MORE CALCULATORS: STS calculator 6% and STS 15% Calculator for calculating penalties for taxes Calculator for tax on interest on deposits

After the calculation, we suggest using a sample of filling out a payment order to pay insurance premiums for this year with a full description of all the characteristics of the fields of the document.

How to use the calculator

Instructions for using the individual entrepreneur insurance premium calculator

- By default, calculations are made for the selected whole year. If you registered an individual entrepreneur this year, or you closed it, then select a more specific start and end date for the period.

- If your income for the selected period was no more than 300,000 rubles, then you can leave the “Income for this period” field empty. The entered amount will not affect the final result.

- Click "CALCULATE". You can save the result with all the calculation details to a doc file.

How to calculate income

If you earned more than 300,000 rubles in a year, then an additional 1% of the excess amount is paid to the Pension Fund. There is no need to pay anything extra to the FFOMS.

To pay an additional 1% to the Pension Fund, the amount of income is calculated as follows:

- for the simplified tax system - this is all earnings without taking into account expenses (line 113 of section 2.1.1 of the declaration under the simplified tax system, income and line 213 of section 2.2 of the declaration of the simplified tax system, income minus expenses);

- for UTII - this is imputed income for the year (the sum of the values on line 100 of section 2 of the UTII declarations for all quarters);

- for the patent system, this is the potential annual income (line 010); if the patent was received for a period of less than 12 months, then the total indicator is divided by 12 and multiplied by the number of months of the period for which the patent was issued (line 020).

If an entrepreneur combines several tax regimes, then earnings for each of them are summed up. In this case, the total amount is entered into the calculator for calculating pension contributions for individual entrepreneurs in 2021 and contributions from it are calculated.

About the individual entrepreneur insurance premium calculator

As soon as an individual entrepreneur has received registration in this capacity, he has obligations to the state for taxes and fees. Regardless of the taxation system he adheres to and the financial success of his business, individual entrepreneurs must annually pay contributions to insurance funds.

To calculate the amount of amounts required to be paid, you can use an online calculator, which will make this process quick and transparent.

Closing an individual entrepreneur: what is needed for this

Sometimes a situation arises when an entrepreneur decides to close his individual entrepreneur. The reasons for this can be completely different. Maybe the business, as they say, “didn’t take off”, maybe the profit is small, but you have to transfer a fairly significant amount to the budget, or the decision was simply made not to do business anymore and to work for hire.

Regardless of the reasons, closure always follows the same pattern. In addition, the closing procedure can be carried out in two ways:

- Conduct the closing yourself. The procedure is simple; after completing the activity, you need to collect a set of documents and submit them to the tax authority. This method is not expensive, however, it will require time to prepare documents.

- Involve a specialized company in the closing procedure. For those who want to save their time or are afraid of making mistakes in documents, closing with the help of specialists in this matter is suitable. The method requires the entrepreneur to make material investments as payment for the service

In order to close an individual entrepreneur, you need to provide only two documents to the tax authority:

- Application on form P26001

- Receipt for payment of state duty in the amount of 160 rubles

The application form and receipt can be downloaded from the tax office website. Recommendations for filling out the application can also be found on the Internet. You can attach a photocopy of your passport to these documents, since some inspections require it.

When do you need to pay?

Insurance premiums are calculated to be paid once a year. They must be transferred by the end of the current year, that is, by December 31. Otherwise, the entrepreneur is free to choose the terms for payment: you can make one payment at any time of the year, or you can make payments in installments, again at intervals convenient for the entrepreneur. Usually, a quarterly mode of making equal shares of insurance premiums is chosen - this way the tax burden will be distributed more evenly.

If an additional contribution to the Pension Fund is provided for an individual entrepreneur (in case of income over 300,000 rubles), then it must be paid before April 1 of the next year. At the same time, the obligatory part must be paid by December 31, and until July 1 you can “delay” with contributions calculated from the amount that exceeded the limit of 300 thousand rubles.

Calculation of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund until 2022

- Amount of contribution to the Pension Fund = minimum wage * 12 * 26%

- Amount of contribution to the Compulsory Medical Insurance Fund = minimum wage * 12 * 5.1%

where the minimum wage (Minimum Wage) from July 1, 2017 is set at 7,800 rubles.

Please note that when calculating the amount of insurance premiums, the minimum wage is used, which was set on January 1 of the current year, despite its changes during the year.

Thus, the amount of fixed insurance premiums in 2022 is equal to 27,990 rubles.

Also, starting from 2014, upon receipt of income in excess of 300,000 rubles per year, the individual entrepreneur is obliged to pay 1% to the Pension Fund of the Russian Federation on the amount exceeding 300,000 rubles. For example, when receiving an income of 400,000 rubles, 1% must be paid on the amount of 400,000 - 300,000 = 100,000 rubles, we get 1,000 rubles.

In this case, the amount of contributions to the pension fund will not exceed (8 * minimum wage * 12 * 26%). In 2022 it is 187,200 rubles, in 2016 - 154,851.84 rubles.

How to pay insurance premiums?

The payment method is chosen by the individual entrepreneur. The easiest way, and this method is the most common, is a transfer from the entrepreneur’s current account by bank transfer. You can deposit these funds from any personal account, not necessarily registered as a settlement account and linked to the activities of an individual entrepreneur. Payment in cash is also possible, just remember to keep the bank receipt to confirm payment of insurance premiums.

IMPORTANT INFORMATION! The budget classification code (BCC) for the transfer of insurance premiums has changed since 2022 - now these payments are subject to the jurisdiction of the Federal Tax Service. Both mandatory fixed payments and a contribution from increased income of more than 300 thousand must be paid to the same BCC.

In what cases do individual entrepreneurs not pay contributions for themselves?

