If the goods do not comply with the terms of the contract or are of poor quality, the buyer has the right to return it to the supplier. Processing a return from a buyer in 1C 8.3 has a number of features that we will consider in this publication.

You will learn:

- how to return goods in 1C 8.3 from the buyer,

- how to reflect the return of goods in transactions,

- what documents need to be used.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

What you need to pay attention to when returning goods from a buyer in 1C 8.3

Registration of the operation of returning goods from the buyer in 1C 8.3 Accounting depends on some nuances:

- whether the buyer is a VAT payer;

- whether the goods are registered with the buyer before they are returned;

- the entire batch of goods or only part of it is returned.

There is a solution for every situation. You can familiarize yourself with processing a return from a buyer in 1C and regulations in the table.

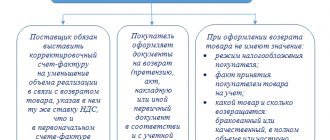

When returning goods by buyers who do not pay VAT, suppliers apply the general procedure for applying and processing deductions provided for in clause 5, clause 13 of Art. 171 Tax Code of the Russian Federation, clause 4, clause 10 art. 172 of the Tax Code of the Russian Federation (Letter of the Federal Tax Service dated May 14, 2013 N ED-4-3/ [email protected] ):

- when part of the goods is returned by the supplier, an adjustment invoice is generated and reflected in the purchase book;

- When returning an entire item, the supplier records the original invoice issued for that item in the purchase ledger.

As for the case of signing an agreement on non-issuance of invoices between a supplier and a buyer who does not pay VAT, this situation is not clearly established in the legislation. In our opinion, the supplier has the right to deduct VAT, calculated earlier upon shipment, on the basis of a primary document (for example, a shipping invoice), which must be registered in the purchase book (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 01/27/2015 N ED-4-15/ [email protected] ).

Return of goods to 1C: new rules from 2022 (from the broadcast recording dated February 6, 2022)

Let's look at how to return goods from a buyer in 1C in various circumstances and what postings are generated by 1C Accounting 8.3 in each case.

Returning funds to the buyer’s bank card in “1C: Accounting 8” (rev. 3.0)

We remind you that the return of goods by the buyer in “1C: Accounting 8” edition 3.0 is registered by the document Return of goods from the buyer (Sales section). To reflect transactions involving payment for goods (work, services) by customers using a bank payment card, the Payment Card Transaction document is intended. To summarize information on cash flows under acquiring agreements, subaccount 57.03 “Sales by payment cards” is intended.

Starting from version 3.0.49 of the program, you can issue a refund to the buyer to his payment card using the document Transaction on a payment card with the transaction type Return to the buyer (section Bank and cash desk).

We will consider the procedure for transferring funds to the buyer’s bank card when returning goods using the following example.

Example 1

| Andromeda LLC sells goods and services at retail, applies the general taxation system, is a VAT payer, and does not apply the provisions of PBU 18/02. In accordance with the accounting policy of the organization, retail goods are accounted for at purchase prices. Goods and services are sold through an automated point of sale using cash register equipment (CCT). Andromeda LLC accepts bank cards for payment. According to the terms of the agreement concluded by the organization with the acquiring bank: the acquiring bank's remuneration is 2% of the amount of revenue received; funds for goods paid for by the buyer by bank card (minus the amount of remuneration) are credited to the organization’s bank account the next day after the day of purchase; In the case of a return of goods not made on the day of purchase, the funds for the returned goods credited to the buyer’s card are withheld by the acquiring bank from the amount due for the transfer to the organization. In this case, no bank commission is charged for transferring funds. Sequence of operations: — On April 10, 2017, the organization sold men’s suits (5 pieces) for the amount of RUB 118,000.00. (including VAT 18%), which were paid by buyers in cash (RUB 70,800.00) and payment cards (RUB 47,200.00); — on April 12, 2017, the acquiring bank transferred funds to the settlement account of Andromeda LLC, minus the amount of remuneration; — 04/13/2017 an individual buyer returned a suit (1 piece), paid for by bank card, in the amount of RUB 23,600.00; — On April 17, 2017, the organization provided services in the amount of RUB 100,000.00. (including VAT 18%), which were paid by the buyer by payment card; — On April 18, 2017, the acquiring bank credited the bank account of Romashka LLC with funds minus the amount of remuneration and the amount transferred to the buyer when returning the goods. |

Retail sales of suits are reflected in the document Retail Sales Report (Sales section) with the transaction type Retail Store. On the Products tab, the goods sold to retail customers per day are indicated: their product range, quantity, price and amount (five suits for RUB 23,600.00, including 18% VAT).

