What are the contributions?

Personal injury contributions are payments paid on a regular basis. Their size is determined based on tariffs. Discounts and surcharges are possible. Contributions are sent to the Social Insurance Fund by the employer. Payments must be made:

- Legal entities that are residents of the Russian Federation.

- Legal entities that are not residents of the Russian Federation.

- Individual entrepreneurs whose activities involve the use of hired labor.

The basic features of contributions are established by Article 20.1 of Federal Law No. 125. The subject of taxation is wages, which are calculated on the basis of employment agreements and civil contracts. Some payments are not subject to contribution. In particular, these include:

- Government benefits (for example, unemployment benefits).

- Funds paid in connection with the layoff of an employee during the liquidation of a company.

- Financial assistance provided in case of emergency.

- Compensation for work in difficult conditions.

- Payments in connection with advanced training.

Contributions are calculated based on the salary amount determined by the contract. The payment amount includes VAT and excise taxes.

How much will the Social Insurance Fund reimburse costs?

In order to stimulate a more responsible attitude towards labor protection and interest (including from an economic point of view) in reducing accidents and occupational diseases, the Social Insurance Fund has the right to establish discounts or premiums to the tariff assigned to the organization . Therefore, the amount of contributions may change up or down, even if the company or individual entrepreneur has not changed the type of activity.

But no matter what amount of contributions you pay, the calculation of the amount of financing is done according to the same principle, based on the data of the previous calendar year . To do this, it is necessary to take the amount of contributions for injuries and subtract from it the costs incurred to pay sick leave in connection with accidents or occupational diseases and the costs of paying for employee leave (in addition to annual paid leave in accordance with the legislation of the Russian Federation) for the period of treatment and travel (there -back) to the place of treatment.

Multiply the result obtained by 20% - this is the amount of possible financing of preventive measures. An employer who takes care of employees of pre-retirement and retirement age and allocates additional funds for their sanatorium-resort treatment can count on a higher share - 30%.

Also, special conditions have been established for those organizations or individual entrepreneurs whose staff has less than one hundred employees and which have not applied for support measures over the previous two years. For them, the calculation is carried out immediately from the three previous years, but the amount of financing cannot exceed the amount of contributions for the current year .

Key Features

The amount of contributions for injuries is determined based on these factors:

- Area of activity of the company.

- Availability of benefits.

- Current rates for injury insurance premiums.

Federal Law No. 125 contains articles establishing the procedure for calculating penalties, processing deferments and collecting arrears. The law also spells out the specifics of carrying out desk audits.

IMPORTANT! From 2022, the policyholder has the right to compensation for expenses on workwear. However, this is only possible if the organization purchases workwear from a domestic manufacturer.

Sample payment order for injuries in the Social Insurance Fund 2022

When filling out a payment form for contributions for injuries, you should be guided by the rules prescribed in:

- Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulations of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Payment order form 2020

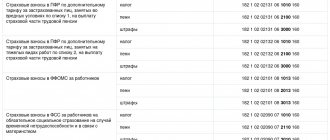

The procedure and features of drawing up a payment order for contributions for injuries are shown in the table:

| Props name | Number (according to Appendix No. 3 to the Regulations of the Bank of Russia dated No. 383-P) | Note |

| Admission to the bank of payments. | 62 | There is no need to fill them out, the bank employee will fill them out independently. |

| Debited from account plat. | 71 | |

| № | 3 | If you generate a payment manually, the number must be greater than zero. If the document is drawn up in electronic form, this field will be filled in automatically and there is no need to further adjust it |

| date | 4 | The order in which the date is indicated also depends on how the payment is filled out:

|

| Payment type | 5 | When paying contributions for injuries, this field does not need to be filled in. |

| Payer status | 101 | Regardless of who pays the fees (individual entrepreneur or organization), the code “08” is indicated here |

| Suma in cuirsive | 6 | Write down the amount of contributions paid in words:

For example: “Eight hundred thirty-four rubles 50 kopecks” |

| Sum | 7 | We transfer the amount from field 6, but in the form of numbers. We do not indicate the words “ruble” and “kopecks” at all, but separate them from each other:

The round sum can be written in another way: “834-00” |

| TIN | 60 | We enter the TIN of the employer paying the contributions. For an organization, the number consists of 10 characters, for an individual entrepreneur - of 12 |

| checkpoint | 102 | Checkpoints are indicated only by organizations and separate divisions (OP):

