22.02.2019

In accordance with Art. 262 of the Labor Code of the Russian Federation, one of the parents (guardian, trustee) to care for disabled children, upon his written application, is provided with four additional paid days off per month, which can be used by one of these persons or divided among themselves at their discretion. Payment for each additional day off is made in the amount of average earnings. In this consultation we will consider the nuances of applying this norm.

Documentation of additional days of care for disabled children.

The package of documents that an employee must submit in order to be provided with additional days to care for a disabled child is determined by clauses 2, 3 of the Rules for the provision of additional paid days off to care for disabled children, approved by Decree of the Government of the Russian Federation of October 13, 2014 No. 1048. This :

1) an application drawn up in the form approved by Order of the Ministry of Labor of the Russian Federation dated December 19, 2014 No. 1055n. The frequency of filing an application is determined by the parent in agreement with the employer, depending on the need to use additional paid days off:

– monthly; – once a quarter; - once a year; – according to circulation or others;

2) a copy of a certificate confirming the fact of disability, issued by the Bureau of Medical and Social Expertise (the form of the certificate is approved by Order of the Ministry of Health and Social Development of the Russian Federation dated November 24, 2010 No. 1031n). Please note that the certificate has a limited validity period (submitted in accordance with the deadlines for establishing disability - once, once a year, once every two years, once every five years), so it is necessary to ensure that the accounting department always has a copy of the current certificate;

3) documents confirming the place of residence (stay or actual residence) of a disabled child (submitted once);

4) a copy of the child’s birth (adoption) certificate or a document confirming the establishment of guardianship or trusteeship of a disabled child (submitted once);

5) a certificate from the place of work of the other parent (guardian, trustee) stating that at the time of application additional paid days off in the same calendar month were not used or partially used, or a certificate from the place of work of the other parent (guardian, trustee) that that this parent (guardian, trustee) has not received an application to provide him with additional paid days off in the same calendar month (this certificate must be submitted each time an application is submitted). A certificate is not required if there is documentary evidence of the death of the other parent, recognition of him as missing, deprivation (limitation) of parental rights, imprisonment, stay on a business trip for more than one calendar month or other circumstances indicating that the other parent cannot exercise caring for a disabled child, as well as if one of the parents avoids raising a disabled child.

Do I need to submit a certificate from the social security authorities stating that the child is not on state support?

In fact, the list of documents given above is exhaustive, and requiring other documents from an employee is unlawful (Letter of the Ministry of Labor of the Russian Federation dated March 28, 2016 No. 17-1/OOG-451).

At the same time, when checking the correctness of payment for four additional paid days off per month provided to one of the working parents (guardian, trustee) to care for disabled children, inspectors from the Social Insurance Fund use the Methodological Instructions on the procedure for assigning and conducting documentary on-site inspections of policyholders under mandatory social insurance and taking measures based on their results, approved by Resolution of the Federal Insurance Service of the Russian Federation dated 04/07/2008 No. 81, in accordance with clause 87 of which the insurer’s accounting department must be stored for each recipient, in particular:

1) an application for additional days to care for a disabled child;

2) a certificate from the social protection authorities about the child’s disability indicating that the child is not on state support (in a boarding school or other similar institution), submitted annually;

3) a copy of the order to provide additional days to care for a disabled child;

4) a certificate from the other parent’s place of work stating that at the time of application they have not used additional paid days off in the same calendar month;

5) if one parent is working under an employment contract:

– a certificate from the state employment service confirming the fact that the other parent is unemployed; – certificate of state registration of an individual as an individual entrepreneur – if the second parent is self-employed; – civil contract – if the second parent works under such a contract.

The same manual states that in the event of documentary confirmation of the dissolution of marriage between the parents of a disabled child, as well as death, deprivation of parental rights of one of the parents and in other cases of lack of parental care (imprisonment, business trips for more than one calendar month of one of the parents and etc.) a working parent raising a disabled child is provided with four additional paid days off without presenting a certificate from the other parent’s place of work. In the same manner, four additional paid days off are provided to single mothers.

