How to conclude an agreement with a pension fund

A self-employed person, like any person, can voluntarily buy additional experience and pension points, and thus earn the right to a pension.

To do this, you need to conclude an agreement on voluntary insurance with the Pension Fund of the Russian Federation - submit an application for voluntary entry into legal relations for compulsory pension insurance (Appendix No. 1 to Order of the Ministry of Labor dated May 31, 2017 No. 462n). This can be done through the My Tax application.

You can also submit an application with documents:

- through your personal account on the Pension Fund website;

- in person to the fund branch;

- by mail.

If a self-employed person decides to personally submit an application to the Pension Fund, then he must contact the local department at his place of residence.

The application must be accompanied by a copy of your passport and information about registration as a tax payer.

A certificate of registration can be ordered in the “My Tax” application in the “Settings” → “Generate a certificate” → “Certificate of registration” section.

If a self-employed person contacts the department in person, the Pension Fund of Russia will issue a notification of registration in the voluntary insurance system immediately. If a self-employed person sent an application electronically, a notification will be sent to his personal account within three working days. If the application was sent by mail, then the notification will be sent in the same way.

How to make contributions to the Pension Fund yourself

In order to enter into voluntary legal relations under pension insurance, you must submit a corresponding application to the Pension Fund.

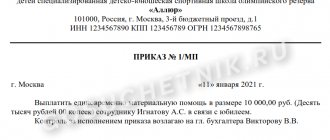

The application form looks like this. You can download it at the end of the article.

Article 29 167-FZ provides for the minimum and maximum amount of voluntary annual payment:

- minimum: the product of two times the minimum wage and the current rate of insurance contribution to the Pension Fund, increased by 12 times;

- maximum: the product of eight times the minimum wage and the current insurance premium rate, increased by 12 times.

Periods of transfer of voluntary payments to the Pension Fund are counted towards the insurance period. Moreover, such periods cannot account for more than half of the length of service required to grant a pension.

Contributions to the Pension Fund: amount in 2022 and payment deadline

The self-employed person calculates and pays contributions to the Pension Fund independently. The minimum size is not specified in the legislation. But if the NPA payer wants to receive a whole year of insurance experience for a full year of activity, then he needs to rely on Art. 430 NK.

To get a full year of experience for 2022, a self-employed person must pay 34,445 rubles.

If the NAP payer pays less than 34,445 rubles in 2022, then the number of months of service will be counted towards him in proportion to the amount paid .

For example, if a self-employed person transfers 10,000 rubles to the Pension Fund for 2022, then he will be credited with approximately 3.5 months of experience.

The maximum contribution is limited to 22% of eight times the minimum wage for 12 months.

That is, the amount of paid pension contributions in 2022 cannot be more than 293,356.80 rubles (8 * 13,890 rubles * 22% * 12 months).

The higher the amount of contributions paid, the larger the amount of contributions to a future pension and the accrued individual coefficient.

It doesn’t matter how much or when to make payments. The main thing is to pay them no later than December 31 of the current year.

That is, a self-employed person can choose how to transfer contributions:

- monthly in equal amounts;

- quarterly;

- once a year;

- in an arbitrary amount and with different payment frequencies.

The amount of contributions depends on the date of registration. That is, if a person registered as a NPA payer on July 1, 2022 and immediately entered into an agreement on voluntary pension insurance, then he can pay 17,222.50 rubles until December 31, 202, and six months when he “worked” as self-employed.

What is voluntary pension insurance

The concept of voluntary pension insurance is not disclosed by current legislation. Only in some regulatory documents (for example, the Tax Code) does the term non-state pension provision (hereinafter also referred to as NPO) appear, which in practice is a synonymous concept.

In simple words, it means entering into a voluntary contractual relationship with a non-state pension fund to form an additional pension to the state pension. After concluding such an agreement, the citizen or his employer has an obligation to make payments within a certain period of time in the amount established by the agreement.

All funds transferred voluntarily will form an additional pension in the future . Also, the specified finances can be moved from one management organization to another or received by the citizen or his heirs.

In addition to NPFs, voluntary pension insurance programs are also offered by insurance companies.

In this case, an insurance contract is concluded, and the insured person or policyholder makes periodic payments towards a future pension. Important! Non-state pensions are not regulated by separate legislation, and the procedure for its formation is determined by the internal rules of the NPF. At the same time, the activities of the fund within the framework of voluntary insurance should not contradict the law.

Do voluntary contributions affect the work of customers with self-employed people?

No, it is entirely up to the performer himself to pay the fees or not. Unlike GPC agreements with ordinary individuals without self-employed status, when the employer is obliged to calculate and pay insurance premiums to the Federal Tax Service (for pension and medical insurance) from the contractor’s income, an agreement with an NAP payer does not require any additional costs.

The customer just needs to transfer the remuneration to the contractor, and further expenses - tax and voluntary contributions - fall on the self-employed person.

