The formation of an invoice occurs when there is a movement of inventory. It is most widespread in plants, factories and production facilities with their own shipping warehouses, as well as in enterprises operating in the trade sector, and their field of activity does not play a role: it can be the sale of tools and equipment, household goods, food, etc. d.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

What is the invoice form used for?

Any movement of products, goods and materials must be recorded in special accompanying documentation. One of these documents is the invoice. It confirms the release of goods, and also serves as the basis for carrying out various accounting operations (primarily, writing off inventory items from the warehouse).

Thus, the priority value of the document is to take into account the movement of products within the organization itself.

The invoice can also be used when returning goods to the supplier, for example, in cases where, during sales or after purchase, a defect, breakage or defect was discovered in the product, as well as when it turned out that the products were not delivered in the required configuration or have low quality.

Why do you need an M-11 consignment note?

The movement of material assets within an organization are operations that are reflected in accounting. To document them, you must use a special primary form - demand invoice M-11

This is what the invoice requirement is for: this is the primary document used to reflect operations on the movement of assets within one business entity. M-11 is filled out:

- when changing the financially responsible person in one structural unit;

- when transferring materials from warehouse to production;

- when shipping goods from a warehouse for the institution’s own needs.

There are quite a few reasons for discharge. We recommend that you specify all possible situations in your accounting policies.

At what stage of shipment of goods is an invoice generated?

The invoice is drawn up immediately at the time of the transaction.

Since accounting entries are made on its basis, you should be very careful when filling it out. In particular, it is undesirable to make any errors or inaccuracies in the invoice or make corrections.

And it is absolutely forbidden to enter unreliable or deliberately false information into the form - if such facts are revealed by regulatory authorities, the responsible persons or even the organization may incur serious administrative punishment, in the form of large fines.

It should also be borne in mind that in some cases the invoice may acquire the status of a legally significant document - when one of the parties, due to some unfavorable circumstances, decides to go to court.

In what cases is it prescribed?

This document applies only in cases where the releasing and receiving units are actually located at a significant territorial distance from each other. Otherwise, it is recommended to use other forms of documents that also reflect the movement of inventory items.

an invoice for the release of materials to the third party in the case when there is no sale of goods and materials when moving goods (for these purposes, a TORG-12 invoice is usually used). This operation can take place either within one organization or between two different enterprises by prior agreement. Such movements of inventory items include their transfer for safekeeping or transfer of customer-supplied raw materials.

When transferring goods and other inventory items for safekeeping

Material assets transferred without transfer of ownership rights to them, but with the obligation of the recipient to ensure their safety, are considered property under safekeeping.

The transfer of goods and materials for safekeeping is accompanied by the execution of a storage agreement and an invoice.

At the end of the storage period, material assets are returned . A similar document is issued for a return, only now the recipient is the sender.

For customer-supplied raw materials

Provided raw materials are materials that are received from the customer for processing or manufacturing of products.

In this case, goods and materials are accepted without payment of their cost and the performing organization is obliged to return them in processed form to the customer in full (paragraph 2, clause 156 of the Methodological Guidelines for Accounting for Inventories).

Sample of drawing up an invoice

Since 2013, single, standard unified forms of primary accounting documents have been abolished, therefore there is no standard form of invoice. Company employees can draw it up in any form, using previously existing, mandatory document samples (form TORG 12, TORG 14, etc.), or, if the organization has its own developed and approved invoice template, based on it. The main thing is that in its structure it corresponds to certain standards of office work, and in content it includes a number of certain information.

Conventionally, the invoice can be divided into three parts: the “header”, the main part and the conclusion. The first is entered in order:

- number and date of document preparation;

- the name of the organization that issues the goods and the name of the organization that receives it (if it is an individual or individual entrepreneur, respectively, his last name, first name and patronymic name are entered here);

- a reference is also made here to the agreement for the purpose of which this operation is being carried out (its number and date of conclusion are indicated);

- if one of the persons involved in the transfer of inventory items acts on the basis of a power of attorney, information about this must also be included in the invoice, indicating its number and date of issue.

The second , main part of the document, which is usually formed in the form of a table, contains detailed information about the inventory items sold:

- their name;

- quantity (in appropriate units of measurement - pieces, liters, kilograms, meters, etc.);

- price for one;

- total cost.

If necessary, this section of the document can be supplemented with other information, including the variety, category, type, purpose, features, packaging, storage conditions of products, etc. The length of the table depends on how many products are entered into it.