For reference:

in accordance with the previously in force Resolution of the Ministry of Labor of the Russian Federation No. 26, FSS of the Russian Federation No. 34 dated 04/04/2000 “On approval of the Explanation “On the procedure for providing and paying additional days off per month to one of the working parents (guardian, trustee) for caring for disabled children” to receive additional days off, the employee had to submit, among other documents,

a certificate from the social protection authorities

about the child’s disability indicating that he

is not being kept

in a specialized children’s institution (belonging to any department) on full state support. At the same time, it was indicated that boarding homes for children with a five- or six-day stay per week are not classified as specialized children's institutions with full state support.

According to the new procedure, such a certificate is not provided. Instead, it is required to submit a document confirming the place of residence (stay or actual residence) of the disabled child. At the same time, amendments to eliminate discrepancies have not yet been made to the Methodological Instructions on the procedure for appointing, conducting documentary on-site inspections of policyholders for compulsory social insurance and taking measures based on their results. Thus, the question of whether this certificate needs to be submitted is debatable. In our opinion, this is not necessary.

Is it possible to provide an employee with an additional paid day off if he and the child are registered at different addresses?

The situation when one of the parents and a disabled child are registered at different addresses is described in detail in Letter of the Ministry of Labor of the Russian Federation No. 17-1/OOG-451. In particular, the letter states that the rule on submitting a document confirming the place of residence (stay or actual residence) of a disabled child was introduced in order to prevent abuse of the right to receive additional paid days off. At the same time, cohabitation of a parent and a disabled child in the same living space is not a mandatory condition for the provision of these additional paid days off. If the places of actual residence of the parent and the disabled child are located at a relatively short distance from each other, which gives the parent the opportunity to actually care for the child, the employer has the right to decide to provide paid additional days off to care for disabled children.

There are also explanations on this issue from FSS inspectors posted on the website of the Sevastopol regional branch of the FSS (https://r92.fss.ru/130561/183929.shtml): you can confirm the place of residence of a disabled child, for example, with a certificate issued by the management company, an extract from the house register, a certificate of registration at the place of residence, and his place of stay - a certificate of registration at the place of stay (forms of certificates of registration at the place of residence and place of stay are approved by Order of the Ministry of Internal Affairs of the Russian Federation dated December 31, 2017 No. 984). The rules do not require parent and child to live together, so their addresses may not be the same.

Thus, we believe that the fact that the mother and child are registered at different addresses should not prevent payment for additional days to care for a disabled child.

What is additional paid leave?

It is additional paid leave for parents that is not provided. The Labor Code of the Russian Federation says nothing about this benefit. However, some people understand additional leave as:

- Standard leave, issued in accordance with benefits.

- Leave to care for a child up to 3 years old.

- Extra days off.

The last point is closest to the concept of second paid leave. The right to additional days off is stipulated by Article 262 of the Labor Code of the Russian Federation. It is provided only to one of the parents. To receive a day off, you must make a written application. The employer is obliged to provide an employee caring for a disabled child with 4 additional days off per month. All these days are paid at the standard rate.

ATTENTION! All provisions discussed here are enshrined in law. However, nothing prevents an entrepreneur from establishing additional leave with payment as a benefit for parents of disabled children. To do this, it will be necessary to make all relevant amendments to collective acts.

Documentary support of registration

To provide time off, parents will need some documents:

- Conclusion of a medical and social examination confirming disability (the examination must be taken regularly).

- Papers establishing the child’s place of residence.

- Birth or adoption certificate.

- A certificate from the second parent’s work stating that they did not use the right to holidays and did not submit a corresponding application to the employer.

Most documents are provided only once. For example, a parent can bring a birth certificate once and not do it again when applying for a day off. However, there are a number of documents that must be provided regularly. These include:

- Certificates from the second parent's work.

- Conclusion of the examination (depending on the type of disability, you need to undergo this procedure every 1-5 years).

