Equipment accounting in 1C 8.3 - step-by-step instructions

On January 21, the Organization purchased equipment - Charging station SZ X-05ND in disassembled form for the amount of 240,000 rubles. (including VAT 20%).

January 24 The equipment was handed over to the contractor for assembly and installation in the production facility.

On January 28, the contractor completed work on the assembly and installation of the facility in the amount of 10,000 rubles. (without VAT).

The facility was put into operation on the same day.

According to the accounting policies of the Organization, the object is a fixed asset.

Installation of equipment in 1C 8.3 step-by-step instructions PDF

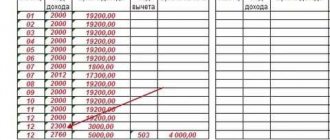

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of equipment | |||||||

| January 21 | 07 | 60.01 | 200 000 | 200 000 | 200 000 | Acceptance of equipment for installation | Receipt (act, invoice, UPD) - Equipment |

| 19.01 | 60.01 | 40 000 | 40 000 | Acceptance for VAT accounting | |||

| Acceptance of VAT deduction on equipment | |||||||

| March 31 | 68.02 | 19.01 | 40 000 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 40 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Transfer of equipment for installation | |||||||

| January 24 | 08.03 | 07 | 200 000 | 200 000 | 200 000 | Transfer of equipment for installation | Transfer of equipment for installation |

| Receipt of installation works | |||||||

| 28 January | 08.03 | 60.01 | 10 000 | 10 000 | 10 000 | Accounting for installation costs in the asset cost | Receipt (act, invoice, UPD) - Services (act, UPD) |

| OS commissioning | |||||||

| 28 January | 01.01 | 08.03 | 210 000 | 210 000 | 210 000 | OS commissioning | Acceptance for accounting of fixed assets - Construction objects |

Features of accounting for costs of equipment that needs installation

For accounting, account 07 “Equipment for installation” is used. It is considered active. Based on the debit balance, you can understand whether there is equipment that needs installation at the beginning of the period. Debit turnover records the receipt of equipment that needs installation. The final balance reflects the availability of equipment that needs installation at the end of the reporting period.

FOR YOUR INFORMATION! Detailed accounting by account. 7 is carried out according to the storage location of the equipment and its name/brands.

Nuances of accounting for equipment that needs installation

OSes that require installation must be sent to a separate synthetic account. Objects will be held in a segregated account until they are ready for use. It is assumed that after installation the OS will be launched.

Equipment is recorded in accounting based on the total amount of expenses incurred for acquisition and preparation. In particular, these are the following expenses:

- Cost of equipment.

- Delivery of the object and its shipment.

- Adjustment and installation work.

- Storage of equipment until it is started.

- Installation of supports for equipment and foundations.

An enterprise can simultaneously purchase several objects that need installation. In this case, the total costs are distributed among the assets involved.

Installation is either carried out by company employees or outsourced. This activity may include the following work:

- Installation of the asset in the area where the launch will take place.

- Assembly of parts.

- Attaching control elements.

- Analysis of the performance of the object and its serviceability.

- Wiring insulation.

If the equipment was not launched on time, this is recorded in the reporting.

Installation costs are credited to the value of the asset on the basis of these papers: an act of work performed by the contractor, an accounting certificate. Help is needed when the installation was carried out by company employees. The next stage is checking the functionality of the equipment. After this, the equipment is put into operation. The asset becomes the OS.

Features of accepting equipment for accounting

Accounting for equipment that needs installation involves drawing up primary documentation. The primary report is compiled according to these forms:

- OS-14 (acceptance certificate).

- OS-15 (sending equipment for installation work).

- OS-16 (defect detection).

- OS-1 (accounting in OS status).

These forms are not required to be used. The company itself can approve the necessary forms of documents.

Receipt of equipment

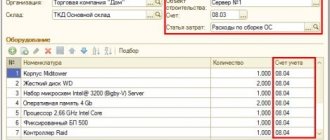

For the received equipment, fill out the document Receipt (act, invoice, UPD) operation type Equipment in the Purchases .

