Composition of general business expenses

Order of the Ministry of Finance No. 94n clearly establishes that account 26 in accounting is used to reflect general business expenses (OHR).

Such expenses of an enterprise include some types of expenses that cannot be attributed to the main production, but without which the implementation of the main activities would become impossible or problematic. The following types of costs are attributed to accounting account 26 (for dummies):

- Remuneration of management personnel, as well as taxes and insurance premiums accrued on the salaries of administrative and managerial personnel.

- Fixed assets, intangible assets, which are used to ensure the work of the enterprise administration. As well as depreciation charges for such property.

- Material supplies (stationery, fuels and lubricants, spare parts) that are purchased for management, ensuring the operation of the farm and the AUP.

- Payment of rental and leasing payments for property purchased directly for the needs of the company administration. For example, renting office space.

- Information, consulting, legal and other support services of third-party organizations and firms that are used in the company’s activities as auxiliary.

For exceptional types of activities, account 26 can include not only general business expenses, but also expenses for core activities. For example, the activities of brokerage companies. Such features should be described in detail in the accounting policies.

Scheme for accounting for direct costs in 1C - 20 and 23 accounts

Figure 1 schematically shows direct costs, i.e. those that can be attributed to specific products. These costs are written off to 20 (main production) and 23 (auxiliary) accounts.

By “cost” we can understand the wages of production workers, the cost of consumables, depreciation of equipment, and other types of costs. The main thing that unites such costs is that the products to which they relate are known in advance.

Fig.1

Different colors indicate products and costs with the same analytics. In 1C, these are item groups (and, possibly, divisions, if their use is configured). In order for the cost to “go” to the desired product, it must have the same analytics.

Within a product group, costs are distributed in proportion to the planned cost.

“Cost 10” (Fig. 1) will “hang” in the department, since its analytics do not coincide with any products. This is the main reason for errors when closing 20 accounts.

In this case, in the program after the month is closed, the cost calculation will look like this (Fig. 2):

Fig.2

As you can see, a line with zero cost appeared in the report, although there are both direct (“nuts”) and indirect costs (“labor”). There is no issue for this nomenclature group. To correct the error in closing account 20 in 1C Accounting, you need to check the costs for the “Footwear” item group.

For analysis, you can use the standard “Subconto Analysis” report (Fig. 3). Most likely, for the cost “Nuts” the “Main nomenclature group” should be selected, according to which “Nut butter” was produced.

Fig.3

Structure of OCR in the table

A complete list of expenses for general business needs with examples:

| Main categories | Compound | Examples |

| Administrative and management expenses | Salaries of management personnel, secretariat, accounting, personnel department and legal department. Insurance premiums and other charges on the earnings of the AUP. Representation expenses of the organization. Expenses for business trips and business trips. Payment for postal services, telephony, internet, communications, etc. Security services. | The official salary and bonus of the director of the organization, insurance premiums for the reporting month. Payment for postage stamps for sending business correspondence. |

| Repair and depreciation | Costs of an economic entity for the repair of non-production equipment. Depreciation charges for fixed assets and intangible assets not involved in the production cycle. | Repair of the CEO's company car. Depreciation for office premises of the AUP and accounting department. |

| Material support | Acquisition of inventory and intangible assets to meet general economic needs. | Purchasing computers for the secretary. Purchasing specialized software for accounting. |

| Rent | Payment of rent for AUP. | Calculations of monthly rental payments for the office of the organization's directorate. |

| Budget payments | Taxes, fees, contributions. | Payment of fiscal payments to the budget of the Russian Federation. |

| Other | Consulting, information, audit services. | Payment for external audit control. |

Features and characteristics of 26 accounts

General business expenses are subject to reflection on active accounting account 26. Debit turnover accumulates the cost of all expenses incurred, and credit turnover reflects the closure of account 26.

Account 26 is considered a transaction account. This means that this accounting account is not reflected in the annual balance sheet, or as part of other reporting forms. Consequently, the account at the end of the reporting period cannot have a closing balance. All turnover must be distributed to the appropriate accounting accounts.

The current standards of PBU require the organization of analytical accounting for account 26. Provide detail in the context of cost items, according to the approved cost estimate. Conduct additional analytics by structural divisions - places where costs arise, by intended purposes and other accounting features.

IMPORTANT!

Account 26 cannot have a final balance at the end of the reporting period. This means that the account is subject to monthly closure.