ATTENTION! The right to additional days off can be used by either one or the other parent. In this case, such “vacation” is divided. For example, a mother took 2 days off to care for a child with disabilities. The father still has the right to take the remaining 2 days.

Procedure for provision

The procedure for registering additional days off is specified in Resolution No. 1048 of October 13, 2014. The following stages of this procedure can be distinguished:

- Submission of an application by one of the parents.

- Providing the employee with all necessary documents.

- Drawing up an order from the manager to issue additional days off. The document is drawn up according to the T-6 form or another template developed by the company.

- The employee must be familiarized with the order against signature.

The employee indicates in his application those days for providing days off that are convenient for him. However, usually specific dates are determined after negotiations with the boss. For example, there is little work on Friday, and therefore the employer wants to send the employee on a day off on this particular day, so as not to interfere with work processes.

ATTENTION! The employer is obliged to provide the employee with additional days off if he has submitted a corresponding application to which he has attached all the necessary documents. Otherwise, the company is fined in the amount of 30-50 thousand rubles or its work is suspended for up to 3 months. These penalties are established by part 1 of article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Payment for additional days off

Article 17 of Federal Law No. 213 states that additional days off are paid by the Social Insurance Fund. Paragraph 12 of the rules established by Resolution No. 1048 of October 13, 2014 states that payment must correspond to the employee’s average earnings. That is, for example, an employee receives 1,000 rubles per shift. Accordingly, his income for 4 additional days off will be 4,000 rubles.

IMPORTANT! The FSS often tries to refuse payments if part-time workers demand them. This is due to the fact that employees have already received compensation at their main place of work. However, this is illegal, since the worker can enjoy benefits at both places of work. This is stipulated by part 2 of article 287 of the Labor Code of the Russian Federation. Therefore, it is necessary to obtain all required payments from the Social Insurance Fund.

When are additional days to care for a disabled child not provided?

In accordance with clause 7 of the Rules for the provision of additional paid days off for caring for disabled children, additional days of rest are not provided to the parent (guardian, trustee):

– during his next annual paid leave; – during the period of leave without pay; – during the period of parental leave until the child reaches the age of three years.

At the same time, the other parent (guardian, trustee) retains the right to receive four additional paid days off.

The legislation does not provide for other grounds for refusal to provide additional days of care for disabled children. From this we conclude that additional days off can be provided while the employee is on a business trip.

In addition, it should be taken into account that the law does not require confirmation of the fact that the employee is using the four additional days off per month allocated to him for the purpose of caring for a disabled child. Therefore, he can use such days at his own discretion (for example, while away).

Paid days off for caring for disabled children, provided but not used in a calendar month by a parent (guardian, trustee) due to his temporary disability, are provided to him in the same calendar month (subject to the end of temporary disability in the specified calendar month and presentation of sick leave). Additional paid days off that are not used in a calendar month are not transferred to another calendar month (clauses 9, 10 of the Rules for the provision of additional paid days off for caring for disabled children).

Calculation of average earnings to pay for days of care for disabled children.

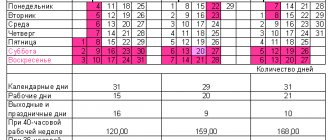

According to Art. 139 of the Labor Code of the Russian Federation, payment for each additional day of care for disabled children is made in the amount of average earnings, determined in accordance with the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as the Regulations).

The average salary is calculated based on the salary actually accrued to the employee and the time actually worked by him for the 12 calendar months preceding the period in which the employee is given an additional day off to care for a disabled child. In this case, the calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive) (Part 3 of Article 139 of the Labor Code of the Russian Federation, p. 4 Regulations). Thus, the calculation period for calculating average earnings for paying for days of care for disabled children provided in February 2019 is the period from 02/01/2018 to 01/31/2019.

