Sometimes it is more profitable for an organization to use the services of a third-party contractor to produce products than to spend money on equipment, specialized personnel, etc. To do this, it enters into a toll processing agreement with the contractor.

From the article you will learn:

- what is toll processing;

- on the regulatory regulation of this business transaction in NU and BU;

- how to keep accounting records of customer-supplied raw materials from a processor in 1C 8.3;

- how to keep records for the contractor performing processing;

- postings for customer-supplied raw materials in 1C 8.3 from the processor.

Accounting for customer-supplied raw materials - regulatory regulation

Toll processing is the performance of work on the production of products from the customer’s material under a contract (Article 702, Article 713 of the Civil Code of the Russian Federation).

BOO. When transferred for processing, there is no transfer of ownership: the materials continue to be accounted for on the customer’s balance sheet. For the processor, they are reflected in off-balance sheet account 003 “Materials accepted for processing” (clause 156 of the Guidelines for accounting for inventories, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n, Chart of Accounts 1C).

Income and expenses from processing work are related to income and expenses for ordinary activities (clause 5 of PBU 9/99, clause 5 of PBU 10/99.).

WELL. The contractor’s revenue from performing work on processing the customer’s raw materials (materials) is income from sales (clause 1 of Article 248 of the Tax Code of the Russian Federation).

VAT. The transfer of raw materials to the processor is not a sale to the customer and is not subject to VAT (Article 38, Article 146 of the Tax Code of the Russian Federation).

The implementation of processing work by the contractor is subject to VAT (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation, clause 5, article 154 of the Tax Code of the Russian Federation).

Accounting for the processor

As a rule, the contractor-processor does not have any difficulties in registering and recording transactions with customer-supplied raw materials, since the accounting of revenue and costs for performing work (rendering services) in this case is carried out in accordance with the generally established procedure.

The only exceptions are materials received for processing, the cost of which does not participate in the formation of the cost of the finished product. The processing organization records the customer-supplied raw materials received for processing on off-balance sheet account 003 “Materials accepted for processing” at the agreed value. According to the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, analytical accounting is organized by customers, types, grades of raw materials and materials and their locations.

When accepting customer-supplied raw materials, the primary accounting documents of the processor must indicate the name of the customer, the name of the material itself, its quantity and cost, as well as the location of storage and processing.

The following entries are made in the processor's accounting records:

D-t 003 - the cost of customer-supplied raw materials has been taken into account;

D-t 20, K-t 10, 26, 60, 70, 69 - expenses for processing customer-supplied raw materials are reflected;

D-t 62, K-t 90 - revenue from the sale of work performed (services provided) for processing customer-supplied raw materials is reflected;

D-t 90, K-t 68 - VAT is charged on the cost of processing services;

D-t 90, K-t 20 - actual costs of providing services are written off;

D-t 90, K-t 99 - financial result determined;

K-003 - upon delivery of the finished product to the customer, the cost of customer-supplied raw materials is written off.

Accounting for customer-supplied raw materials in 1C 8.3 at the processor - step-by-step instructions

On September 02, the Organization received from the customer STROITEL LLC raw materials for the manufacture of products:

- edged board 5 cubic meters at a price of 6,000 rubles, in the amount of 30,000 rubles.

On September 12, the Organization manufactured the following products:

- street bench 100 pcs.

On September 13, the Organization handed over to the customer:

- finished products,

- certificate of completion of work in the amount of 120,000 rubles. (including VAT 20%).

On September 30, the salary of an employee engaged in processing work was accrued in the amount of 20,000 rubles.

On September 30, depreciation of fixed assets used in processing was accrued in the amount of RUB 5,208.33.

The Organization's accounting policy stipulates that the calculation of the cost of products (work) is carried out using planned prices. The planned cost of work on the manufacture of benches has been approved:

- 300 rub. - per unit products.

