Features of replacing spare parts of fixed assets

The installation of new parts, assemblies, and spare parts on the fixed asset (OS) is carried out to replace failed worn out elements. When replacing spare parts, the OS characteristics remain unchanged, the cost does not increase. The purpose of repair work is to eliminate malfunctions and implement preventive measures to replace worn parts.

Repair work is carried out on our own (self-employed) or with the involvement of contractors (service centers). Regardless of the method of carrying out repairs, the enterprise must develop a document flow.

For each fixed asset, the procedure and frequency of conducting are approved: (click to expand)

- Preventive measures.

- Routine maintenance.

- Medium repair (for vehicles).

- Major renovation.

Control over the condition of the operating system and repairs is carried out by a commission permanently operating at the enterprise. Enterprises that have not approved the list of spare parts to be replaced carry out repairs based on the defective list. The document is used to write off parts and approve a repair plan.

How to write off spare parts

In this case, the document must contain mandatory details that allow it to be recognized as primary. The structure of the act for writing off car spare parts is as follows: Information about the owner Name of the organization, details, legal address Name of the document Registration number, date of preparation Details of the structural unit Write-off of spare parts Data on the types of spare parts to be written off, indicating their numbers according to the nomenclature Quantity and cost of Write-off spare parts Information about the accounts used to record the write-off of spare parts The drawn up act is signed by a representative of the organization or unit-initiator, an employee of the repair shop, the chief accountant and the manager. Purpose of the document Write-off of automobile spare parts assumes that the purchase of new parts will be required. That is, the organization will incur certain expenses.

Attention: Complete a loss-making claim using Form M-11. The document must be signed by the storekeeper and the mechanic of the site, who at the end of the month is obliged to draw up a physical report on the use of materials and a report on the repair of cars. The report indicates which vehicle the spare parts were used for. The document is signed by a commission for writing off materials, appointed by order of the boss. Based on the physical report and the car repair report, include the cost of spare parts transferred to the transport section as expenses for the table of contents of auxiliary production by posting: “Debit account 23 “Auxiliary production”, Loan account 10-5 “Spare parts”. 3. Register worn-out spare parts on the basis of the defective statement and the vehicle repair report.

Purchase and sale of spare parts

After purchasing spare parts, inventory items are received and placed in a warehouse for storage. Receipts are accounted for on the basis of primary documents.

| Documentation | Application procedure |

| Agreement | The form of delivery, purchase and sale is used |

| Waybill | Confirms the shipment of goods and materials |

| Invoice TORG-12 | Used to obtain information about inventory items - nomenclature, quantity, parameters and confirmation of transfer |

| Advance report | Used to document purchases made by an accountable person |

| Payment documents - orders, BSO, receipts, checks, PKO | Confirm the fact of payment for the supply, which is a prerequisite for accounting for costs in enterprises with the cash method of accounting for income and expenses |

The sale of spare parts is carried out as part of normal business or as part of the sale of surplus stock. When selling goods and materials:

- Documents similar to the purchase process are used.

- Enterprises using OSNO or simplified tax system take the cost of acquisition into account as expenses. Sales are made to wholesale or retail customers.

- When organizations sell spare parts on UTII, sales are made only to retail customers.

The sale of spare parts is carried out by enterprises that have declared trade in non-food products as part of their activities.

Accounting for receipt of spare parts for storage: postings

Analytical accounting of spare parts is carried out within the nomenclature (homogeneous groups) at the cost of acquisition. The basis for obtaining credentials is the invoice.

Example of spare parts receipt

Planer LLC has a car on its balance sheet that is used for business purposes. To carry out a medium repair, the purchase of a gearbox is required in the amount of 25,700 rubles, including VAT of 3,920.34 rubles. The following entries are made in the company's accounting:

- The supply of spare parts is reflected: Dt 10/5 Kt 60 in the amount of 21,779.66 rubles;

- The VAT presented by the supplier is taken into account: Dt 19 Kt 60 in the amount of 3,920.34 rubles;

- Payment to the supplier is taken into account: Dt 60 Kt 51 in the amount of 25,700 rubles.