If an entrepreneur has been operating for an incomplete year, the amount of contributions is recalculated in proportion to the number of full months of doing business, and for an incomplete month - in proportion to the number of days of activity (clauses 3, 5 of Article 430 of the Tax Code of the Russian Federation).

In some circumstances, individual entrepreneurs are exempt from paying contributions upon presentation of supporting documents (clause 7 of Article 430 of the Tax Code of the Russian Federation, Decree of the Government of the Russian Federation of October 2, 2014 No. 1015):

- during military service;

- when on parental leave for up to 1.5 years;

- when caring for a disabled child, a disabled person of group 1 or a person over 80 years old, etc.

Individual entrepreneurs who have become NAP payers, i.e., who have received the status of self-employed through the “My Tax” mobile application, also do not pay insurance premiums for themselves.

How NAP is calculated in 2022 - see here.

Amount of insurance premiums: calculate using a calculator

Although contributions are fixed, the amount payable changes annually. Until 2022, it was entirely dependent on the minimum wage established by the state. The object and basis for calculations do not matter.

To calculate the amount of fixed contributions using the calculator, you need to know the following basic initial indicators:

- the minimum wage value established for the reporting year at the legislative level (necessary for calculation only until 2018);

- tariffs for contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund (constant values, required for calculation only until 2022);

- fixed amounts in the Pension Fund and the Federal Compulsory Medical Insurance Fund (for 2018-2020);

- the number of billing months for which it is planned to transfer the contribution (12 in the case of annual payment);

- income for the selected period (in rubles).

The first three indicators do not need to be entered; they are fixed in the calculator. You need to enter the start date of the reporting period and its end, the calculator will take into account the estimated time independently.

Example 1. Calculation of contributions when registering as an individual entrepreneur in 2022

Pimenova A.A. received the status of individual entrepreneur on February 26, 2021, which is confirmed by the Unified State Register of Entrepreneurs and Entrepreneurs. Let's calculate contributions in a fixed amount for 2021:

| Index | OPS | Compulsory medical insurance |

| Amount of individual entrepreneur contributions for the full year 2022, rub. | 32 448 | 8 426 |

| Full months of activity | 10 (March-December 2021) | |

| Number of days of doing business in the month of registration - February | 3 out of 28 days (February 26-28, 2021) | |

| Calculation of payments for full months, rub. | 32 448 / 12 * 10 = 27 040 | 8 426 / 12 * 10 = 7 021,67 |

| Calculation of payments for partial February, rub. | 32 448 / 12 / 28 * 3 = 289,71 | 8 426 / 12 / 28 * 3 = 75,23 |

| Total fixed contributions, rub. | 27 040 + 289,71 = 27 329,71 | 7 021,67 + 75,23 = 7 096,90 |

| 34 426,61 | ||

This amount will be paid by individual entrepreneur A. A. Pimenova until December 31, 2021, if her income for 2022 does not exceed 300 thousand rubles. (Clause 2 of Article 432 of the Tax Code of the Russian Federation).

How to correctly determine the amount of income from which contributions are paid?

In order to correctly enter into the appropriate window of the calculator the key indicator on which the amount of mandatory insurance payments will depend, you need to know exactly what financial results fall under the concept of “income of an individual entrepreneur” and are the basis for this calculation.

If the size of the contribution itself does not depend on the tax system, then this is decisive for determining income.

- Entrepreneurs under the general taxation system must pay contributions on the same income on which they pay personal income tax (not to be confused with the tax base; unlike the amount of income, it is reduced by tax deductions).

- Under the simplified tax system (USN), for calculating contributions, income is taken that is not reduced by the amount of expenses, even if the tax is paid according to the “income minus expenses” scheme.

- When using UTII, income for calculating insurance premiums is considered imputed, which must be calculated according to a specially provided formula, including basic profitability (it is determined by the Tax Code depending on the indicators of the object), multiplied by corrective indicators.

- The patent system takes into account potentially real income established by regional laws, and it is taken as an insurance base.

- When combining several tax systems at the same time, the amounts of income to take into account the amount of insurance premiums are added up.

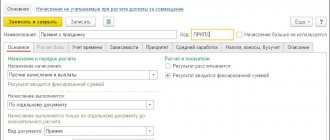

How the calculator works

Since 2022, the calculator for calculations is based on Article 430 of the Tax Code of the Russian Federation and in fact the calculation formula can be written as follows:

Svzn = Rfix / 12 x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Rfix – a fixed amount of a specific insurance contribution (to the Pension Fund of the Russian Federation or to the Federal Compulsory Compulsory Medical Insurance Fund);

- Nmonth – the number of months for which the contribution is paid (after all, the business may not have been started from the beginning of the year or only part of the payment needs to be calculated).

Until 2022, the calculator uses the formula established by Article 14 of Federal Law No. 212-FZ to calculate insurance premiums:

Свзн = minimum wage x Рtar x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Minimum wage – the minimum wage value adopted by the state for the reporting year;

- Rtar – the rate of a specific insurance premium (in the Pension Fund of the Russian Federation - 26% or in the Federal Compulsory Medical Insurance Fund - 5.1%);

- Nmonth – the number of months for which the contribution is paid.

If you need to calculate an additional contribution amount for an individual entrepreneur with more than 300 thousand annual income, then the Pension Fund should receive an additional 1% on the amount exceeding the limit.

Individual entrepreneur contributions for themselves in 2022

Individual entrepreneurs, regardless of the presence of employees, are required to pay insurance contributions to the budget in the amount provided for in Art. 430 Tax Code of the Russian Federation:

When concluding an agreement with the Social Insurance Fund, an individual entrepreneur has the right to voluntarily transfer funds to social insurance.

You will find the KBK 2022 for individual entrepreneur contributions for yourself in the material.