What are insurance premiums

Insurance premiums are mandatory payments that organizations and individuals pay for their employees for compulsory social, pension and health insurance. Entrepreneurs also pay contributions for themselves.

There are four types of compulsory insurance:

- Pension;

- In case of temporary disability and maternity;

- Medical;

- From industrial accidents and occupational diseases.

Sometimes beginning businessmen confuse taxes and contributions. Let's clarify: a tax is a mandatory payment from the income of a business or individual in favor of the state or municipalities. And insurance premiums are contributions to the Pension, Social and Health Insurance Funds. The budgets of these funds are formed separately from the federal one - namely from contributions from policyholders, which is why the funds are called extra-budgetary. They provide support to citizens who have suffered an insured event: for example, the Pension Fund assigns a pension upon reaching retirement age, the Social Insurance Fund pays benefits upon pregnancy and the birth of a child.

Insurance premiums differ from personal income tax in that they are paid from the policyholder’s own funds. Whereas the employer withholds personal income tax from payments to his employee.

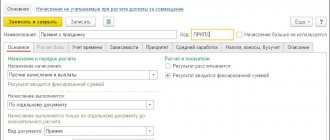

Control of insurance premiums in the register Expenses under the simplified tax system

Entries in the accumulation register Expenses under

the simplified tax system

are formed when posting the main documents recording the accrual and payment of insurance premiums:

- Payroll,

- Sick leave,

- Vacation,

- Reflection of salaries in accounting,

- Debiting from current account.

Manual entry

does not create register entries !

Entries in the Register of Expenses

under the simplified tax system

for the recognition of insurance premiums:

- Status of payment of expenses of the simplified tax system: Not paid;

- Type of movement: + Receipt

– calculation of insurance premiums, - — Expense

– repayment of obligations to the budget.

Reports – Standard – Universal report.

Standard situation

Part of the insurance premiums is recognized as expenses when accrued.

The reason for recognizing insurance premiums along with accrual is the presence of overpayments for this type of insurance premiums.

Overpayment occurs when:

- excessive payment (withholding) of insurance premiums - document Write-off from current account ;

- repaying an obligation in another way - the document Debt Adjustment ;

- when calculating disability benefits at the expense of the Social Insurance Fund - the document Sick Leave

(with a credit system for paying benefits).

Who pays insurance premiums

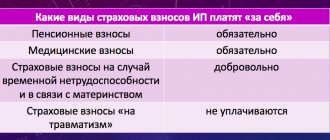

Individual entrepreneurs, lawyers, mediators, arbitration managers, notaries, etc. additionally transfer contributions for themselves in a clearly established amount. Every year, officials review the amount of these contributions.

Individual entrepreneurs, organizations and ordinary individuals who are employers also pay monthly insurance premiums for employees for all types of compulsory social insurance. If an individual entrepreneur transfers contributions as an employer-insurer, this does not exempt him from paying contributions for himself.

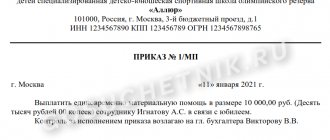

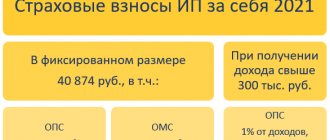

The amount of insurance premiums for individual entrepreneurs for themselves in 2022

In 2022, individual entrepreneurs using the simplified tax system will pay 43,211 rubles in fixed insurance premiums for themselves. Of this, 34,445 rubles are paid for pension insurance. 8,766 rubles are transferred for medical insurance. In 2022, premiums were lower. In total, entrepreneurs paid 40,874 rubles in fixed contributions last year.

Individual entrepreneurs do not have to pay contributions to the Social Insurance Fund, but if an entrepreneur wants to obtain the right to social benefits (sick leave, maternity leave, child care), then he needs to transfer contributions to the Social Insurance Fund voluntarily. The contribution amount is 4,883.72 rubles per year, additionally it must be increased by the regional coefficient, if any.

Additionally, the individual entrepreneur must transfer to the Pension Fund 1% of those income for the year that exceed 300,000 rubles. But the total amount of contributions to the pension fund in 2022 cannot be more than 275,560 rubles per year. The calculation of income depends on the taxation system of the entrepreneur:

- OSNO - income received from entrepreneurial and other professional activities, reduced by professional deductions;

- STS “income” - the income of an entrepreneur, determined according to the rules of Art. 346.15 Tax Code of the Russian Federation;

- The simplified tax system “income minus expenses” is the income of an entrepreneur, determined according to the rules of Art. 346.15 of the Tax Code of the Russian Federation, reduced by expenses calculated according to the rules of Art. 346.16 Tax Code of the Russian Federation;

- PSN - potential income.

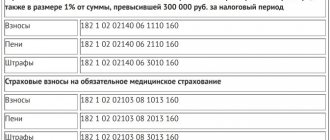

The BCC of the additional contribution to the compulsory pension insurance is the same as for the fixed contribution - 182 1 0210 160.

How to reduce the simplified tax system “Income minus expenses” for contributions

In “Income minus expenses,” contributions are taken into account as regular expenses. The tax becomes less, but only slightly - no comparison with the simplified tax system “Income”. Even the expression “reduction of contribution tax” is usually not used in this case. As an accountant would say: here contributions reduce not the tax, but the taxable base.

For example, IP Kudryavtsev O.R. pays dues only for himself. Let’s assume that in 2022 he earns 1,350,000 rubles and incurs expenses of 489,000 rubles.

The fixed part of contributions in 2022 is 40,874 rubles.

We reduce income for expenses and fixed contributions:

1 350 000 — (489 000 + 40 874) = 820 126

The amount of the entrepreneur's contribution for an amount exceeding 300,000 rubles will be 520,126 x 1% = 5,201.26 rubles.

We reduce income by the variable part of the contribution:

820,126 - 5,201.26 = 814,924.74 rubles.

As a result, individual entrepreneur Kudryavtsev will calculate and pay tax on the amount of 814,924.74 rubles at the end of 2022.