In the document on the Equipment , indicate all components from the supplier document. In our example, the equipment is listed as one item despite the fact that it requires assembly.

The accounting account is entered automatically if the item type is Equipment for installation .

At the bottom of the document, register the invoice or select the UTD radio button if the supplier provided one. VAT will be deducted in the document Formation of purchase ledger entries.

Clarified when to deduct VAT on equipment requiring installation

If the components arrived in several batches, arrange each one in the same way.

Postings

Transfer of equipment for installation in 1C 8.3

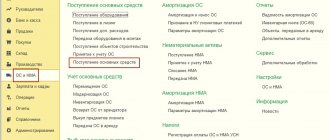

After all components have arrived and assembly of the fixed asset has begun, create a document Transfer of equipment for installation in the OS and intangible assets .

Construction objects in 1C 8.3 is a reference book. Create a directory entry for this object and specify it in the appropriate field. The accounting account is filled in automatically.

In the tabular section, indicate all equipment transferred for installation.

Postings

For this construction project, all costs for the creation of fixed assets will be accumulated on account 08.03 “Construction of fixed assets”.

Initial cost

Accept fixed assets that require installation for accounting at their original cost (clause 7 of PBU 6/01). Include in the initial cost of such objects:

- cost of equipment or its individual parts (components);

- the amount of expenses associated with bringing the installed equipment to a condition suitable for use as a fixed asset. These are, for example, installation costs, the cost of materials used during installation, salaries of employees who carried out installation, etc.

The amount of expenses that form the initial cost of a fixed asset requiring installation is determined based on:

- primary accounting documents (contracts, invoices, acceptance certificates, acts of completed work, etc.);

- other primary documents confirming the costs incurred (customs declarations, business trip orders, etc.).

This procedure is provided for in paragraph 8 of PBU 6/01.

Situation: how to determine in accounting the cost of equipment (or its individual parts) that requires installation (account 07) upon its receipt?

The answer to this question depends on how the equipment is received: for a fee, by barter, free of charge or as a contribution to the authorized capital.

In accounting, the cost of equipment or its individual parts (components) requiring installation is included in the initial cost of the fixed asset along with other costs (for example, installation costs, cost of consulting services) associated with the creation of this fixed asset (clause 8 of PBU 6/ 01).

The norms of PBU 6/01 and PBU 5/01 do not apply when determining the cost of equipment requiring installation (clause 3 of PBU 6/01, clause 4 of PBU 5/01). Therefore, when capitalizing an object to account 07, follow the rules set out in paragraph 23 of the Regulations on Accounting and Reporting. In particular, if the equipment is purchased for a fee, include in its cost the amount paid to the supplier, as well as other costs associated with the acquisition. The same procedure is provided for in the Instructions for the chart of accounts.

When determining the cost of equipment received free of charge, take into account its market value and associated costs associated with receiving such property (clause 23 of the Regulations on Accounting and Reporting). At the same time, when determining the market value, follow the same rules as for the gratuitous receipt of fixed assets.

When determining the cost of equipment received as a contribution to the authorized capital, take into account the requirements of paragraph 3 of Article 34 of the Law of December 26, 1995 No. 208-FZ and paragraph 2 of Article 15 of the Law of February 8, 1998 No. 14-FZ. Include the monetary value agreed upon by the founders (participants) in the cost of the equipment. However, this indicator should not exceed the market value of the property, determined by an independent appraiser:

- in joint stock companies;

- in an LLC, if the participant’s share in the authorized capital, which is paid for with fixed assets, exceeds 20,000 rubles.

Advice: upon receipt of equipment contributed as a contribution to the authorized capital, additional costs may arise (for example, delivery costs). The procedure for their accounting is not established by law. Therefore, develop it yourself and enshrine it in your accounting policies (Article 8 of the Law of December 6, 2011 No. 402-FZ, clauses 4–6 PBU 1/2008).

It is most convenient to take into account additional costs when determining the cost of equipment that requires installation (on account 07). After installation, this equipment will be included in fixed assets. Consequently, the costs of its delivery should increase the initial cost of the finished fixed asset (clauses 8 and 12 of PBU 6/01).