Entrepreneurs do not have a checkpoint, so they leave this field blank or set the value “0” |

| Payer | 8 |

|

| Account No. | 9 | Bank account number of the organization or entrepreneur. It must consist of at least 20 characters |

| Payer's bank | 10 | Bank account details of an organization or individual entrepreneur paying contributions for injuries |

| BIC | 11 | |

| Account No. | 12 | |

| payee's bank | 13 | Bank details of the Social Insurance Fund branch to which contributions are paid. You can find out which department they should be transferred to from the notice sent by the fund, as well as on the website of this department |

| BIC | 14 | |

| Account No. | 15 | This field is intended to indicate the correspondent account number of the paying bank. There is no need to fill it out when paying personal injury contributions. |

| TIN | 61 | TIN and KPP of the Social Insurance branch to which contributions are transferred. You can also find out from the notification sent by the fund for the payment of these payments |

| checkpoint | 103 | |

| Recipient | 16 | The recipient of contributions is the Federal Treasury: “UFK for ___ (enter the name of the region in which contributions are transferred).” After this, you need to indicate the FSS branch to which contributions are transferred. For example: “UFK for Moscow (GU - Moscow regional branch of the FSS of Russia) |

| Account No. | 17 | Bank account number of the recipient of contributions (UFK). You can find it on the website of the regional branch of the Social Insurance Fund, to which contributions are transferred |

| Type op. | 18 | For insurance premiums for injuries, enter code “01” |

| Payment deadline. | 19 | We do not fill out these fields |

| Name pl. | 20 | |

| Essay. Plat. | 21 | The order of payment is 5, so enter the code “05” in this field |

| Code | 22 | When paying contributions on time, indicate the code “0”. If contributions are paid at the request of the Social Insurance Fund, in this field you must indicate the UIN from the request |

| Res. field | 23 | We do not fill in |

| Purpose of payment | 24 | The name of the payment and the period for which it is transferred. It is advisable to indicate the registration number of the policyholder in the Social Insurance Fund. For example, “Insurance contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases for January 2022. Registration number in the FSS - 7712123453" |

| M.P. | 43 | We put a stamp (as in the sample card). If the payment form is generated by a bank, it is not necessary to put a stamp. |

| Signatures | 44 | We put the signature of the person indicated in the sample signature card |

Contribution rates for 2022

Premium rates in 2022 remain the same as they were in 2016. They depend on the occupational risk class. Let's take a closer look at the bet size:

- Risk class 1 – the insurance rate will be 0.2%.

- Class 2 – 0.3%

- Class 3 – 0.4%.

- Class 4 – 0.5%.

- Class 5 – 0.6%.

- Class 6 – 0.7%.

- Next, 1 is added to both the class and the rate (class 7 - 0.8% and so on).

- Class 15 – 1.7%.

- Class 16 – 1.9%.

- Next, 2 is added to both the bet and the class.

- Class 20 – 2.8%.

- Class 21 – 3.1%.

- Next, 3 is added to both the class and the rate.

- Class 23 – 3.7%.

- Class 24 – 4.1%.

- Class 25 – 4.5%.

- Class 26 – 5%.

- Class 27 – 5.5%.

- Class 28 – 6.1%.

- Class 29 – 6.7%.

- Class 30 – 7.4%.

- Class 31 – 8.1%.

- Class 32 – 8.5%.

As is obvious, the rate varies from 0.2% to 8%. The higher the risk of injury, the more expensive insurance premiums are for the employer. The existing 32 tariffs are established by Federal Law No. 179 of December 22, 2005. The risk class can be determined based on OKVED or the classifier established by Order of the Ministry of Labor No. 851.

To find a rate, you must first confirm your OKVED ID. For this purpose, it is necessary to send a number of documents to the FSS by April 17:

- A statement confirming the main activity of the company.

- Certificate certificate.

- Explanatory note for the previous year.

What happens if you don’t contact the FSS? No fines are assessed, but in this case the rate is set by FSS employees. All areas of the organization’s activities are registered in the Unified State Register of Legal Entities. The most dangerous activity is selected from the list under consideration. It is on this basis that the tariff is selected. This is not the most profitable option for the organization, and therefore it is recommended to timely confirm the main direction of activity according to OKVED.

IMPORTANT! If the FSS has established a tariff independently, the company does not have the right to challenge it. This rule was approved by Resolution No. 551 of June 17, 2016.

What are insurance premiums for and who should pay them?

They are necessary so that if an insured event occurs, the employee receives all payments due by law.

There are 2 types of contributions to the Social Insurance Fund:

- Social - payment of sick leave, maternity leave

- Injuries - industrial accidents, occupational diseases

Note: the first of them is subject to the Tax Code (Article 34). The second - injuries - is regulated by Federal Law No. 125 and Federal Law No. 179.

Payers of contributions are organizations, entrepreneurs (individual entrepreneurs, private entrepreneurs, LLCs, private practitioners - lawyers, doctors), that is, all those who have officially working employees: on staff or engaged in contract work.

Until 2022, employees received all social benefits (sick leave, maternity leave, injuries) from the employer. Starting this year, the procedure has changed: now the FSS will pay the money directly.

As for the size of payments: social benefits depend on the amount of salary and length of service, and compensation for injuries received is regulated by tariffs. They differ depending on the type of activity: the higher the professional risk class, the higher the percentage accrued.

In 2022, tariffs remained at 2022 levels. It is expected that they will remain this way until 2023. Basis - Federal Law No. 434 dated December 22, 2020. However, there is a nuance here: indexation was carried out in February 2022, and the actual amount of contributions increased by 3.8% compared to the previous year.

