Features of working in hazardous working conditions

Harmful working conditions are considered to be those that can lead to occupational disease, and dangerous - to injury. In the workplace, health can be affected by high levels of noise, dust, vibration, radiation, poor lighting, high or low temperature, etc. There are many harmful and dangerous production factors, they can be physical, chemical, biological, psychophysiological.

The extent to which workplaces are harmful and (or) dangerous is determined based on the results of a special assessment of working conditions (SOUT). Employers are required to conduct it once every 5 years. All jobs of employees who work for individual entrepreneurs or organizations under employment contracts are assessed, with the exception of homeworkers and remote workers. There are conditions under which a special assessment is carried out even before the expiration of five years, for example:

- introduced new equipment that significantly changed the production process;

- a new workplace was introduced and the employee began his duties there, including after the opening of an organization or individual entrepreneur;

- moved the workplace to another room, etc.

In these cases, an unscheduled special assessment must be carried out within 12 months after the changes.

If, during the implementation of the special labor assessment, you have identified workplaces with harmful and (or) dangerous working conditions, you are obliged to provide additional payments, guarantees and compensations provided for by law to the employees employed there. The specific list of benefits for “harmful workers” depends on the class and subclass of working conditions assigned based on the results of a special assessment. For example, for working in harmful working conditions of the 3rd or 4th degree or dangerous conditions, employees are entitled to:

- shortened working hours - no more than 36 hours per week;

- increased wages - at least 4% of the rate or salary established for work under normal working conditions;

- at least 7 calendar days of annual additional paid leave .

Guarantees and compensation are enshrined in Art. 92, 117 and 147 of the Labor Code of the Russian Federation , but the employer can independently supplement them.

There are professions, positions and industries that by default require working in harmful or difficult conditions, even when a special assessment has not yet been carried out. For example, if they are listed in List No. 1 and List No. 2, approved by Resolution of the Cabinet of Ministers of the USSR No. 10 of January 26, 1991.

How to get them back

If there are compelling reasons why a person does not want to keep funds in a certain non-state fund, then he has the right to withdraw them, losing interest.

Unreliability or finding a better offer can be used as an argument. To return, you must write an application and submit it to the current Pension Fund; the form indicates the details for transferring funds. The application is accompanied by documents reflecting the rights to the money and its management.

According to federal law, people who work in dangerous and difficult conditions receive a pension supplement. However, additional contributions are transferred to the funded part of the future payment. The transfer of DSV gives the right to early retirement. State and private programs for increasing funded pensions can bring good dividends; therefore, if the employer makes special contributions for difficult working conditions, then it is worth thinking about increasing the funded part of the pension.

Read also: Transfer of land from one category to another

In what cases do you need to pay contributions to the Pension Fund for “harmfulness”

For payments to “harmful workers,” the employer is obliged to charge pension insurance contributions at general (or reduced) rates and at additional rates (Article 428 of the Tax Code of the Russian Federation).

But this applies only to certain types of work that give the right to an early pension:

- from clause 1, part 1, art. 30 of Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” (List No. 1);

- from clauses 2–18, part 1, art. 30 of Law No. 400-FZ (List No. 2).

If the employee is not engaged in the work specified in paragraphs 1–18 of Part 1 of Art. 30 of Law No. 400-FZ, insurance premiums for additional tariffs do not need to be charged, and it does not matter that his working conditions were recognized as harmful or dangerous by a special assessment. This has been repeatedly confirmed by the Ministry of Finance, in particular, by letter No. 03-15-06/74288 dated September 27, 2019.

Contributions to the Pension Fund of the Russian Federation at additional rates must also be calculated in relation to “harmful workers” who already receive a preferential old-age pension, but continue to work in harmful and (or) dangerous working conditions.

The concept of additional insurance premiums

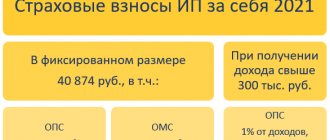

DSV are contributions transferred to the Pension Fund of the Russian Federation in addition to standard transfers to the funded part of the pension. They can be transferred both at the initiative of the employee and the employer. Let's consider both options in more detail.

- At the request of the employee. He submits an application that he wants to make contributions from his salary to the funded part of the pension;

- By law, the employer. If an employee works in difficult conditions and harmful to health, then additional deductions are made for him. As a rule, management deliberately includes this amount in wages.

In the first option, the employee must draw up a unified statement indicating the exact amount of the transfer on a monthly basis.

Healthy! If you want to make additional contributions to the funded part of your pension, it is best to submit an application through your employer, so you can immediately inform him of your initiative. It is permissible to submit the form directly to the Pension Fund or MFC, but you will need to notify the company management of your desire.