Account 26 “General business expenses”

| Debit | Credit |

| Balance (initial) – none | |

| During the reporting period (month), indirect costs incurred by the organization related to the management of the organization are reflected | At the end of the reporting period (month), the entire amount of general business expenses is written off in one of the following ways: |

| ∙ is included in the costs associated with the manufacture of products by debiting account 20 “Main production” and analytical accounts opened for its development, in the share found by calculation; | |

| ∙ as conditionally constant, they will reduce the income of the period in full by debiting account 90 “Sales” without distribution by type of product produced | |

| Turnover by debit | Loan turnover |

| Balance (final) – none |

Account 26 “General expenses” is intended to summarize information on expenses for management needs not directly related to the production process.

In particular, the following expenses may be reflected in this account: administrative and management expenses; maintenance of general business personnel not related to the production process; depreciation charges and expenses for repairs of fixed assets for management and general economic purposes; rent for general business premises; expenses for payment of information, audit, consulting and other services; other administrative expenses similar in purpose. During the reporting month, general business expenses are reflected in the debit of account 26 “General business expenses” in correspondence with the credit of the accounts for accounting for consumed inventories (account 10 “Materials”), settlements with employees for wages (account 70 “Settlements with personnel for wages”) , settlements with other organizations (persons) (account 60 “Settlements with suppliers and contractors”), settlements with accountable persons (account 71 “Settlements with accountable persons”), depreciation charges (account 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets"), etc.

Account 26 “General business expenses” is a collection and distribution account and cannot have a balance as of the reporting date. In this regard, at the end of each month, general business expenses recorded in the debit of account 26 “General business expenses” are written off in full from the credit of this account in correspondence with the accounts determined by the organization’s accounting policies. Currently, it is possible to use two options for correspondent accounts, reflecting different approaches to interpreting the nature of the participation of management expenses in the production activities of the organization:

∙ in the 1st option - general business expenses, similarly to general production expenses, are written off as a debit to account 20 “Main production” with the inclusion of the calculated share of general business expenses in the actual costs of production;

∙ in the 2nd option - general business expenses in full are written off as semi-fixed expenses to the debit of account 90 “Sales” without distribution to the cost of specific types of products.

When using the 1st option for writing off administrative expenses, based on the data recorded in account 20 “Main production”, the actual production cost

finished products;

when using the 2nd write-off option - the reduced actual production cost

of finished products.

Thus, production cost accounting can be divided into the following stages:

First stage. During the reporting period (month):

∙ direct production costs are reflected directly on the debit of account 20 “Main production” and analytical accounts opened for its development;

∙ indirect costs, depending on their purpose, are preliminarily reflected in the debit of accounts 25 “General production expenses” and 26 “General expenses”.

Second phase. At the end of the reporting period (month), indirect costs according to a predetermined method are distributed between individual types of products and written off from the credit of indirect cost accounts in the following order:

∙ general production expenses are written off in full to the debit of account 20 “Main production” and analytical accounts opened for its development by type of product produced;

∙ general business expenses are written off in full either to the debit of account 20 “Main production” and analytical accounts opened in its development for the types of products produced in the share determined by calculation, or to the debit of account 90 “Sales” as conditionally fixed expenses of the reporting period, not related to the production of specific types of finished products and therefore not included in the cost of their production.

Third stage. Based on the costs recorded in the debit of account 20 “Main production” and the analytical accounts opened for its development, the actual production cost of finished products is determined, which is written off from the credit of account 20 “Main production”.

Part of the costs related to products not completed by processing forms the cost of work in progress, reflected as a debit balance in account 20 “Main production”.

The distribution of expenses reflected in the debit of account 20 “Main production” between the cost of manufactured products during the reporting period of finished goods and work-in-process inventories is carried out as follows.

First, the volume of work in progress is determined and assessed in one of the following ways:

∙ at actual cost;

∙ at standard cost;

∙ for direct cost items;

∙ for items of direct material costs.

Secondly, the actual cost of finished products is calculated using the following formula:

,

where Sп.п – actual production cost of finished products produced during the reporting period;

Szн.п,к.п – balances of work in progress at the beginning and end of the reporting period (incoming and outgoing balance on account 20 “Main production”);

S – production costs for the reporting period (debit turnover to account 20 “Main production”);

О – cost of returnable production waste.

To summarize the above, let us illustrate the general cost accounting scheme using a conditional example.