Accounting for customer-supplied raw materials in 1C 8.3 for the processor step-by-step instructions →

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of materials for processing | |||||||

| 02 September | 003.01 | — | 30 000 | Receipt of materials from the customer for processing | Receipt (act, invoice) - Materials for processing | ||

| Write-off of materials for production | |||||||

| 03 September | 003.02 | 003.01 | 30 000 | Write-off of materials for production | Request-invoice | ||

| Production of finished products | |||||||

| 12-th of September | 20.02 | 20.01 | 30 000 | 30 000 | 30 000 | Release of finished products at planned cost | Shift production report |

| Receipt of finished products | |||||||

| 12-th of September | 002 | — | 30 000 | Transfer of finished products to the warehouse | Manual entry - Operation | ||

| Transfer of products to the customer | |||||||

| September 13 | — | — | — | Transfer of finished products to the customer | Transfer of goods - Transfer of products to the customer | ||

| — | 002 | 30 000 | Write-off of finished products from warehouse | Manual entry - Operation | |||

| Implementation of processing work | |||||||

| September 13 | 62.01 | 90.01.1 | 120 000 | 120 000 | 100 000 | Proceeds from the sale of work | Sales of processing services |

| 90.02.1 | 20.02 | 30 000 | 30 000 | 30 000 | Write-off of the planned cost of work | ||

| — | 003.02 | 30 000 | Write-off of customer materials from accounting | ||||

| 90.03 | 68.02 | 20 000 | VAT accrual on revenue | ||||

| Submission of the SF for the implementation of work | |||||||

| September 13 | — | — | 120 000 | Drawing up an invoice for shipment | Invoice issued for sales | ||

| — | — | 20 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Calculation of wages and insurance premiums | |||||||

| September 30th | 20.01 | 70 | 20 000 | 20 000 | 20 000 | Payroll | Payroll |

| 70 | 68.01 | 2 600 | 2 600 | Withholding personal income tax | |||

| 20.01 | 69.01 | 580 | 580 | Calculation of contributions to the Social Insurance Fund | |||

| 20.01 | 69.03.1 | 1 020 | 1 020 | Calculation of contributions to the FFOMS | |||

| 20.01 | 69.11 | 40 | 40 | Calculation of contributions to NS and PP | |||

| 20.01 | 69.02.7 | 4 400 | 4 400 | Calculation of contributions to the Pension Fund | |||

| Depreciation calculation | |||||||

| September 30th | 20.01 | 02.01 | 5 208,33 | 5 208,33 | 5 208,33 | Depreciation calculation | Closing the month - Depreciation and wear and tear of fixed assets |

| Adjustment of the cost of processing materials supplied by the supplier | |||||||

| September 30th | 20.02 | 20.01 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | Closing the month - Closing accounts 20, 23, 25, 26 |

| 90.02.1 | 20.02 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | ||

Transfer of raw materials for processing to a third-party manufacturer

Task: to arrange the transfer of raw materials - lumber and receipt of finished products - a wooden pallet from the Manufacturer

We have 10 m3 of lumber which makes 200 pallets

Let's create 2 product items - Pallet and Lumber from which it will be made.

In the Pallet card, for the convenience of subsequent operations, we can create a specification indicating the material consumption.

1. fill in the Name to distinguish the specifications - if we ourselves produce there will be a more complete specification with processing operations, etc., in this case the specification is simplified.

2. fill out the Composition tab - in it we indicate material reserves (Materials, Assembly, Unit) and intangible services of third-party organizations (Consumed).

3. select the type of stock

– material, material stock used in the production process

- assembly, part of a finished product produced at this enterprise as part of another production process

- a set of nomenclature items, reflected in accounting as different items, but used in this process as one block - node. For example: a “flooring” unit may include 9 boards of 1200 mm each and 3 boards of 1000 mm each.

In this example, we only use lumber and we may not know the production process of the Manufacturer - so we only supply lumber with a consumption of 1 m3 per 20 pallets.

