The concept of "advertising"

First, let's define the terms and concepts.

Advertising means information disseminated in any way, in any form and using any means, addressed to an indefinite number of persons and aimed at attracting attention to the object of advertising, creating or maintaining interest in it and promoting it on the market (Clause 1 Article 3 of Law No. 38‑FZ).

| note As noted in the Resolution of the Supreme Court of Ukraine dated March 18, 2020 No. F09-1053/20 in case No. A47-14439/2018, the concept of “an indefinite circle of persons” implies a circle of persons who cannot be individualized (determined) in advance. Therefore, based on the concept of “advertising” for tax purposes, the costs of distributing advertising materials can be included in advertising costs only if these materials are intended for an indefinite number of people. |

Accounting for the main operations of a travel agency: postings

The procedure for recording travel agency transactions depends on what scheme is used when paying remuneration to the agent: (click to expand)

- the agency independently deducts the amount of income from the proceeds;

- income comes from the operator after funds from clients are transferred to him.

Below we will look at accounting for each of the above schemes using examples.

Example No. 1. On 02/12/16, an agreement was concluded between the travel agency “Labyrinth” and the tour operator “Perfect” for the sale of the tourism product “Venice Spring”. The cost of the product is 102,450 rubles, the reward for “Labyrinth” is 12,580 rubles. Under the terms of the agreement, “Labyrinth” transfers to “Perfect” the amount received from the tourist, minus its own income.

On 03/15/16, the client purchased the “Venice Spring” tour from the Labyrinth agency at a price of 115,030 rubles. (RUB 102,450 + RUB 12,580).

03/18/16 “Labyrinth” transferred to “Perfect” the amount of income minus its own commission. The accountant of “Labyrinth” made the following entries in the accounting:

| date | Debit | Credit | Description | Sum |

| 12.02.16 | 004 | “Labyrinth” took into account the cost of the “Venice Spring” tour received from “Perfect” for sale | RUB 102,450 | |

| 15.03.16 | 50 | 76 | The client purchased the “Venice Spring” tour by paying the amount to the “Labyrinth” box office | 115.030 rub. |

| 15.03.16 | 76 | 90 Revenue | The commission from the sale of the “Venice Spring” tour has been taken into account | RUB 12,580 |

| 15.03.16 | 004 | The cost of the sold “Venice Spring” tour has been written off | RUB 102,450 | |

| 18.03.16 | 76 | 51 | “Perfect” received the amount from the sale of the “Venice Spring” tour minus the “Labyrinth” commission. | RUB 102,450 |

Example No. 2. On 08/20/16, an agreement was concluded between the travel agency “Minotaur” and the tour operator “Around the World” for the sale of the tourism product “Autumn in Greece”. The cost of the product is 122,040 rubles, the reward for “Minotaur” is 14,710 rubles.

Under the terms of the agreement, Minotaur transfers the full amount received from the tourist to Around the World, after which the operator pays Minotaur a commission.

On 10/02/16, the client purchased the “Autumn in Greece” tour from the Minotaur agency at a price of 136,750 rubles. (RUB 122,040 + RUB 14,710).

10/05/16 “Minotaur” transferred the entire amount for the tour to “Around the World” (RUB 136,750). “Minotaur” received a reward from “Around the World” on 10/11/16. The accountant of “Minotaur” made the following entries in the accounting:

| date | Debit | Credit | Description | Sum |

| 20.08.16 | 004 | “Minotaur” took into account on the balance sheet the cost of the “Autumn in Greece” tour received from “Around the World” for sale | RUB 122,040 | |

| 02.10.16 | 50 | 76 | The client purchased the “Autumn in Greece” tour by paying the amount to the “Minotaur” box office | RUR 136,750 |

| 02.10.16 | 004 | The cost of the sold tour “Autumn in Greece” was written off | RUB 122,040 | |

| 05.10.16 | 76 | 51 | The entire amount of proceeds from the sale of the “Autumn in Greece” tour was transferred to the tour operator “Around the World” | RUR 136,750 |

| 11.10.16 | 51 | 76 | The commission amount was received from “Around the World” | RUR 14,710 |

| 11.10.16. | 76 | 90 Revenue | Income from the sale of the “Autumn in Greece” tour is included in revenue | RUR 14,710 |

Tax accounting rules

“Simplers” have the right to take into account the costs of advertising manufactured (purchased) and (or) sold goods (work, services), trademark and service mark (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation). Advertising expenses are recognized as expenses in the manner prescribed by Art. 264 of the Tax Code of the Russian Federation (see also Letter of the Ministry of Finance of Russia dated December 17, 2019 No. 03‑11‑11/98698).