Warehouse accounting is carried out using materials accounting cards No. M-17 in manual or electronic form. A special need for maintaining cards arises when an organization uses an exchange fund of spare parts that are repaired and subsequently installed on the operating system.

Enterprises independently determine the list of accounting documents for inventory items. A number of organizations with small warehouse receipts and issues keep a log of the movement of spare parts. If there is automated accounting, the journal is not used.

Spare parts accounting registers for OS repairs

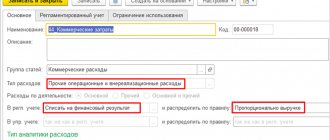

In accounting, the movement of spare parts is reflected in account 10. Sub-accounts are opened to the account to account for new parts (5), failed spare parts (6), materials transferred to the contractor for repairs (7).

In budget accounting, account 09 is used to obtain information about spare parts issued to replace worn-out ones. The organization must approve the list of parts accounted for in the account. The service life of spare parts is less than the service life of the property, which requires accounting for replaced parts that do not change the original cost. When transferring a spare part for repairs on your own or with the help of contractors, the cost is debited from the account and taken into account on the balance sheet.

Accounting for write-off of spare parts for repairs

Write-off of parts is carried out on the basis of form M-11 or a record of the consumption of materials in card No. M-17. Before writing off spare parts, the commission draws up a free-form defective statement.

Using the statement, the following are determined: (click to expand)

- Identification and state of the object.

- Measures necessary to maintain the operating condition of the OS object, including a list of parts to be replaced.

- The amount required to replace parts.

- The reasons that caused the need for repairs.

The document is signed by the commission members and the director. The presence of a statement allows you to confirm the economic feasibility of the repair and separate the purpose of the work from modernization or restoration.

The importance of separating modernization from repair is determined by the taxation procedure. Costs associated with OS repairs are included in current expenses. To carry out planned repairs, a reserve is created at the enterprise. The cost of the reserve is determined separately for low-value and high-value types of repairs. The enterprise must establish an amount above which repairs are defined as costly.

Documenting

If an organization repairs a car on its own, and the repair department is located on its territory, then when writing off spare parts, fill out a demand invoice in form No. M-11. If spare parts are transferred for repair to a department that is located outside the organization’s territory, or to a contractor, then issue a transfer of the invoice for the release of materials to the third party (Form No. M-15). Such rules are provided for in paragraph 100 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and instructions for filling out forms No. M-11 and No. M-15, approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

Situation: is it necessary to draw up a report in form No. OS-3 when replacing spare parts in a car?

If the location of the car does not change when replacing spare parts, then there is no need to draw up a report in form No. OS-3.

This is explained by the fact that drawing up an act in form No. OS-3 is mandatory when accepting and delivering a car from the customer to the contractor (instructions for filling out form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2001 No. 7). If the car is repaired by an employee of the organization (for example, a driver), then the acceptance and transfer of the fixed asset does not occur. In this case, the replacement of the part must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ). To do this, you can draw up an act for replacing spare parts in the car. There is no standard form for such a document, so it can be drawn up in any form.

Advice : to simplify document flow, acts on the replacement of spare parts in a car can be drawn up at the end of the month for each performer of work.

Carrying out repairs with installation of spare parts on vehicles

Replacement of vehicle parts is carried out under warranty or upon expiration of its validity. According to para. 9 tbsp. 346.27 of the Tax Code of the Russian Federation, replacement of parts under warranty does not apply to repair work. Warranty services are paid by the manufacturer and cannot be included in expenses even if there are additional costs.