Click the “Save and close” button

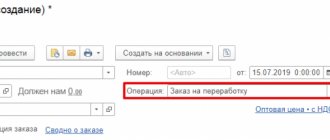

We create an “Order to the supplier”:

1 – Select the operation “Order for processing”

2 – We choose a company that will produce pallets from our raw materials. In this case – Manufacturer

3 – Select the date when we will receive the pallets

In the “Products” tab fill in:

4 – Select a product item for finished products

5 – Required quantity

6 – Planned price

In the “Materials for recycling” tab

If we have entered “Specification” in the Nomenclature of Finished Products, then simply click the “Fill in according to specification” button and the tab will be filled in with the material and quantity.

If there is no specification, then fill in fields 7 – Nomenclature and Quantity field 8

In both cases, we fill in the planned date of shipment of raw materials.

Click the spend button.

Based on the supplier’s order, by clicking the “Create based on” button, we create a document “Invoice”

We check that 1 is “Transfer for processing” and fill in the price of the material - everything else is filled in automatically.

By clicking on the printer icon, we print the document required for shipment, in this case M15

After the Manufacturer returns the finished product and remaining material to you, you need to, based on the “Supplier Order”, by clicking on the “Create based on” button, create a “Processor Report” document, which is filled in automatically only partially

In the “Materials” tab, fill in the real cost of materials at the internal accounting price.

In the “Waste” tab we enter the returned balances

In the "Services" tab

We choose and set the price according to the documents from the Manufacturer.

We post the document, but do not close it

At the very bottom of the document card, in the line “Invoice (received)”, click the “create” link. The card for creating an incoming invoice opens

And fill in the number and date of the incoming C-invoice and click “Post and close”

Also in the “Processor’s Report”, click “Post and close” - all movements in warehouses were carried out on the basis of the “Report”

Let’s check by creating the “Movement of Goods” report

A brief view of the report shows the income/expenses of lumber warehouses and the income of annual products. You can expand the report more fully by clicking “+” above the table header.

In the “Supplier Order” document

Change state 1 to “Completed”

Check the 3rd box “Successfully”

Process completed

Receipt of customer-supplied materials for processing

Register the receipt of customer-supplied raw materials from the customer in 1C with the document Receipt (act, invoice) type of operation Materials for processing in the section Production - Processing - Receipt for processing - Create button (or section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Materials for recycling).

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - agreement with the customer: Type of agreement - With the buyer .

Specify on the Products :

- Nomenclature - the name of the received materials, selected from the Nomenclature directory;

- Amount - the cost of materials indicated in the transfer document (in our example - 6,000 rubles);

- Accounting account - 003.01 “Materials in warehouse”.

Postings according to the document

The document generates the posting:

- Dt 003.01 - reflection of customer-supplied materials on the balance sheet.

Transfer of customer-supplied raw materials for processing

On August 13, the Organization transferred the following raw materials to AGROCOM LLC for processing:

- wheat grain 1,000 kg.

On August 20, the Organization received from the processor AGROKOM LLC:

- products:

- wheat flour 900 kg;

- act and invoice for processing services in the amount of 2,400 rubles. (including VAT 20%).

How to transfer customer-supplied materials to the contractor in 1C 8.3? Complete the transfer of customer-supplied raw materials to the processor using the document Transfer of raw materials for processing in the section Production - Transfer for processing - Transfer of raw materials for processing - Create button.

Submission for processing in 1C 8.3:

Indicate in the header of the document:

- Counterparty - the name of the raw material processor, selected from the Counterparties directory;

- Agreement - agreement with the processor, Type of agreement - With the supplier .

Specify customer-supplied materials on the Products :

- Nomenclature - transferred raw materials (materials), selected from the Nomenclature directory;

- Quantity - transferred amount of raw materials (materials);

- Accounting account - the account from which raw materials (materials) are transferred, in our example - 10.01 “Materials”;

- Transfer account - 10.07 “Materials transferred for processing to third parties.”

Transfer of materials to third parties in 1C 8.3 postings:

The document generates the posting:

- Dt 10.07 Dt 10.01 - transfer of raw materials to the processor.

Write-off of customer-supplied materials for production

Reflect the transfer of customer-supplied materials to production with the document Requirement-invoice in the section Production - Production - Requirements-invoices - Create button (or Warehouse - Warehouse - Requirements-invoices - Create button).