When determining average earnings, all types of payments provided for by the remuneration system and applied in the relevant institution are taken into account, regardless of the sources of these payments, including wages accrued to the employee (clause “a”, clause 2 of the Regulations). In this case, time, as well as amounts accrued during this time, are excluded from the billing period if (clause 5 of the Regulations):

– the employee was on regular paid leave, a business trip, he was paid the average salary on other grounds provided for by the Labor Code of the Russian Federation (clause “a”); – the employee received temporary disability benefits (paragraph “b”); – the employee was provided with additional paid days off to care for disabled children (paragraph “e”).

In addition, when calculating average earnings, social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account (clause 3 of the Regulations).

In practice, when checking the correctness of expenses for the payment of insurance coverage for compulsory social insurance, disputes often arise between FSS inspectors and employers about the legality of including certain payments in the calculation of average earnings. For example, SZO arbitrators believe that if financial assistance is provided for in the wage system, then it should be included in the calculation.

| Judges' conclusion | Details of the resolution |

| The amount of financial assistance is rightfully included in the calculation of average earnings to pay for days to care for disabled children, since it relates to incentive payments and is part of the remuneration system (in the case under consideration, financial assistance to employees of a state government institution was paid in accordance with the regulations on remuneration for their taking annual paid leave) | Resolutions of the AS SZO dated September 27, 2018 No. F07-11091/2018 in case No. A66-8838/2017, dated November 27, 2017 No. F07-12522/2017 in case No. A66-13705/2016 (Determination of the Supreme Court of the Russian Federation dated May 10, 2018 No. 307 -KG18-918 refused to transfer the case to the Judicial Collegium for Economic Disputes of the RF Armed Forces) |

To avoid disputes, the institution's accountant must weigh the pros and cons of adopting this approach.

Personal income tax.

By virtue of paragraph 1 of Art. 217 of the Tax Code of the Russian Federation, state benefits are not subject to personal income tax, except for temporary disability benefits (including benefits for caring for a sick child), as well as other payments and compensations made in accordance with current legislation.

For a long time, the question of whether this norm of tax law applies to the payment of average earnings for additional days off provided to employees caring for disabled children in accordance with Art. 262 of the Labor Code of the Russian Federation, was controversial. Officials gave a negative answer. However, the issue has now been resolved in favor of taxpayers. The Presidium of the Supreme Arbitration Court expressed the opinion that payments for additional days off to care for disabled children are not subject to personal income tax, and the tax authorities had no choice but to agree:

– Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 1798/10; – Letter of the Federal Tax Service of the Russian Federation dated December 11, 2018 No. BS-3-11/ [email protected]

If the employer withheld personal income tax from the amounts paid for additional days of rest provided for in Art. 262 of the Labor Code of the Russian Federation, the employee has the right to return the excessively withheld amount of tax by submitting a corresponding application to the employer.

Amendments to personal income tax: the list of payments exempt from taxation has been expanded

Payment for travel of employees from “northern” organizations on vacation and back

As you know, the list of income that is exempt from personal income tax is given in Article 217 of the Tax Code of the Russian Federation.

Amounts of compensation for travel to and from the place of vacation paid by the employer to persons who work in the Far North and equivalent areas are not mentioned in the current version of this article. The new version of paragraph 1 of Article 217 of the Tax Code of the Russian Federation, which will come into force on January 1, 2022, states that payments by employers to their employees working and living in the Far North and equivalent areas are exempt from personal income tax:

- the cost of travel for an employee within the territory of the Russian Federation to the place of use of vacation and back, as well as the cost of transporting luggage weighing up to 30 kg;

- the cost of travel for non-working family members of the employee (husband, wife, minor children actually living with the employee) and the cost of carrying their luggage.

Let us note that the judges previously believed that these compensations fall under paragraph 3 of Article 217 of the Tax Code of the Russian Federation and are not subject to personal income tax. In turn, the Russian Ministry of Finance advised to be guided by court decisions (see, for example, letters dated June 30, 2014 No. 03-04-06/31355 and letters dated June 21, 2017 No. 03-04-05/38798).

