Filing reports is one of the main responsibilities of a taxpayer. Of course, people don’t start a business in order to endlessly fill out and submit documents to the tax and other supervisory authorities. The main goal of an entrepreneur is to make a profit.

But without submitted reports, the tax office will not be able to control the correct calculation of taxes and their timely payment. Therefore, for violating the deadlines of the tax calendar, the entrepreneur is fined and the current account is blocked.

In order not to create problems for yourself and not to slow down the development of your business, you need to know how to report within the framework of your tax regime. In this article you will learn what reports an individual entrepreneur submits using a simplified procedure and what taxes he pays.

Submit reports online

Types of reporting

Before moving on to what kind of reporting an individual entrepreneur submits without employees, a little information about its types.

- Tax reporting. Each taxation system has its own forms of declarations and accounting books. In addition, it is necessary to ensure that the declaration form corresponds to the reporting period. If you file a declaration on an outdated form, it will be considered unfiled.

- Employee reporting. As soon as a business employs hired personnel, the employer has additional responsibilities. Personnel reporting does not depend on the tax regime; it is complex and voluminous, and it is difficult to maintain it without special knowledge or a program.

- Reporting on insurance premiums. Nowadays, individual entrepreneurs without employees do not submit reports on insurance premiums, but such an obligation existed several years ago. That is, it is necessary to report on the payment of contributions only if there are hired personnel. And information on contributions for oneself is reflected only in the annual declaration; there is no special report for these payments.

- Statistical reporting. It is known that a system of interdepartmental interaction has been developed for government bodies. This is done so that the Federal Tax Service, extra-budgetary funds and other departments independently exchange information about the activities of the taxpayer (amount of income and expenses, payment of taxes and contributions, availability of employees, etc.). But despite this, Rosstat was able to introduce into the Code of Administrative Offenses of the Russian Federation a provision on high fines for individual entrepreneurs in case of violation of the deadlines for submitting statistical reports: from 10 to 50 thousand rubles. Moreover, there are no common deadlines for all, so each entrepreneur must periodically check whether he is included in the reporting sample.

- Financial statements. Individual entrepreneurs are exempt from accounting and are not required to submit these reports. But some individual entrepreneurs who own large businesses keep accounting records voluntarily, for themselves.

- Property reporting. An individual entrepreneur remains an individual, therefore his property is subject to taxes upon notification from the Federal Tax Service. This means that, unlike organizations, individual entrepreneurs do not submit special declarations on real estate or transport. The main thing here is to pay the tax on time in the amounts and terms specified in the notice.

Thus, if an entrepreneur has switched to the simplified tax system and has no employees, his reporting obligations are minimal. A simplified individual entrepreneur only needs to appear at the tax office once a year - when submitting a declaration.

Prepare a simplified taxation system declaration online

OSNO, simplified tax system and UTII

General taxation system

Individual entrepreneurs under the general taxation regime must provide the tax inspectorate with reporting information on personal income tax and VAT:

- report on form 3-NDFL – once a year until April 30 (for personal income tax);

- VAT return – by the 25th day after each quarter (must be submitted electronically).

General regime residents are required to file a declaration regardless of whether they received income or not. If there is no income, a zero declaration is submitted. Submission deadlines are the same.

Entrepreneurs on OSNO who have just started doing business must also report on Form 4-NDFL. The declaration must indicate the amount of expected income for the next year. Reporting in this form must be submitted at least once. Term – within five days after receiving the first income from business activity. Such a report is necessary so that the tax office can calculate advance payments for personal income tax.

When calculating advances for the following periods, tax authorities will start from the income for the past year. Thus, there is no need to submit a declaration annually in Form 4-NDFL. However, if income increases or decreases by more than 50 percent, it will be necessary to recalculate the advances.

Simplified taxation system

Individual entrepreneurs need to report only once a year. The deadline for filing a declaration for the year for individual entrepreneurs on the simplified tax system is no later than April 30.

All simplified entrepreneurs have one declaration form. The difference in filling out the sections depends on the object of taxation: income for the simplified tax system of 6% and income minus expenses for the simplified tax system of 15%.

If during the reporting period the individual entrepreneur was not engaged in entrepreneurial activity or had no income, he is obliged to report in any case by filing a zero declaration.

A single tax on imputed income

Entrepreneurs using UTII report quarterly, that is, every three months. They are required to submit a UTII declaration within the following deadlines:

- for the first quarter – until April 20;

- for the second quarter – until July 20;

- for the third quarter – until October 20;

- for the fourth quarter – until January 20.

If the specified deadline falls on a weekend or holiday, you must submit the declaration on the next business day. For example, in order to report for the third quarter of 2022, an imputed individual entrepreneur had to submit a declaration no later than October 21, 2022.