Indicate in the header of the document:

- Warehouse - a warehouse from which materials are transferred.

Specify on the Customer Materials :

- Customer - the customer under the processing agreement, selected from the Counterparties directory.

Indicate in the table section:

- Nomenclature - transferred materials, selected from the Nomenclature directory;

- Accounting account - 003.01 “Materials in warehouse”;

- Transfer account - 003.02 “ Materials transferred to production.”

Postings according to the document

The document generates the posting:

- Dt 003.02 Kt 003.01 - transfer of customer-supplied materials to production.

The concept and procedure for conducting an inventory of customer-supplied materials

In some cases, organizations engaged in construction, production, trade activities, or providing various types of services, may transfer materials or goods for processing, development and refinement. In turn, the transferring party retains ownership of the materials transferred for processing, which is a distinctive feature of these operations. An organization that processes materials only provides services for transferring raw materials to the customer.

Provided materials (raw materials) are raw materials accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without paying the cost of the accepted materials and with the obligation to fully return the processed (processed) materials, hand over completed work and manufactured products (paragraph 2 clause 156 of the Methodological Instructions, approved by Order of the Ministry of Finance dated December 28, 2001 No. 119n). [2]

Based on the order of the supplier organization, an inventory of customer-supplied materials is carried out. This order contains information about the timing, procedure and inventory commission. an inventory of customer-supplied raw materials is carried out at least once a year before preparing tax and accounting reports.

The purpose of the inventory is to compare the balances of materials that are listed in the records of the giving organization with their actual availability.

In order to strengthen control over resources, the organization freely approves in its accounting policy an increase in inventory activities, for example: “The inventory of raw materials and materials transferred for external processing is carried out monthly” (clause 2.1 of the Instructions). [2]

An order for the organization, which determines the timing and composition of the inventory commission, is the basis for conducting an inventory of customer-supplied materials transferred for processing.

In the contract with the contractor, the customer should establish the procedure and forms of submitted receipts and expenditure documents and/or a report on the movement of material assets. [4, P. 147]

Let us define the main stages of conducting an inventory of customer-supplied materials transferred to the contractor for processing:

1. The first stage is to receive receipt and expenditure documents from the customer from the date of the last use of the materials by the owner. The availability of materials transferred for processing to another organization is established (clause 2.7 of the Guidelines). It is necessary to determine the storage area for materials to eliminate shortages, mis-grading or surplus. It is necessary to take into account the nuance that materials can be used by the contractor in an indefinite amount at the time of checking their actual availability.

2. Participation of materially responsible persons is necessary (clause 2.8 of the Guidelines). The materials are kept by the contractor (subcontractor), therefore, the presence of an employee of the contractor organization during the inventory is mandatory. [5]

3. Data on actual availability is entered into the inventory records (for example, in the INV-3 form, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 N 88, or another form developed by the organization).

In the inventories, it is necessary to indicate the name of the organization engaged in processing, the name of the valuables, the actual cost according to accounting data, numbers and dates of documents, quantity, and the date of transfer of valuables for processing (clause 3.24 of the Instructions).

4. Deviations that were identified in comparison with the documentary and actual quantities of materials reflected in the accounting records (taking into account the received documents on the movement) must be reflected in the matching statements (Section 4 of the Instructions).

Thus, the purpose of the inventory is to compare the balances of materials that are listed in the accounting of the giving organization with their actual availability. Inventory of customer-supplied materials can be divided into 4 main stages. With successful inventory results, we can say that the organization is working smoothly and efficiently.

Production of finished products

Reflect the production output from the customer's supplied materials in 1C with the document Production Report for a Shift in the section Production - Product Output - Production Reports for a Shift - Create button.

Indicate in the header of the document:

- Cost account - 20.01 “Main production”;

- Warehouse - a warehouse where customer materials are stored.

Specify on the Products :

- Products - products made from customer materials are selected from the Nomenclature directory (in our example - Street Bench ): Type of nomenclature - Products .

