In the 1C: Accounting 8 program (starting from version 3.0.81), each user can use a simplified version of accounting for electronic travel tickets. This also applies to those users whose program does not provide integration with the Smartway service.

Users can enter travel tickets purchased from different agents into the accounting program themselves, and after this action, indicate travel costs in the advance report.

In this case, you can fill out advance reports in both standard and simplified forms.

Accounting for electronic travel tickets in 1C: Accounting 8

Users who carry out accounting in 1C: Accounting 8 can, when using version 3.0.81, indicate the costs of electronic tickets in a simplified form. This is very useful in determining the costs incurred by a company when it sends workers on business trips.

If the user does not use the download of tickets from Smartway, then he himself enters into the program information on tickets that were purchased from different counterparties. In addition, it is possible to record any actions with electronic tickets, for example, additional payment, exchange or refund.

To reflect electronic tickets in 1C: Accounting, you need to go to the “Directories” section, then to the “Purchases” subsection and select the “Ticket Receipt” document. Then you need to select a special accounting account - 76.14 “Purchase of tickets for business trips.”

If the user uses the capabilities of the Smartway service, which allows him to manage business trips, then the task is simplified for him. Electronic tickets paid for by the company are automatically loaded into the directory, and therefore there is no need to enter information manually. Additional ticket transactions (refund or exchange) are also recorded automatically in the accounting program.

When information about received tickets is registered in the program (regardless of the method - automatically or manually), travel costs are accounted for through the “Advance Report” document, which is located in the “Bank and Cashier” or “Purchases” sections.

Results

The electronic document includes:

- route/receipt - for air transportation;

- control coupon - for rail transportation;

- receipt of an electronic multi-purpose document - when using travel tickets.

The listed documents refer to strict reporting forms.

Therefore, an electronic ticket can be considered a BSO if the above documents are printed on paper. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Receipt and accounting of electronic tickets in 1C

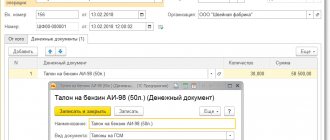

When purchasing from a counterparty, a new ticket is recorded in the 1C: Accounting program through the “Ticket receipt” list form using the “Create - Purchase” command. In this case, a new document “Purchase of tickets” opens, which needs to be checked so that the type of operation “Purchase” is indicated. Next, information on the new ticket is entered into it in accordance with the itinerary receipt of the airline ticket or with the control coupon of the train ticket.

When the new ticket is recorded, the user fills out the remaining columns of the document, indicating:

- name of the counterparty (carrier or agent) from whom the ticket was purchased;

- the name of the contract for the purchase of a ticket, if the company carries out accounting under contracts;

- the total cost of travel and the amount of VAT highlighted in a separate line.

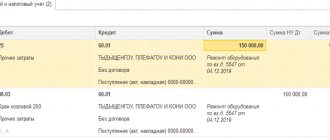

When creating the “Ticket Receipt” document, the program generates invoice correspondence:

- Dt 60.02 Kt 60.01 - the amount of the offset prepayment is indicated;

- Dt 76.14 Kt 60.01 - indicates the amount of costs for purchasing a ticket.

Account 76.14 “Purchase of tickets for business trips” is used to account for the costs of purchasing tickets when traveling for employees. The cost of tickets for it is reflected in rubles.

Analytical accounting is maintained by account in the context of each employee sent on a business trip (sub-account “Employees of the Organization”) and ticket (sub-account “Tickets”). Employees are included in the “Individuals” directory, and tickets are included in the “Tickets” directory.

If the employer initially paid for an electronic ticket, and then additionally purchases some services for it, for example, seat selection, luggage, etc., then these expenses are recorded through the document “Receipt of tickets” indicating the type of operation - “Additional payment”. Payment for additional services must be included in the final cost of the electronic ticket, which is indicated in the itinerary receipt or control coupon of the updated electronic ticket.

If you change the essential parameters of a ticket, for example, the date or route, in which the number of the document itself changes when making a reservation, the information must be reflected in the document “Receipt of tickets” indicating the type of transaction “Exchange”. When this action is carried out, the old ticket is written off and a new one is issued. For this reason, the new document reflects information about the retired ticket, as well as about the new ticket, indicating its cost, etc. VAT.

If the trip is cancelled, then you need to fill out a document “Receipt of tickets” indicating the type of operation “Refund”.

Each purchased ticket is recorded in the “Tickets” directory. When opening a specific document, the user is shown not only basic information about prepaid tickets), but also all actions carried out with the ticket (hyperlink “Ticket Operations”).

What about BSO?

BSO is a document that a legal entity or businessman can issue to an individual instead of a cash register check for non-cash or cash payment for services.

The use of BSO is regulated by the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash registers (approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359).

As a general rule, taxpayers issue BSO only when paying for services from the list of OKUN (OK 002-93, approved by Decree of the State Standard of the Russian Federation dated June 28, 1993 No. 163) and equivalent to them. BSO cannot be issued to a legal entity when purchasing goods. But BSO can be issued to entrepreneurs, since they are equated to individuals (paragraph 4, clause 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16).

For the form to be considered valid, it must include the following required details:

- name, 6-digit number and series;

- name of the company or full name of the individual entrepreneur;

- TIN and location of the enterprise;

- type and cost of service;

- payment amount;

- date of operation and document generation;

- position, full name and personal signature of the person responsible for documenting the operation;

- Stamp of the company.

If the BSO was produced in a printing house, then information about it is indicated on the form. What other requirements apply to BSO - read the article “What applies to strict reporting forms (requirements)”.

