Re-invoicing is a procedure that is often initiated within the framework of relations between an individual and a legal entity. The event is relevant when services are supplied by one company and paid for by another person. That is, intermediaries participate in the transaction. It is in these circumstances that a tool such as re-invoicing is used.

Question: A Russian intermediary organization works with a Russian organization as a principal under an agency agreement on its own behalf. When purchasing services for the principal from a foreign organization that is not registered with the tax authorities of the Russian Federation, the intermediary performs the functions of a tax agent. The intermediary issued and registered the invoice as a tax agent with transaction type code 06, and the reissue of the invoice to the principal with code 01. The tax authority demanded clarification after submitting the VAT return. Did the intermediary correctly apply transaction type code 06 when performing the functions of a tax agent for services purchased from a foreign organization that is not registered with the tax authorities of the Russian Federation? View answer

How does re-invoicing work?

The law does not provide clear guidelines regarding the sequence of re-invoicing. The nuances of accepting VAT for deduction are also not specified. But it is imperative to focus on the provisions of laws that indirectly relate to the rules of re-listing, and on judicial practice. This will reduce the risk of claims from authorized bodies.

Question: Should a commission agent (agent) applying the simplified tax system reissue invoices received from sellers to the principal (principal) in the event of the acquisition of goods (work, services) on the instructions of the principal (principal) on his own behalf (clause 1 of Article 168 Tax Code of the Russian Federation, clause 1 of the Rules for filling out an invoice, clause “a”, clause 7 of the Rules for maintaining a log of received and issued invoices, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137)? View answer

There are general rules regarding re-invoicing. In particular, it is necessary to confirm the expenses incurred by the intermediary at the expense of the customer. Documents are used for this. The corresponding rule is stipulated in paragraphs 1-2 of Article 1008 of the Civil Code of the Russian Federation.

The main rules for selling products through an intermediary:

- If an intermediary is involved in the sale of goods, information about him is written down in the invoice for payment. The invoice is issued in several copies.

- A copy of the invoice is issued to the customer.

- The customer must draw up the invoice that the intermediary needs.

In what cases is it possible to reissue invoices ?

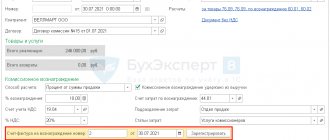

When issuing an invoice (IF), the first line of the document contains its number and date of completion. You need to record the date the invoice is submitted to the agent. The principal needs to make a note based on the invoice in the purchase ledger.

Within the framework of the transactions under consideration, agency fees will be considered income. That is, it is from it that VAT will be paid. The relevant provisions are contained in Articles 41, 153 of the Tax Code of the Russian Federation.

Question: Is it possible to hold an agent liable under Art. 120 of the Tax Code of the Russian Federation in the event that he purchased goods for the principal on his own behalf, but did not reissue the invoice to him? View answer

Let's look at how settlements with an agent are made.

At this step, the agent’s services are posted and payment is made.

The agency agreement belongs to the category of paid contracts. Therefore, for actions performed under an agency agreement, the agent must receive remuneration from the principal, the amount and procedure for payment of which must also be stipulated by the agreement between them.

The agent issues an invoice to the principal for the amount of his remuneration, files such a document in the journal of issued invoices and registers it in the sales book. The agent must give the second copy of the invoice to the principal.

Posting agent services:

•Let's go to the journal of the movement of values and. Let's select one or more invoices with the operation type “Principal. Report from the agent (on behalf of the agent)”, for which it is necessary to capitalize the agent’s service.

•Select the context menu item “Generate reward”.

•In the request window that appears, enter the remuneration expense account. Click <OK>.

•In the header of the invoice that appears we will indicate the number and date of the invoice. The agent's account and VAT accounting type will be entered automatically. In the invoice details, the agent service will be automatically added with the calculated quantity, price including VAT, amount including VAT and VAT amount. Click <OK>. In the journal “Movement of Values and Services” the operation “Capitalization” will be added.