Postings according to the document

The document generates the posting:

- Dt 20.02 Kt 20.01 - the costs of production are reflected at the planned cost.

What types of materials are there?

In accounting, materials, according to the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), are accounted for on account 10 “Materials”.

Materials have a diverse grouping according to purpose and nature of use. Depending on these conditions, the organization’s materials are grouped into the following subaccounts.

| Subaccount designation | Subaccount name | What is taken into account |

| 10.1 | "Raw materials" | Inventories included in manufactured products that are involved in the manufacturing and processing process |

| 10.2 | "Components, purchased semi-finished products" | Materials purchased for further packaging of manufactured products |

| 10.3 | "Fuel" | Movement of fuel, including gasoline and diesel, as well as lubricants necessary during the operation of vehicles |

| 10.4 | "Container and packaging materials" | Availability and movement of all types of containers (except for those used as household equipment), as well as materials and parts intended for the manufacture of containers and their repair |

| 10.5 | "Spare parts" | Movement of materials used as spare parts for vehicles and other equipment |

| 10.6 | "Other materials" | Production waste, irreparable defects, material assets received from the disposal of fixed assets that cannot be used as materials, fuel or spare parts in a given organization (scrap metal, waste materials), worn tires, etc. |

| 10.7 | “Materials transferred for processing to third parties” | Materials transferred for processing to other companies |

| 10.8 | "Construction Materials" | Used by real estate developers. The invoice takes into account the materials needed for construction and installation work |

| 10.9 | "Inventory" | Inventory and other household supplies |

| 10.10 | "Special equipment and clothing in the warehouse" | Special equipment, uniforms, special uniforms in warehouse |

| 10.11 | “Special equipment and clothing in use” | Special equipment, uniforms, special uniforms handed over to employees for use |

Receipt of finished products

Reflect the receipt of the customer's finished products at the warehouse using the document Transaction entered manually in the Transactions - Accounting - Transactions entered manually - button Create - Transaction section.

Please indicate:

- Debit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products arriving at the warehouse;

- Amount - the cost of incoming products at the price of the raw materials used.

Transfer of products to the customer

Create a document Transfer of goods type of operation Transfer of products to the customer in the section Production - Processing - Transfer of products to the customer - Create button.

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - an agreement with the customer;

- Warehouse - a warehouse from which products are transferred.

Specify on the Products :

- Nomenclature - product name, selected from the Nomenclature directory;

- Quantity - the quantity of products transferred.

The document does not generate postings: it is used to generate printed forms. By clicking the Print , you can print a form approved by the accounting policy as a document for transferring products to the customer:

- invoice for the release of materials to the side (M-15),

- waybill,

- consignment note (1-T),

- waybill (TORG-12),

- universal transfer document (UDD).

Manufacture of products using customer-supplied raw materials: reflected in accounting

Our company produces products using raw materials supplied by customers, which account for about 20% of the product structure. The production cycle is from 60 to 90 days.

We use the 1C program: UPP 8.

Please explain the document flow diagram for production and sales of products, taking into account the use of customer-supplied purchased items (PKI), accounting entries.

This option is the simplest, as it represents the classic scheme of a contract: the processor performs the work, and the customer pays for this work in cash.

The work can be performed using the customer’s raw materials, i.e., customer-supplied raw materials. This must be specified in the contract. Materials transferred for processing remain the property of the customer (Article 220 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation)). Materials are transferred to the processor on the basis of invoices and transfer acts.

In accordance with the Chart of Accounts, the cost of raw materials received by the processor is recorded in off-balance sheet account 003 “Materials accepted for processing.”

To account for materials in the warehouse and materials transferred to production, sub-accounts are opened:

003-1 “Materials in warehouse”;

003-2 “Materials in production”.

Accounting is carried out in quantitative and monetary terms at the prices specified in the documents for the transfer of raw materials. In addition, analytical accounting should be organized by customers, types of raw materials and supplies, and at their location.