Example 9.1 . The organization produces two types of finished products - product A and product B. During the reporting month, the following expenses were incurred for ordinary activities:

∙ direct material costs for the production of product A – 600 rubles;

∙ direct material costs for the production of product B – 300 rubles;

∙ the basic salary of workers producing product A is 200 rubles;

∙ the basic salary of workers producing product B is 100 rubles;

∙ depreciation of production premises – 150 rubles;

∙ salary of management personnel – 300 rubles;

∙ there are no stocks of work in progress for products A and B at the beginning of the period.

During the reporting period, 10 units were produced. products A and 9 units. product B. At the same time, at the end of the reporting period, there was 1 unit in the work-in-process inventory. products B.

In accordance with the accounting policy adopted by the organization:

∙ general production costs are distributed among the types of products produced in proportion to direct costs;

∙ general business expenses are written off as semi-fixed and are not included in the cost of production;

∙ assessment of work in progress is carried out according to direct cost items.

In relation to the conditions of the example, accounting for production costs and calculating the cost of manufactured finished products will be carried out as follows.

1st stage. During the reporting month, expenses incurred are reflected in the accounting accounts:

| Contents of operation | Amount, rub. | Corresponding accounts |

| Debit | Credit | |

| Accounting for direct costs of production | ||

| 1. Direct materials used for production: | 20 "Main production" | 10 "Materials" |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| 2. Wages have been accrued to the main production workers producing: | 20 "Main production" | 70 “Settlements with personnel for wages” |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| Accounting for indirect costs | ||

| 3. Depreciation of fixed assets for production purposes has been calculated | 25 “General production expenses” | 02 “Depreciation of fixed assets” |

| 4. Salaries of the organization’s management personnel have been calculated | 26 “General business expenses” | 70 “Settlements with personnel for wages” |

2nd stage. At the end of the reporting month, general production costs are distributed between individual types of products in proportion to direct costs:

| Type of expenses | Total amount, rub. | Amount of expenses for product A, rub. | Amount of expenses for product B, rub. |

| Direct expenses | 1 200 | ||

| General production expenses (distributed in proportion to direct costs) | |||

| Total |

In accordance with the accounting policy of the organization, the distribution of general business expenses between individual types of products is not carried out.

Upon completion of calculations for the distribution of indirect costs, their write-off is reflected in the accounting accounts as follows:

| Contents of operation | Amount, rub. | Corresponding accounts |

| Debit | Credit | |

| Accounting for direct costs of production | ||

| 1. At the end of the reporting month, general production expenses are written off, including for: | 20 "Main production" | 25 “General production expenses” |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| 2. At the end of the reporting month, general business expenses were written off as semi-fixed expenses | 90 "Sales" | 26 “General business expenses” |

3rd stage. At the end of the reporting month, the actual production cost of finished products produced in the reporting period was calculated:

1) calculation of the cost of manufactured finished products A:

∙ work in progress at the beginning of the period – absent;

∙ production costs for the period – 900 rubles;

∙ work in progress at the end of the period – absent;

∙ returnable waste – no.

Cost of finished products A

:

0 + 900 – 0 = 900 (rub.);

2) calculation of the cost of manufactured finished products B:

∙ work in progress at the beginning of the period – absent;

∙ production costs for the period – 450 rubles;

∙ work in progress at the end of the period – 1 unit. products B;

∙ returnable waste – no.

To calculate the cost of manufactured finished product B, it is necessary to determine the estimate of 1 unit. product B, unfinished production. Due to the fact that, in accordance with the accounting policy, the assessment of work in progress is carried out at actual production costs, when assessing work in progress, the corresponding share of all costs incurred must be taken into account. Assuming that there are no significant differences in the degree of readiness of released finished products B and 1 unit. product B, work in progress, you can make the following calculation of the assessment of work in progress:

2 LnhtbFBLBQYAAAAABAAEAPMAAABOBwAAAAAA= ">

| (300 rub. + 100 rub. + 50 rub.) ———————————————- = x 1 unit. = 45 rub. 10 units |

Therefore, the cost of finished products B

:

0 + 450 – 45 – 0 = 405 (rub.)

The release of finished products from production will be reflected in the credit of account 20 “Main production” and the corresponding analytical accounts opened for its development.

