enter the adjustment number as follows:

- 0 – if taxpayers submit a declaration for verification for the first time in the year specified in the document as the tax period;

- 1 – if an individual sends a document for consideration again. This often happens if errors were made when filling out the previous form, and the tax inspector demanded that they be corrected;

- 2 – if an applicant for an income tax refund reissues or simply submits Form 3-NDFL for verification for the third time in a year. This happens when one individual has the right to several deductions at the same time and decides to receive them during one tax period. For example, this could be the registration of compensation for training, for medical services and for the purchase of property.

Several cells for this number are allocated for a reason. In some rare situations, individuals submit Form 3-NDFL more than ten times, and then they need to indicate a two-digit code.

Where can I get a list of codes?

The list of payer codes for the 3-NDFL report is fixed in Appendix No. 1 to the procedure for filling out the declaration, approved. by order of the Federal Tax Service of Russia dated August 28, 2022 N ED-7-11/ [email protected]

. There are 6 codes in total, namely:

- Code 720 (indicated in the declaration by a citizen registered as an individual entrepreneur).

- Code 730 (corresponds to a citizen registered as a notary engaged in private practice, or as another person engaged in private practice).

- Code 740 (lawyer who has his own office).

- Code 750 (arbitration manager).

- Code 760 (an ordinary citizen who is not registered either as an individual entrepreneur or as another private practitioner).

- Code 770 (head of a peasant farm, registered as an individual entrepreneur).

The use of the specified taxpayer category codes in the 3-NDFL declaration has a number of nuances.

Taxpayer category in 3-NDFL

Current legislation provides for the possibility of income tax refunds for various categories of individuals.

These may be taxpayers who are individual entrepreneurs, private lawyers, as well as some other individuals. In order for the tax agent to understand who exactly is claiming the deduction, the “taxpayer category code” cell was invented.

ATTENTION! All codes encrypting the categories of applicants for personal income tax refunds are given in Appendix 1, which is published as an addition to the document entitled “Procedure for filling out the tax return form.” This application was put into effect by the Federal Tax Service on December 24, 2014 using a special order (under number ММВ-7-11/671).

Where should the category be indicated?

Any individual filling out form 3-NDFL will be faced with a taxpayer category code almost immediately.

On the title page of the tax return, after its name, there is a line in which you need to enter the adjustment code and tax period. It is also necessary to indicate the number of the authority to which the document will be submitted for verification. Then the line below requires the country codes and taxpayer category.

Rules for entering code

On the 2022 return form, there are as many as three empty cells for writing the taxpayer category. Since the codes that encrypt categories are usually three-digit, there should not be a single empty cell left.

The code itself must be entered into the document carefully and ensure that each digit is clearly inscribed in the cell and does not go beyond its limits. If an individual decides to fill out a declaration manually, then the entire document must be filled out in the same color ink - black or blue.

It should be noted that if a taxpayer mistakenly indicates the wrong code, then corrections in the 3-NDFL form are not allowed. In such a situation, you need to reprint the damaged page and write the correct numbers of the taxpayer category code.

Existing codes and their explanations

Today, there are six options for three-digit digital combinations that can be indicated in the declaration field, which requires a mark such as the taxpayer category.

They all start with the number seven and end with zero, that is, they differ only in the second digit in the combination. In the 3-NDFL form, the applicant for the deduction must enter one of the following codes:

- 720 – if the taxpayer filling out the declaration legally carries out business activities, while continuing to remain an individual (that is, he does not open any firm, enterprise or organization);

- 730 – if the individual wishing to refund income tax is an official who has the right to prepare and certify various documentation (notary);

- 740 – if the applicant for a tax rebate conducts legal cases, namely, acts as a defense attorney in this process and does not work for a government organization (a private lawyer);

- 750 – if the taxpayer submitting form 3-NDFL for consideration is a member of the staff of any of the organizations of arbitration managers that are independently regulated. At the same time, he must be a citizen of Russia and engage in private activities, which consists of exercising powers of a public legal nature;

- 760 – if the taxpayer does not belong to any of the above categories, but submits a declaration on the basis of article number 227 (first paragraph) or 228. Or if the applicant for tax refund has the right to reduce the tax base in accordance with the text of one of the articles of the Tax Code: from 218 by 221;

- 770 – if an individual is registered as an individual entrepreneur whose activities are directly related to running a peasant-type farm. For example, these are taxpayers who head the village council.

https://youtu.be/cjZCmuB-5wc

Choosing a code: nuances

On the one hand, it’s easy to indicate the category code in 3-NDFL. You need to choose the one that best suits the taxpayer, and it’s difficult to make a mistake here. On the other hand, the declarant should pay attention to two points:

- The code indicated is the one that was relevant for the declarant during the tax period for which the declaration is submitted. For example, if a person was an individual entrepreneur in 2022, but no longer in 2021, then he, as a former individual entrepreneur, is required to submit the OSN reports for the previous year and indicate code 720 in the declaration.

- If a person is still an individual entrepreneur, but submits a declaration specifically for filing a deduction for personal income tax (for example, when selling an apartment), code 720 is entered in 3-NDFL.

The fact is that the purpose of the code is not to establish the reason for submitting the declaration, but to correctly identify the declarant. And if an individual entrepreneur indicates code 760 when filing a deduction, he will misinform the Federal Tax Service, since this code is used only by those who are not registered as individual entrepreneurs (regardless of the grounds for submitting the report).