•A capitalization transaction will appear in the journal of accounting transactions, with the following entries: 44/USL/01588 – 76/PROCH/Agent = Amount of agency fee excluding VAT 19/USL – 76/PROCH/Agent = Amount of VAT of agency fee 68/VAT – 19/USL = VAT amount of agent remuneration

•An invoice from the agent will be automatically added to the journal of posted invoices.

| Attention! From January 1, 2015, the obligation to keep accounting logs remained only for agents (commission agents) who issue or receive invoices when carrying out activities in the interests of another person on their own behalf. Therefore, in this case, invoices made after 01/01/2015 do not appear in the journal of recorded invoices. |

Payment from the agent.

Advance from agent

A situation is possible when the agent first receives an advance payment from the buyer, and then uses this advance to ship the goods.

Based on the invoice issued by the agent to the buyer upon receipt of an advance from him, the principal “re-issues” an invoice with similar indicators to the agent in the name of the buyer. The principal registers the “overissued” invoice in the sales book without recording the issued invoices in the journal.

To register an invoice for an advance payment from a buyer (received from an agent), do the following:

•Let's go to the journal of payment documents in the main menu “Operations | Payment documents" (or "Operations | Incoming bank"). Let’s add a payment document with the transaction type “Receipt from commission agent, agent”, indicate the payer’s account (this is the buyer’s account), the agent’s account, indicate the amount that the agent returns, as well as the number of the invoice for the advance and the date of the invoice for the advance. The remaining parameters will be entered automatically. Click <OK>;

•A payment document for the advance received from the agent will appear in the payment document journal.

•In the journal of accounting transactions, the operation of receiving an advance payment to the account from an agent will appear, with transactions: 51/0784 – 62/AB/Agent = Advance amount 76/VAT/Agent – 68/VAT = Advance VAT amount

•In the form of the sales book, a record will appear about the advance received with the note “Advance received” indicating information about the intermediary (commission agent, agent) (with transaction type code 05). This invoice is not recorded in the journal of issued invoices;

•Let’s go to the journal of the movement of values and services in the main menu “Operations | Movement of values and services." Let's open the operation “Principal. Report from the agent (on behalf of the agent).” On the “Payments” tab, add this payment document for the advance as payment; the “This is an advance” checkbox should be selected automatically. Click <OK>.

•In the journal of the accounting transactions of the transaction, an entry will be added to offset the amount of the advance from the buyer, listed by the agent: 62/AB/Agent – 62/REAL/Agent = Amount of the specified advance (not a payment document, namely indicated on the advance tab) 68/VAT – 76 /VAT/AGENT = VAT amount of the specified advance

•In the form of the purchase book, a record will appear about the reversal of a previously received advance from the buyer, listed by the agent with the note “Advance credited” (with transaction type code 22). Please note that there will be no “advance invoice” in the “Capitalized invoices” journal; an entry in the sales book appears automatically on the “advance invoice” and “sales invoice”. This invoice is not recorded in the journal of posted invoices;

This action is performed both for the case when the agent acts on his own behalf, and for the case when the agent acts on behalf of the principal.

| Comment! In the case of a partial advance, it is necessary to post the payment document, indicating it on the “Payments” tab in the previously entered transaction “Principal. Report from the agent (on behalf of the agent).” In this case, you need to uncheck the “This is an advance payment” checkbox (the program turns it on automatically). |

Agent fee payment:

| Comment! When an agent takes his remuneration from the amount of goods sold, then the action “Payment of remuneration to the agent” is not performed, and payment from the agent is formalized by the operation “Receipt from commission agent, agent” (if there is no such operation, enable it in the menu “Service | Operation settings | Types payment documents"), where the amount of goods sold is indicated as the amount, and the amount of the commission is indicated in the “Remuneration” column. |

•Let's go to the journal of the movement of values and. Let's select the invoice with the type of transaction "Capitalization" that needs to be paid.

•Select the “Pay” context menu item.

•The payment document that appears will automatically indicate the recipient's (commission agent's) account, the recipient's current account, the amount, the VAT rate, and the VAT amount. Click <OK>.

•A payment transaction will appear in the journal of accounting transactions, with the following entries: 60/POST/Agent – 51/Current account = Amount of agency fee including VAT

Features of re-invoicing

An invoice is both confirmation of acceptance of products and the basis for deduction for VAT. The corresponding provision is stipulated in Article 169 of the Tax Code of the Russian Federation. It is necessary to take into account the specifics of the procedure in which an agency agreement is present. In this case, an additional link is formed between the seller and the consumer - an agent. It works in the interests of the consumer (Article 1005 of the Civil Code of the Russian Federation).