As mentioned earlier, a feature of the recognition of advertising expenses when applying the simplified tax system is the standardization of some of them. In other words, part of the advertising expenses is accepted for tax accounting in full, and the rest - in an amount not exceeding 1% of sales revenue (clause 4 of article 264, clause 20 of clause 1, clause 2 of article 346.16 of the Tax Code of the Russian Federation ).

Results

Only single tax payers with the object of taxation “income and expenses” can recognize advertising expenses when calculating the single tax. Non-standardized expenses can be taken into account when calculating the single tax in the full amount of paid advertising costs, and normalized expenses can be taken into account only within 1% of the revenue received and advances received in the reporting period.

About the nuances of reflecting expenses and the requirements for expenses, read the article “Accounting for expenses under the simplified tax system with the object “income minus expenses” " .

Sources:

- Tax Code of the Russian Federation

- Law “On Advertising” dated March 13, 2006 No. 38-FZ

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

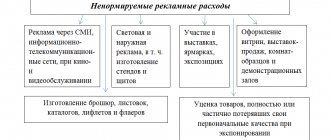

Which expenses are regulated and which are not?

In paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, advertising costs are divided into two types - normalized and non-standardized.

For ease of perception, the contents of this paragraph are presented in the table.

Advertising expenses (clause 4 of article 264 of the Tax Code of the Russian Federation)

| Non-standardized expenses (paragraph 2 - 4) | Standardized expenses (paragraph 5) |

| For advertising events through the media (including advertisements in print, broadcast on radio and television), the Internet, during film and video services | For the purchase (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns |

| For illuminated and other outdoor advertising, including the production of advertising stands and billboards | For other types of advertising that are not listed in the list of non-standardized expenses |

| For participation in exhibitions (fairs, expositions), design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures (catalogs) containing information about the goods (works, services) being sold, trademarks and service marks and (or) about the organization itself, markdown of goods that have completely or partially lost their original qualities during exhibition |

| note The list of advertising expenses not standardized for tax purposes is closed (see Resolution of the AS PO dated 03/09/2016 No. F06-6351/2016 in case No. A06-3246/2015). The list of regulated advertising expenses, on the contrary, is open. The Ministry of Finance in Letter No. 03‑11‑11/3772 dated January 24, 2018 emphasized: the taxpayer’s expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, as well as expenses for other types of advertising not specified in paragraph . 2 - 4 p. 4 tbsp. 264 of the Tax Code of the Russian Federation, carried out by him during the reporting (tax) period, are recognized for tax purposes in an amount not exceeding 1% of the proceeds from sales, determined in accordance with Art. 249 of the Tax Code of the Russian Federation. |

Financiers believe that standard advertising costs should include, for example, the following costs:

- to pay for services for placing information about goods (works, services) sold by the company in catalogs of retail chains;

- to send advertising SMS messages;

- for the placement of billboards in the subway.

| For your information Due to the fact that the costs of holding advertising events, promotions, and loyalty programs are not directly mentioned in clause 4 of Art. 264 of the Tax Code of the Russian Federation and are not specified in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system do not have the right to take into account these expenses for tax purposes. Meanwhile, the Resolution of the Federal Antimonopoly Service of Moscow dated September 24, 2009 No. KA-A40/9145-09 in case No. A40-62621/08-4-304 states that holding cultural events, in particular with the aim of increasing customer loyalty, is an advertising campaign . In addition, the judges pointed out that tax legislation does not make the possibility of recognizing expenses dependent on the type of advertising or methods of advertising. In accordance with paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, it is allowed to include in the costs the cost of other types of advertising not specified in paragraph. 2 - 4 p. 4 tbsp. 264. |

Confirm your consumption

It is necessary to carefully store documents containing information about money paid for advertising. The tax authorities may require proof of expenses. If the company fails to do this, the tax will be assessed additionally. A fine will also be imposed. If the funds for advertising are significant, then the documents must be prepared especially carefully.