However, there are a number of BSOs, the registration of which has separate requirements approved by special regulatory legal acts. Such forms include cinema tickets, season tickets, tour packages, etc. Can an electronic ticket be considered a BSO?

How to prepare an advance report

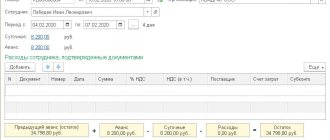

To include the cost of a used ticket in the company’s expenses, information about it must be reflected in the advance report. Both standard and simplified forms are used for the report.

When filling out an advance report indicating the type “Purchase, expenses,” travel costs are indicated in the “Tickets” tab. In previous versions of the 1C program, this bookmark could only be used if integration with Smartway was configured. When you click the “Fill” button, the advance report is automatically filled in with ticket information in accordance with the selected employee and travel period.

When filling out an advance report indicating the “Business trip” type, the user specifies the employee and the travel period, and tickets that match the date are downloaded automatically and then reflected as a link “Tickets purchased by the organization.”

If the posted employee paid for some expenses himself, this information must be entered manually in the “Employee expenses supported by documents” table.

When the user posts an expense report, the program creates a correspondence of invoices:

- Dt 26 (20.01, 44.01...) Kt 71.01 - the expenses of the person sent on a business trip are indicated;

- Dt 26 (20.01, 44.01...) Kt 76.14 - the amount of the company’s travel expenses is fixed;

- Dt 19.04 Kt 76.14 - the amount of VAT is indicated when it is highlighted on the ticket as a separate line.

Do you have any questions or need help updating 1C? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Accounting

Accountants often have a question: should electronic tickets be taken into account in account 50.3 “Cash documents”?

In order to avoid reservations on the part of auditors, it is better to adhere to this particular, classical method, using account 50.3. Then, when purchasing electronic tickets, you must make the following entries: Debit 76 (60) Credit 51

– tickets purchased;

Debit 50.3 Credit 76 (60)

– tickets are capitalized as monetary documents;

Debit 71 Credit 50.3

– tickets issued to an accountable person.

However, a number of experts believe that since the electronic ticket does not have a paper form, then there is no need to use account 50.3. In this case, this operation is regarded as payment for a service from a third party. If you choose this method, it is recommended to open a new sub-account “Payments for electronic tickets” to account 76. The chosen method should be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”).

Accounting for VAT on tickets, purchase book

VAT is taken into account as part of deductions during the period of approval of the advance report. According to paragraph 7 of Art. 171 of the Tax Code of the Russian Federation, if business trip expenses, including the cost of tickets, are taken into account when taxing profits, VAT is deductible. Conditions for the deduction:

- Availability of the document in its original form.

- Highlighting the tax amount in the document.

- Recording a document in the purchase book.

- Entering data into the purchase book during the approval period for expenses.

An invoice is not required to apply the deduction. When making an entry in the purchase book, it is necessary to take into account that the cost of a ticket consists of several component parts, among which there are amounts subject to VAT at different rates. The cost includes travel at a rate of 10% and may include services taxed at a rate of 18%.

To include tax as a deduction, it is not necessary to separate the amounts by rate.

The law prohibits the purchaser of services (goods, works) from changing or dividing into components the VAT amounts billed by the supplier. Entries in the purchase book are made on the basis of the BSO (or their copies), in which the tax amount is highlighted separately. The tax amount is indicated in the amount corresponding to that specified in the BSO.

About the rules of electronic registration

If travel documents are ordered via the Internet for several passengers at once, then remote registration is carried out for all at the same time. The remote verification service is available for boarding and traveling to any station on trains numbered 001-898, which are formed by a subsidiary of Russian Railways.

Remote check-in is also available for the following trains:

- With a route between Russia and Latvia;

- Traveling between Russia, the Republic of Belarus and Ukraine (some trains);

- With a route between Moscow and Helsinki, including additional trains running on holidays.

Passing and canceling online registration is allowed no less than an hour before the scheduled departure of the train from the first station.

Online check-in cannot be canceled more than one hour before departure. A passenger with a completed ER can request a paper ticket at the ticket office. In this example, remote registration is canceled. To board, you must hand over your ticket and passport.

For a number of trains, online registration is allowed 5 minutes before the departure of the train. Such trains must provide special tools for checking digital travel documents.

If remote verification has already been completed, you will not be able to:

- Extend the validity of a ticket if you are late for a train (the exception here will be trains that run exclusively within Russia);

- Abort your trip and renew your online registration.

Foreign language tickets

When traveling abroad, tickets issued in a foreign language are purchased. The position of the legislative bodies is reflected in the letter of the Ministry of Finance dated April 10, 2013 No. 03-07/11/11867. The document indicates the need to maintain primary accounting documents in Russian, which requires a translation of the forms presented line by line.

To accept expenses, translation of secondary document information is not required. If data is used for VAT deduction, translation is required based on information about the service provider, buyer, description of the document amount and tax. There are no special conditions for the form of translation. The text does not need to be notarized.

What documents will confirm the cost of air travel?

In civil aviation, when purchasing an electronic passenger ticket, the strict reporting document is the itinerary/receipt of the electronic ticket. This is a paper extract from the automated information system for registration of air transportation (clause 2 of Order No. 134 of the Ministry of Transport of Russia dated November 8, 2006, hereinafter referred to as Order No. 134). It shows the cost of the flight.

Also, according to the general rules of air transportation, when checking in for a flight, the passenger is given a boarding pass, which indicates his initials and surname, flight number, departure date, departure time, boarding gate number and other information (clause 84 of the order of the Ministry of Transport of Russia dated June 28, 2007 No. 82).

Thus, in order to confirm the costs of using the airline's services for tax purposes, the reporting person is required to submit an itinerary/e-ticket receipt and a boarding pass.