When was the BCC for insurance premiums last updated?

Since 2022, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities.

As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs. The existence of a situation where, after 2016, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2022, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2016 and for periods after January 2022. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

Read more about KBK in this material.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

From January 2022, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2022 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2022 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

We talked about the nuances in the material “From 2022 - changes in the KBK.”

However, as of April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2022 BCC.

In 2022, the list of BCCs was determined by order of the Ministry of Finance dated November 29, 2019 No. 207n, in 2021 - by order No. 99n dated June 8, 2020, and from 2022 a new list of BCCs is introduced, approved. by order of the Ministry of Finance dated 06/08/2021 No. 75n. But the BCC for contributions did not change any of these regulations. Find out which BCCs have changed here.

Thus, the last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2022 (Order of the Ministry of Finance dated 06/08/2021 No. 75n).

All current BCCs for insurance premiums, including those changed as of April 14, 2019, can be seen in the table by downloading it in the last section of this article.

A complete list of current BCCs on taxes and insurance premiums can be found in ConsultantPlus, having received a free trial access to the legal system.

Decoding KBK 18210202010061010160

Budget classification codes identify payments to various departments made by tax agents or individuals. To pay pension fees, the Ministry of Finance has developed and established the appropriate numbers, which are indicated on the payment receipt when making pension payments. The encodings were last updated in 2017. The codes are valid in 2022.

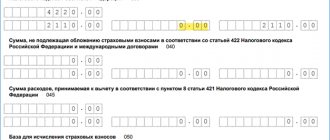

In Russia, the amounts of fees are calculated for two periods: before and after January 1, 2022. The code in question is valid when paying insurance pension contributions to the Pension Fund for citizens whose contributions are calculated from 01/01/2017. This information is reflected in the group of subtypes of income 18210202010061010160. And for the payment of insurance premiums that are accrued during the period from January 1, 2022, the code 182010202010061000160 is used. Thus, the decoding 18210202010061010160 is the payment of the standard payment of insurance premiums under compulsory health insurance to the Pension Fund for employees whose fees are calculated from 01/01/2017.

Detailed transcript of KBK 18210202010061010160:

- 182 - the department to which funds for insurance pensions are sent. For this code, this is the tax office.

- 1 - indicates the type of revenue that goes to the budget. In this case, tax revenues.

- 02 - subtype of collection: insurance premiums for compulsory health insurance, which are paid to the Pension Fund budget, calculated from January 1, 2022.

- 02010 - determines the subcategory of tax revenues and the treasury where the money is transferred.

- 06 — territorial location of the budget: regional. There are also municipal, federal, and others.

- 1010 - cash receipts subtype: indicates the class of insurance pension fees - accrued from the beginning of January 1, 2022.

- 160 - details payments: contributions to compulsory social insurance.

BCC for insurance premiums in 2022 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2022, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period is paid until 2017) are established.

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2022, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2022 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (see letter from the Ministry of Finance of Russia dated 04/07 .2017 No. 02-05-10/21007).

Find out about the current fixed payment amount for individual entrepreneurs by following the link.

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202010061010160 (if accruals relate to the period from 2017) and KBK 18210202010061000160 (if accruals are made for the period until 2022) . This is KBK at a general and reduced rate.

KBC for insurance premiums for compulsory health insurance at additional rates:

- for workers engaged in hazardous work (the list of works is specified in clause 1, part 1, article 30 of the law on insurance pensions):

- contributions at an additional tariff that does not depend on the results of the special assessment - 18210202131061010160;

- contributions at an additional tariff depending on the results of the special assessment - 18210202131061020160;

- for workers engaged in heavy or dangerous work (list in paragraphs 2 - 18, part 1, article 30 of the law on insurance pensions):

- contributions at an additional tariff that does not depend on the results of the special assessment - 18210202132061010160;

- contributions at an additional tariff depending on the results of the special assessment - 18210202132061020160.