Initial SFs are issued to the agent. For the principal to use the deduction, you need to re-issue the SF to him. That is, the agent needs to provide the principal with the SF when transferring authority for the products.

The Federation Council is drawn up in a certain form. All the nuances of its preparation are specified in Government Decree No. 1137 of December 26, 2011. Re-listing of paper is carried out by an agent who acts on his own behalf.

The agent is considered to be directly involved in the re-registration if these conditions are met:

- Execution of instructions under agreement.

- Working on your own behalf.

Re-listing must be carried out on the basis of the law.

Features of an agency agreement for utilities

- the agency agreement is paid by its nature, therefore the parties to the agreement need to establish the amount and procedure for paying the agency fee;

- if the agency agreement is concluded for an indefinite period, then any of the parties to the transaction may unilaterally refuse to fulfill it, in which case the agreement is terminated. If an agency agreement for utilities is concluded for a certain period, then unilateral termination of the transaction is impossible.

- the sale of utilities under an agency agreement can be concluded on behalf of the principal and on behalf of the agent;

- to fulfill the contract, the agent has the right to enter into a subagency agreement with another person, remaining responsible for the actions of the subagent to the principal;

- parties to a transaction may limit each other's rights. It is possible to prescribe a condition under which the principal does not have the right to enter into similar agreements with other agents operating in a certain territory, or must refrain from carrying out independent activities in this territory, similar to the activities that form the subject of the agency agreement.

The agent's obligation may be stipulated not to enter into similar transactions with other principals, which must be executed in the territory that fully or partially coincides with the territory specified in the agreement.

Legislative justification

Re-issuance of the SF is a procedure that is regulated by these regulations:

- Article 169 of the Tax Code of the Russian Federation . It states that invoices can be issued by agents selling goods/services on their own behalf.

- Articles 171, 172, 169 of the Tax Code of the Russian Federation . These articles indicate the conditions for deducting VAT. In particular, these are the following circumstances: acceptance of products for registration, use in work subject to VAT or use for resale, receipt of an invoice from the supplier.

- Article 1011 of the Civil Code of the Russian Federation . The SF is first filled out for the agent.

When filling out, you must take into account the provisions of Government Decree No. 1137 of December 26, 2011.

Related documents

The agency agreement for utility services can be found on our website along with the accompanying documents:

- Agent's report;

- List of services (agency);

- Additional agreement;

- Protocol of disagreements;

- Protocol for reconciliation of disagreements.

For more information about Agency Agreements, see the following pages:

- Subject of the agency agreement

- Parties to the agency agreement

- Terms of the agency agreement

- Agency agreement form

- Rules of law of agency agreement

- Accounting for an agency agreement

- Comparison of agency agreement

- Applications of the agency agreement

- Agency agreement documents

More on the topic:

- Agency agreement for the provision of services;

- Agency agreement for transport services;

- Agency agreement for utilities;

- Agency agreement for attracting clients;

- Agency agreement with an individual;

- Agency agreement for work performance;

- Agency agreement between legal entities;

- Agency agreement with individual entrepreneur;

- Agency agreement to find buyers;

Selling products by agent

The agent may, on his own behalf, sell the principal's products subject to the latter's instructions. In this case, you need to do the following:

- Filling out two SFs.

- One paper is sent to the acquirer.

- The second paper is registered in the SF accounting journal.

- There is no need to register the document in the sales ledger.

- The SF values are sent to the principal.

The principal, when receiving values from the agent, performs these actions:

- Issuance in the name of the SF agent.

- Registering an account in the sales ledger.

All this information must be recorded in part 2 of the Federation Council journal.

Method 2. Changing the cost of the product

This type of re-invoicing of transport costs is not common in practice, but it is simpler in terms of documentation compared to the first.

- Agreement

Clause 3 Art. 485 of the Civil Code of the Russian Federation provides that in the sales contract it is possible to include a clause on changing the value of the goods upon the occurrence of certain circumstances. Alternatively, you can add a condition: if the delivery of the goods to the buyer is organized by the supplier, then the cost of the goods increases by the cost of transporting the goods to the buyer.