Calculate salary, contributions and personal income tax in the web service

Payment for additional days off to care for disabled children

Based on Article 262 of the Labor Code of the Russian Federation, one of the working parents (guardian, trustee) is provided with four additional paid days off per month to care for a disabled child.

Previously, this payment was not mentioned in Article 217 of the Tax Code of the Russian Federation in the list of income exempt from personal income tax. In this regard, the Russian Ministry of Finance has long insisted that such payments are subject to personal income tax in the general manner (see, for example, letter dated November 22, 2013 No. 03-04-06/50506). However, later the financial department took into account the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 1798/10 dated 06/08/10. The court recognized that payment for additional days off to care for a disabled child is in the nature of state support. This means that it should not be subject to personal income tax on the basis of paragraph 1 of Article 217 of the Tax Code of the Russian Federation (see letter of the Ministry of Finance of Russia dated March 30, 2017 No. 03-15-05/18599).

Thanks to the commented amendments, this issue is now resolved at the legislative level. According to the new paragraph 78 of Article 217 of the Tax Code of the Russian Federation, the amount of payment for days off provided in accordance with Article 262 of the Labor Code of the Russian Federation to persons (parents, guardians, trustees) who care for disabled children should not be subject to personal income tax.

This rule will come into force on January 1, 2022, but will apply to income received starting from the 2022 tax period. Thus, if in 2022 personal income tax is withheld from these payments, then next year the taxpayer will be able to return the overpayment of tax.

Calculate salary, vacation pay and benefits in the web service

Other income exempt from personal income tax

Also, in connection with the adoption of the commented law, the following income of individuals will not be subject to personal income tax:

- in cash and in kind, received by taxpayers in accordance with legislative acts of the Russian Federation, acts of the President of the Russian Federation, acts of the Government of the Russian Federation, laws or other acts of constituent entities of the Russian Federation in connection with the birth of a child;

- in cash and in kind received by disabled people and disabled children in accordance with the Federal Law of November 24, 1995 No. 181-FZ “On Social Protection of Disabled Persons”;

- in the form of an annual cash payment to persons awarded the “Honorary Donor of Russia” badge;

- in the form of monetary compensation paid in exchange for the due land plot, if such compensation is established by law;

- in the form of payments to citizens who were exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, as a result of nuclear tests at the Semipalatinsk test site, as well as as a result of the accident at the Mayak production association and the discharge of radioactive waste into the Techa River;

- in cash and in kind, received in accordance with the Federal Law of January 12, 1995 No. 5-FZ “On Veterans”, the Law of the Russian Federation of January 15, 1993 No. 4301-1 on the status of heroes, the Federal Law of January 9, 1997 No. 5-FZ on providing social guarantees to heroes;

- in cash and in kind, received by certain categories of citizens in order to provide them with social assistance in accordance with legislative acts, acts of the President of the Russian Federation, acts of the Government of the Russian Federation, laws or other acts of constituent entities of the Russian Federation;

- in the form of one-time payments to medical workers, not exceeding 1 million rubles, the provision of which is carried out under state programs. (This rule applies to payments for which the right to receive arose from January 1, 2022 to December 31, 2022).

The rules exempting the listed payments from personal income tax (with the exception of one-time payments to medical workers) will come into force on January 1, 2022, but will apply to income received starting from the 2022 tax period.

In addition, legislators clarified that income in the form of compensation for unused vacations, as well as for unused additional days of rest, is not exempt from personal income tax.

Insurance premiums.

The issue of charging insurance premiums for payments to parents for providing additional days off to care for a disabled child is also controversial.

The official position is that insurance premiums must be calculated from these amounts (Part 17, Article 37 of Federal Law No. 213-FZ dated July 24, 2009, Letter of the Ministry of Finance of the Russian Federation dated March 30, 2017 No. 03-15-05/18599). In particular, in accordance with paragraph 17 of Art. 37 of Federal Law No. 213-FZ financial support for the costs of paying for additional days off provided for caring for disabled children in accordance with Art. 262 of the Labor Code of the Russian Federation, including accrued insurance contributions to state extra-budgetary funds, is carried out at the expense of interbudgetary transfers from the federal budget provided to the Social Insurance Fund budget.