The rules for determining the value of equipment received under a barter agreement (exchange agreement) are also not regulated by law. Therefore, when you receive equipment that requires installation, determine its cost in the same way as for fixed assets. Fix this procedure in the accounting policy (Article 8 of the Law of December 6, 2011 No. 402-FZ, clauses 4–6 PBU 1/2008).

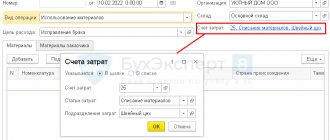

Receipt of installation works

Accept installation work for accounting using the document Receipt (act, invoice, UPD) transaction type Services in the Purchases .

In the Accounts , indicate the same Construction Object .

Postings

Installation costs will increase the cost of the property.

Commissioning of fixed assets

When all costs have been collected and the object has been installed, put it into operation using the document Acceptance for accounting of fixed assets type Construction objects in the section fixed assets and intangible assets .

On the Construction Object , select the desired object, and using the Calculate amounts , the cost of the costs collected for it will be filled in automatically.

On the Fixed Assets , specify the newly created directory item of the same name.

Fill in all the necessary parameters for accounting and tax accounting of the fixed asset on the appropriate tabs.

Document Acceptance for accounting of fixed assets

Postings

The cost of the object is transferred to the account on 01.01.

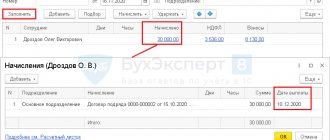

Control

Generate SALT according to equipment accounting accounts for the period from its receipt to the commissioning of the fixed asset.

These accounts should not have a balance for this equipment, except for account 01.01 “Fixed assets in the organization.”

Installation of fixed assets: when purchasing alone is not enough

Among the many types of fixed assets acquired by an organization, there may be those that require installation. For example, such objects include production equipment, which is put into operation only after assembly and attachment to a support, or control and measuring instruments mounted in the installed equipment.

As a rule, equipment after its installation is accounted for as part of fixed assets, therefore it is taken into account at its original cost.

So how do you take into account fixed assets that require installation?

The initial cost of the property should include:

— the amount paid to the supplier for the equipment under the contract;

- the amount paid for the delivery and bringing the fixed asset into a condition suitable for further use.

This accounting procedure is specified in clauses 7 and 8 of PBU 6/01.

To determine the cost of equipment requiring installation, account 07 “Equipment for installation” is used. It reflects all the costs of installing fixed assets: the cost of materials used for installation, salaries of employees performing installation, consulting services, etc.

All this increases the initial cost of the fixed asset. The amount of costs for installation of equipment is determined on the basis of primary documents: these can be contracts, invoices, certificates of work performed, etc. In addition, documents confirming expenses incurred may be business trip orders, customs declarations, etc.

Meanwhile, it is necessary to pay attention to the following point: when determining the cost of equipment that requires installation, the standards of PBU 6/01 are not applied. In this case, you should be guided by the rules of paragraph 23 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

We prepare the documents correctly!

When preparing documentation for equipment that requires installation, it is necessary to take into account the norms of the Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets.”

Acceptance of fixed assets requiring installation is carried out by a special commission, which checks the compliance of the equipment with technical characteristics, the absence of defects, the possibility of its use, etc., and draws up an act on the acceptance (receipt) of the equipment (form No. OS-14).

You can install fixed assets either on your own or with the help of a contractor. In any case, an act on acceptance and transfer of equipment for installation is drawn up (form No. OS-15), into which information is entered based on the act f. No. OS-14. It is worth noting the fact that when installation work is performed by a contractor, this document is drawn up in a single copy: in the organization’s act, the contractor notes that he has received the equipment for installation, signs and takes a copy of the act.

After completion of all installation work, the commission checks the completeness and quality of the work performed and draws up an act of acceptance and transfer of fixed assets (form No. OS-1). From this moment on, the equipment becomes the main means.