After completion of the work, the processor provides the customer with a report on the materials used and the remaining unused material. Depending on the terms of the contract, the remaining unused raw materials are returned to the customer or remain with the processor.

After completion of the work, the finished products are transferred to the customer according to the acceptance certificate and invoice.

It should be noted that both raw materials received for processing and finished products are accounted for in account 003 “Materials accepted for processing” until the finished product is transferred to the customer.

The costs the processor incurs during the processing process are recorded in the production cost accounts. These include:

- the cost of the processor's own materials;

- wages and insurance premiums accrued on wages;

- depreciation of fixed assets;

- general and general production expenses.

The cost of work performed does not include the cost of customer-supplied raw materials.

When using customer-supplied raw materials, the enterprise must draw up the following primary documents:

when accepting customer-supplied raw materials:

- a contract for the manufacture of products with a note that the products are made from customer-supplied raw materials and an indication of its cost;

- invoice for the transfer of raw materials for processing (or transfer act) received from the customer of the work. The invoice must contain the following entry: “Raw materials are transferred on a toll basis under an agreement dated ___ No. ___”;

- receipt order in form No. M-4, on which a note is also made: “On tolling terms under an agreement dated __ No. __”;

when releasing customer-supplied raw materials into production:

- requirement-invoice for release into production indicating the quantity of customer-supplied raw materials supplied;

when releasing finished products (products):

- invoice for the receipt of finished products from processing to the warehouse in quantitative terms;

when transferring finished products (products) to the customer:

- act of acceptance and transfer of completed work, which indicates the price of the manufactured product, the number of products and the cost of the work performed;

- invoice for the transfer of manufactured products (products) to the customer;

- report on used materials and remaining unused material;

- invoice for the transfer to the customer of remaining raw materials unused in production or waste.

In the accounting records of a processing organization, business transactions related to customer-supplied raw materials are reflected using accounting entries:

| Account correspondence | Contents of operation | |

| debit | credit | |

| 003 “Materials accepted for processing” | The cost of materials accepted for processing on the basis of an invoice or transfer certificate received from the customer is reflected. | |

| 20 "Main production" | 02 “Depreciation of fixed assets” (10, 23, 25, 26, 70, 69) | The costs of processing raw materials and materials are reflected in accounting |

| 90 “Sales” subaccount “Cost of sales” | 20 "Main production" | The costs of manufacturing finished products according to the customer’s instructions are written off |

| 62 “Settlements with buyers and customers” | 90 “Sales” subaccount “Revenue” | Revenue from processing work is reflected (excluding the cost of materials received on toll basis) |

| 90 “Sales” subaccount “VAT” | 68 “Calculations for taxes and fees” sub-account “VAT” | VAT charged |

| 90 “Sales” subaccount “Profit (loss) from sales” | 99 "Profits and losses" | Financial result reflected |

| 51 “Current accounts” | 62 “Settlements with buyers and customers” | Repayment of receivables from the supplier is reflected |

| 003 “Materials accepted for processing” | The cost of materials accepted for processing has been written off | |

If a processing organization, along with processing customer-supplied raw materials, produces products from its own raw materials and sells them, separate accounting must be organized.

If waste is generated during the processing process, the contract may stipulate that the waste is returned to the customer or remains with the processor.

If the waste, according to the agreement, remains with the processor, then an entry is made in the credit of account 003 “Materials accepted for processing” for the amount of the cost of raw materials transferred for processing, with simultaneous acceptance for accounting in account 10 “Materials”.

Correspondence of invoices depends on the terms of payment for waste.

If the waste received from the processing of the supplier’s materials remains with the processor as partial payment for the work performed by him and is taken into account, for example, as auxiliary materials, then the following entry is made in the processor’s accounting:

Debit account 10 “Materials” subaccount “Other materials” Credit account 60 “Settlements with suppliers and contractors”.

If the waste received from processing does not affect the price of the transaction, then such an operation qualifies as a gift agreement (Clause 1 of Article 572 of the Civil Code of the Russian Federation). This is reflected in accounting by posting:

Debit of account 10 “Materials” subaccount “Other materials” Credit of account 98 “Deferred income” subaccount “Gratuitous receipts”.