Payment procedure

Contributions must be made monthly. Payments are made after salary accrual. Let's consider the calculation procedure:

- Summarization of payments. To carry out calculations, the following payments are added up: wages, bonuses, vacation pay, travel allowances.

- Determination of the injury base. From the amount received, you must subtract payments for which contributions are not calculated. These payments are prescribed in Article 20.2 of the Law.

- Setting the tariff. If the company confirms the main direction of its work every year, the required percentage can be found in the notice from the Social Insurance Fund. If the main activity is not confirmed, the percentage should be sought according to OKVED. It is indicated in the registration papers from social insurance.

- Determination of the contribution amount. The found base is multiplied by the tariff.

The amount received is sent to the fund. Calculations are carried out on the basis of official documents.

Calculation example

Let's look at an example. The accountant is faced with the task of calculating injury payments for May 2022. The company makes the following payments to employees:

- Salary – 1,542,120 rubles.

- Remuneration for length of service – 125,470 rubles.

- Business trips – 3,520 rubles.

- Maternity benefit – 284,250 rubles.

- The bonus for the quarter is 617,800 rubles.

- Vacation compensation – 58,730 rubles.

You need to add up all these indicators and then subtract those payments that are not taxed: 2,542,120 + 125,470 + 3,520 – 284,250 + 617,800 – 58,730 = 1,945,930 rubles. The organization's OKVED code is 10.52. This is risk class 3. The contribution rate is 0.4%. You need to multiply the resulting amount by the tariff. The result is 7,783.72. This is the amount that needs to be sent to the Social Insurance Fund.

When to Apply for Financing

The treatment regulations are prescribed in the Rules for financial support for preventive measures to reduce industrial injuries and occupational diseases of workers and sanatorium and resort treatment for workers engaged in work with harmful and (or) dangerous production factors (approved by Order of the Ministry of Labor No. 580n dated December 10, 2012), hereinafter referred to as the Rules .

You have the right to submit an application to the Fund with supporting documents attached in general until August 1 of the current year, but in 2022, due to the onset of the pandemic, the deadline has been extended until October 1, 2020.

Important! Contact the Social Insurance Fund as early as possible, because funding is provided through budgetary allocations, and they are, naturally, limited. Even if you meet the deadlines and submit all documents, there is a chance of being rejected simply because the allocated funds have run out.

Where do you need to pay?

Contributions are sent to the local FSS branch. The funds are paid to the fund in which the company is registered. Payment must be made before the 15th (based on paragraph 4 of Article 22 of the Law). For example, contributions are calculated based on payments made in April. In this case, funds must be sent before May 15. If the 15th falls on a weekend or holiday, payments are made on the next weekday.

The amount of insurance premiums is not rounded. If the company has overpaid, the next payment will be reduced by the corresponding amount. If the company has transferred an insufficient amount of contributions, the difference must be made up immediately. If arrears are detected by the FSS, the company is sent a corresponding notification.

Benefits on contributions for injuries

A discount can be provided to companies that regularly and on time transfer contributions to the Social Insurance Fund. There should also be no cases of injuries at the enterprise. To receive the discount, you must submit an application before November 1 of the year preceding the payment year. For example, to receive a discount in 2022, you must submit an application before November 1, 2016. The size of the discount depends on such indicators as the number of injuries per thousand employees and the duration of disability when an injury occurs. The maximum discount is 40%. If the company employs employees of the first, second and third disability groups, the discount can be increased to 60%. Benefits are provided on the basis of Article 2 of Federal Law No. 179 of December 22, 2005.

FOR YOUR INFORMATION! This procedure for calculating benefits motivates companies to take measures to reduce the number of injuries, as well as to pay contributions on time. The more conscientious the organization, the greater the discount percentage it will receive.

Reporting on deductions for injuries in 2022

Reporting on injuries in 2022 remains submitted quarterly in the month following the end of the next quarter, no later than (Clause 1, Article 24 of Law No. 125-FZ):

- on the 20th, if the report is generated on paper (insured persons with an average number of no more than 25 people have this right);

- On the 25th, if delivery is made electronically.

To compile it, form 4-FSS is used, approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 in its current version. The same document contains rules for reporting. Data is entered into the form as a total that increases from quarter to quarter. Only those tables for which the necessary data are available must be filled out.

For information on how to fill out Form 4-FSS in 2022, read the material “Form 4-FSS for the year - reporting form and example of completion.”

Along with Form 4-FSS, another report is submitted - on the use of insurance funds to implement measures to reduce injuries at work.

How to reimburse the costs of preventive measures in 2022, read the ready-made solution ConsultantPlus. Access to the system can be obtained free of charge for several days.

The legality of applying a certain tariff when calculating contributions requires annual confirmation of the type of activity being carried out. The deadline for confirmation is defined as April 15 of the year following the one for which the information substantiating the type of activity is generated (clause 3 of the confirmation procedure approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). In 2022, the confirmation deadline is 04/15/2022.

For information about what documents are submitted to the Social Insurance Fund in this regard, read the material “Application for confirmation of the main type of activity.”