Individuals with resident status

If an individual is in Russia for at least 183 calendar days within 12 consecutive months, he can be called a resident of the Russian Federation. These 183 days do not have to be consecutive. There are exceptions when staying outside the country does not make a person a non-resident:

- if the individual was absent from the country for reasons of undergoing treatment, training or fulfilling obligations under an employment contract abroad;

- if a Russian serviceman is on military duty abroad or an employee of government agencies on a business trip outside the Russian Federation;

- if an international treaty establishes a different procedure for determining residence, then its provision applies, since its legal force is higher.

If absent from the country for 183 days or more over the past year, an individual is considered a non-resident. Resident status is confirmed by information from the work time sheet, copies of passport pages with border crossing marks, registration documents at the place of residence, and migration card data.

By law, a person's nationality is not relevant for recognition as a resident. They can be recognized as a stateless person or a foreign citizen. Individual entrepreneurs receive residency if they pay Russian taxes and are registered with the Federal Tax Service of Russia.

Example 4. Calculation of insurance premiums for a foreign employee abroad

An employee working abroad is NOT a citizen of the Russian Federation. It is necessary to ensure that only contributions from industrial accidents are calculated according to it.

In the Employee's the Insurance link, we will establish for the employee the status of an insured person. Non-insured persons, including foreign citizens who are not subject to insurance and temporarily staying in the territory of the Russian Federation .

When calculating the salary of such an employee, only contributions from industrial accidents will be calculated.

Such an employee and his income will not be included in the calculation of insurance premiums This is in accordance with the law.

But in the Accounting Card for Insurance Contributions (Taxes and Contributions – Reports on Taxes and Contributions) income amounts will be filled in for such an employee. In our opinion, this is an incorrect completion of the report.

If you need to provide the Insurance Premium Accounting Card to inspectors, it is better to reset the amounts in it manually. Or you can not hand over this employee’s card at all, because... he is not an insured person.

Resident legal entities

The residence of a legal entity is determined by its membership in the tax system of the Russian Federation. A legal entity must be registered with the relevant authorities and pay taxes to the budget. To assign this status, take into account the place of registration of the company, the location of the governing body and the place of activity. A legal entity that is a resident of the Russian Federation is considered to be:

- organizations registered in Russia;

- foreign organizations in accordance with an international treaty;

- international organizations whose head office is located in Russia and is managed from the territory of the Russian Federation.

If a legal entity operates in Russia, but is created and registered abroad, it cannot be a resident.

Location of sources of income

What income is considered income received from sources in the Russian Federation, and what income is considered income from sources outside the Russian Federation, is explained by the Tax Code in Art. 208.

Income from sources in the Russian Federation

Income from sources in the Russian Federation includes, first of all, remuneration for the performance of labor or other duties, work performed, services rendered, actions performed in the Russian Federation (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

In this case, it does not matter whether a Russian or foreign organization pays remuneration related to income from sources in the Russian Federation, as well as the tax status of an individual (Letters of the Ministry of Finance of Russia dated September 26, 2012 N 03-04-06/4-292 and dated September 13. 2012 N 03-04-06/6-277).

Note. Payments to executives of a Russian company Remuneration to a director or member of the board of directors of an organization - a tax resident of the Russian Federation, the location (management) of which is the Russian Federation, is considered as income received from sources in the Russian Federation. In this case, it does not matter where the managerial responsibilities assigned to these persons were actually performed or where the remuneration was paid (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

Also, income from sources in the Russian Federation includes pensions and benefits provided for by current Russian legislation (clause 7, clause 1, article 208 of the Tax Code of the Russian Federation).

Income from sources outside the Russian Federation

Income from sources outside the Russian Federation includes remuneration for the performance of labor or other duties, work performed, service rendered, or action performed outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation).

Tax resident status and its features

Whether a person is a resident of a country determines in which country he will pay income tax and what tax rules will apply to him. Articles 207, 209, 210 and 224 of the Tax Code regulate residency issues in Russia.

A resident of the Russian Federation is obliged to declare all income, including income received outside the country, and pay taxes on it; The tax base is calculated as the sum of all taxable income, excluding the amounts of required tax deductions. The tax amount for a resident is calculated on an accrual basis from the beginning of the year based on the results of each month. A non-resident pays tax only on income received in Russia; no tax deduction is provided. The tax amount for a non-resident is calculated separately for each amount of accrued income (per month).