The “My Self-Employed” service allows the customer to work with any number of self-employed performers, organizes electronic document management, and transfers payments for completed tasks. Self-employed people do not have to worry about timely receipt of funds, writing checks and paying taxes - the service automatically generates documents, transfers them to the customer and transfers professional income tax in a timely manner.

Who pays voluntary contributions to the Pension Fund?

Persons for whom social insurance payments are not transferred, in order to acquire the right to receive a pension, can independently enter into voluntary legal relations under compulsory pension insurance and personally pay contributions (Article 29 of the Federal Law of December 15, 2001 No. 167-FZ). These include:

- citizens of the Russian Federation working outside the Russian Federation, transferring contributions for themselves;

- individuals making transfers for another person for whom they are not paid by the policyholder;

- paying an insurance premium in a fixed amount, in part exceeding this amount;

- persons temporarily and permanently residing in the territory of the Russian Federation, who are not subject to the OPS;

- individuals who decide to pay additional contributions to form a funded pension.

Why should a self-employed person make pension contributions voluntarily?

In order to receive an old-age insurance pension in the future, a person must have a certain insurance period:

- in 2022 - at least 13 years;

- in 2023 - at least 14 years;

- from 2024 and later - at least 15 years.

In addition, in order to receive an insurance pension, a person must have a certain number of individual points:

- in 2022 - 23.4 points;

- in 2023 - 25.8 points;

- in 2024 - 28.2 points;

- from 2025 and later - 30 points or more.

If a person does not have enough experience or points by retirement age, he will be denied an insurance pension. He will only be able to apply for social insurance, which is smaller than insurance and is assigned only five years after reaching retirement age.

The size of the social pension in 2022 is slightly more than 10 thousand rubles. And with all additional payments it is equal to the living wage for pensioners in the region.

You can calculate the size of your future pension using an online calculator on the Pension Fund website or through State Services.

Compulsory insurance

Valid in all regions of the country, applies to Russian citizens, stateless persons and foreigners living on the territory of the Russian Federation. Regulated by Basic Law No. 167-FZ of December 15, 2001. “On compulsory pension insurance in the Russian Federation” and other regulations. The insurer is the Pension Fund of Russia.

All employers register with the Pension Fund, where they pay monthly insurance premiums for their employees (22%). The composition of pension contributions is divided into insurance (16%) and funded parts (6%). An insurance pension is assigned to the policyholder in order to compensate for lost earnings (upon reaching retirement age, in case of loss of ability to work). A funded pension works on the principle of a bank deposit - money is accumulated in a state fund, which invests the funds in reliable assets. After termination of employment, the policyholder can withdraw the funded portion at a time or in installments.

The size of the labor pension for compulsory pension is affected by:

- Duration of insurance period;

- Salary amount;

- Length of work experience.

In 2014, the State Duma imposed a moratorium on the funded part - money is not accumulated in the accounts of working citizens, but is used to pay pensioners. The moratorium is valid until 2022, but it is possible that mandatory savings will be abolished completely. The Ministry of Finance is preparing proposals for changes to legislation.

An insured event is reaching retirement age (61.5 years for men, 56.5 for women), with an insurance record of at least 12 years, a maximum individual pension coefficient of 21. To receive insurance payments, the insured person submits an application to the Pension Fund of Russia, labor book, insurance certificate (“green card” of the Pension Fund of Russia). The appointment period is from the date of submission of the application, but not earlier than the right to a pension arises (reaching the established age). Payments - monthly (at home, at the post office at your place of residence, to a bank card). The pension can be received by the insured person or a trusted person (by power of attorney).

If a citizen does not have the required work experience or the size of the individual coefficient is not enough to obtain an insurance pension, the state can assign him a social pension (for the loss of a breadwinner, for disability, for old age).

Goals and functions of voluntary insurance

The main goal of voluntary pension insurance is to generate additional income after a citizen stops working due to age. An NGO allows you to have an additional source of monthly income along with government support. Also, this tool allows you to provide a citizen with a more decent financial condition in old age.

One of the functions of NGOs can also be investment of funds, i.e. their investment with the aim of making a profit. Thus, some NGO programs imply not only the possibility of transferring funds accumulated in this way to other funds, but also receiving them for further personal disposal. With the right choice of fund, its investors have the opportunity to accumulate a certain amount, as well as increase it in the case of financially competent activities of the NPF.

This type of insurance also makes it possible for citizens who work in harmful or dangerous jobs to retire before the deadline established by law. Early NPO allows citizens to receive a guaranteed monthly income before becoming eligible for payments from the state, while ceasing their work activities.

Another function is the provision of additional social guarantees to employees by the employer. Thus, a collective agreement between an organization and its employees may provide for the employer’s obligation to additionally insure employees within the framework of NPO. Thus, the employer can interest citizens in entering into labor relations with him, and the employee can receive additional guarantees.