By default, all payments are considered cash. If during the day payments were made with payment cards, bank loans or gift certificates, then you must fill out the Non-cash payments tab (Fig. 1).

Rice. 1. Non-cash payments in the retail sales report

On the Non-cash payments tab, in the Payment type field, indicate the type of payment from the directory of the same name and the amount of non-cash payments per day - RUB 47,200.00. The following details must be indicated in the form of the Payment Types directory element (Fig. 2):

- payment method - Payment card;

- information about the acquiring bank: agreement, settlement account, amount of bank commission.

Rice. 2. Type of payment

If there are several payment options from customers, retail revenue is reflected in the intermediate account 62.Р “Settlements with retail customers”, after which it is distributed according to payment methods.

After posting the document Retail Sales Report dated April 10, 2017, the following accounting entries will be generated:

Debit 90.02.1 Credit 41.01 - for the cost of suits sold (RUB 80,000.00); Debit 62.R Credit 90.01.1 - for the amount of proceeds from the sale of suits (RUB 118,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 47,200.00); Debit 50.01 Credit 62.R - for the amount of cash payment received (RUB 70,800.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 18,000.00).

For the purposes of tax accounting for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt and Amount NU Kt for accounts with a tax accounting attribute (TA). Since, according to the conditions of Example 1, there are no differences between accounting and tax accounting, we will not mention these resources in the further description.

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2022.

We will generate a document Receipt to the current account dated 04/12/2017 with the transaction type Receipts from sales on payment cards and bank loans. Minus the amount of remuneration, the acquiring bank transfers funds to the organization in the amount of RUB 46,256.00. (47,200.00 - 2%). If the document is not downloaded from the “Client-Bank” program, but is entered manually, then in the Amount of services field you need to indicate the amount of the bank’s commission (944.00 rubles).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 46,256.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (944.00 rubles).

The buyer returns one suit on April 13, 2017. The document Return of goods from the buyer can be generated based on the document Retail Sales Report dated April 10, 2017.

On the Products tab, the tabular part needs to be adjusted so that only the returned suit in the amount of RUB 23,600.00 is indicated there.

Despite the fact that the sale was carried out at retail, where analytical records of counterparties are not kept, when processing a return you should pay attention to the following points:

- in the header of the document you must indicate the name of the counterparty and the agreement with the counterparty. To simplify accounting, you can specify an abstract individual and an abstract agreement with him as a counterparty (for example, Retail sales);

- on the Settlements tab, account 62.01 “Settlements with buyers and customers” and account 62.02 “Settlements for advances received” are indicated as accounts for settlements with customers (and not auxiliary account 62.R).

The fields Cash receipt order No. and from are not filled in, since the refund to the buyer will be made to his bank card, that is, by non-cash method.

After posting the document Return of goods from the buyer, the following entries are entered into the accounting register:

REVERSE Debit 90.02.1 Credit 41.01 - for the cost of the returned suit (-16,000.00 rub.); REVERSE Debit 62.02 Credit 90.01.1 - for the amount of proceeds from the sale of the returned suit (-23,600.00 rub.); REVERSE Debit 90.03 Credit 19.03 - for the amount of VAT (-3,600.00 rub.).

In the postings to accounts 62.02 and 19.03, the individual buyer is indicated as the counterparty.

In addition to the accounting register, an entry is entered into the VAT register presented with the type of movement Receipt.

To reflect the transaction of transferring funds to the buyer to the card, we will create a document Payment card transaction with the type Return to buyer (Fig. 3). It is convenient to create a document based on the document Return of goods from the buyer.

Rice. 3. Payment card transaction

As a result of posting the Payment Card Transaction document, the following transactions will be generated:

Debit 62.02 Credit 57.03 - for the amount of return of funds to an individual (RUB 23,600.00).