How to count 183 calendar days

183 days of stay in the Russian Federation, after which an individual will be recognized as a tax resident of the Russian Federation, are calculated by summing up all calendar days in which the individual was in the Russian Federation for the next 12 consecutive months (Letter of the Ministry of Finance of Russia dated October 8, 2012 N 03-04 -05/6-1155).

Note. If the 183rd day falls on December 31 If the 183rd calendar day falls on December 31, the employee is recognized as a tax resident of the Russian Federation for the expired tax period.

Days of entry and exit . When determining the tax status of an employee, the employer must also take into account the days of his entry into the Russian Federation and the days of departure from the Russian Federation, since on these days the employee was actually in the Russian Federation (Letter of the Federal Tax Service of Russia dated March 31, 2009 N 3-5-04 / [email protected] ).

Treatment and training . The Tax Code does not contain requirements for the continuity of 183 calendar days (Letter of the Federal Tax Service of Russia dated August 30, 2012 N OA-3-13 / [email protected] ).

The time of travel abroad of the Russian Federation within 12 consecutive months is not taken into account when calculating 183 calendar days, with some exceptions. Exceptions are made:

- for short-term treatment;

- training.

Note. In this case, short-term is considered to be a period of less than 6 months.

Note. Long-term treatment or training If an individual studies at a foreign educational institution under a training contract for more than six months, the days the individual is outside the Russian Federation for the purposes of this training cannot be taken into account when calculating the days of his stay in the Russian Federation (Letter of the Ministry of Finance of Russia dated October 8, 2012 N 03-04-05/6-1155).

Days of travel abroad for short-term treatment or training are taken into account when calculating the days of an employee’s stay in the Russian Federation.

A mandatory condition is that immediately after completing training (treatment), the employee must return to the Russian Federation (Letter of the Ministry of Finance of Russia dated September 26, 2012 N 03-04-05/6-1128).

At the same time, in Art. 207 of the Tax Code of the Russian Federation does not establish restrictions on age, types of educational institutions, educational disciplines, medical institutions, types of diseases, as well as on the list of foreign countries in which citizens of the Russian Federation can undergo treatment or training (Letter of the Federal Tax Service of Russia dated September 23, 2008 N 3-5 -03/ [email protected] ).

It should also be borne in mind that when determining the tax status of an individual, his citizenship does not matter (Letter of the Ministry of Finance of Russia dated March 19, 2012 N 03-04-05/6-318).

Let's look at an example of how the tax status of a foreign employee is determined during the year and at the end of the tax period.

Example. Norwegian citizen A. Tyssedal has been working at JSC Continent since February 7, 2011. He entered the territory of the Russian Federation on February 1, 2011. On February 28, 2011, he left the Russian Federation for treatment. On November 3, 2011, A. Tyssedal returned to Russia.

In 2012, the employee traveled outside the Russian Federation:

- on a business trip - left on February 5, returned on February 19;

- on vacation - left on March 11, returned on March 25;

- for treatment - left on May 27, returned on November 28.

Is the employee a tax resident of the Russian Federation based on the results of 2012?

Solution. We will track changes in the employee’s tax status during 2012 as of each date of payment of income, at the end of each calendar month and at the end of the tax period.

According to paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, the date of payment of income in the form of wages is the last day of each calendar month. Therefore, for each date of payment of income, the 12-month period is counted back, starting from the day preceding the date of payment of income. For example, for May 31, 2012, the period under consideration is from May 31, 2011 to May 30, 2012. We similarly determine the periods for all other dates. The last day of each month (if the employee was in Russia) will apply to the 12-month period on the next date of payment of income.

In our example, there will be one exception due to the leap year 2012. For February 29, 2012, let's take the 12-month period from February 28, 2011 to February 28, 2012.

In table Table 2 presents the results of calculations of the number of days an employee stays in the Russian Federation and abroad.

table 2

Change in employee tax status during 2012

| 12 month billing period | Number of calendar days | Tax status on the date of payment of income | |||

| Periods of stay | in Russia | outside Russia | |||

| beginning of period | end of period | ||||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 31.01.2011 — 30.01.2012 | 31.01.2011 | 31.01.2011 | X | 1 | |

| 01.02.2011 | 28.02.2011 | 28 | X | ||

| 01.03.2011 | 02.11.2011 | X | 247 | ||

| 03.11.2011 | 30.01.2012 | 89 | X | ||

| Total | X | X | 117 | 248 | Non-resident |

| 28.02.2011 — 28.02.2012 | 28.02.2011 | 28.02.2011 | 1 | X | |

| 01.03.2011 | 02.11.2011 | X | 247 | ||

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 28.02.2012 | 10 | X | ||

| Total | X | X | 107 | 259 | Non-resident |

| 07.03.2011 — 06.03.2012 | 07.03.2011 | 02.11.2011 | X | 241 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 06.03.2012 | 17 | X | ||

| Total | X | X | 113 | 253 | Non-resident |

| 31.03.2011 — 30.03.2012 | 31.03.2011 | 02.11.2011 | X | 217 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 30.03.2012 | 6 | X | ||

| Total | X | X | 125 | 241 | Non-resident |

| 30.04.2011 — 29.04.2012 | 30.04.2011 | 02.11.2011 | X | 187 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 29.04.2012 | 36 | X | ||

| Total | X | X | 155 | 211 | Non-resident |

| 31.05.2011 — 30.05.2012 | 31.05.2011 | 02.11.2011 | X | 156 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 30.05.2012 | X | 3 | ||

| Total | X | X | 183 | 183 | Resident |

| 30.06.2011 — 29.06.2012 | 30.06.2011 | 02.11.2011 | X | 126 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | |||

| 28.05.2012 | 29.06.2012 | X | 33 | ||

| Total | X | X | 183 | 183 | Resident |

| 31.07.2011 — 30.07.2012 | 31.07.2011 | 02.11.2011 | X | 95 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 30.07.2012 | X | 64 | ||

| Total | X | X | 183 | 183 | Resident |

| 31.08.2011 — 30.08.2012 | 31.08.2011 | 02.11.2011 | X | 64 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 30.08.2012 | X | 95 | ||

| Total | X | X | 183 | 183 | Resident |

| 30.09.2011 — 29.09.2012 | 30.09.2011 | 02.11.2011 | X | 34 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 29.09.2012 | X | 125 | ||

| Total | X | X | 183 | 183 | Resident |

| 31.10.2011 — 30.10.2012 | 31.10.2011 | 02.11.2011 | X | 3 | |

| 03.11.2011 | 06.02.2012 | 96 | X | ||

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 30.10.2012 | X | 156 | ||

| Total | X | X | 183 | 183 | Resident |

| 30.11.2011 — 29.11.2012 | 30.11.2011 | 06.02.2012 | 69 | X | |

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 28.11.2012 | X | 185 | ||

| 29.11.2012 | 29.11.2012 | 1 | X | ||

| Total | X | X | 157 | 209 | Non-resident |

| 31.12.2011 — 30.12.2012 | 31.12.2011 | 06.02.2012 | 38 | X | |

| 07.02.2012 | 18.02.2012 | X | 12 | ||

| 19.02.2012 | 12.03.2012 | 23 | X | ||

| 13.03.2012 | 24.03.2012 | X | 12 | ||

| 25.03.2012 | 27.05.2012 | 64 | X | ||

| 28.05.2012 | 28.11.2012 | X | 185 | ||

| 29.11.2012 | 30.12.2012 | 32 | X | ||

| Total | X | X | 157 | 209 | Non-resident |

The treatment lasted more than six months. It is not taken into account in the number of days the employee stays in the Russian Federation. The number of days an employee stayed in the Russian Federation during 2012 is shown in table. 3.

Table 3

Number of days spent in the Russian Federation in 2012

| Month | January | February | March | April | May | June | July | August | September | October | November | December |

| Number of days of stay in the Russian Federation at the end of the month | 31 | 47 | 66 | 96 | 124 | 124 | 124 | 124 | 124 | 124 | 126 | 157 |

The employee was recognized as a tax resident of the Russian Federation based on the results of May, June, July, August, September and October 2012. The tax agent began to apply a rate of 13% to his income received during these months. At the end of November, A. Tyssedal lost his status as a tax resident of the Russian Federation, and the tax agent began to withhold personal income tax from his income at a rate of 30%. This status remained as of December 31, 2012. Therefore, the tax agent withheld personal income tax at a rate of 30% from the employee’s income for 2012 (the total amount of income received by a foreign employee from sources in the Russian Federation was 400,000 rubles).