After the warranty expires, the vehicle is repaired in-house or at a service center. The document flow in both cases is different.

| Operation | Economic method | Third-party organizations |

| Appointment of a commission to oversee repairs | Required | Required |

| Drawing up a defect sheet | Required | Required |

| Purchasing spare parts | The purchase is carried out in-house | Spare parts are purchased by a service center or enterprise |

| Installation certificate | Issued by the enterprise | A two-sided acceptance certificate is drawn up |

| Repair costs | Cost of spare parts, wages for repairmen, taxes on wages | Cost of spare parts and services |

An example of vehicle repair operations

Mimosa LLC, a commercial company, has a Gazelle vehicle on its balance sheet. There is no repair team at the enterprise; replacement of spare parts is carried out by a contractor - a service center. The organization's commission determined the need to replace the battery. The spare part was purchased at retail for the amount of 8,554 rubles; the cost of the work was 3,000 rubles. The following entries are made in the organization's accounting:

- The spare part purchased by the accountable person was capitalized: Dt 10/5 Kt 71 in the amount of 8,554 rubles;

- The transfer of spare parts to the contractor is reflected: Dt 10/7 Kt 10/5 in the amount of 8,554 rubles;

- The spare part was written off on the basis of the work completion certificate: Dt 44 Kt 10/7 in the amount of 8,554 rubles;

- The accounting for the contractor's services is reflected: Dt 44 Kt 60 in the amount of 3,000 rubles.

When carrying out repair work on your own, it is necessary to draw up an act for writing off spare parts. The form of the act is developed by the enterprise independently and approved by internal regulations. The document must be signed by the storekeeper, a representative of the repair team, a commission with approval by the manager.

General aspects

Automotive parts that are unusable should be scrapped. But the essence of the procedure is not so clear.

First of all, there must be confirmation of the validity of the write-off. In addition, there may be situations where spare parts are deregistered but not retired.

For example, if an organization has the necessary parts, they can be used for repairs, which requires them to be written off as a separate object.

If a faulty spare part that is not suitable for restoration is written off, a defective statement is issued. The document is drawn up by a specially created commission with the participation of a mechanic.

Based on the statement, an application for the purchase of a new spare part is submitted. The application must be approved by the chief accountant and the head of the organization.

Next, the necessary spare parts are purchased and taken into account. The purchased spare part, in accordance with the mechanic’s memo, is transferred to replace the faulty part.

After this, the old spare part can be written off. The write-off is documented by a defective statement and an inventory write-off act.

When car repairs are carried out by a third party, spare parts can be written off on the basis of an invoice for the release of materials to the third party in the M-15 form.

In this case, an acceptance certificate is additionally drawn up in a unified form.

When repairing on your own, the transfer of the part is carried out on the basis of a demand invoice, and the act can be drawn up in any form.

What it is

The act is the primary document confirming the fact of the transaction. Thus, the act of writing off car spare parts certifies the fact of writing off certain values from the organization’s accounting records.

Based on the provisions of Federal Law No. 402, the obligation to use unified forms of primary documentation is excluded.

Since 2013, organizations have the right to develop their own forms of documents, guided by standard templates. In this case, the document must contain mandatory details that allow it to be recognized as primary.

The structure of the act for writing off car spare parts is as follows:

| Owner information | Name of organization, details, legal address |

| Title of the document | Registration number, date of compilation |

| Details of the structural unit | Write-off spare parts |

| Data on types of spare parts | Subject to write-off, indicating their numbers according to the nomenclature |

| Quantity and cost | Write-off spare parts |

| Account information | Used to record the write-off of spare parts |

The drawn up act is signed by a representative of the initiating organization or unit, an employee of the repair shop, the chief accountant and the manager.

Purpose of the document

Disposal of automobile parts assumes that new parts will need to be purchased. That is, the organization will incur certain expenses.

The basis for recognizing the actual costs of repairing a vehicle is the contract and other documents drawn up by the participants in the repair process to confirm the work performed.

For example, an act of completion of work, a work order, etc. To provide an economic justification for repair costs, additional documents are required. These become:

- memo from the responsible person about the need for repairs;

- a defective statement certifying the need for repair work or a defective report;

- repair estimate;

- manager's order.

Based on the above documents, a write-off act for car parts is drawn up. Guided by the act, the accountant writes off spare parts from warehouse records if they were stored in the organization as separate objects.

In the case of purchasing the necessary spare parts, the write-off act becomes a justification for the expenses incurred by the organization.

Legal grounds

If the organization has at least one car, then accounting of transactions reflecting the accounting of spare parts is carried out regularly.