Additional tariff rates for insurance contributions to the Pension Fund in 2021

If there has not yet been a special assessment, insurance premiums for “pests” must be calculated according to general additional tariffs:

- 9% - for employees from clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013 (List No. 1);

- 6% - for employees from clauses 2–18 of Part 1 of Art. 30 of Law No. 400-FZ (List No. 2).

If a special assessment has been carried out, the tariff will depend on the assigned subclass of working conditions.

Additional tariff rates based on the results of SOUT

Additional tariffs 2022 (special assessment was carried out): table

If the employer has carried out special labor and safety work on the above-mentioned jobs, then, depending on the established class (subclass) of working conditions, the following additional insurance premium rates are applied:

| Working conditions | Assessment of working conditions | Tariff for compulsory pension insurance |

| Dangerous | 4 | 8% |

| Harmful | 3,4 | 7% |

| 3,3 | 6% | |

| 3,2 | 4% | |

| 3,1 | 2% | |

| Acceptable | 2 | 0% |

| Optimal | 1 | 0% |

How to calculate contributions according to additional tariffs

Tariffs that need to be applied based on the results of the special assessment begin to apply from the date its results are entered into the federal state information system (Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”). The appraising company must notify you of this no later than three working days after entering the information.

For the month in which the information appeared in the FSIS SOUT, additional tariffs based on the results of the special assessment are calculated not from all payments, but from the day the information appears in the system until the end of the month.

For payments to employees from paragraphs 1–18 of Part 1 of Art. 30 of Law No. 400-FZ, accrued before this date, contributions for “harmfulness” are calculated at general rates - 6% or 9%.

If the results of the special assessment contain information that cannot be disclosed (state or other secret protected by law), additional tariffs can be applied from the date of approval of the special assessment report.

Additional contributions must be calculated like regular insurance contributions to the Pension Fund - for all taxable payments separately for each employee, from the beginning of the calendar year to the end of each month on an accrual basis. But there are also peculiarities.

- If regular insurance premiums have limits on the annual salary limit, above which premiums are reduced, additional premiums are calculated equally on all amounts.

- The application of additional tariffs depends on the period in which payments were accrued, and not for which they were accrued. For example, in 2022, an employee was awarded a bonus based on the results of the previous year. In the month of accrual, he is engaged in harmful and dangerous work. The bonus must be included in the base for calculating contributions “for harmfulness”, even if the employee worked under normal conditions for the entire last year for which the bonus was issued.

- The accrual of additional tariffs does not depend on the operating mode. If an employee is employed in harmful and difficult conditions for less than 80% of the working time, this period is not included in the preferential period for early retirement. But additional tariff contributions still need to be calculated.

- They also need to be calculated in cases where the “harmmaker” was absent due to illness, business trip, vacation (annual paid, child care, maternity leave) and other periods that are included in the preferential length of service. In such cases, the employee is considered to be employed in work that gives the right to early retirement.

- During the month, the “harmful worker” can be employed alternately in the work indicated in both List No. 1 and List No. 2. Then additional contributions must be calculated at different rates. If the enterprise does not keep separate records of payments, contributions for additional tariffs must be calculated proportionally - the actual days worked for each type of work are divided by the total number of calendar days of the month and multiplied by payments for the month and the corresponding tariff.

- If an employee was employed in both hazardous and normal working conditions during the month, then additional tariffs should be calculated only on payments for the time actually worked in hazardous conditions. They are calculated in the same way as in the previous situation (if there is no separate accounting of payments).

- Periods when the “harmmaker” is on leave without pay or on study leave are not counted toward the length of service for early retirement. And here the Pension Fund and the Ministry of Finance disagree on whether additional contributions should be accrued. The position of the Pension Fund of the Russian Federation is not to accrue, since the employee was not employed in work with special working conditions. The Ministry of Finance believes that payments for this period are subject to additional contributions in full. It’s safer to charge them anyway. Thus, the Ministry of Labor in letter No. 17-3/B-256 dated June 17, 2016 explained that the base for calculating contributions for additional tariffs does not depend on the periods included or not included in the preferential period. This position is confirmed by judicial practice.

When are additional fees charged?

Contributions to the Pension Fund at the additional rate must be calculated for the month in which the employee actually worked fully or partially under “harmful” conditions. It does not matter whether the days (hours) of such work are included in the length of service for early assignment of a pension (hereinafter referred to as “harmful” experience) or not.

