In Russia, the future pension of every working citizen does not depend on the length of service, as it was before, under the USSR, but on the number of pension points (IPC) accumulated by him over a certain period of work.

The IPC is directly formed from employers’ monthly contributions to the Pension Fund, the amount of which depends on the employee’s salary.

However, in practice, it happens that representatives of organizations in which citizens work do not fully fulfill their responsibilities for transferring funds , thereby affecting the quality and volume of pension provision for their employees in the future. How to check the presence of deductions, their amounts, as well as how to deal with employer dishonesty is discussed in detail in this article.

What is ILS

ILS is an electronic account containing information about the work experience and pension rights of any Russian. Thanks to him, PF employees make decisions regarding the purpose of payments. Each electronic account is assigned an insurance number called SNILS.

Information on the rules for the formation of ILS is contained in Federal Law No. 27. The opening of an ILS is carried out by representatives of the PF on the basis of an application from a citizen or upon receipt of data from government agencies. For example, if a person applies for a passport, then if there is no account, one is automatically opened.

Attention! The ILS is opened not only for Russian citizens, but also even for foreigners or stateless persons if they live on a temporary or permanent basis in the territory of the Russian Federation.

An extract from the ILS is required to solve several problems:

- verification of pension rights, since a citizen can assess the correctness of accounting for length of service and points, as well as obtain information about the amount of a funded pension;

- errors made by PF employees when calculating points or length of service are identified;

- the honesty of the employer is checked, since sometimes heads of companies and individual entrepreneurs do not formally register citizens, so their length of service is not accrued;

- the method of pension formation is determined;

- it becomes clear which fund is used to increase the savings portion.

Attention! You can receive this statement not only by visiting a Pension Fund office in person, but also remotely, for which you can use the fund’s website or the State Services portal.

Why is it necessary to check pension savings?

Citizens of the Russian Federation have been receiving insurance certificates since 1996. Until 2013, the Pension Fund of Russia sent notifications about the size of the current account to everyone at the address indicated as the place of permanent registration. Now, if necessary, the insured person needs to independently find out the amount of savings. Over the past five years, several Federal laws have been adopted that have changed the procedure for calculating pensions. To understand how it will be calculated for a particular citizen, you need to know the amount of cash savings and the number of pension points.

Who can receive information

Information about the HUD is confidential, so unauthorized persons cannot obtain it. Information is requested exclusively by the account owner or a legal representative holding a notarized power of attorney. If a person is incapacitated, then his interests are represented by a guardian or trustee.

To obtain information about the account status, a special statement is requested. To obtain it, different methods are used:

- sending an application by mail;

- personal application to the MFC or PF branch;

- through the State Services portal if you have an identified account;

- using the PF website.

Attention! If a citizen decides to personally come to the PF office, then he can choose any unit, regardless of his place of registration.

Basic methods

Before checking the fact of the presence of contributions to the pension fund on the part of the employer, you should find out what amounts, in fact, he is obliged to transfer.

They are not fixed and the same for everyone, since in accordance with federal law, the amount of contributions is 22% of the salary of each employee. It is worth noting that it is not calculated from wages, as is the case when paying the same income tax, that is, the employee does not feel the very fact of the transfers in his wallet and this is not reflected in the pay slips issued to him every month.

An amount of 22% of wages is generally obligatory for transfer for all employees, with a few exceptions. Thus, for employees performing work functions in conditions that are harmful and hazardous to health, an increasing coefficient applies. Depending on the hazard class, the additional tariff can reach 4% of the salary amount.

In turn, there are certain concessions for organizations using a simplified taxation system. They transfer 20% of the salary for each employee.

Reference! Persons who are individual entrepreneurs make transfers independently for themselves according to the tariffs approved by the Pension Fund.

So, having figured out what amounts should be transferred by the employer to the Pension Fund of the Russian Federation, you should begin to check his conscientiousness in relation to the duties assigned to him by law.

There are quite a few ways to check contributions to the Pension Fund, some of them are presented below:

- by contacting the Pension Fund in person;

- through your personal account on the fund’s website;

- on the State Services website;

- through the MFC;

- by mail;

- through banks.

The easiest way to check is through the employer's accounting department. If the employer transfers insurance premiums in full, the necessary information will be provided. However, there is a risk that this information may be unreliable and biased.

Via Russian Post

To receive an extract about the status of your personal account, you can send a letter with the corresponding request to the PF address. The following rules are taken into account :

- Only registered mail is used, since the sender retains proof of dispatch provided by the check;

- such letters are assigned a specific track number, with which a citizen can track exactly where the document is located, and confirmation of receipt by the addressee is also provided;

- To speed up the process, it is recommended to send a letter to the address of the nearest PF branch.

Thanks to such simple actions, it is guaranteed that PF representatives will not ignore an official statement from a citizen.

By last name

Information from a personal account is provided exclusively to its owner. To do this, you must have an identified account on the State Services portal, and you can also contact PF employees directly. to obtain up-to-date information using a person's last name alone .

If a citizen cannot independently come to the PF branch, then he will have to choose in advance a representative for whom a power of attorney is drawn up and certified by a notary.

Using SNILS and TIN online

SNILS is the main document that confirms the fact of registration of a citizen in the personalized pension accounting system. It also allows you to identify him when contacting the Pension Fund of Russia.

A personal account number is also needed for registration in electronic services, including via the Internet: in “State Services” and in your personal account on the website of the Pension Fund itself. After registration has been completed, the SNILS number can be used as a login to gain access to the corresponding services.

If the SNILS number is unknown, for example, due to the loss of a green card, and there is no time to restore the document in the Pension Fund, then you can find it out using a document such as TIN.

This can be done in two ways:

- through the pension fund website;

- via the Federal Tax Service website.

In the second case, you should go to nalog.ru and select the “Business Risks” section. Then a window will appear in which the user will be asked to enter the TIN in the pop-up field. After this, a file will be generated in which SNILS will be reflected.

Attention! There is a high probability that SNILS may lose circulation within the official document flow, since a bill has been approved in parliament, which, among other things, would abolish the issuance of green cards and stop their use.

On the State Services website

To find out about transfers to the pension fund through the State Services website, you should perform the following algorithm of actions:

- Open the “Pensions, benefits, benefits” tab.

- Select from the menu “Notice on the status of the pension account in the Pension Fund of the Russian Federation.”

- Click “Get service”.

Some time after this, a notification about the readiness of the corresponding extract will appear on the portal. Using the information contained in it, you can check the frequency and amount of insurance premiums. In addition, this extract can be used as part of electronic document management to confirm certain information.

To gain access to all the features provided by the site, you must register on it and go through the identity verification procedure. There are several ways to do this, explained in detail on the portal itself.

MFC

This issue can also be clarified through multifunctional centers, which are convenient because they are located in every municipality in the country.

To do this, the citizen must personally arrive at the nearest center and provide its employees with the following documents:

- passport;

- SNILS;

- statement.

Within one week after this, the MFC will provide an extract from the Pension Fund on the status of the personal account.

In banks

All money transferred by employers is stored in the accounts of credit institutions. The Pension Fund of Russia has concluded agreements with several banks, including Sberbank. In order to find out about transfers, a citizen can contact the credit institution directly, having with him a passport and SNILS.

Pension contributions in Sberbank

All pension contributions occur through various credit organizations, but only through those with which the Pension Fund has an agreement. Among them is Sberbank, to which you can submit an application to receive a statement of savings. As when visiting the Pension Fund, a citizen must have SNILS and passport data with him, which will be used to draw up an application for the provision of services.

Instructions for verification through the Pension Fund of Russia

To obtain the necessary information, you must register on the website pfrf.ru.

If a citizen has an account on the State Services website, then he automatically becomes registered on the Pension Fund website.

Then you should go to your personal account and perform the following algorithm of actions:

- Select the “Ministry of Health and Social Development” tab.

- Select the “Pension Fund” button.

- Select the section “Information on the status of personal accounts”.

Why is it dangerous to find out your pension fund online?

There are many scam sites on the Internet that offer to find out information about which pension fund your savings are stored in. These sites may request passport data or SNILS. Later, the attackers use this information for their own purposes, but you will not receive any information on the issue of interest.

Another type of fraudulent sites are those that require payment for the service. The visitor follows the instructions on the site, registers in the system, and then is asked to send an SMS to a specific number. After this, the amount for a call to a paid number is debited from your mobile or home phone account.

You should not trust such sites, even if at first glance they seem honest. Remember that only two online resources can provide information on your own accumulated pension fund - the government services portal and the official website of the Pension Fund.

If the employer does not make transfers

If it is established that the employer does not make contributions to the Pension Fund, the employee has the right to go to court in order to oblige him to pay the existing arrears. To do this, the following documents must be attached to the claim:

- passport;

- SNILS;

- a copy of the work book;

- Statement of the pension account;

- payslips;

- employment contract.

Reference! Both the employee himself and a third party who has a notarized power of attorney for this purpose have the right to conduct business in court.

Checking the deductions of funds to the Pension Fund for employees requires careful monitoring on the part of the employee himself, since many organizations perform their respective duties in bad faith. There are many means for this. If the fact of absence of transfers has been established, the employee should go to court.

Checking the correctness of accrual and correcting errors

To correctly check the information from the extract, the following points are taken into account:

- Method for forming future pension payments .

Both the insurance and savings parts can be accumulated. But for some citizens, only an insurance payment is formed. These include persons born before 1967, as well as people who were born after 1967, but they did not apply for the allocation of the funded portion. Under such conditions, the first page of the document indicates that all insurance premiums are directed towards the insurance pension. If a citizen voluntarily wrote an application to divide the future pension into two parts, it will be indicated that funds from employers are used to increase both the insurance and funded parts. - Amount of funded pension .

If this part is accumulated simultaneously with the insurance, then the funds are transferred to the account of the management company. Now the Pension Fund is cooperating with Vnesheconombank. The statement contains information about the exact amount of savings, taking into account the interest received from the investment. If a decision was previously made to transfer the savings portion to the account of a non-state pension fund, then information about its size will not be available. To obtain this data, you will have to contact representatives of the NPF where the money was sent. Any citizen has the right to return funds to the PF account at any time. In order not to lose accumulated income, it is recommended to perform the process no more than once every 5 years. - Experience and points. These parameters directly affect the future pension of any person. Points are otherwise called IPC. They increase with the receipt of insurance premiums paid by employers.

These amounts are recorded on your personal account and then converted into points. The cost of 1 point increases annually, so it is impossible to determine the exact amount of the pension in a few years. The length of service is represented by the period during which the citizen carried out labor activities. During this time, insurance premiums must be paid for the citizen. Points are accumulated not only for work, but also for other periods of life.This includes conscription service, caring for a child or a disabled person, as well as a woman living with her military husband in military camps where there is no opportunity for employment.

When studying statements, citizens often discover errors or inconsistencies. To correct them, an official letter is drawn up to the Pension Fund. It contains a list of clarifications that need to be made to the ILS. The application can not only be brought in person, but also sent by mail, as well as uploaded on the Pension Fund website. Documents proving the citizen’s case are attached to the appeal. These include papers confirming work experience for a particular period of time.

Submitted documentation is reviewed within 10 working days, but this period can be extended if additional checks are necessary. Often other documents are requested for clarification. If the applicant’s correctness is confirmed, then adjustments are made that have a positive effect on the length of service and the number of points.

How is the funded part of a Russian citizen’s pension formed?

Pension contributions of citizens of the Russian Federation are divided into two categories: insurance and funded.

The total amount of pension contributions is 22% of wages. When two types of deductions are formed: 16% goes to the insurance part and 6% to the savings part.

The funded part of the pension is automatically formed for citizens:

- those born in 1967 and later;

- those who started their working career in 2014;

- those who have chosen the option with a funded pension until December 31, 2015.

Others can independently form the funded part of their pension through voluntary contributions. During the first 5 years of working life, but not earlier than 23 years of age, citizens of the Russian Federation born in 1967 and later can choose whether to form the funded part of the pension or refuse it.

A significant disadvantage of forming a funded part of a pension is that such payments reduce the amount of insurance pension contributions indexed by the state. One of the advantages is that this amount can be paid to the heirs in the event of the death of the insured person before the start of pension payments. In addition, it is through the funded part that you can significantly increase the size of your pension in the future.

Checking savings in non-state pension funds

Each citizen can independently dispose of the funded part, for which it is not only formed in the Pension Fund account, but also transferred to some non-state fund.

Nowadays there are many non-state pension funds operating in Russia, differing in profitability, duration of operation, interest rate, investment risks and other characteristics. If a citizen has funds stored in a non-state pension fund account, then information about the amount of savings can only be obtained by contacting this institution:

- NPF Sberbank. You can obtain information about the size of the savings portion through terminals, your personal account on the website, a mobile application or branches of a banking institution.

If you choose to visit the institution in person, you need to take your SNILS and passport with you. One visit is enough to obtain comprehensive information. The client is offered a detailed statement for the required period of time. Typically, citizens prefer to use Sberbank online banking. - Gazfond . If this organization is selected to transfer a funded pension, then you can use different methods to obtain information about the status of the account. The easiest way is to use a personal account on the institution’s website. It offers prompt and up-to-date information for any period of time. You can not only view the data, but also print a statement. A paper document containing the necessary information can be sent to the client by mail, for which a simple or registered letter is selected. The extract can be sent to the citizen’s email address. Thanks to such simple methods of obtaining data, there are no difficulties in controlling your own savings.

- VTB .

If VTB NPF is chosen to store and increase the funded pension, then clients have the opportunity to easily control their pension account. Citizens can send an application to open a pension account through a special mobile application. With its help, it is easy to control the status of your account by checking the accumulated amount. This will allow you to properly plan the future and calculate your possible retirement. If necessary, clients can top up their NPF account. To do this, select the “Pension Savings” tab, where current accounts are visible.

Important! Almost all large non-state pension funds offer their clients the opportunity to remotely receive information about the status of their savings.

Contributions to the Pension Fund for individual entrepreneurs without employees, notaries and lawyers

If an individual entrepreneur does not have employees, he will still have to pay contributions to the Pension Fund, but for himself. The calculation logic is different: there is a fixed amount. In 2022, this is 29,354 RUR. This amount must be paid, even if the individual entrepreneur has not earned a single ruble.

But that is not all. You also need to pay contributions for compulsory health insurance, in 2022 it will be 6884 RUR.

If the income of an individual entrepreneur exceeds RUB 300,000, you will have to pay an additional 1% of the excess amount. But there is a maximum limit for insurance pension contributions - 234,832 RUR. That is, even if an individual entrepreneur earns significantly more than three hundred thousand rubles, he will still pay only 234,832 rubles in taxes.

For example, an individual entrepreneur earned 350,000 RUR. This is what he must pay:

- mandatory contributions: 29,354 R + 6884 R = 36,238 R;

- additional contributions: (350,000 RUR − 300,000 RUR) × 1% = 500 RUR.

Every year the mandatory amount of contributions for individual entrepreneurs changes; check the current one on the Federal Tax Service website. In 2022 it will be like this:

- insurance premiums for compulsory health insurance - 32,448 RUR;

- insurance premiums for compulsory medical insurance - 8426 RUR.

Lawyers, notaries, arbitration managers, appraisers, patent attorneys pay fees for themselves according to the same scheme.

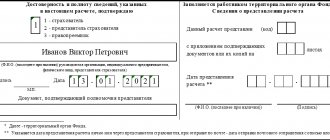

Contents of the extract

The document consists of an introductory part, as well as 5 separate blocks. Each element has its own characteristics :

- Introductory part. It includes personal information about the owner of the HUD. This includes your full name, date of birth, SNILS number and the chosen method of securing your future pension. The length of service and accumulated points are provided. If a pensioner requests information, then there is no information about the length of service.

- 1 block. This includes periods of employment from 2015 onwards. The list indicates the companies in which the citizen officially worked. These organizations paid fees per person, which allowed points to be awarded.

- 2 block. It is intended for employment periods up to 2015.

- 3 block. Contains detailed information about all savings in the Pension Fund. This block is available provided that the citizen has not transferred his savings portion to the account of any non-state pension fund. Provide information about the management company and investment portfolio. If a person transferred his pension to another fund, then the information will be missing.

- 4 block. If a person chose to store and increase the savings portion in a non-state pension fund, then the name of the fund is indicated, as well as general data on the amount of savings. If a citizen keeps all funds in a PF account, then this block will not be in the statement.

- 5 block. Includes data on the date of assignment of the pension, its size and the amount of the fixed payment, and also provides the size of the funded pension, if any. If a citizen receives an urgent or one-time payment, its amount is given. If the person is not the recipient of these payments, then the block will be missing.

After studying this document, a citizen will be able to determine the size of his savings, as well as whether there are any errors that could negatively affect the size of his future pension.

Relationship between SNILS and pension savings

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

For each Russian citizen who registers with the Pension Fund of the Russian Federation, a personal account is opened that contains a permanent insurance number (SNILS) - Article 6 of the Federal Law of the Russian Federation No. 27 (dated 04/01/1996). Each such citizen receives an insurance certificate from the territorial department of the Pension Fund of the Russian Federation, on which the SNILS is indicated - Article 7 of the Federal Law of the Russian Federation No. 27.

It is a green laminated or plastic card containing the following information:

- Owner's full name.

- Date and place of birth.

- Gender.

- The date when the owner received an account with the Pension Fund.

- SNILS.

Worth knowing! Due to the presence of the insurance number on the certificate, it is usually called SNILS.

The owner’s personal account accumulates information about places of work, the amount of cash contributions to the Fund, all periods of activity, the presence of which is important for the future calculation of pensions. The account reflects the amount of all pension savings of the citizen.

Throughout life, SNILS remains unchanged. Even if the owner changes the basic passport data, this does not affect the number in any way. This means that, if necessary, you can check your savings in the Pension Fund using SNILS at any time.