The final part of the form includes the following information: the number of items of goods and the total amount (both of these values are taken from the table).

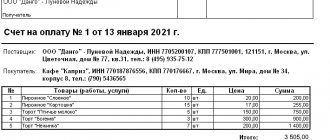

The upper part of the consignment note TORG-12 (header)

- TORG-12 is created in two copies, one for the seller and the other for the buyer.

- The invoice number must correspond to the document numbering approved in the organization’s accounting policies.

- The date of the invoice is indicated as current, at the time of the fact of economic life or after its end, in accordance with Art. 9 clause 3 of the Federal Law “On Accounting”.

- The Shipper column is filled in with the details of the shipper organization. In practice, this column usually coincides with the Supplier , or the details of another organization that is the shipper (for example, a transport company) are indicated.

- The Structural unit column is filled in if inventory items are transferred from a separate unit of the supplier organization.

- Consignee column is filled in with the details of the consignee organization. In practice, this column coincides with the Payer , or the details of another organization that is the consignee are indicated.

- The Supplier column is filled in with the details of the supplier organization, i.e. this column indicates the details of the organization selling the product.

- The Payer column is filled in with the details of the paying organization, i.e. it contains the details of the organization to which the goods are sold.

- The details of the Shipper , Consignee , Supplier and Payer must indicate: name of the organization or entrepreneur, address, telephone, fax, INN, KPP, bank details, name of the bank, BIC, correspondent account, r/account or l/account.

- Opposite all details at the end of the line, a special field is filled in - OKPO code .

- The type of activity according to OKDP is not filled in in practice; the field remains empty.

- In the Basis , “Account” or “Agreement” is usually indicated; at the end of this line, in special fields, the number

and

date

are indicated, respectively, the number and date of the Invoice or Agreement. - In the column number

and

date

of the Waybill, its number and date are indicated, respectively. This field is optional; it can be left blank if the waybill is not created. - Type of operation - in practice it is not filled in, the field remains empty.

Document preparation

Just like the content, the design of the form depends entirely on the vision of the document by representatives of organizations and their needs. The form can be drawn up on a simple blank A4 sheet or on the company’s letterhead, and it can be filled out either by hand or on a computer.

Important condition! The invoice must contain “live” signatures of materially responsible employees: the one who authorized the release of products, the one who directly carried it out, and the buyer.

At the same time, it is necessary to certify the invoice using stamped products only if the norm for their use is enshrined in the internal regulations of the company.

The document is always made in at least two identical copies , one of which is handed over to the representative of the receiving party, the second remains with the employee of the company distributing the products.

Invoice M-15 for outsourcing of materials: sample filling

You can fill out the M-15 document either manually or on a computer. The invoice numbering is continuous; as a rule, starting from the new year, it starts with one. Form M-15, fill in your data and use it as a template.

Sample of filling out form M-15

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Put a dash if you leave a line or cell empty - then you won’t be able to enter false information there.

If you made a mistake, cross out the incorrect information with one line, write the correct data, indicate “Corrected to believe” and sign.

You can avoid corrections if you use the MyWarehouse service. Just enter the data on the website and print the finished document. More about this below.

Do I need to stamp it?

Forms of form M-15 and form 0504205 according to OKUD do not provide for stamping on them . Accordingly, these documents are valid even without a seal.

However, it is customary for business rules to certify the signatures of both parties when exchanging documents between two different enterprises. Organizations can record this point in an appendix to the custody agreement or to the toll agreement.

You can also affix stamps when moving materials between different structural divisions of the same organization, if this is provided for by an internal local document.

Signing the document

Form M-15 is signed by the person who authorized the release of material assets (for example, director, chief engineer, deputy for production or head of a structural unit). In addition, the invoice must be signed by the organization’s chief accountant and the financially responsible person.

The invoice in form 0504205 according to OKUD is certified by the responsible executor - this is, as a rule, the accountant of the material desk who issued the document. When releasing material assets, the invoice is endorsed by the materially responsible person shipping the materials.

Signatures of the manager and chief accountant are not provided here , because the release of material assets to third parties is carried out on the basis of an agreement concluded between two organizations and a power of attorney to receive goods and materials.

From the receiving side, the invoice is endorsed either by the storekeeper, who accepts the materials into his warehouse, or by the head of the production workshop, who will transfer the received materials to production.

All signatures must necessarily contain the name of the position of the person signing the document and a transcript of his signature. Without at least one signature, this document is invalid and cannot be taken into account.