Note: the UTII declaration must be submitted to the Federal Tax Service where the entrepreneur registered as a UTII payer. If an individual entrepreneur is registered with several branches of the tax office, he must report to each Federal Tax Service.

Entrepreneurs on UTII are required to keep records of physical indicators necessary for calculating tax. These include employees, vehicles, retail space and the like. They may not keep records of income and expenses for tax purposes.

Individual entrepreneurs on imputation do not submit a zero declaration, including those cases when there was no activity or no income. It is believed that they can file a zero return if there was no physical indicator, but this has no clear legal basis.

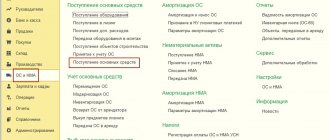

Tax reporting of individual entrepreneurs on the simplified tax system

So, the annual declaration of individual entrepreneurs on the simplified tax system without employees in 2022 is the main form of reporting to the tax office. You can find all the details about filling out and submitting the declaration using the example of the simplified tax system for income here.

In addition, the tax reporting of individual entrepreneurs without employees includes a ledger for recording income and expenses. Although KUDiR is not submitted to the Federal Tax Service, it must be kept for each year and kept at home. The fact is that at the end of the reporting campaign, the tax office can request a book and check whether the data from it coincides with those indicated in the declaration.

Additionally, some entrepreneurs using the simplified tax system can submit the following tax reports:

- declaration on indirect taxes when importing goods from the EAEU;

- VAT return for tax agents on VAT or conducting operations under joint venture agreements, trust management of property, concession agreements.

As you can see, these forms are required only in cases specified by law; the majority of simplified students do not submit them.

Individual entrepreneurs' tax reporting depending on the taxation regime.

BASIC:

- VAT declaration. Submitted at the end of each quarter no later than the 25th day of the month following the reporting quarter.

- Declaration 3-NDFL. Due at the end of the calendar year no later than April 30 of the year following the reporting year.

USN:

- Declaration of the simplified tax system. Due at the end of the calendar year no later than April 30 of the year following the reporting year.

Unified agricultural tax:

- Declaration of the Unified Agricultural Tax. Due at the end of the calendar year no later than March 31 of the year following the reporting year.

PSN:

- Under the patent taxation system, a declaration is not filed.

NPD:

- When paying tax on professional income, which only individual entrepreneurs without employees have the right to pay, a declaration is not submitted.

Important:

- In all tax regimes, except NPA, you need to keep records of income and expenses in a special book (KUDIR). This document has not been required to be certified by the tax office for several years. But it is necessary to keep the book in proper form - bound and numbered. Failure to keep a Book of Income and Expenses may result in a fine.

- If an individual entrepreneur uses different taxation systems for different types of activities, for example, simplified tax system and PSN, then reports must be submitted for each of them.

- All reporting on the chosen taxation system is submitted to the Federal Tax Service.

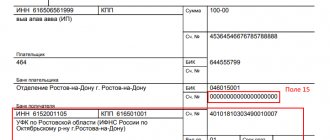

Mandatory payments to the simplified tax system

But knowing what kind of reporting an individual entrepreneur submits to the simplified tax system without employees is not enough. The simplified tax calendar also includes deadlines for paying taxes and contributions. Let’s take a closer look at what payments an individual entrepreneur makes to the budget using a simplified taxation system.

1. Insurance premiums for yourself. These payments are divided into fixed, the same for all entrepreneurs, and additional. An individual entrepreneur must pay 43,211 rubles for himself in 2022 plus an additional contribution (1% of the excess annual income of 300,000 rubles).

2. Advance payments at a rate of 6% of income. This is part of the single tax that is paid at the end of each reporting period:

- first quarter;

- half year;

- nine month.

Advances are paid only when income is received in the reporting period; if there is no income, then nothing needs to be paid.

3. Tax at the end of the year at a rate of 6%. The final calculation of the single tax occurs at the end of the year, taking into account all advance payments and insurance premiums paid. Often, with low income of an entrepreneur without employees, tax payments are completely reduced by contributions, so the tax at the end of the year is zero.

Important: if an entrepreneur works within the tax holiday, he can take advantage of the benefit for up to two years and not pay tax. As for insurance premiums for themselves, all simplifiers pay them, including on vacation.

Deadlines

The tax period under the simplified tax system is a year.

Reporting periods: first quarter, half year, 9 months. Based on the results of the tax period, entrepreneurs submit a declaration to the tax service. Individual entrepreneurs must meet the deadline by April 30 of the year following the expired tax period.

Entrepreneurs make advance payments throughout the year. Deadlines for paying individual entrepreneur taxes on the simplified tax system in the form of advance payments:

- until 25.04. for the first quarter;

- until 25.07. For half a year;

- until 25.10. in 9 months

Advance payments made during the year are taken into account when calculating the annual tax. The tax amount can be reduced by paying insurance premiums.