When there are no actual days worked in a month, additional contributions must be accrued if days (hours) fall within it:

- equated to those worked under “harmful” conditions, that is, when the employee did not actually work for them, but was listed as employed. For example, when you are on study leave (leave at your own expense) or during downtime. Whether such days are included in the “harmful” length of service also does not matter (letters from the Ministry of Labor dated June 17, 2016 No. 17-3/B-256, dated October 13, 2015 No. 17-3/B-502, dated January 20, 2015 No. 17-3 /B-14);

- included in the “harmful” experience. These include, in particular, days (clauses 5, 8, 9 of the Rules, approved by Government Decree No. 516 dated July 11, 2002, letters of the Ministry of Labor dated December 26, 2014 No. 17-3/B-637 (clause 1) , dated January 24, 2014 No. 17-3/B-25, dated April 11, 2014 No. 17-3/B-151):

- annual basic and additional leave granted for the year in which there were periods included in the “harmful” length of service;

- temporary disability that occurred during the period included in the “harmful” length of service;

- transfer from a “harmful” job to a job that does not give the right to an early pension (no more than one month during the year);

- paths from the collection point to the place where “harmful” work is performed and rest between shifts.

The next step is to determine for which payments in favor of the employee additional contributions need to be accrued and how to determine the base for their accrual.

When and how to pay

Additional tariff premiums are transferred within the same time frame as for regular insurance premiums - no later than the 15th day of the month following the month in which they were accrued. If the last day of payment is a weekend or non-working day, it is postponed to the next working day.

When making a payment for additional insurance contributions to the Pension Fund for hazardous working conditions in 2022, special budget classification codes (BCC) are used. They will be different depending on what types of work the “harmmakers” are engaged in and whether a special assessment was carried out.

If additional tariffs are established based on the results of the SOUT, then for List No. 1 use KBK 182 1 02 02131 06 1020 160, and for List No. 2 - KBK 182 1 02 02132 06 1020 160. If the SOUT was not carried out, then for List No. 1 use KBK 182 1 0210 160, and for List No. 2 - KBK 182 1 02 02132 06 1010 160.

Basic provisions

Modern pension legislation indicates that all citizens form the insurance part of their old-age benefits.

Employers make contributions for hired employees, and self-employed citizens make contributions themselves. As for the funded part of the pension, its formation is voluntary and can occur either at the initiative of the employee or as necessary by the employer. In particular, additional insurance premiums for work hazards are automatically transferred to the funded part.

Good to know! Transfers for additional insurance contributions can be made to both the state and private Pension Funds. When transferring from one to another, savings are preserved.

What happens if you don’t pay fees for “pests”

For non-payment or incomplete payment, a fine of 20% of the unpaid amount of insurance premiums is provided (clause 1 of Article 122 of the Tax Code of the Russian Federation). Penalties are applied if the payer:

- erroneously underestimated the basis for calculating insurance premiums;

- incorrectly calculated contributions (for example, applied a reduced tariff);

- committed other unlawful actions (inactions).

The fine will increase to 40% of the unpaid amount if all this was done intentionally (Clause 3 of Article 122 of the Tax Code of the Russian Federation).

What kind of reporting to submit?

Information about additional contributions for payments to “pests” is included in several reports.

Calculation of insurance premiums

The DAM is submitted to the tax office, organizations - at their location, and individual entrepreneurs - at their place of residence.

The amounts of payments for which additional tariff contributions are calculated, and the contributions themselves must be reflected:

- in subsection 1.3.2 or 1.3.2 of appendix No. 1 to section 1;

- in subsection 3.2.2 of section 3, which reflects information on a specific employee.

Using the special service “My Business” you can generate a free calculation of insurance premiums.

SZV-STAZH and ODV-1

These forms are submitted as a set to the territorial office of the Pension Fund at the place of registration.

Codes of working conditions that give the right to early assignment of a pension are indicated in column 9 of the SZV-STAZH report . The codes are taken from the classifier of the Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018. For example, the working conditions of an electric welder for manual welding, which is included in List No. 1, are marked with code 27-1.

If special working conditions are indicated in the SZV-STAZH form, then section 5 must be completed in EDV-1.

Using the special service “My Business” you can generate a free calculation of insurance premiums.

4-FSS

In the report for social insurance, on the title page, fill in the number of workers employed in work with harmful and (or) hazardous production factors and Table 5.

Types of activities providing for DSA

Transfer of additional insurance premiums is made to persons applying for early retirement. This is done so that by the time of retirement the state has sufficient funds. In most cases, we are talking about harmful and difficult working conditions. Let's look at the list of professions and labor characteristics that require DSA:

- underground work and activities in hot shops;

- difficult working conditions;

- participation in locomotive crews;

- geological excavations and expeditions;

- work with persons in prison.

Women typists and employees of the textile industry are included in a special category. A complete list of professions can be found in Federal Law No. 400 of 2013.

Attention! Transport drivers working in mines and mines are treated as ordinary employees. That is, they also have the right to early retirement and special additional payments.

Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Read also: Refusal of warranty repairs