Count 60

This account is used to summarize all transactions between the organization and its suppliers and contractors, such as:

- receipt of materials, goods or work;

- consumption of services, including data on used electricity, gas, water, etc.;

- payment for goods, works, services.

All delivery transactions are displayed regardless of whether payment has been made for them or not.

Attention! Account 60 is active-passive, that is, at the beginning and end of the analyzed time, both debit and credit balances can be displayed.

A more visual form of assessing interaction with suppliers for a period is the preparation of a balance sheet.

What does account credit 60 reflect?

That is, suppose there was a transfer of 60.2-51, then receipt of 60.2-60.1 and 10.1-60.1. And because of this, the amount is double.

I will devote today’s article to one of the most important accounting documents, without which analysis of the company’s economic activities would be extremely difficult.

Passive accounts are needed to reflect the sources of funds. An increase in the objects recorded on them is reflected as a credit, a decrease - as a debit. A classic example of passive accounts is 66 “Settlements for short-term loans and borrowings”, 80 “Authorized capital”, 82 “Reserve capital”. If necessary, other sub-accounts are also opened, for example, 60.03 “Settlements on issued bills of exchange.”

Turnover - balance sheet for settlements with suppliers and contractors

Its formation is one of the key elements that makes it possible to control the document flow at the enterprise for further reporting to the tax authorities

Statement structure

In general, it is represented by the following figure:

Balance sheet for account 60

The first column contains the names of all sellers. The opening balance allows you to see debts and advances transferred previously. The debit balance indicates the transfers of funds made, for which there was no delivery of materials or the documents were not submitted to the accounting department on time; for a loan - the sum of all received inventory items, the purchase of which was not paid for.

During the period, current mutual settlements arise. Similarly to the balance, all payments are included in the debit turnover, and receipts are included in the credit turnover. The length of time for analysis is arbitrarily selected (from operations on one specific day to any arbitrarily chosen interval). The ending balance indicates any unresolved issues with supplies and allows you to clearly track document flow and payments.

Advice! When maintaining accounting in specialized software products, you can consider not only the general type of calculations, but also statements separately for advances paid and purchases.

Filling example

The organization purchased a new computer for 20,000 rubles. Under the terms of the agreement, payment can be made in installments of 5,000 rubles per month. In accounting, these actions are reflected in the following entries:

- Dt10 Kt 60 - 20000 received a computer from the supplier

- D60 Kt51 – 5000 transferred the first payment on the computer

Based on the results of checking mutual settlements, we see that the organization’s debt to the counterparty is 15,000 rubles at the end of the period. It is necessary to track debt data so that selling companies are interested in working with the company.

Errors that occur

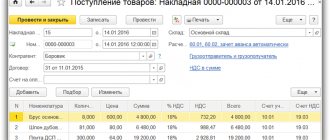

In the era of active development of technology, the manual method of drawing invoices is almost never used, but various software products are widely used, the leaders of which are 1C developments. Accounting registers can be created in them to better analyze the status of all payments and receipts.

The advantage of using the balance sheet in 1C for control is the ability to analyze not only the general statement, but also to consider separately paid advances (60.02) and the resulting debt for received goods, works, services (60.01). In addition, from the statement you can go to account analysis specifically for transactions with a given counterparty and, if questions arise, immediately see the presence or absence of documents.

There are situations when the same amount falls into circulation at 60.01 and 60.02 and does not overlap. This may be due primarily to a violation of the sequence of documents. If re-execution does not change the situation, then you should pay attention to the possible linking of payments and receipts to various contracts or accounts.

How to create a balance sheet for account 60 in 1C can be seen in the video:

What does the debit of account 60 reflect?

The balance sheet for account 60 (hereinafter referred to as OSV) is a summary of data on business transactions that are carried out using this account. The peculiarities of the formation of OSV are related to the fact that the count of 60 is active-passive.

The purchase of all purchased valuables, materials for production and goods for resale creates a connection with counterparties - sellers. When drawing up contracts, it is necessary to take into account the procedure for settlements under executed agreements. Typically, mutual settlements for the transfer of funds can occur in the following order:

- Advance payments for inventory items.

- Postpayment (specifies the period within which funds for the goods must be transferred).

The balance sheet is an accounting register. Turnover accumulates all information on accounts: their balances and turnover for the period.

If the SALT shows the resulting balance for account 62 (debit only or credit only), then the balance will be filled in incorrectly. After all, the debit balance of account 62 is subject to reflection in the “Assets” section, and the credit balance – in the “Liabilities” section.

