Why do you need a route sheet?

To answer the question of what a route sheet is, it is necessary to determine the purposes of its creation and use. Many employees in the organization: drivers, couriers, forwarders - have a traveling nature of work. The Labor Code (Article 168.1 of the Labor Code of the Russian Federation) obliges employers to reimburse workers for expenses related to business trips. Expenses must be supported by relevant documents. One of them is a route sheet.

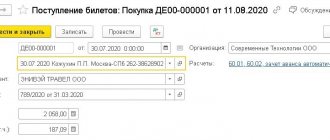

With its help, employees confirm, for example, the costs of paying for gasoline or purchasing public transport tickets.

In the future, the form, together with a report on the use of money allocated by the enterprise, is the basis for paying compensation to the employee according to his expenses. It is also an accounting and tax document.

In some cases, such reports help business managers analyze employee routes and create optimal delivery routes, that is, work out logistics. These actions significantly reduce the organization’s costs for moving employees around the city.

There is no approved form, and organizations develop their own forms. It is important that the form allows you to trace the goals and routes of travel and contains all the “primary” details.

As a basis, it is allowed to use form No. 3, approved by Resolution of the State Statistics Committee of the Russian Federation No. 78 of November 28, 1997. The form prepared by the enterprise is approved in the accounting policy of the organization. It also specifies the frequency of preparation and submission, and the procedure for its execution. When using a travel voucher form, the mandatory details introduced by Order of the Ministry of Transport No. 368 of September 11, 2020 and Federal Law No. 402 of December 6, 2011 on accounting are taken into account. If forms are used for write-offs, it is recommended to take them into account - these are details such as, for example, types of messages and transportation (introduced by Order of the Ministry of Transport of the Russian Federation No. 368 of September 11, 2020) or date, name of the organization, content of the operation, measurement value of the operation, name of the official and his signature (Article 9 of the Federal Law-402).

An example of filling out a route sheet for a truck driver:

The difference between a waybill and a route

There are specialists, including those in regulatory authorities, who do not see any differences between waybills and route sheets. In some letters from departments, the route sheet is placed in brackets after the waybill, thereby indicating an analogy. Meanwhile, these are completely different documents . The only thing they can have in common is that they both fill in the route.

As mentioned above, the waybill is mandatory document. Its form has been approved by the Ministry of Transport for cars, trucks, self-propelled vehicles, cranes, etc. Drawing up a driver’s route sheet is voluntary . It may not contain information about fuel consumption and speedometer readings in order to avoid duplication of information.

The developed form of the driver’s route sheet must be approved in the order on accounting policies. It is also possible to approve its form or include it in the album of primary accounting documents by a separate order. Or prepare separate orders for types of activities. For example, documents on working on freight transport, passenger transportation, etc.

Registration procedure

The order of document movement in the organization:

- It is compiled personally by the employee before the trip or by a logistician.

- Issue data is entered into a journal.

- Marks are made along the way.

- Upon return, the paper is handed over to the accounting department or logistics department.

Original documents (checks) confirming expenses are attached to it: an employee’s report on expenses incurred, travel documents, etc.

The organization's accountant checks the expenses, and the director signs an order for reimbursement of expenses. After this, the employee is reimbursed for expenses if he spent his own money, or the accounting department prepares accountable amounts that were issued.

ConsultantPlus experts figured out how to write off fuel and lubricant expenses. Use these instructions for free.

Route sheet and waybill are two different documents

A waybill is a document that is used to record and control the operation of a vehicle and driver.

It is compiled as required by law. Operating a vehicle without a waybill is in most cases prohibited. In particular, transportation of passengers and cargo is not allowed without a waybill. The list of details and rules for drawing up this document are established by law. And for its absence there is a fine. The route sheet is an optional document. The company decides on its introduction into its document flow voluntarily, guided by its own goals and needs. She also determines the form and details of this document herself. The waybill is drawn up only for vehicles, while route sheets can be issued to employees traveling on public transport, wheeled vehicles and even on foot.

There is a whole selection of materials dedicated to waybills on our website. And in this article we will tell you more about the route sheet. And of course, then you can also get a sample route sheet for free.

Filling rules

Since there is no unified form and rules for filling it out, the route sheet is drawn up according to the internal rules of the enterprise. It is recommended to provide the basic details for identifying expenses, columns reflecting the route, and fill it out as follows:

- The name of the organization is written at the top center of the line. Below indicate the location and date of registration;

- write down your full name. and the position of the employee for whom the route sheet is drawn up, information about the make of the car is entered, and the purpose of the trip is formulated;

- in the table, the date of the trip, address, time of arrival and departure, name and details confirming the costs of the trip, the amount of funds spent are entered in order;

- The form is signed by the employee for whom it is issued and his immediate supervisor.

Once the form is completed and certified properly, it becomes a tax accounting document in the accounting department. In the event of tax audits, regulatory structures have the right to review it.

How to create your own form

There are no strict regulatory requirements for how to make a route sheet; it is permissible to develop an individual document format that fully meets the specifics of the institution’s activities and the specifics of the work of a particular employee. Please ensure that the paper contains the following mandatory details:

- Title of the document.

- Full name of the organization that issued the ML.

- Place and date of issue of the form, if prepared outside the company.

- Validity. ML is issued for a period of one day or for a week or a month.

- FULL NAME. the employee who received the document, his position and structural unit.

Next, a special table is filled in. The following must be indicated in the tabular section:

- Destination, that is, where the employee is sent.

- Purpose of the trip - indicates the specific purpose for which the employee went to the destination, for example, delivering a report.

- Arrival or departure notes. Such marks are made by a representative of the organization (government agency) visited by the employee.

- A type of transport used as a means of transportation, for example, a bus, taxi or personal car.