You will find a sample payment order for contributions to compulsory pension insurance for employees in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Other BCCs for pension contributions for employees

KBK 1821020201006 1010 160 is needed to transfer insurance premiums for employees in the standard manner. But if in any of the previous months the employer did not pay contributions on time, he may be assessed fines and penalties. For payments under KBK sanctions, others:

- penalty — 18210202010062110160;

- fines - 18210202010063010160.

In the codes for the main payment, penalties and fines, only the numbers at the 14th and 15th places differ. Be careful when filling out. If you transfer the main payment to the BCC for penalties, then there will be an overpayment for the penalties, and an arrears for the main payment. Then payments will need to be clarified.

A funded pension is not the same as an insurance pension. If you withhold additional contributions to a funded pension from your employees’ salaries, then use other BCCs when transferring them.

Note! Contributions for workers to compulsory pension insurance must be paid at additional rates if they are engaged in harmful, difficult or dangerous work. BCCs in such cases differ.

What BCCs for FFOMS contributions are established in 2022

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using KBK 18210202103081013160 (if related to the period from 2022) and KBK 18210202103081011160 (if related to the period until 2022).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2022) and KBK 18210202101081011160 (for accruals made before 2022).

You will find a sample payment order for compulsory medical insurance contributions for employees in ConsultantPlus. You can get a trial full access to K+ for free.

KBK PFR for 2022 for individual entrepreneurs for employees

An individual entrepreneur can act as an employer for individuals (Article 20 of the Labor Code of the Russian Federation).

In this case, the employment relationship is formalized by an employment contract, and the employer pays insurance premiums for the employee (Article 303 of the Labor Code of the Russian Federation). Payments for insurance premiums to the Pension Fund of the Russian Federation, accrued on income paid to employees, are paid by 1 general payment order monthly. One of the required details of this document is the budget classification code (BCC), given in field 104 of the payment.

The KBK-2022 values for contributions to the Pension Fund for employees will be as follows:

| Payment type | KBK | |

| For payments for periods from 2022 | For payments accrued until 2022 | |

| Contribution to compulsory pension insurance | 18210202010061010160 | 18210202010061000160 |

| Penalty | 18210202010062110160 | 18210202010062100160 |

| Fines | 18210202010063010160 | 18210202010063000160 |

Read about what the KBK has become for paying insurance premiums for compulsory medical insurance in the article “KBK for paying insurance premiums to the Federal Compulsory Medical Insurance Fund in 2022 - 2023.”

ConsultantPlus experts explained what to do if the wrong BCC was mistakenly indicated on the payment. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

What BCCs for insurance premiums are established for the Social Insurance Fund in 2022

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

A sample payment order for contributions to OSS from VNiM for employees can be found in ConsultantPlus. You can get a trial full access to K+ for free.

Read more about the specifics of calculating insurance premiums when signing civil contracts in this article .

KBK PFR for 2022 for individual entrepreneurs for themselves

Individual entrepreneurs pay an insurance premium for compulsory pension insurance at a fixed rate. It is approved for a year and recorded in the Tax Code of the Russian Federation. Contribution rates for 2021-2023 can be found here. If the amount of income exceeds the established limit, then an additional 1% of the excess amount is paid, but not more than 8 times the fixed rate.

When paying these fees, the individual entrepreneur will also have to use 2 BCC values:

| Payment type | KBK | |

| For payments for periods from 2022 | For payments accrued until 2022 | |

| Contribution to compulsory pension insurance (the payer’s income does not exceed the income limit) | 18210202140061110160 | 18210202140061100160 |

| Contribution to compulsory pension insurance (payer’s income in excess of the income limit - 1%) | 18210202140061110160 | 18210202140061200160 |

| Penalty | 18210202140062110160 | 18210202140062100160 |

| Fines | 18210202140063010160 | 18210202140063000160 |

Results

Insurance premiums intended for extra-budgetary funds are required to be paid by both individual entrepreneurs and legal entities. BCC for insurance premiums in 2022 when making payments, you should use only current ones - this is an important factor in the timely recording of payment by its recipient.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.