We reflect the installation of fixed assets in accounting

First of all, it is necessary to reflect in accounting all the costs of purchasing equipment. For this, account 07 “Equipment for installation” is used. This includes not only the cost of the equipment itself, but also consulting services, delivery costs, etc. Based on the act f. No. OS-14 the following entries are made:

Debit 07 Credit 60 (76)

— the cost of equipment requiring installation and the cost of its acquisition;

Debit 19 Credit 60 (76)

- for the amount of “input” VAT.

To account for the costs of installation of fixed assets, account 08-3 “Construction of fixed assets” is intended. After registration of the act f. No. OS-15 for the cost of equipment transferred for further installation (including all costs for its acquisition), the following is posted:

Debit 08-3 Credit 07

Costs associated with installation are also collected in the debit of account 08-3:

Debit 08-3 Credit 10 (23, 25, 26, 60, 70, 76, etc.)

For these costs it is also necessary to reflect the “input” VAT:

Debit 19 Credit 60 (76)

- the amount of VAT on costs associated with the installation of equipment.

When the installation of fixed assets is completed, then on the basis of the act f. No. OS-1, they are accepted for accounting as newly created fixed assets and put into operation. In this case the following wiring is done:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3

or

Debit 01 (03) subaccount “Fixed assets in operation” Credit 08-3

- to the initial cost of the created fixed asset.

VAT

It is worth dwelling on some points related to VAT accounting:

— input VAT on equipment that requires installation is deducted at the moment when it is reflected in accounting (on account 07);

- in the case when the equipment is supplied for a fee, then both the VAT paid to the supplier and the VAT on the costs associated with the purchase of the equipment are taken into deduction;

— when installing equipment by a contractor, “input” VAT is taken for deduction immediately after the cost of installation work is reflected on account 08-3;

— if the installation was carried out on its own, then at the end of each tax period VAT is charged on the cost of installation work, and in the same period it is deducted.

These provisions are specified in the Tax Code of the Russian Federation (clause 2 of article 159, clause 10 of article 167, clauses 1 and 6 of article 171, clauses 1 and 5 of article 172), as well as in letters from the Ministry of Finance of Russia dated April 13 2006 No. 03-04-11/65 and dated August 27, 2010 No. 03-07-08/250.

Example

In June 2012, Snezhinka LLC purchased equipment to assemble a production line. In accordance with the supply agreement, the equipment costs RUB 2,360,000. (including VAT – 360,000 rubles). Paid 11,800 rubles for delivery to the transport company. (including VAT - 1800 rubles). In the same month, the organization began installing equipment in the main production workshop.

A contractor was hired to install the equipment. The cost of his services was 59,000 rubles. (including VAT – 9,000 rubles).

In July, the installation of the production line was completed and the equipment was put into operation. In the same month, the contractor drew up an act in form No. KS-2 and a certificate in form No. KS-3, on the basis of which the organization made payments to him for installation.

When commissioning the equipment, the company accountant drew up a report in form No. OS-1.

The following entries were made in the accounting records of Snezhinka.

In June:

Debit 07 - Credit 60 - 2,000,000 rub. – cost of equipment purchased from the supplier;

Debit 07 - Credit 60 - 10,000 rub. – transport services for the delivery of equipment have been taken into account;

Debit 19 - Credit 60 - 360,000 rub. input VAT on equipment has been taken into account;

Debit 19 – Credit 60 – 1,800 – input VAT on transport services;

Debit 08-3 - Credit 07 - 2,010,000 rub. – the equipment has been handed over for installation;

Debit 68 subaccount “Calculations for VAT” Credit 19 – RUB 361,800. – input VAT is accepted for deduction.

In July:

Debit 08-3 - Credit 60 - 50,000 rub. – cost of contractor services for installation of equipment;

Debit 19 - Credit 60 - 9,000 rub. – input VAT on installation work is taken into account;

Debit 01 – Credit 08-3 – RUB 2,060,000. – the equipment has been put into operation;

Debit 68 - Credit 19 - 9,000 rubles. – input VAT on installation work is accepted for deduction.

Read here what else needs to be included in the initial cost of a fixed asset. And about when to start calculating depreciation, see here.

In your practice, do you often encounter the purchase of fixed assets that require installation? Please share in the comments!