That is, they must be accrued and paid (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” ):

– insurance contributions for compulsory pension insurance; – insurance premiums for health insurance and compulsory social insurance in case of temporary disability and in connection with maternity; – insurance contributions for compulsory social insurance against accidents at work and occupational diseases.

There is an alternative position supported by judges in all districts. According to the arbitrators, since payment for additional days off provided to care for disabled children does not fall into the category of remuneration for labor, but is a means of ensuring social protection for the relevant categories of citizens, it is not subject to insurance contributions:

– Ruling of the Supreme Court of the Russian Federation dated April 19, 2018 No. 306-KG18-3498 in case No. A12-8078/2017; – Ruling of the Supreme Court of the Russian Federation dated April 19, 2018 No. 306-KG18-3492 in case No. A12-8081/2017; – Resolution of the Supreme Court of the Russian Federation of October 3, 2018 No. F01-4399/2018 in case No. A29-16002/2017; – Resolution of the Supreme Court of the Supreme Soviet of July 2, 2018 No. F02-2352/2018 in case No. A74-12264/2017; – Resolution of the Supreme Court of the Russian Federation of November 8, 2017 No. F03-3640/2017 in case No. A73-1890/2017; – Resolution of the AS ZSO dated May 30, 2018 No. F04-1817/2018 in case No. A70-9326/2017; – Resolution of the AS MO dated June 28, 2018 No. F05-8607/2018 in case No. A40-136588/2017; – Resolution of the AS PO dated August 15, 2018 No. F06-35197/2018 in case No. A06-8864/2017; – Resolution of the AS SZO dated September 19, 2018 No. F07-10646/2018 in case No. A13-19088/2017; – Resolution of the AS SKO dated 06/08/2017 No. F08-3553/2017 in case No. A32-23265/2016; – Resolution of the AS UO dated November 9, 2018 No. F09-6672/18 in case No. A76-24776/2017; – Resolution of the AS CO dated March 22, 2018 No. F10-520/2018 in case No. A48-3193/2017.

In fairness, we note that all court decisions adopted to date are based on the provisions of the Federal Law of July 24, 2009 No. 212-FZ “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” which has become invalid from 01/01/2017, and not according to the norms of the Tax Code of the Russian Federation. However, since the wording of these two documents is almost identical, we believe that the arbitrators will not change their opinion in the future.

What advice should you give to policyholders? If they are not afraid of being in a courtroom, payments for additional days off provided to employees with disabled children may not be subject to insurance premiums. For those who are more careful - in order to avoid controversial situations - it is better to charge insurance premiums.

Registration

Payroll and taxes

Letter of the Ministry of Finance of the Russian Federation No. 03-04-05/18802 dated March 31, 2017

07/07/2017 Print

At the written request of one of the parents (guardian, trustee), the employer provides them with four additional paid days off per month to care for disabled children. Each additional day off is paid from the federal budget funds provided by the Social Insurance Fund of the Russian Federation - based on the employee’s average earnings (Part 1 of Article 262 of the Labor Code of the Russian Federation, Clause 8 of the Regulations on the Social Insurance Fund of the Russian Federation, approved by Decree of the Government of the Russian Federation of February 12, 1994 No. 101).

Personal income tax

When determining the tax base for personal income tax, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits are taken into account - with the exception of the amounts specified in Article 217 of the Tax Code RF (Article 210 of the Tax Code of the Russian Federation).

In particular, according to paragraph 1 of Article 217 of the Tax Code of the Russian Federation, the following are not subject to personal income tax:

- income in the form of state benefits, with the exception of benefits for temporary disability (including benefits for caring for a sick child);

- other payments and compensation in accordance with current legislation.