As can be seen from the example, if you do not make postings between subaccounts, then the balance of account 60 will be overstated in both debit and credit. And this in turn will lead to distortion of balance sheet lines.

The only drawback of the turnover is that it is difficult to read without knowledge of the chart of accounts and accounting entries. Let's try to imagine one day in the life of a company in the form of OCB.

The larger the company, the more entries the accountant creates. Only the purchase of materials can be reflected several times a day. But there are also salary payments, loan payments, equipment purchases, leasing, and so on. If you ask an accountant how much raw materials were purchased, he will not go to look at all the accounting records for Dt10 Kt60, but will immediately open the SALT.

This error must be corrected, since the information affects the reliability of the financial statements (lines 1230, 1520).

The turnover balance sheet shows the balance and turnover of all accounting accounts for the selected period. This is convenient for checking the correctness of the reflection of balances, for analyzing activities as a whole, and for identifying errors in accounting. For example, from the SALT you can see that a credit balance has appeared on the active account, and a debit balance on the passive account.

Analysis of the 62nd accounting account allows you to obtain information about the status of settlements with buyers of goods and other customers for the performance of work and receipt of services. To reflect the data in detail, it is necessary to consider the turnover balance sheet (SAS) for account 62 in the context of each counterparty.

During the period, the following business transactions were recorded:

- Purchase of goods from a supplier 2000 rubles. Dt 41 Kt 60.

- Cashless payment for goods to the supplier is 2000 rubles. Dt 60 Kt 51.

- Issued on account of 400 rubles. Dt 71 Kt 50.

- Wages of 15,000 rubles were transferred to employees. Dt 70 Kt 51.

- Funds from customers in the amount of 7,000 rubles were received into the bank account. Dt 51 Kt 62.

- A short-term loan of 3,000 rubles was received into the current account. Dt 51 Kt 66.

Analysis of the 62nd accounting account allows you to obtain information about the status of settlements with buyers of goods and other customers for the performance of work and receipt of services. To reflect the data in detail, it is necessary to consider the turnover balance sheet (SAS) for account 62 in the context of each counterparty.

During the period, the following business transactions were recorded:

- Purchase of goods from a supplier 2000 rubles. Dt 41 Kt 60.

- Cashless payment for goods to the supplier is 2000 rubles. Dt 60 Kt 51.

- Issued on account of 400 rubles. Dt 71 Kt 50.

- Wages of 15,000 rubles were transferred to employees. Dt 70 Kt 51.

- Funds from customers in the amount of 7,000 rubles were received into the bank account. Dt 51 Kt 62.

- A short-term loan of 3,000 rubles was received into the current account. Dt 51 Kt 66.

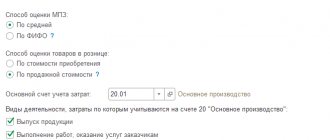

The main thing is to have access to information about overdue debts to sellers, as well as about debts that have not yet matured.\n\n\n\n\n\n\nWhich subaccounts are used\n\n\nIn most cases, they are opened the following subaccounts:\n\n\n\n\t\n- 60.01 “Settlements with sellers (contractors)”. Here they show the posting and payment of inventory items, works, services.\n\n\t\n- 60.02 “Advances”.

Settlements with buyers and customers

Buyers and customers for any organization are the key to receiving revenue. To expand their business and search for potential customers in a highly competitive market, sellers often resort not only to all kinds of discounts and promotions, but also to deferred payments. Here there is a need for daily checking of mutual settlements. All transactions with customers are recorded on account 62.

Attention! Account 62 is also active-passive, that is, at the beginning and end of the selected period of time, both debit and credit balances can be displayed.

What transactions are reflected in account 62 in accounting?

According to the recommended Chart of Accounts, a business entity must use account 62 to record transactions with buyers and customers.

The law establishes that two types of debts must be kept in the account:

- To the company for goods sold, or work and services performed;

- To buyers for advances received from them.

When selling products or performing work, it must be immediately shown in the debit of the account. At the same time, the same amount is indicated on the sales accounts (90, 91) or the gradual execution of work. After receiving payment from the counterparty, it should be reflected on the credit of the account, simultaneously with the debit of the cash settlement accounts.

If the buyer makes payment before actually receiving goods or work, then this receipt is reflected in account 62 as an advance received. Since this amount is accounts payable, it must be recorded in separate accounts. It is not possible to show both debts collapsed.

Also, the buyer may not repay the debt, but issue his own bill. This paper will act as a deferment of payment and a guarantee of further repayment of the debt.