Note! Due to the spread of coronavirus infection, the Government has decided to extend the deadlines for submitting declarations and paying taxes. More details in the summary table.

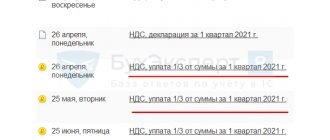

Tax calendar for individual entrepreneurs on the simplified tax system without employees in 2022

Although the calendar of deadlines for submitting reports and payments in the simplified mode is one of the simplest, it is more convenient to remember it in the form of a table. Keep it for yourself so you don’t forget that the individual entrepreneur pays in a simplified manner and when he reports.

Table: what payments does an individual entrepreneur pay and what reports does he submit to the simplified tax system without employees in 2022

| Payment or reporting | Reporting period | Deadline |

| Advance payment for the 1st quarter | 1st quarter 2022 | 25.04.22 |

| Tax return | 2021 | 30.04.22 |

| Tax at the end of the year | 2021 | 30.04.22 |

| Advance payment for half a year | 1st half of 2022 | 25.07.22 |

| Advance payment for 9 months | 9 months of 2022 | 25.10.22 |

| Fixed insurance premiums for yourself | 2022 | 31.12.22 |

| Additional contribution (for income above 300,000) | 2022 | 01.07.23 |

Individual entrepreneurs on the simplified tax system with hired employees: reports for 2022

What kind of reporting do individual entrepreneurs submit under the simplified tax system? If we talk about simplified tax reporting for individual entrepreneurs, then this is just one declaration at the end of the year. Individual entrepreneurs are required to submit a simplified declaration no later than April 30 of the current year for the previous one.

Organizations have less time to submit a declaration under the simplified tax system; for them the deadline is March 31. At the end of each quarter, simplified tax payers must calculate and pay an advance payment on the income received. Quarterly reporting on the simplified tax system is not established.

The form of the declaration under the simplified tax system often changes, and submission of individual entrepreneurs’ reports using an outdated form is equivalent to its failure to submit it. You can find the current, valid declaration form on the Federal Tax Service website tax.ru or in our sample documents.

Prepare a simplified taxation system declaration online

Individual entrepreneurs using the simplified tax system with employees submit RSV and 6-NDFL reports to the tax office, which reflect information about the amounts paid to employees, as well as the withheld and transferred income tax. In the case of personal income tax, the employer is not a taxpayer, but a tax agent.

- The deadline for submitting the DAM for individual entrepreneurs in 2022 is every quarter, no later than the 30th day of the month following the reporting period;

- The deadline for submitting 6-NDFL in 2022 for individual entrepreneurs is no later than the end of the next month for the reporting quarter, and for the last year you must report no later than March 1, 2022.

As for information on the average number of employees, in 2022 they will not be submitted separately, but as part of the DAM.

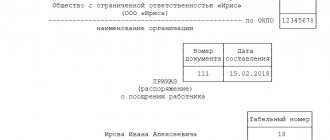

The accounting of an individual entrepreneur with employees is much more complicated than the reporting of an entrepreneur working independently. You must be able to calculate and pay wages twice a month, calculate and transfer insurance premiums monthly, and, if necessary, calculate vacation pay, sick leave, and maternity benefits. Plus, you have to submit reports - once a quarter or month. We recommend transferring the maintenance of calculations, accounting, and reporting to specialists, because mistakes can result in severe penalties. Outsourcing accounting services often costs much less than the salary of a full-time accountant.

Free accounting services from 1C

Every month, no later than the 15th day of the month following the billing month, individual entrepreneurs pay insurance premiums for employees from their own funds. You can learn more about which funds these amounts are distributed into in the article “Insurance premiums of individual entrepreneurs.”

What reports does the individual entrepreneur submit to the funds? As before, the report to the Social Insurance Fund is submitted quarterly using Form 4-FSS. In addition, starting from January 2022, a new report “Information about the insured person” will be submitted to the social insurance fund. The deadline for submission is when an employee is hired, as well as when previously submitted information about him is changed.

In 2022, employers submit monthly reports for employees to the Pension Fund in the SZV-M form. In addition, at the end of 2022, it is necessary to submit annual reports on employees to the Pension Fund of Russia - SZV-Experience. The deadline is no later than March 1 of the following year and upon the occurrence of certain personnel events.

Another reporting form, SZV-TD, was approved in connection with the introduction of electronic work books. It must be submitted no later than the 15th day of the month following the reporting month. However, not every month is considered reporting, but only the one in which a personnel event occurred (hiring, transfer, dismissal of an employee or receiving from him an application on the format of the work book).

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Many banks offer favorable conditions for servicing and maintaining current accounts; you can view the offers here.