In this case, such basic operations are recorded as:

- posting of spare parts;

- movement of spare parts between departments;

- writing off spare parts for repairs.

According to the provisions of the Instruction, ratified by Order of the Ministry of Finance of the Russian Federation No. 157n dated December 1, 2010, any facts of financial and economic activity must be documented in primary documentation.

The forms are unified or contain the mandatory details specified in Part 2 of Article 9 of Federal Law No. 402 of December 6, 2011. When writing off spare parts, the act of writing off spare parts for the car is used.

Since 2013, the use of unified forms is not mandatory. Therefore, an organization can approve an independently developed template.

The prototype can be unified forms, namely an invoice of form M-15 or a demand invoice in form M-11.

These forms are used to display the release of inventory items from the warehouse. But they cannot always accurately reflect the specifics of the process being performed. You can also use the vehicle decommissioning act sample 0504105.

The form was approved by Order of the Ministry of Finance No. 52n dated March 30, 2015 for use when writing off vehicles. Most often it is used in budgetary institutions. You can adapt the form to your specific situation.

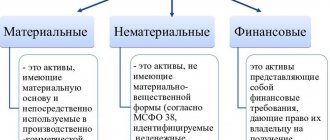

Accounting for spare parts obtained as a result of dismantling

Receipt of spare parts can be made as a result of dismantling the OS. Parts suitable for further use arise when a fixed asset is written off as a result of its becoming inoperative or as a result of replacement with new ones. Parts replaced as part of current or other types of repairs are not written off and must be returned to the warehouse.

Further movement of the spare part requires an assessment by the commission. Materials suitable for further use are subject to repair and storage in a warehouse. Registration is carried out at the market value approved by the commission. Completely failed spare parts are activated and subsequently sold as scrap or disposed of. The form of the act is arbitrary and is drawn up by a commission.

Rules for accounting for inventory items received upon write-off of fixed assets

When preparing accounting records from 2022, the company is obliged to apply FAS 5/2019 “Inventories”, regulated by Order of the Ministry of Finance dated November 15, 2019 No. 180n. In addition, it can be used ahead of schedule.

The main points regarding innovations under this standard are indicated in the information of the Ministry of Finance dated April 10, 2020, No. IS-accounting-27.

For example, the new standard has changed the rules for determining the actual cost of inventories that are received upon disposal of fixed assets or during its ongoing maintenance, repair, and modernization. The costs included in the actual cost of these inventory items are considered to be the least of the following values:

- the cost at which similar inventory items acquired or created by a company are accounted for during the standard operating cycle. In other words, this is the market price;

- the amount of the book value of the written-off fixed assets and the expenses that were incurred during dismantling or disassembling the fixed assets, extracting inventory and materials and bringing them into a condition suitable for use or sale as inventories.

In accordance with the Recommendations of the Accounting Methodological Center No. R-63/2015-KpR, when extracting inventory and materials from the liquidation of a fixed asset, income does not appear in accounting, since:

- there is no new asset entering the company;

- the company has no economic benefit, since the retiring fixed asset was already its asset, and it had already incurred expenses in the previous period to obtain and operate it.

Accordingly, when liquidating a fixed asset, inventory items must be registered at the expense of the book value of the fixed asset at the time it is written off from accounting.

If inventory items remain after the liquidation of a fixed asset, and the company plans to sell them, then they are accepted as long-term assets for sale. Their accounting is regulated by PBU 16/02 “Information on discontinued activities,” which is regulated by Order of the Ministry of Finance dated July 2, 2002 No. 66n.

When an asset is written off, non-current assets available for sale must be valued at the lower of:

- the amount of the book value of the written-off fixed asset and the costs of retrieving inventory and materials and bringing them to a condition that is suitable for sale;

- net sales value - the estimated selling price of inventory items, reduced by the amount of planned expenses that are needed to extract them from the operating system, bring them to readiness for sale and carry it out.

For profit tax purposes, the market value of inventory items is included in non-operating income on the date of filling out the act on write-off of fixed assets (Articles 250, 271 of the Tax Code).