Additional information is provided in no particular order. It is possible to provide notes about the time spent in transit (this is relevant, for example, if we are talking about paper for a courier), or information about the amounts of costs incurred.

At the end, the paper is first certified by the employee responsible for drawing up the ML (full name, position, date and time, signature), and then similar information and the signature of the employee who received the document are affixed.

What to pay attention to

- Approve the procedure for working with this form in the LNA, which lists the persons responsible for its registration, issuance and storage.

- Exclude from the route sheet the item that is optional and complementary.

- It is not necessary to put a seal, but if there is a seal, then this is not a violation and will add solidity.

- The entered expenses must be justified and easily verified; entering false information will not allow reimbursement of expenses.

- It is not a waybill, and medical workers do not put marks on it.

Design features

The developed form should be approved in the accounting policy of the institution or enshrined in a separate local order. The procedure and rules for filling out must be fixed in the order. We recommend that responsible persons be familiarized with these local regulations against signature. This procedure will eliminate errors and problems in filling out the primary documentation.

If an error was made in the document when filling out, it must be corrected accordingly. An incorrect entry (error) is crossed out (with one line), a corrective entry is made next to it and a date, signature and full name are added. the employee who made the correction. The use of grouts and corrective agents is prohibited.

It is not necessary to put a stamp, since the form is an internal document - this is at the individual discretion of the institution.

The completed document must be submitted to the head of the department or directly to the accounting department. It is acceptable to attach checks, receipts and other documents confirming the employee’s expenses. For example, a taxi ticket or a bus ticket.

An example of what a route sheet looks like:

Storage order

Completed forms must be stored for at least five years, and if they confirm work in difficult, harmful or dangerous working conditions, they must be stored for 75 years. An indication of this is in paragraph 553 of the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating their storage periods, approved. By Order of Rosarkhiv No. 236 dated December 20, 2019.

How to register

Along with filling out the document itself, the correct preparation of route sheets consists of the following steps:

- The corresponding order, which is issued on behalf of the director or other authorized person. The order confirms the fact that the route sheet has been drawn up according to the sample, as well as the data presented in it.

- An employee's report on expenses for fuel and lubricants or travel - it is compiled either one-time (if trips are made rarely) or periodically (for example, once a month).

- Attached to the report are travel tickets or receipts for payment of fuel and lubricants, and other financial documents that confirm the fact of expenditure. They are subsequently used for accounting and tax accounting, as well as for calculating compensation.

Normative base

Commentary to the Letter of the Ministry of Transport of Russia No. DZ/10239-is “Route in the waybill: additional details required to confirm expenses” dated 05/14/2019

Order of the Ministry of Transport of Russia No. 368 “On approval of mandatory details and the procedure for filling out waybills” dated 09/11/2020

Resolution of the State Statistics Committee of the Russian Federation No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport” dated November 28, 1997

Shelf life

The responsibility to store the route sheet remains with the authorized employee - most often this is the chief accountant. As for shelf life, this is a less clear-cut question. On the one hand, the requirement of the Ministry of Transport (Order No. 152) states that the organization must store such a document for at least 5 years, after which it can continue storing it or destroy it if it wishes.

On the other hand, if the document is the only document that confirms the fact that the work of a driver or other employee is characterized by a certain danger, harmfulness or severity (for example, transportation of dangerous goods), its shelf life is increased by at least 70 years - i.e. original papers must be kept for 75 years.

Thus, a route sheet of any type must be kept in its original form for a minimum of 5 years, and in some cases the period is increased - 75 years.

Purpose of the sheet

The route sheet is issued for employees whose activities involve movement outside the enterprise itself. This category of workers includes:

- drivers;

- couriers;

- purchasing and sales managers;

- advertising agents;

- lawyers participating in court hearings;

- other categories of employees depending on their job functions.

The purpose of the route sheet is to record the company’s expenses for ensuring the movement of workers from the above list. Expenses include costs for fuels and lubricants, costs for public transport or taxis, costs associated with the use of an employee’s own car, etc.

In addition to the function of accounting for expenses to confirm them with the tax authorities, route sheets also have some control functions. Thus, when conducting expense audits, managers can determine the difference between expenses and actual movement or develop less expensive methods of movement.

In addition, based on the data available in the route sheets, the enterprise reimburses employees for the costs they incurred for travel for production purposes.

Sample of filling out a waybill for a legal entity

A sample form for a legal entity contains the same information as a passenger car voucher for an individual entrepreneur. However, the section about the owner of the car must be filled out a little differently.

Please indicate:

- full name of the enterprise;

- location address;

- phone number;

- organizational and legal form;

- registration number.

You will also need to fill out a column indicating which employee or department the car is at the disposal of. For example, this could be the sales department or director.

The easiest way for legal entities to issue vouchers is on a pre-designed and printed form. Because manually issuing such documents daily takes quite a lot of time. In addition, organizations and enterprises often add additional details to the form. Usually the latter relate to fuel consumption. This may also include additional notes about delays, downtime, or vehicle entries into the garage.

Exceptional moments

Some organizations undertake to pay their employees travel to their holiday destination. Such provisions must be enshrined in the local regulations of the institution, and must also have an economic justification (in terms of volume and feasibility).

Payment for this type of expense can only be made with supporting documents. For example, tickets, checks. Or the employee has the right to provide a route sheet for vacation by car if he went on vacation by personal transport.

Arrival or departure must be marked by the relevant party. For example, the administration of a sanatorium or hotel. Next, we offer an itinerary for a vacation by car.

Employees of an organization who, due to their activities, often make business trips several times a day, are usually compensated for travel expenses. To document them, a route sheet is drawn up. You can learn how to fill out this document correctly from this article, as well as download the form for a business trip itinerary sheet for free.