The description of the operation can be summarized schematically using T-accounts.

| Account 20 “Main production” | Account 25 “General production expenses” | Account 26 “General business expenses” | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Balance 0 | NO balance | NO balance | |||

| (1)[24] 900 | 1 305 (3) | (1) 150 | (1) 300 | ||

| (1) 300 | 150 (2) | ||||

| (2) 150 | 300 (2) | ||||

| Balance 45 | NO balance | NO balance |

| Account “Production of product A” | Account “Production of product B” | ||

| Debit | Credit | Debit | Credit |

| Balance 0 | Balance 0 | ||

| (1) 600 | 900 (3) | (1) 300 | 405 (3) |

| (1) 200 | (1) 100 | ||

| (2) 100 | (3) 50 | ||

| Balance 0 | Balance 45 |

| Debit | Credit |

| Balance (initial) – none | |

| During the reporting period (month), indirect costs incurred by the organization related to the management of the organization are reflected | At the end of the reporting period (month), the entire amount of general business expenses is written off in one of the following ways: |

| ∙ is included in the costs associated with the manufacture of products by debiting account 20 “Main production” and analytical accounts opened for its development, in the share found by calculation; | |

| ∙ as conditionally constant, they will reduce the income of the period in full by debiting account 90 “Sales” without distribution by type of product produced | |

| Turnover by debit | Loan turnover |

| Balance (final) – none |

Account 26 “General expenses” is intended to summarize information on expenses for management needs not directly related to the production process. In particular, the following expenses may be reflected in this account: administrative and management expenses; maintenance of general business personnel not related to the production process; depreciation charges and expenses for repairs of fixed assets for management and general economic purposes; rent for general business premises; expenses for payment of information, audit, consulting and other services; other administrative expenses similar in purpose.

During the reporting month, general business expenses are reflected in the debit of account 26 “General business expenses” in correspondence with the credit of the accounts for accounting for consumed inventories (account 10 “Materials”), settlements with employees for wages (account 70 “Settlements with personnel for wages”) , settlements with other organizations (persons) (account 60 “Settlements with suppliers and contractors”), settlements with accountable persons (account 71 “Settlements with accountable persons”), depreciation charges (account 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets"), etc.

Account 26 “General business expenses” is a collection and distribution account and cannot have a balance as of the reporting date. In this regard, at the end of each month, general business expenses recorded in the debit of account 26 “General business expenses” are written off in full from the credit of this account in correspondence with the accounts determined by the organization’s accounting policies. Currently, it is possible to use two options for correspondent accounts, reflecting different approaches to interpreting the nature of the participation of management expenses in the production activities of the organization:

∙ in the 1st option - general business expenses, similarly to general production expenses, are written off as a debit to account 20 “Main production” with the inclusion of the calculated share of general business expenses in the actual costs of production;

∙ in the 2nd option - general business expenses in full are written off as semi-fixed expenses to the debit of account 90 “Sales” without distribution to the cost of specific types of products.

When using the 1st option for writing off administrative expenses, based on the data recorded in account 20 “Main production”, the actual production cost

finished products;

when using the 2nd write-off option - the reduced actual production cost

of finished products.

Thus, production cost accounting can be divided into the following stages:

First stage. During the reporting period (month):

∙ direct production costs are reflected directly on the debit of account 20 “Main production” and analytical accounts opened for its development;

∙ indirect costs, depending on their purpose, are preliminarily reflected in the debit of accounts 25 “General production expenses” and 26 “General expenses”.

Second phase. At the end of the reporting period (month), indirect costs according to a predetermined method are distributed between individual types of products and written off from the credit of indirect cost accounts in the following order:

∙ general production expenses are written off in full to the debit of account 20 “Main production” and analytical accounts opened for its development by type of product produced;

∙ general business expenses are written off in full either to the debit of account 20 “Main production” and analytical accounts opened in its development for the types of products produced in the share determined by calculation, or to the debit of account 90 “Sales” as conditionally fixed expenses of the reporting period, not related to the production of specific types of finished products and therefore not included in the cost of their production.

Third stage. Based on the costs recorded in the debit of account 20 “Main production” and the analytical accounts opened for its development, the actual production cost of finished products is determined, which is written off from the credit of account 20 “Main production”.

Part of the costs related to products not completed by processing forms the cost of work in progress, reflected as a debit balance in account 20 “Main production”.

The distribution of expenses reflected in the debit of account 20 “Main production” between the cost of manufactured products during the reporting period of finished goods and work-in-process inventories is carried out as follows.