For each operation a set must be generated:

- Contract. It indicates the type of advertising being purchased. Details. This document is optional, but the information in it will clearly indicate which advertising you have paid for.

- Certificate of completion of work, which confirms the fact of completion of work. List the services provided in detail. If the contractor fails to submit a report, save email correspondence, especially those letters that contain confirmation. It is better to print it out and notarize it.

- Proof of payment: cash receipt and bank statement.

The procedure for recognizing standard advertising expenses

Non-standardized expenses are fully taken into account when calculating the “simplified” tax.

Standardized items are taken into account in an amount not exceeding 1% of sales revenue, calculated in accordance with Art. 249 of the Tax Code of the Russian Federation. The advertising expenditure standard is calculated based on revenue on an accrual basis from the beginning of the year.

| Example 1 |

| ) in the first quarter of 2022 paid 50 for advertising on public transport 000 rub. The company's sales revenue for this period amounted to 2 211 749 rub. The maximum amount of advertising expenses in the first quarter is 22,117.49 rubles. (RUB 2,211,749 x 1%). Consequently, the company can include normalized advertising expenses in the amount of 22,117.49 rubles in the actual expenses incurred based on the results of the first quarter. |

Under the simplified tax system, all income according to Art. 346.17 of the Tax Code of the Russian Federation are accounted for on a cash basis, and for the purposes of rationing advertising expenses, this provision is preserved. That is, revenue must be calculated taking into account received advance payments.

If standard advertising expenses exceeded 1% of revenue in one reporting period, then excess expenses can be taken into account in the next reporting period, and so on until the end of the year. Indeed, under the simplified tax system, income and expenses are calculated on an accrual basis (clause 5 of article 346.18 of the Tax Code of the Russian Federation). However, expenses that exceed this limit at the end of the year cannot be transferred to the next year.

| Example 2 | ||||||

| Let's use the data from the previous example. In June 2022, the company held a promotion with gifts for its participants. 27,000 were spent on buying gifts . And in September, advertising brochures were printed. The amount of expenses for them amounted to 32,500 rubles . | ||||||

| The maximum amount of advertising expenses in the first quarter is 22,117.49 rubles. (RUB 2,211,749 x 1%). Consequently, the company can include normalized advertising expenses in the amount of 22,117.49 rubles in the actual expenses incurred based on the results of the first quarter. Period | Revenue, rub. | Advertising expenses, rub. | Advertising standard on an accrual basis, rub. | Advertising expenses recognized at the end of the quarter, rub. | ||

| During the period | Cumulative total | Standardized | Non-standardized | |||

| I quarter | 2 211 749 | 2 211 749 | 50 000 | 22 117,49 | 22 117,49 | — |

| II quarter | 2 253 526 | 4 465 275 | 27 000 | 44 652,75 | 22 535,26 | — |

| III quarter | 3 032 634 | 7 497 909 | 32 500 | 74 979,09 | 30 326,34 | 32 500 |

| IV quarter | 2 891 416 | 10 389 325 | — | 103 893,25 | 2 020,91 | — |

| Total | 10 389 325 | 109 500 | 103 893,25 | 77 000 | 32 500 | |

Thus, the company has the right to take into account all advertising expenses incurred in the tax base.

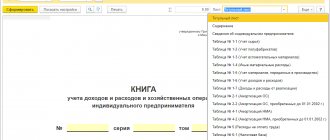

Travel agency accounting

A tourist voucher is a mandatory integral part of the Agreement on the sale of a tourism product. This is a Strict Reporting Form (SRF). Filled out in 2 copies, one each for the tourist and the Travel Agency. In what cases is it necessary to use CCT? In the case of issuing BSO, you do not need to use cash register equipment (CCT).

This provision does not apply in cases where the client has made an advance payment (advance payment) for the trip. In case of receiving an advance for a trip, the client must be issued a cash register receipt. If the Travel Agent sells other, non-tourist products to clients, for example, booking air tickets, it is impossible to work without the use of cash register systems.

Mandatory preparation of an Agent's Report on the sale of vouchers. The travel agent is obliged to submit to the Tour Operator the Agent's Report on the sale of the tour. The Report calculates the remuneration. This document is signed by the head of the Tour Operator.

Possible terms of remuneration for a travel agent

When concluding an agreement for the provision of paid services, the income of a travel agent, subject to taxation, is formed in the usual manner as the difference between the sale price to a tourist and the purchase price of the service from a tour operator, taking into account other sales expenses (with a simplified tax system of 15%) or as the entire cost of sale (with a simplified tax system of 6 %).

For an agency agreement concluded between the final buyer and a travel agent, the travel agent's income (his agency fee) will be the difference between the amount received from the buyer and the amount paid to the tour operator. Depending on the chosen tax base, the entire amount of remuneration will be subject to tax (STS 6%) or reduced by sales expenses (STS 15%). A mandatory requirement for such an agreement will be the preparation of an agent’s report reflecting the amount of his remuneration, which must be signed by the end buyer.

For a sample of such a report, see the material “Sample Agent Report under an Agency Agreement.”

With an agency agreement, according to which the travel agent acts on the instructions of the tour operator, the amount of the travel agent’s remuneration, from which tax will be charged according to the rules of the selected tax base, largely depends on the conditions included in the agreement. Options for this reward may be:

- The tour operator pays a fixed amount of remuneration for each tourist product sold, regardless of its actual cost.

- The size of the travel agent's remuneration is determined as a percentage of the cost of the tourism product. Here it will be necessary to clarify which one, since the real cost of a tourist product can be changed due to a discount, an additional increase in price or exchange rate difference (if the cost is indicated in monetary units).

- The remuneration is calculated according to a special algorithm, which is given in the contract.

Special clauses in the contract are required in situations where sales are allowed at a discount or at a price higher than that offered by the tour operator. The right to such a sale must be included in the contract. A minimum acceptable selling price may be specified. But in any case, it is necessary to establish at whose expense the discount is being made, and who will be the recipient of the additional income.

The discount can be achieved through:

- tour operator income;

- travel agent fees;

- income of both of them, which requires defining in the contract the procedure for distributing the discount between them.

When sold at a higher price, the additional income can become income:

- tour operator,

- travel agent,

- both of them.

In the latter case, the agreement must specify the principle of distribution of additional income. If there is no such clause, then it must be divided equally between the parties to the agency agreement (Article 992 of the Civil Code of the Russian Federation).

Thus, the final amount of a travel agent’s remuneration under an agency agreement depends on its terms and consists of the agent’s remuneration itself (letter of the Ministry of Finance of the Russian Federation dated March 30, 2012 No. 03-11-06/2/50) and additional income (letter of the Ministry of Finance of the Russian Federation dated November 18, 2009 No. 03-11-06/2/244). Other amounts related to the fulfillment by a travel agent of the instructions assigned to him by the tour operator are not included in the travel agent’s income (letter of the Ministry of Finance of the Russian Federation dated September 4, 2013 No. 03-11-11/36394).

All calculations regarding the final amount of remuneration under the agency agreement concluded between the travel agent and the tour operator must be present in the travel agent’s monthly report provided to the tour operator. In accordance with them, both parties determine the actual amount of their income. For the tour operator, it will be equal to the entire amount of receipts from the final buyer. At the same time, the tour operator will also see in the report the amount of its expenses for this income. The expense will be equal to the amount of remuneration due to the travel agent. For a travel agent who is on the simplified tax system, the income subject to tax of 15 or 6% will be his agency fee.

The contract must also include a condition on how the travel agent will receive remuneration from the tour operator:

- deducting its amount from the cost of the tourism product received from the final buyer;

- directly from the tour operator after transferring to him the entire cost of the tourism product received from the final buyer.

With the simplified tax system, which involves accounting for income and expenses using the cash method, the date for determining the income on which tax will be calculated depends on this condition.