Payment for additional days off is not a state benefit, since it is not named in the list of state benefits from Article 3 of Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children.” However, the Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 1798/10 dated 06/08/2010, recognized: payment of additional days of rest to one of the parents to care for disabled children is not subject to personal income tax on the basis of paragraph 1 of Article 217 of the Tax Code of the Russian Federation - like other payments made in accordance with with current legislation.

According to the Russian Ministry of Finance, in this case, the employer should be guided by the position of the Supreme Arbitration Court of the Russian Federation and not impose personal income tax on the employee’s income in the form of average earnings over the weekend.

Insurance premiums

Payments in favor of individuals within the framework of labor relations are subject to insurance contributions (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents in production and occupational diseases”, hereinafter referred to as Law No. 125-FZ).

An exception is made for payments named in Article 422 of the Tax Code of the Russian Federation and in Article 20.2 of Law No. 125-FZ. This is, for example (subclause 1, clause 1, article 422 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 20.2 of Law No. 125-FZ):

- state benefits paid in accordance with the legislation of the Russian Federation;

- benefits and other types of compulsory insurance coverage for compulsory social insurance.

Payment for additional days off is not included in the list of state benefits established by Article 3 of Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children.” It is also not named in the list of types of insurance coverage for compulsory social insurance established by Article 1.4 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

In this regard, according to the Ministry of Finance of Russia, insurance premiums are calculated in the usual manner for the amount of the payment in question to the employee (clause 4 of the letter of the Ministry of Finance of Russia dated March 21, 2017 No. 03-15-06/16239, clause 1 of the letter of the Ministry of Finance of Russia dated March 30. 2017 No. 03-15-05/18599).

The regulatory agencies gave the same explanations earlier - during the period of validity of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (letters from the Ministry of Labor of Russia dated March 11 .2015 No. 17-3/B-107, FSS of the Russian Federation dated August 15, 2011 No. 14-03-11/08-8158). Although the Supreme Court of the Russian Federation believed otherwise - that the payments in question do not fall under the object of taxation of insurance premiums, since this is not remuneration for work, but a means of ensuring social protection for the relevant categories of citizens (Definitions of the Supreme Court of the Russian Federation dated 04.04.2017 No. 306-KG17-2242 on case No. A65-10939/2016, dated 02/09/2017 No. 305-KG16-19944 in case No. A40-182153/2015, dated 11/16/2016 No. 304-KG16-15222 in case No. A03-22073/2015).

Example.

Accounting for payment of additional days off

An employee of Vector LLC (a citizen and tax resident of the Russian Federation) was accrued an average salary for additional days off to care for a disabled child in the amount of 4,000 rubles. The accountant will make the following entries:

DEBIT 69 subaccount for accounting for insurance premiums for VNIM CREDIT 70

– 4000 rub. – the average salary for additional days off is accrued to the employee;

DEBIT 69 subaccount for accounting for insurance premiums for VNiM

CREDIT 69 subaccount for accounting for insurance premiums for compulsory health insurance

— 880 rub. (4000 * 22%) – insurance premiums for compulsory health insurance have been calculated;

DEBIT 69 subaccount for accounting for insurance premiums for VNiM

CREDIT 69 subaccount for accounting for insurance premiums for compulsory medical insurance

— 204 rub. (4000 * 5.1%) - insurance premiums for compulsory medical insurance have been calculated;

DEBIT 69 subaccount for accounting for insurance premiums for VNiM

CREDIT 69 subaccount for accounting for insurance premiums at VNiM

— 116 rub. (4000 * 2.9%) - insurance premiums for compulsory medical insurance have been calculated;

DEBIT 69 subaccount for accounting for insurance premiums for VNiM

CREDIT 69 subaccount for accounting for insurance premiums “for injuries”

— 8 rub. (4000 * 0.2%) - insurance premiums “for injuries” are charged;

DEBIT 70 CREDIT 50 (51)

— 4000 rub. - the average salary was paid to the employee.