Let's talk about the possible consequences of incorrectly indicating the taxpayer category code in the 3-NDFL declaration, because such an error cannot be ruled out.

Detailed transcript (760, 720)

Each tax payer belongs to a certain group, which is determined by law.

Taxpayers often wonder when preparing their return what the symbols on the first page mean.

When drawing up the title page in 3-NDFL, the responsible person must register the CCI in the reporting. Information can take on different meanings.

This depends on the position of the person providing the declaration. KKN may have the following designation:

| 720 | A private person who is entered in the register as an individual entrepreneur. Individual entrepreneurs using a special regime do not file an income tax return, because VAT and personal income tax are replaced by one tax, which corresponds to a certain regime. Moreover, if an entrepreneur receives income from activities that do not fall under the special regime, then he must file an income tax return as an individual, taking into account the rules of Chapter. 23 Tax Code of the Russian Federation |

| 760 | Other persons who declare income that is subject to tax |

What happens if you enter the code incorrectly?

The most obvious thing is that the declaration will not be accepted by the Federal Tax Service. In case of delivery according to the TKS, the document management system can turn it back. When submitting a written declaration, the tax authorities will most likely ask the declarant for clarification (they will ask to submit an adjustment declaration). Or they may not request it, as a result of which the report will not be considered submitted - with all the accompanying penalties.

Previously, in relation to an individual entrepreneur who did not submit tax reports, the Pension Fund calculated insurance contributions in the maximum allowable amount, and the individual entrepreneur had no reason not to pay them (definition of the Constitutional Court of the Russian Federation dated July 18, 2017 No. 1725-O). Now the Federal Tax Service calculates contributions itself and even if taxes are declared late, recalculates them without a huge increase in payment (and also contributes to the normalization of previous contributions to the Pension Fund, as evidenced, for example, by the letter of the Federal Tax Service of Russia dated October 3, 2017 No. GD-4-11/19837) . But even taking into account the loyalty of the tax authorities, it is advisable to avoid such risks.

If an individual entrepreneur submits 3-NDFL to the bank when applying for a loan, then if an erroneous code is indicated, not set for an individual entrepreneur, but for an ordinary citizen, the credit institution may refuse to consider the declaration. This is stipulated in the internal regulations of the largest banks.

If the declarant is an ordinary individual filing a deduction, he will be ordered to send a new declaration with the correct code to the Federal Tax Service, otherwise the deduction will not be given.

When to submit a declaration for consideration

We recommend that all individuals who have filled out the 3-NDFL form do not delay submitting it. This is due to the fact that some types of deductions are accrued only over a certain point in time.

For example, these are tax discounts provided for social expenses (payment for medical services, purchase of medicines, charitable contributions, education expenses). Thus, if a taxpayer, after paying for a service belonging to the social type, waits more than three years and only then sends a declaration for verification, then his tax base will not be reduced.

There is also no need to rush to submit the document. You need to submit 3-NDFL to the tax authority only when the year has ended during which the individual spent money on paying for services that require a deduction. If the taxpayer claims compensation for providing for a child, then the document can be sent and filled out at any time.

How to fix incorrect code

To do this, you need to submit an updated 3-NDFL declaration to the Federal Tax Service. It is advisable for an individual entrepreneur (or an individual for taxable income) to do this within the deadline for submitting reports (and if this does not work out, then in accordance with the conditions specified in clause 4 of Article 81 of the Tax Code of the Russian Federation). When applying for a deduction, an individual should do so as quickly as possible, since speeding up the processing of the application to the Federal Tax Service is in his interests.

The clarification on the title page contains the number of the adjustment (if it is the first - 001) and indicates all the information reflected in the primary declaration, except for the incorrect category code. The correct one is entered instead.

There are many different “code” fields on the title page of 3-NDFL and in the declaration itself as a whole. Among them there is one very similar to the payer category code, namely the taxpayer attribute code in 3-NDFL. It is important to prevent their accidental mutual substitution.

What does the 3-NDFL form include?

Russian legislation provides that so-called tax payers are required to calculate and withhold taxes. tax agents, which include:

- Russian organizations and foreign companies, individual divisions of which operate in Russia.

- Individuals engaged in private practice. These, in accordance with tax legislation, include notaries and lawyers.

- Individual entrepreneurs.

Loan “Cash (online application)” Alfa-Bank, Person. No. 1326

from 15.9%

rate per year

up to 5 million

for up to 7 years

Apply now

The largest number of tax agents are organizations that withhold income taxes from the salaries of their employees. The remaining categories of citizens who are required to submit a declaration to the tax authority in form 3-NDFL are individual entrepreneurs and individuals engaged in private practice, as well as those who received income in excess of their salary in the past year. What kind of financial income, in addition to official earnings, can we talk about?

- Income from the sale or receipt of property as a gift - for example, real estate, vehicles, company shares, etc.

- Rewards from those organizations and individuals who do not pay personal income tax on the basis of concluded agreements (civil and civil law). In particular, this applies to rental or rental income.

- Income from prize draws and lotteries.

- Income that comes to an individual from sources outside the Russian Federation.

In addition, people who rely on personal income tax deductions must file a tax return. We are talking about returning part of the funds spent on treatment, training, paying taxes for the purchase of real estate, contributions to non-state pension funds, and charitable purposes.

Credit "MTS Cashback" MTS Bank, Person. No. 2268

from 0.01%

rate per year

up to 1 million

for up to 3 years

Apply now