First, the volume of work in progress is determined and assessed in one of the following ways:

∙ at actual cost;

∙ at standard cost;

∙ for direct cost items;

∙ for items of direct material costs.

Secondly, the actual cost of finished products is calculated using the following formula:

,

where Sп.п – actual production cost of finished products produced during the reporting period;

Szн.п,к.п – balances of work in progress at the beginning and end of the reporting period (incoming and outgoing balance on account 20 “Main production”);

S – production costs for the reporting period (debit turnover to account 20 “Main production”);

О – cost of returnable production waste.

To summarize the above, let us illustrate the general cost accounting scheme using a conditional example.

Example 9.1 . The organization produces two types of finished products - product A and product B. During the reporting month, the following expenses were incurred for ordinary activities:

∙ direct material costs for the production of product A – 600 rubles;

∙ direct material costs for the production of product B – 300 rubles;

∙ the basic salary of workers producing product A is 200 rubles;

∙ the basic salary of workers producing product B is 100 rubles;

∙ depreciation of production premises – 150 rubles;

∙ salary of management personnel – 300 rubles;

∙ there are no stocks of work in progress for products A and B at the beginning of the period.

During the reporting period, 10 units were produced. products A and 9 units. product B. At the same time, at the end of the reporting period, there was 1 unit in the work-in-process inventory. products B.

In accordance with the accounting policy adopted by the organization:

∙ general production costs are distributed among the types of products produced in proportion to direct costs;

∙ general business expenses are written off as semi-fixed and are not included in the cost of production;

∙ assessment of work in progress is carried out according to direct cost items.

In relation to the conditions of the example, accounting for production costs and calculating the cost of manufactured finished products will be carried out as follows.

1st stage. During the reporting month, expenses incurred are reflected in the accounting accounts:

| Contents of operation | Amount, rub. | Corresponding accounts |

| Debit | Credit | |

| Accounting for direct costs of production | ||

| 1. Direct materials used for production: | 20 "Main production" | 10 "Materials" |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| 2. Wages have been accrued to the main production workers producing: | 20 "Main production" | 70 “Settlements with personnel for wages” |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| Accounting for indirect costs | ||

| 3. Depreciation of fixed assets for production purposes has been calculated | 25 “General production expenses” | 02 “Depreciation of fixed assets” |

| 4. Salaries of the organization’s management personnel have been calculated | 26 “General business expenses” | 70 “Settlements with personnel for wages” |

2nd stage. At the end of the reporting month, general production costs are distributed between individual types of products in proportion to direct costs:

| Type of expenses | Total amount, rub. | Amount of expenses for product A, rub. | Amount of expenses for product B, rub. |

| Direct expenses | 1 200 | ||

| General production expenses (distributed in proportion to direct costs) | |||

| Total |

In accordance with the accounting policy of the organization, the distribution of general business expenses between individual types of products is not carried out.

Upon completion of calculations for the distribution of indirect costs, their write-off is reflected in the accounting accounts as follows:

| Contents of operation | Amount, rub. | Corresponding accounts |

| Debit | Credit | |

| Accounting for direct costs of production | ||

| 1. At the end of the reporting month, general production expenses are written off, including for: | 20 "Main production" | 25 “General production expenses” |

| ∙ product A | subaccount A | |

| ∙ product B | subaccount B | |

| 2. At the end of the reporting month, general business expenses were written off as semi-fixed expenses | 90 "Sales" | 26 “General business expenses” |

3rd stage. At the end of the reporting month, the actual production cost of finished products produced in the reporting period was calculated:

1) calculation of the cost of manufactured finished products A:

∙ work in progress at the beginning of the period – absent;

∙ production costs for the period – 900 rubles;

∙ work in progress at the end of the period – absent;

∙ returnable waste – no.

Cost of finished products A

:

0 + 900 – 0 = 900 (rub.);

2) calculation of the cost of manufactured finished products B:

∙ work in progress at the beginning of the period – absent;

∙ production costs for the period – 450 rubles;

∙ work in progress at the end of the period – 1 unit. products B;

∙ returnable waste – no.

To calculate the cost of manufactured finished product B, it is necessary to determine the estimate of 1 unit. product B, unfinished production. Due to the fact that, in accordance with the accounting policy, the assessment of work in progress is carried out at actual production costs, when assessing work in progress, the corresponding share of all costs incurred must be taken into account. Assuming that there are no significant differences in the degree of readiness of released finished products B and 1 unit. product B, work in progress, you can make the following calculation of the assessment of work in progress:

2 LnhtbFBLBQYAAAAABAAEAPMAAABOBwAAAAAA= ">

| (300 rub. + 100 rub. + 50 rub.) ———————————————- = x 1 unit. = 45 rub. 10 units |

Therefore, the cost of finished products B

:

0 + 450 – 45 – 0 = 405 (rub.)