- Source documents

At the time of transfer of the goods to the carrier organization, you will already have an agreement on the provision of transport services and an invoice for payment for these services. Using these documents, we determine the amount of transportation costs (including VAT) and add it to the cost of the goods shipped to the buyer. We indicate the amount received in the delivery note. If several types of goods are shipped, then we distribute transportation costs between them in equal shares.

You can familiarize yourself with the form of the consignment note in the article “Unified form TORG-12 - form and sample” .

IMPORTANT! Do not include the cost of transport services as a separate line in the invoice. You do not provide services for the transportation of goods, therefore such a service should not be included in the invoices you issue.

If the cost of transport services changes after the buyer receives the invoice, adjustments are made to it in one of two ways:

- registration of a new adjusted invoice;

- making corrections to already completed 2 copies of the invoice: yours and the buyer’s.

Read about changes to primary documents in this material.

The invoice received from the carrier organization will be considered the basis for reflecting expenses associated with the sale of goods (subclause 1, clause 1, article 253 of the Tax Code of the Russian Federation).

- Invoice

We issue an invoice for the amount indicated in the delivery note: the cost of the goods, increased by the cost of transport services. We record it in the sales book. If the cost of transport services included in the price of the goods changes, we generate an adjustment invoice for the amount of the increase (decrease) in transport costs (paragraph 3, clause 1, article 169 of the Tax Code of the Russian Federation). There is no need to correct the old invoice.

For an example of filling out adjustment invoices, see the article “Sample of filling out an adjustment invoice (2020 - 2021).”

We register the invoice received from the carrier organization in the purchase book.

Features of re-issuance of invoices when purchasing products

If products are purchased for a principal, the procedure for creating invoices will be different:

- The SF in the name of the agent is issued by the supplier.

- The document is registered in the sales book.

- The agent enters the account in the second part of the SF accounting journal.

- The agent, on his own behalf, fills out the SF with the same meanings addressed to the principal. The “seller” line records the actual supplier.

- The agent enters the SF in part 1 of the accounting journal.

The last step is the registration by the principal of the SF previously issued by the agent. A purchase ledger is used for registration.

If an agent makes purchases (purchases goods, pays for work or services) for several principals at once and receives a common invoice for the purchase he made, then when re-issuing it needs to be “sorted”. Each specific principal should receive not a single list, but an invoice relating only to his order. This requirement is stated in the letter of the Federal Tax Service No. GD-4-3 / [email protected] dated April 18, 2014.

If the agent has received from sellers for the same principal several invoices of the same date, he is allowed to combine them into a single one when reissuing. In this case, all data must be given using the “;” sign. This is permitted in paragraphs. “c” clause 1 of the Rules for filling out an invoice, approved by Government Decree No. 1137 of December 26, 2011.

Purchasing goods for the principal: algorithm for re-issuing an invoice

When purchasing goods for the principal, the chain of interaction for issuing an invoice differs from that described above:

- the supplier issues an invoice in your name (as an agent) and registers it in its sales book;

- you enter it in part 2 of your invoice journal;

- then, on your behalf, issue an invoice with similar indicators to the principal (indicate the actual supplier as the seller) and record it in Part 1 of the accounting journal;

- The principal records the invoice received from you in his purchase ledger.

Familiarize yourself with the position of the Ministry of Finance on the nuances of issuing agency invoices.

If an agent purchased goods for several principals and the invoice contains data for the entire purchase, when re-issuing an invoice to each principal, the agent must transfer information only on those goods (services or works) that were intended specifically for this principal (letter of the Federal Tax Service dated April 18 .2014 No. GD-4-7/ [email protected] ).

Read about deducting VAT from the principal when purchasing goods through a chain of intermediaries here.

Features of invoice design

Let's consider a scheme for filling the SF with intermediaries (they could be, for example, developers, freight forwarders):

- Line 1 – date of creation of the SF by the agent.

- Page 1a – number of the correction included in the Federation Council.

- Page 2 – name of the selling company.

- Page 2a – address of the seller, contained in the Unified State Register of Legal Entities, address of the forwarder.

- Page 2b – TIN and checkpoint of the seller.

- Page 3 – name of the shipper (must correspond to the information recorded in the constituent documentation).