Then, as they are used, their cost is written off by posting:

Debit of account 98 “Deferred income” sub-account “Gratuitous receipts” Credit of account 91 “Other income and expenses” sub-account “Other income”.

In the tax accounting of the processor, the value of property received free of charge is included in non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). The date of recognition of this income will be the day the parties sign the waste acceptance and transfer act (subclause 1, clause 4, article 271 of the Tax Code of the Russian Federation).

Write-off of products from warehouse

Reflect the write-off of products from the warehouse with the document Transaction entered manually in the section Operations - Accounting - Transactions entered manually - button Create - Transaction.

Please indicate:

- Credit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products transferred from the warehouse;

- Amount - the cost of the transferred products.

Implementation of work on processing customer-supplied raw materials

Create a document Sales of processing services in the section Production - Processing - Create button - Sales of processing services. It can also be created based on the document Request-invoice or Production report for a shift, then part of the document will be filled out automatically.

Check the completion of the document.

In the header please indicate:

- Counterparty - customer under the processing agreement, selected from the Nomenclature directory;

- Contract - an agreement with the customer,

On the Customer Materials , specify:

- Nomenclature - the name of the customer’s materials used, selected from the Nomenclature directory;

- Quantity - the amount of materials used;

- Accounting account - 003.02 “Materials transferred to production.”

On the Products (processing services) , indicate:

- Nomenclature - products made from customer materials are selected from the Nomenclature directory; in the bottom line, indicate the name of the processing work for the work completion certificate;

- Quantity - the number of products produced;

- Price - the price for work to produce a unit of product;

- Planned price - the planned cost of production per unit of production;

- Accounting account - 20.02 “Production of products from customer-supplied raw materials”;

- Nomenclature group - nomenclature group for processing work;

- Specification - filled in when using product specifications in 1C, selected from the Product Specifications (in our example, not filled in).

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 90.01.1 - revenue from the implementation of processing work;

- Dt 90.02.1 Kt 20.02 - write-off of the cost of work performed at the planned price;

- Kt 003.02 - write-off of customer materials;

- Dt 90.03 Kt 68.02 - VAT calculation.

Inventory of tolling assets. Who conducts it and how

Having concluded a tolling agreement, one party (the toller) transfers the tolling raw materials for processing (processing), and the other (the processor) accepts it and makes products from it or simply refines it. The owner of both the raw materials and the final product is the providing organization. The processor only performs processing (refinement) work <*>. This is the peculiarity of the tolling scheme. And this feature leaves an imprint on the order of inventory of tolling assets on both sides of the transaction.

Who does the inventory?

To answer this question, let us turn to the general rules for conducting inventory. Thus, assets are subject to inventory regardless of their location. It is also necessary to take inventory of assets that do not belong to the organization, but are listed on its balance sheet <*>.

The purpose of inventory is to compare the balances of assets listed in accounting with their actual availability. It should also be carried out before drawing up the annual balance sheet so that the figures in it are reliable <*>.

Thus, to answer the question of who should inventory the toll assets, let us recall where and how the parties to the transaction take them into account.

As we have already said, the owner of the transferred raw materials remains the supplier. He takes into account these raw materials in subaccount 10-7 “Materials transferred for external processing.” And the processor who received the raw materials transfers them to off-balance sheet account 003 “Materials accepted for processing.”

Subsequently, having manufactured the final product and written off the used raw materials from account 003, the processor also shows such products on the balance sheet until they are returned to the seller. For example, on account 002 or an additionally opened account <*>.

The above means that the supplier is obliged to take inventory of the supplied raw materials, even though he does not physically have the raw materials. After all, the seller is responsible for taking inventory of the assets he owns, regardless of where they are actually located.

In addition, the processor must also conduct an inventory. Since both the raw materials supplied by the customer and the final products are listed on his balance sheet before being returned to the customer.

How does a recycler take inventory?