The release of finished products from production will be reflected in the credit of account 20 “Main production” and the corresponding analytical accounts opened for its development.

The description of the operation can be summarized schematically using T-accounts.

| Account 20 “Main production” | Account 25 “General production expenses” | Account 26 “General business expenses” | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Balance 0 | NO balance | NO balance | |||

| (1)[24] 900 | 1 305 (3) | (1) 150 | (1) 300 | ||

| (1) 300 | 150 (2) | ||||

| (2) 150 | 300 (2) | ||||

| Balance 45 | NO balance | NO balance |

| Account “Production of product A” | Account “Production of product B” | ||

| Debit | Credit | Debit | Credit |

| Balance 0 | Balance 0 | ||

| (1) 600 | 900 (3) | (1) 300 | 405 (3) |

| (1) 200 | (1) 100 | ||

| (2) 100 | (3) 50 | ||

| Balance 0 | Balance 45 |

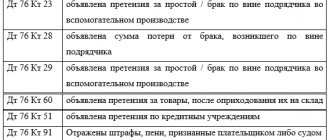

Postings for recording general business expenses

All typical accounting entries for accounting are collected in the table:

| Operation description | Debit | Credit |

| Depreciation was accrued for fixed assets and intangible assets used for the administration of the enterprise | 26 | 02 - fixed assets 05 - intangible assets |

| Salaries and insurance contributions were accrued to the director of the organization and his deputies | 70 - salary 69 – contributions | |

| Materials, equipment, special clothing and personal protective equipment used in work for general business needs of the company have been written off. | 10 | |

| Part of the finished products is sent for chemical and chemical work | 43 | |

| Services of third-party organizations are included in the OCR | 60 76 | |

| The deviation in the cost of written-off materials and raw materials for industrial maintenance is reflected | 16 | |

| Semi-finished products are assigned to our own general facilities. company needs | 21 | |

| Part of the costs of main production (goods, works, services) is written off for own needs | 20 | |

| Auxiliary production costs are written off for maintenance | 23 | |

| Costs of servicing production shops are allocated to administrative needs | 29 | |

| Shortages and thefts were written off without identifying the perpetrators. Except for natural disasters | 94 | |

| OHR are included in the reserve for future expenses and payments | 96 | |

| The share of deferred costs is allocated to maintenance and repair | 97 |

Closing an account and writing off expenses in accounting

It is important to understand how account 26 is closed and what transactions are made. Writing off expenses, that is, closing account 26, is done in several ways:

- Costs are included in the cost of production using production accounts. The method can be used in the production of products.

- Costs are charged to cost of sales. For example, if an economic entity provides services or performs work.

- Expenses are written off as current expenses of the reporting period using the direct costing system.

It is not enough to simply choose a method for writing off OCR. The choice and distribution standards must be fixed in the accounting policies. And the chosen method must be justified.

Typical transactions on how to close account 26:

| Operation | Debit | Credit | Note |

| Write-off reflected at actual cost | 20 23 29 | 26 | If the production activities of an enterprise include auxiliary and service production (shops), then costs should be distributed between the corresponding accounting accounts. Provide information about the distribution method in your accounting policies. |

| Reflected write-off using the direct costing system | 90-2 | 26 | If a company uses the method of forming a reduced cost, or direct costing, then the cost and equipment are written off immediately to the account. 90-2 “Cost of sales”. Fix this decision, how and to what account account 26 is closed, in the accounting policy. |

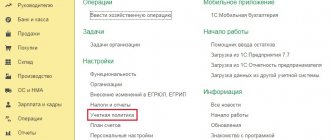

Nuances of closing 26 accounts in 1C Accounting 8.3

Nuances of closing 26 accounts Indirect costs , as well as correction of possible errors, in the 1C Enterprise Accounting program Edition 3.0

Indirect costs are costs associated with the production of products or the performance of work (rendering services). They are included in the cost of products (works, services) by distribution according to the rules established at the enterprise in accordance with the selected distribution base and calculated coefficients. Indirect expenses are accounted for in accounts 25 General production expenses and 26 General business expenses .