Settlements with an individual can be viewed by generating the Account Card report for account 62.02 and setting the selection for the counterparty Individual. The report clearly shows that on April 13, 2017, the buyer returned goods in the amount of RUB 23,000.00. On the same day, the bank was instructed to return the money to the buyer’s card. Thus, the organization’s debt to the buyer is repaid. In other words, at the time of the chargeback operation, the organization’s debt to the retail buyer is transferred to mutual settlements with the acquiring bank.

The provision of services to individuals is also reflected in the document Report on Retail Sales dated April 17, 2017.

On bookmarks:

- Goods - indicates the cost of the service sold to a retail buyer (RUB 100,000.00);

- Non-cash payments - type of payment and amount of non-cash payments per day (RUB 100,000.00).

After posting the document Retail Sales Report dated April 17, 2017, the following transactions will be generated:

Debit 62.R Credit 90.01.1 - for the amount of revenue from the sale of services (RUB 100,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 100,000.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 15,254.24).

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2022.

On April 18, 2017, the acquiring bank transfers funds to the organization minus the amount of remuneration (RUB 2,000) and minus the amount returned to the buyer (RUB 23,600.00), that is, a total of RUB 74,400.00.

We will generate a document Receipt to the current account with the transaction type Receipts from sales on payment cards and bank loans in the amount of RUB 74,400.00. In the Amount of services field, you need to indicate the amount of the bank commission (RUB 2,000.00).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 74,400.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (RUB 2,000.00).

Let's create a balance sheet for account 57.03. The absence of a balance on account 57.03 indicates the complete completion of settlements with the acquiring bank.

To claim input VAT on returned goods for deduction, you must create a document Creating purchase ledger entries (section Operations - Regular VAT operations).

Data for the purchase book on the amounts of tax to be deducted in the current tax period must be reflected on the Purchased assets tab.

As a result of posting the document, an accounting entry is generated:

Debit 68.02 Credit 19.03 - for the amount of VAT accepted for tax deduction (RUB 3,600.00).

An entry with the type of movement Expense is made in the VAT accumulation register presented. To create a purchase book for the second quarter of 2017, an entry is made in the Purchase VAT accumulation register.

| 1C:ITS For step-by-step instructions on recording transactions involving the transfer of funds to the buyer’s bank card when returning goods, see the “Handbook of Business Transactions. 1C: Accounting 8" in the "Accounting and Tax Accounting" section. For information on accounting for VAT in transactions for the return of goods from customers in retail trade, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

How to issue a refund to the buyer in 1C 8.3 Accounting

On March 21, the Organization sold Bureaucrat Chair T-9950AXSN/Black - 15 pcs. at a price of 23,600 rubles. (including VAT 18%) to the buyer ELITE STROY LLC. On the same day, payment was received from the buyer to the bank account in the amount of RUB 354,000.

On March 22, the entire batch of products sold was returned upon acceptance of the goods.

On March 23, payment was transferred from the current account to the buyer.

To register the transfer of payment to the buyer when returning goods, draw up the document Write-off from the current account, transaction type Return to buyer.

It can be created:

- based on documents Return of goods from the buyer or Adjustment of sales ;

- Bank and cash desk - Bank - Bank statements - Write-off button.

Postings

Postings are generated:

- Dt 62.02 Kt - refund of payment to the buyer.

We looked at how to process a return of goods from a buyer in 1C.

How to make a return from a buyer without specifying a sales document

Similar to what was described above, to issue this return, you need to click the Return button in the document log and select the Sale, commission item.

Further actions are similar to the formation of a document indicating the implementation document, with some exceptions, which we will now consider.

Since the Shipping Document is not selected, we do not know the batch of goods and, therefore, its Cost. To indicate the Cost, a special field is provided in each line; it must be filled in manually.

Attention! For the simplified tax system, if the Shipping Document is not specified, you must additionally fill in the Expenses (CO) field. Here it is important to show whether the returned Item relates to accepted expenses at the time of sale.

An example of transactions for returning goods from a buyer can be seen in this screenshot:

Our video on returning goods in the 1C program: