Where to pay contributions for injuries

Social contributions are divided into 2 types:

- contributions in case of temporary disability and in connection with maternity (VNiM) - are paid only for employees signed under an employment contract;

- Contributions for industrial accidents and occupational diseases (“accident” contributions, “injury” contributions) are transferred for all employees with whom an employment contract has been concluded, as well as for performers under the civil process agreement, which stipulates the obligation to pay such contributions.

From 2022, after the transfer of insurance premiums to the jurisdiction of the Federal Tax Service, social contributions are paid:

- to the Federal Tax Service - deductions for VNiM (see the procedure and sample for filling out such a payment form here);

- in the Social Insurance Fund - contributions for injuries.

What benefits are paid from the Fund?

The Social Insurance Fund transfers the following payments to employees:

- sick leave benefits, including due to an accident at work and/or occupational disease;

- according to BiR;

- a one-time benefit for workers who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care payment.

In addition, the Social Insurance Fund also pays additional leave for working citizens who were injured or ill at work.

Employers pay employees from their own funds: funeral benefits, sick leave for the first 3 days of illness, payment for 4 additional days of rest to care for a disabled child.

Deadline for payment of contributions for injuries

The deadline for paying contributions for injuries is no later than the 15th day of the month following the one in which the employee received income. If this day falls on a holiday or day off, it is transferred to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

In 2022, the deadlines for payment of “traumatic” contributions are shifted to February, March, August and November. You can get information about the exact deadlines for paying these payments in 2022 in this article.

Where to see the format of the 4-FSS report for 2022

Form 4-FSS was approved by order of the FSS of the Russian Federation dated September 26, 2016 No. 381 and updated by order of the FSS of the Russian Federation dated June 7, 2017.

This edition will be applied from reporting for 9 months of 2022 and is valid in 2022. The current form can be found:

- on our website;

- on the FSS website.

Note! As before, only those policyholders whose staff in the period under review did not exceed the threshold of 25 employees have the right to generate and submit 4-FSS on paper. All others are required to report to the Social Insurance Fund only electronically.

The electronic format of Form 4-FSS 2022 can be found on the FSS portal.

Note that information on the XSD scheme is provided on the FSS portal more likely for computer scientists working on software for submitting reports (for example, employees of EDF operators). The accountant submitting the report will most likely only be able to determine that the submitted form contains formatting errors - this will follow from the messages of the system through which the report is sent.

CLARIFICATIONS from ConsultantPlus: the organization changed its location from Moscow to St. Petersburg in July. Reporting is submitted electronically. What is the procedure for reporting on forms SZV-M, SZV-STAZH and 4-FSS? The answer to the question can be found here.

To prevent such errors from occurring, the FSS offers special advice on passing the 4-FSS using the new form through its portal. Let's look at the main ones of these tips in the next section.

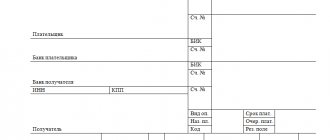

Sample payment order for injuries in the Social Insurance Fund 2022

When filling out a payment form for contributions for injuries, you should be guided by the rules prescribed in:

- Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulations of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Payment order form 2020

The procedure and features of drawing up a payment order for contributions for injuries are shown in the table:

| Props name | Number (according to Appendix No. 3 to the Regulations of the Bank of Russia dated No. 383-P) | Note |

| Admission to the bank of payments. | 62 | There is no need to fill them out, the bank employee will fill them out independently. |

| Debited from account plat. | 71 | |

| № | 3 | If you generate a payment manually, the number must be greater than zero. If the document is drawn up in electronic form, this field will be filled in automatically and there is no need to further adjust it |

| date | 4 | The order in which the date is indicated also depends on how the payment is filled out:

|

| Payment type | 5 | When paying contributions for injuries, this field does not need to be filled in. |

| Payer status | 101 | Regardless of who pays the fees (individual entrepreneur or organization), the code “08” is indicated here |

| Suma in cuirsive | 6 | Write down the amount of contributions paid in words:

For example: “Eight hundred thirty-four rubles 50 kopecks” |

| Sum | 7 | We transfer the amount from field 6, but in the form of numbers. We do not indicate the words “ruble” and “kopecks” at all, but separate them from each other:

The round sum can be written in another way: “834-00” |

| TIN | 60 | We enter the TIN of the employer paying the contributions. For an organization, the number consists of 10 characters, for an individual entrepreneur - of 12 |

| checkpoint | 102 | Checkpoints are indicated only by organizations and separate divisions (OP):

Entrepreneurs do not have a checkpoint, so they leave this field blank or set the value “0” |

| Payer | 8 |

|

| Account No. | 9 | Bank account number of the organization or entrepreneur. It must consist of at least 20 characters |

| Payer's bank | 10 | Bank account details of an organization or individual entrepreneur paying contributions for injuries |

| BIC | 11 | |

| Account No. | 12 | |

| payee's bank | 13 | Bank details of the Social Insurance Fund branch to which contributions are paid. You can find out which department they should be transferred to from the notice sent by the fund, as well as on the website of this department |

| BIC | 14 | |

| Account No. | 15 | This field is intended to indicate the correspondent account number of the paying bank. There is no need to fill it out when paying personal injury contributions. |

| TIN | 61 | TIN and KPP of the Social Insurance branch to which contributions are transferred. You can also find out from the notification sent by the fund for the payment of these payments |

| checkpoint | 103 | |

| Recipient | 16 | The recipient of contributions is the Federal Treasury: “UFK for ___ (enter the name of the region in which contributions are transferred).” After this, you need to indicate the FSS branch to which contributions are transferred. For example: “UFK for Moscow (GU - Moscow regional branch of the FSS of Russia) |

| Account No. | 17 | Bank account number of the recipient of contributions (UFK). You can find it on the website of the regional branch of the Social Insurance Fund, to which contributions are transferred |

| Type op. | 18 | For insurance premiums for injuries, enter code “01” |

| Payment deadline. | 19 | We do not fill out these fields |

| Name pl. | 20 | |

| Essay. Plat. | 21 | The order of payment is 5, so enter the code “05” in this field |

| Code | 22 | When paying contributions on time, indicate the code “0”. If contributions are paid at the request of the Social Insurance Fund, in this field you must indicate the UIN from the request |

| Res. field | 23 | We do not fill in |

| Purpose of payment | 24 | The name of the payment and the period for which it is transferred. It is advisable to indicate the registration number of the policyholder in the Social Insurance Fund. For example, “Insurance contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases for January 2022. Registration number in the FSS - 7712123453" |

| M.P. | 43 | We put a stamp (as in the sample card). If the payment form is generated by a bank, it is not necessary to put a stamp. |

| Signatures | 44 | We put the signature of the person indicated in the sample signature card |

Sending Form 4-FSS electronically to the Social Insurance Fund.

FSS submission of reports in electronic form with step-by-step instructions for user actions.

1. Prepare a 4-FSS report file in xml format. To do this use:

– the “DocMaster” program, or – the “Workstation for preparing calculations for the Social Insurance Fund” program (), or – your own accounting program (for example, 1C).

The report is sent in the Postal Agent program (the “Reporting to the Social Insurance Fund” system). Watch our video or read the instructions below:

2. To send a report, open “Mail Agent” and in the main program window select the “Reporting from the FSS” section. Click the "Create Message" button

3. In the letter creation window, click the “To” button and select the recipient “FSS RF”.

If you do not have this recipient, the program will open a window for adding departments. Select “FSS - FSS RF” from the drop-down list and click “Install”, then “Close”.

4. Once you have selected a recipient, click the Attach File button and select your report.

Once added, you will see it in the Attached Files section.

Click "Save".

5. After saving the letter, it will be displayed “For sending.” Click “Send message” to send the report.

6. After sending, the letter will appear in the “Sent” section. Here you will find detailed information about the processing steps for your report. To receive this information from the FSS, after some time you need to click the “Deliver mail” button in the main program window, or configure automatic mail delivery (menu “Tools-Settings-Options”).

7. Report completion statuses.

1. Confirmation of the date of dispatch - a document indicating that the report was sent on the specified date and time, and arrived at the EDF operator’s server, from where it was sent to the relevant inspection

2. Result of acceptance - a document notifying the successful processing of the report, or a notification of refusal of acceptance.

3. Processing result (positive/negative) – these documents notify the user about the successful submission of the report or the need for clarification and the reason for refusal of admission.

4. Receipt from the Social Insurance Fund - receipt of payment.

All of the above documents are opened in printed form by selecting “View” when you click on the status.

Please note: we recommend sending the report at least two days before the reporting date.

Reporting to the Social Insurance Fund has been sent electronically.

The Foundation reviews the report within 48 hours. The date of submission of the report is contained in the receipt from the Social Insurance Fund.

Payment order for injuries: attention to important fields

The procedure for filling out fields 104-109 when paying contributions for injuries is given in the table:

| Line title | Number | Note |

| 104 | Budget classification code | Since contributions for injuries are administered by the FSS, the first 3 digits of the code will be 383. When filling out a payment form for contributions from accidents and occupational diseases, you should indicate KBK 393 1 0200 160 |

| 105 | OKTMO code | We make an OKTMO of the FSS branch, to which contributions for injuries are transferred:

|

| 106 | Payment basis code | When paying contributions for injuries, “0” is entered in these fields (clause 5 of Appendix No. 4 to Order of the Ministry of Finance dated November 12, 2013 No. 107n). When paying other contributions (for compulsory medical insurance, compulsory medical insurance and VNiM), lines 106 and 107 are filled in |

| 107 | Taxable period | |

| 108 | Document Number | |

| 109 | Document date |

Sample payment order for injury contributions

Let's sum it up

- Contributions for injuries are transferred not to the Federal Tax Service, like all other insurance contributions (for compulsory medical insurance, compulsory medical insurance and VNiM), but to the Social Insurance Fund.

- The deadline for payment of contributions for accidents and occupational diseases is until the 15th day of the month following the one in which the employee received income.

- When filling out the payment form, code “08” is indicated in field 101, regardless of who pays the injury contributions.

- Fields “106-109” are not filled in when paying “unfortunate” contributions.

- Contributions for injuries are paid to KBC - 393 1 02 02050 07 1000 160.