— Expenses recorded on account 25 are always distributed; — Expenses recorded on account 26 are distributed only when using the so-called Full Production Cost method.

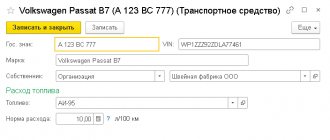

In the program in the installation section Organizational accounting policies

The switch General business expenses are included is set to position B cost of products, works, services .

Please note that access to the accounting policy by default is only possible for users with Administrator and Chief Accountant .

The so-called Reduced Cost ; in the Accounting Policy this will be the option Include expenses in the cost of sales using the direct costing method .

In the case of the full option, you also need to configure a list of cost distribution methods.

Setting up distribution methods is carried out in a separate information register; records are added to it about which cost items (Write-off of materials, Labor compensation, etc.) are indirect and on what basis (distribution by sub-account in machine accounting) they should be distributed (Revenue, Material costs, labor costs, etc.).

To perform account closure 26 in 1C in the program, you need to go to the Operations menu - Closing the month , select Closing month, select Organization and click the button Perform closure .

Once the closing operation is completed, you will see the link Closing accounts 20, 23, 25, 26 .

To correctly and accurately calculate income tax and fill out the relevant reports (declaration, registers), it is necessary to annually set up a list of direct expenses; this list is located in the Main menu - Taxes and reports - Income tax - List of direct expenses .

During the year, as accounting records are maintained, new entries for direct expenses can be added to this list. The list of direct expenses is key; it is thanks to the presence of entries in it that the 1C program determines which expenses will be direct and which indirect.

In this directory, entries are configured for the correct closure of 20 and 23 . Similar to the directory of indirect expenses, entries are created with the Create button. The Validity Period, Organization, Type of Tax Accounting Expenses, Debit Account are indicated, and for greater detail, you can also specify the Accounting Cost Item (one type of expense in Tax Accounting may include several Accounting Items, and you can check this by opening the Items costs (through the menu Directories – Income and expenses – Cost items).

Expense items not listed in this list are defined by the program as indirect costs and when closing the month with the regulatory operation Closing accounts: 20, 23, 25, 26 are written off in tax accounting to account 90.08 .

Possible errors when closing the month.

A very common situation is that the closure was successful, the program did not produce any errors, but when generating the balance sheet, the user notices that on January 20, the account was closed to the account on 08/90 or was not closed at all and a balance was formed for some or all subconto. In this case, you need to do the following:

Look at the transactions in the routine operation Closing accounts: 20, 23, 25, 26 (DK button in the document, or through the Revolving Balance Sheet), to which account the accounts 20/23 .

If the account is 90.08 , then you need to check the list of direct expenses (Main - Taxes and reports - Income tax - List of direct expenses ), perhaps there are not enough entries here (not all expenses were identified as direct);

According to the report Analysis of sub-counts in the context of sub-counts Nomenclature groups, analyze for which Nomenclature group and Cost Item there was no complete / partial closure of accounts 20/23 to account 90.02 . If the direct expense accounts are not closed at the cost of production, this may mean that there is work in progress in the program, there are no necessary entries in the list of direct expenses, or there is no revenue for this item group.

It is also always necessary to take into account that the accounting policy of the organization is created annually, and along with it, Methods for the distribution of indirect expenses and a List of direct expenses are created. And in case of any questions when closing the month, it is also necessary to check this item in the Organization - Accounting Policies . It often happens that immediately after transferring data, for example from the 1C Accounting 7.7 , some checkboxes in the Accounting Policy in the program are not selected or are set incorrectly; they must be reselected manually and the settings saved.

For currency transactions, also often after transferring documents from other programs, it is necessary to remove from processing all related currency documents (invoices, payment documents, currency revaluation), check the Currency directory for correct filling (are there any duplicates, is there a sign of automatic exchange rates everywhere? ) and download courses for all accounting dates, and at the end additionally check that the courses are downloaded correctly using the reference book.

After the checks have been made and changes have been made to the relevant documents, you must perform the Month Closing again.

Separately, you should keep in mind the monthly closing of the so-called Standardized expenses , for example, under an insurance contract. A situation may arise that an agreement for this type of insurance will need to be entered into the program annually, indicating the beginning of the current year as the start date, and manually (through an Operation entered manually ) transfer the balances under this agreement according to accounting and accounting . Since it was noticed that in some releases of 1C Accounting the program does not correctly close the tax amount when writing off expenses from 26 .