Attention! This kind of payment must be taken into account in account 62, but separately from simple debt. However, if the buyer issues a third party’s bill of exchange as payment, then such a step is already recognized as a financial investment and is subject to accounting on account 58.

Score 62

All settlements with buyers and customers are formed on this account, namely:

- sold products of own production;

- goods sold;

- services provided;

- receiving advances against future deliveries;

- payment from buyers.

For a detailed consideration of settlements with customers, a balance sheet can also be used.

Formation of SALT 62 accounts in 1C

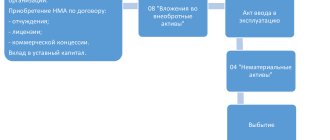

Organization A entered into an agreement with organization B to perform work and transferred it an advance payment in the amount of 12,000 rubles. (including VAT 2,000 rubles) in October. In November, organization B completed the scope of work specified in the contract.

The double entry method was implemented in the middle table "Turnover for the period" The amount of 2.5 million was on the left and the same amount of 2.5 million was on the right.

The balance of liabilities at the beginning is reflected as a loan, an increase in liabilities as a loan, and a decrease in liabilities as a debit.

The organization received an advance payment for its goods worth 10,000 rubles. The company shipped half of it. In accounting, movements under the terms of the contract can be represented by the following entries.

- Dt51 Kt 62 - 10000 advance payment received for future delivery

- D62 Kt 41 – 5000 first batch shipped

Turnover - balance sheet for settlements with customers

Allows you to summarize data for all customers to identify debts. As in settlements with suppliers, the balance sheet of 62 accounts makes it possible to analyze indicators for the period in a cross-section.

Structure

The debit balance at the beginning and end of the period indicates the unfulfilled terms of the agreement, i.e., obligations under the contract to customers were fulfilled, however, payment was not received. The credit balance indicates the presence of unshipped goods. Turnovers that record transactions during the selected time: by debit - shipment, by credit - incoming payments.

Filling example

The organization received an advance payment for its goods worth 10,000 rubles. The company shipped half of it. In accounting, movements under the terms of the contract can be represented by the following entries.

- Dt51 Kt 62 - 10000 advance payment received for future delivery

- D62 Kt 41 – 5000 first batch shipped

From the analysis of the statement, we can conclude that further shipment is necessary to close all obligations.

Video on how to create a balance sheet for account 62.

Example for wiring Dt 60 Kt 76

Let's look at one more situation.

Example 3

Let's take the conditions from example 2, but agree that the goods from the supplier were not received in full. When accepting the goods, LLC "Mag" revealed a shortage in the amount of 24,000 rubles. (including VAT 4,000 rubles) and filed a claim with the supplier.

Dt 60 Kt 76 - a claim was made for a shortage of goods of 24,000 rubles.

Dt 41 Kt 60 - the cost of the accepted goods is reflected as 101,000 rubles.

Dt 19 Kt 60 - reflected input VAT of 16,833.33 rubles.

Dt 51 Kt 76 - a refund was received from the supplier for undelivered goods in the amount of 24,000 rubles.

For information on the procedure for generating a balance sheet for account 60, see the article “Features of the balance sheet for account 60.”

Characteristics

Active - passive 60 account in accounting is used to combine data on transactions with counterparties.

The main characteristics that answer the question of whether the 60 account is active or passive:

- summarizes information about transactions with counterparties;

- summarizes information on transactions with subcontractors under construction contracts;

- the cost of acquired property is reflected according to Dt: 08.10, 20, 41 and Kt60;

- repayment of obligations is reflected according to Dt 60 and Kt 51,52,55;

- analytical accounting is formed in the context of each supplier, contractor and performer.

Count 60 belongs to the active-passive type:

- a debit balance indicates that the partner has not yet fulfilled his obligations to the company. The supplier company has a debt for the supply of goods, works or services;

- the presence of a credit balance indicates that the company has not yet paid the debt to the supplier or contractor.

Advances provided to suppliers for the upcoming supply of materials, raw materials, advances to contractors for upcoming work and services are taken into account.

Analytical accounting for account 60 is maintained for each accrued amount, for each supplier and contractor. The construction of analytical accounting provides the necessary data on:

- suppliers and accepted documents, the payment deadline for which has not yet arrived;

- suppliers who did not pay documents on time;

- to suppliers in case of unpaid deliveries;

- advances to suppliers;

- when issuing bills whose due date has not yet arrived;

- to suppliers for overdue payments;

- when receiving a commercial loan, etc.

Count 60 is active-passive, which characterizes its main feature