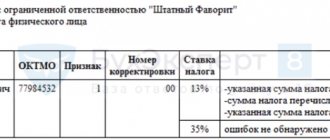

Table 5 of the individual’s income certificate for 2012 according to A. Tyssedal’s Form 2-NDFL will look as shown below.

Sample

Fragment of form 2-NDFL

5. Total amounts of income and tax based on the results of the tax period at a rate of 30%

| 5.1. Total income | 400 000,00 |

| 5.2. The tax base | 400 000,00 |

| 5.3. Tax amount calculated | 120 000 |

| 5.4. Amount of tax withheld | 120 000 |

| 5.5. Tax amount transferred | 120 000 |

| 5.6. Amount of tax over-withheld by the tax agent | |

| 5.7. Amount of tax not withheld by the tax agent |

Income tax for residents and non-residents

The personal income tax rate at which income received is taxed depends on the tax status of an individual. According to Article 224 of the Tax Code, a resident of the Russian Federation pays standard personal income tax at a rate of 13%. For non-resident persons, paragraph 3 of Article 224 establishes a special personal income tax rate of 30%, which can be reduced under certain conditions:

- if a non-resident received dividends from investments in Russian organizations as income, the tax rate can be reduced to 15%;

- for special categories of non-residents the tax rate is 13%.

Special categories of non-residents are recognized: patent workers, highly qualified specialists, immigrants and refugees, citizens of the EAEU, ship crew members.

Example 2. Adjustment of personal income tax accounting for foreign workers using the document “Personal income tax accounting transaction”

An employee working abroad is a tax resident. Employee salary – 63,000 rubles.

From 10/01/2021 to 10/07/2021, the employee was on a business trip in the Russian Federation. The amount of payment based on average earnings during a business trip is 15,000 rubles. Salary payment for actual time worked in October – 48,000 rubles.

It is necessary to set up employee income accounting in such a way that only payment for a business trip in the Russian Federation is subject to personal income tax. The employee’s income, taking into account October, did not exceed 5 million rubles. To calculate personal income tax on business trip payments, a tax rate of 13% must be applied.

In order for personal income tax on business trip payments to be calculated at a rate of 13% (15%), we will establish the employee’s status for the purposes of calculating personal income tax - Resident .

We will calculate the employee’s salary for October 2022 and check the personal income tax calculation. The tax must be calculated in the amount of:

- 15,000 (business trip payment) * 13% (personal income tax rate) = 1,950 rubles.

However, in the document Calculation of salaries and contributions, personal income tax was calculated on all income - in the amount of 8,190 rubles.

- (15,000 <business trip payment> + 48,000 <salary payment>) * 13% (personal income tax rate) = 8,190 rubles.

To ensure that Salary Payment is not included in the personal income tax tax base, we will create a document Personal Income Tax Accounting Operation (Taxes and Contributions - See also - Personal Income Tax Accounting Operations). On the Income , fill in the line with the amount of the salary accrued to the employee (RUB 48,000) with a minus sign. the date of receipt of income as the last day of the salary calculation month – 10/31/2021.

Let's recalculate personal income tax in the document Calculation of salaries and contributions . The final amount of personal income tax will be determined correctly - only from the payment for the business trip (- 6,240 + 8,190 = 1,950 rubles).

On the personal income tax in the document Calculation of salaries and contributions, we see a re-grading in the calculation of personal income tax by department. It was formed because the Personal Income Tax Accounting Transaction does not contain the Division and the tax reduction occurs according to an empty division. This re-grading will not be critical for accounting - it is important that Registration with the Federal Tax Service matches for both lines on the personal income tax .

If, after entering a personal income tax accounting transaction it is not desirable to recalculate the document Calculation of salaries and contributions , the tax can be recalculated in the document Recalculation of personal income tax (Taxes and contributions - Recalculation of personal income tax).