It also happens that the program produces errors indicating specific problems and how to solve them, and what needs to be done to correct them. In this case, you need to read the information provided by the program, correct errors following the recommendations, and then perform the closing process again.

Accounting example for account 26

Let's look at the rules for closing account 26 using an example. NPO “Good Day” produces scissors and rulers. Products are produced at planned cost. In the organization, it is customary to reflect the main costs on account 20, and reflect indirect costs on account 26.

The accounting policy of the NPO “Good Day” reflects:

- General business expenses are written off to the cost of production;

- distribution of costs between types of products should be made according to the volume of material costs.

In March 2022, direct production costs amounted to 220,000 rubles:

- for the production of scissors - 150,000 rubles, including material costs - 80,000 rubles;

- for the production of rulers - 70,000 rubles, including material costs - 40,000 rubles.

Structure of indirect expenses—RUB 140,200:

- salary of management personnel - 100,000 rubles;

- insurance premiums - 30,200 rubles;

- rental of premises - 10,000 rubles.

1. We distribute indirect costs according to the volume of material costs using the formula:

Amount of indirect expenses for the production of scissors: 140,200 × 80,000 / 120,000 = 93,467 rubles.

The amount of indirect costs for the production of rulers: 140,200 × 40,000 / 120,000 = 46,733 rubles.

2. Close account 26, distributing indirect costs:

| Operation | Debit | Credit | Sum |

| Indirect costs for the production of scissors were written off | 20 | 26 | 93 467 |

| Indirect costs for the production of lines are written off to the main production | 20 | 26 | 46 733 |

How to close account 26

The method of closing account 26 depends on the method of generating product costs. The company must regulate such a choice in its accounting policies. Currently two methods are used:

- at actual cost;

- at reduced cost or direct costing method.

When writing off chemical and chemical works at actual cost, costs should be written off to accounting account 20 “Main production”. Note that if the company’s accounting includes auxiliary or servicing production workshops, then costs should also be distributed between 23 and 29 accounting accounts, respectively. However, OMR can be written off to these accounting accounts only if the company has performed such services or work in favor of third-party organizations. The procedure for allocating costs and the method of their distribution between write-off accounts should be fixed in the accounting policy.

Accounting entry:

Dt 20 (23, 29) Kt 26.

To what account is account 26 closed using the direct costing method? If an organization operates at a reduced cost, then expenses for general business needs should be written off immediately to the account. 90-2 “Cost of sales”.

Accounting entry:

Dt 90-2 Kt 26.

Correcting errors in accounting

The use of automated accounting greatly simplifies accounting. Errors are not uncommon in specialized accounting programs. Why account 26 is not closed:

- Check the accounting policy settings in the software product. Follow the prompts that the program gives, or contact the developers.

- Check that transactions are recorded correctly in the special program. In most cases, errors lie in misgrading (for example, an accountant made a mistake in the details or nomenclature).

- Check the dates of registration of transactions. For example, in the 1C software, the dates of registration of a business transaction play a key role in the formation of accounting data.

To avoid mistakes, systematically create the turnover sheet and check the accounting card 26.

Indirect costs on accounts 25 and 26

Let's look at indirect costs (Fig. 4). They apply to several types of products at once, so they require distribution. Such costs are taken into account in accounts 25 and 26. These may include the salaries of storekeepers, dispatchers, accountants, the same depreciation (if the equipment is used to produce different types of products), etc.

Fig.4

Indirect costs are distributed among cost items in proportion to the distribution base. In Fig. 4, each cost item has its own color, and each product has a corresponding base (of the same color).

Necessary conditions for distribution:

- for each item a distribution method must be assigned;

- the corresponding base must be “attached” to the product.

For example, the item “Basic materials” is distributed in proportion to the planned cost. This means that this value must be indicated in the program for each product. In 1C, the planned cost is recorded in the document “Setting item prices”.

In Fig. 4, “purple” costs will not be distributed, since the base for them has not been determined. For example, the distribution method “Wages” was set for them, but in the current period there were no direct costs for the corresponding item.

In this case, the 1C 8.3 program will display a list of errors when closing accounts and recommendations for eliminating them (Fig. 5).

Fig.5

To correct it, you need to either enter documents “Reflections of salaries in accounting” for each department, and the salary will have to be attributed to account 20, or change the distribution method for this item (for example, “by output volume”).