- Page 4 – name of the consignee of the cargo (if the invoice is drawn up for services, a dash is placed in the lines).

- Page 5 – details of payment papers on the transfer of money by the agent to the seller.

- Page 6 – name of the buyer.

- Page 6a – buyer’s address recorded in the Unified State Register of Legal Entities.

- Page 6b – TIN and KPP of the acquirers.

- Page 7 – name of the currency that appears in the transaction.

- Page 8 – this line needs to be filled out only when issuing a SF when working on a government contract.

- Column 1 – name of goods.

- Gr. 1a – product type code.

- Gr. 2 – unit of measurement (if it is not there, a dash is added).

- Gr. 3 – volume of production.

- Gr. 4 – product price.

- Gr. 5 – cost of all products.

- Gr. 6 – excise tax amounts, if these are excisable products.

- Gr. 7 – tax rate.

- Gr. 8 – VAT.

- Gr. 9 – price of all products.

- Gr. 10 – state in which the product was manufactured (you must indicate the code and short name).

- Gr. 11 – this column is filled in when the country of origin of the product is not Russia.

FOR YOUR INFORMATION! The agent is the element between the principal and the merchant. He is obliged to re-expose the Federation Council. An agent trading on his own behalf registers himself as a seller in the Federation Council. Based on the invoice, the buyer has the right to claim a VAT deduction. If the agent buys products at the behest of the principal, when re-listing, you need to write down information about the supplier in lines 2, 2a and 2b.

Structure and content of a sample agency agreement for utilities

- Date and place of conclusion of the agreement.

- Name of the parties.

- Subject of the agreement. The subject of the agreement is the actions of the agent aimed at the sale of public services.

- Contract time. The contract can be fixed-term or indefinite.

- Rights and obligations of the parties. Contractual relations may limit the rights of both one and the other party (for example, non-disclosure, prohibition on concluding similar documents for a given transaction).

- Deadlines for executing agency orders.

- Submission of the Agent's report. The agent must account for his actions in implementing the contract. It is necessary to determine in what form and within what time frame the agency report will be provided.

- Agent's remuneration and payment procedure. The remuneration can be paid after the agent performs certain actions or after the entire agreement is fulfilled.

- Responsibility of the parties.

- Grounds and procedure for termination of the contract.

- Dispute resolution.

- Force Majeure.

- Other conditions.

- List of applications.

- Addresses and details of the parties.

- Signatures of the parties.

Invoices: New for 2022

This year there are some differences in the management of invoices that need to be taken into account, especially for VAT payers.

The main innovation is a new form, which was approved by Decree of the Government of the Russian Federation No. 981 of August 19, 2022. There are a few things that look different now, including:

- a new column in the header of the form, which needs to be filled out only if such data is available (“Identifier of the government contract, contract (agreement)”);

- a new column “Product Type Code” in the plate, information is entered into it only when sending goods to countries that are members of the Eurasian Economic Union;

- the column on the customs declaration has changed its name slightly - before the word “number” the clarification “registration” has been added;

- The signature field has been supplemented - now not only the individual entrepreneur himself, but also “another person” has the right to leave an autograph there, of course, with a executed power of attorney.

Another important innovation is permission from tax services to store second copies of invoices in electronic form (confirmed by Letter of the Federal Tax Service No. SD-4-3 / [email protected] of Russia dated September 6, 2017). This is convenient, and the permit is valid even if the purchase copy was in paper form.

What does an invoice mean in an agency agreement?

If communication means allow and the capabilities of the parties to the contract are combined, then accounting documentation is exchanged between them in electronic form. The procedure for organizing the transfer of payment papers in electronic form is specified in clause 1 of Art. 169 of the Tax Code of the Russian Federation. Documentation is exchanged through telecommunication channels.

Important! According to the commission agreement, the procedure for conducting electronic exchange of invoices is carried out in a certain order.

The commission agent (seller) performs the following functions for organizing electronic document management:

- Formation of payment papers.

- Assignment of an enhanced digital signature.

- Direction through the electronic invoice operator to the buyer's address.

- Waiting for confirmation of receipt of the document.

The commission agreement provides for the need for the commission agent to store payment papers in hard and electronic form. Read about the features of registering and storing invoices here.