The processor's toll assets are subject to inventory on the same basis as their own. So, in order to ensure the presence and safety of the former, the processor should inventory:

- unused customer-supplied raw materials stored in his warehouse;

— customer-supplied raw materials in production (an assessment of the actual amount of raw materials transferred to production can be carried out on the basis of consumable documents);

- manufactured products that have not yet been transferred to the seller.

The processor draws up separate inventory records for assets that do not belong to it. And if deviations are detected - comparison sheets. It is recommended to send one copy of these documents to the seller <*>.

Thus, the processor checks the availability of assets in kind. This may raise a question. Since the processor is conducting an inventory of tolling assets, and they belong to the toller, then perhaps he needs to invite a representative of the toller to participate in the inventory? Indeed, in this case, the latter will sign all inventory documents, which will increase the confidence of the parties in the result of this procedure.

In this regard, we note the following. As a general rule, representatives of the dealer are not included in the inventory commissions <*>. Therefore, the processor, as a rule, does not do this. At the same time, we believe that the parties have the right to stipulate this point in the processing agreement <*>.

Features of inventory from the dealer

For the supplier, the inventory of customer-supplied raw materials transferred for processing consists of reconciling the amounts listed in subaccount 10-7 with the data of invoices, reports on the consumption of raw materials and other documents that are used to document customer-supplied operations. In other words, the dealer carries out only a documentary check and, based on its results, draws up a separate inventory list. In it, he indicates the name of the processor, the name of the transferred raw materials, the date of its transfer for processing, as well as the quantity and cost according to accounting data <*>.

The actual presence of assets can be confirmed by data received from the processor: copies of inventory lists, matching statements or other documents <*>.

Submission of the SF for the implementation of work

Register an invoice using the Write invoice at the bottom of the document Sales of processing services .

Invoice data is automatically filled in based on the document Sales of processing services :

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Calculation of wages and insurance premiums

At the end of the month, accrue wages to employees involved in the production of work using the Payroll document in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll.

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt - payroll;

- Dt Kt 68.01 - personal income tax withholding from wages;

- Dt 20.01 Kt 69.01 - calculation of insurance contributions for social insurance;

- Dt 20.01 Kt 69.03.1 - calculation of insurance premiums to the Federal Compulsory Medical Insurance Fund;

- Dt 20.01 Kt 69.11 - calculation of insurance premiums from NS and PZ;

- Dt 20.01 Kt 69.02.7 - calculation of insurance premiums for pension insurance.

Adjustment of the cost of processing materials supplied by the supplier

At the end of the period, when all information on costs has been collected, when performing the Month Closing procedure in the Operations - Period Closing - Month Closing section, the amount of planned expenses is compared with the actual ones. Regular operation Closing accounts 20, 23, 25, 26 adjusts the cost of production (work, services) for the difference between plan and actual.

Regular operation Closing accounts 20,23,25,26 generates the following posting:

- Dt 20.02 Kt 20.01 - adjustment of the planned cost of work to the actual cost.

Calculation of actual cost:

Expenses Actual amount Planned cost Difference Salary 20 000,00 Insurance premiums 6 000,00 Depreciation 5 208,33 Contributions to the Social Insurance Fund from NS and PP 40,00 Total 31 248,33 30 000,00 1 248,33 In the example, the actual cost of finished products, calculated at the end of the month, is greater than the planned cost. Therefore, the program brings the planned cost of production to the actual cost using additional posting Dt 20.02 Kt 20.01 for the amount of the difference between the actual and the plan.

Income tax return

In the income tax return, revenue from the sale of work on processing customer-supplied materials is reflected:

- Sheet 02 Appendix No. 1: PDF page 011 “revenue from the sale of goods (works, services) of own production.”

The nomenclature group related to the sale of products, services and works of own production must be indicated in the Nomenclature groups for the sale of products and services in the Main section - Settings - Taxes and reports - Income tax tab. PDF

The correct completion of page 011 of Appendix No. 1 to Sheet 02 of the income tax return depends on this setting.

Read more Setting up accounting policies