Since the rules for accounting for extracted inventory and materials in accounting and tax accounting differ, this point can cause temporary differences and the need to recognize deferred tax according to PBU 18/02 “Accounting for income tax calculations”, regulated by Order of the Ministry of Finance dated November 19, 2002 No. 114n .

Accounting for spare parts costing over 40,000 rubles

A number of types of equipment have expensive spare parts. Purchasing parts for further replacement of failed ones after they are received into the warehouse. In accounting, there is a limit for property within 40,000 rubles, above which a durable asset is classified as fixed assets.

At the same time, the assignment of a spare part to a fixed asset cannot be made due to the absence of the main condition - independent operation. The spare part is an integral part of the fixed asset and is not used separately to conduct business. When an expensive spare part arrives at the warehouse, accounting is identical to the registration of standard inventory transactions.

How to formalize the liquidation of fixed assets with the posting of materials?

To reflect the liquidation operation of fixed assets with the capitalization of materials, you must do the following:

Calculation of the amount of depreciation before the decision to liquidate the object

To perform the operation “Accrual of depreciation until the decision to liquidate the object” (see the example table), you need to create a document Regular operation with the type of operation “Depreciation and depreciation of fixed assets”. As a result of posting the document, the corresponding postings will be generated.

Creating a document “Routine operation” with the type of operation “Depreciation and depreciation of fixed assets”:

- Call from the menu: Operations - Closing the period - Closing the month.

- Set the depreciation month.

- Before closing routine operations, it is necessary to restore the sequence of document processing. To do this, click on the hyperlink Repost documents for the month and click the Perform operation button.

- As a rule, closing all routine operations is performed in a list using the Perform month closure button, but you can also select separately any of the presented routine operations.

Formation of a printed form of the Statement of Depreciation of Assets:

Call from the menu: Fixed assets and intangible assets - Reports - Fixed assets depreciation statement, then select the month for which the report is generated and click the Generate button.

Write-off of fixed assets.

To perform operations: “Calculation of depreciation for the last month”; “Write-off of the initial cost of the operating system”; “Write-off of depreciation accrued over the entire period”; “Write-off of the residual value of fixed assets (loss)” (see example table) - you need to create a document Write-off of fixed assets. As a result of posting the document, the corresponding postings will be generated.

Creating a document “Write-off of OS”:

- Call from the menu: fixed assets and intangible assets - Disposal of fixed assets - Write-off of fixed assets.

- Create button.

Filling out the document “Write-off of OS”:

- In the From field, enter the date the fixed asset was written off.

- In the Reason for write-off field, select the reason for writing off the fixed asset from the “Reasons for writing off fixed asset” directory.

- In the Asset location field, indicate the department in which the fixed asset is written off.

- In the Write-off account field, indicate the account in which expenses will be accumulated upon disposal of fixed assets.

- In the OS Event field, select an event that occurs with the main tool from the OS Events reference book.

- In the Expense item field, indicate the cost item by which expenses will be taken into account when disposing of fixed assets.

- Click the Add button in the tabular part of the document and select the fixed asset to be written off.

- Click the Burn button.

- To call up a printed form for the Act on write-off of a fixed asset item, you can use the Act on write-off of fixed assets (OS-4) button.

- Click the Submit button.

As a result of the document “Write-off of fixed assets”, entries were generated for depreciation in the month of disposal, the residual value of the fixed asset was charged to expenses in the debit of account 91.02 “Other expenses”.

Accounting for work performed to dismantle fixed assets.

To perform operations: “Accounting for work performed by the contractor during the liquidation of OS”; “Accounting for input VAT on completed work” (see example table) - you need to create a document Receipt of goods and services. As a result of posting the document, the corresponding postings will be generated.

Creating a document “Receipt of goods and services”:

- Call from the menu: Purchases - Purchases - Receipt of goods and services.

- Click the Receipt button.

- Transaction type of the Services document (simple form). Type of operation “Goods, Receipt of goods and services”:

- In the Act No. field, enter the number of the receipt document.

- In the From field, enter the date of the receipt document.

- In the Contractor field, select a supplier from the Contractors directory. For more information on filling out the details of a counterparty, see the article “Filling in the details of a counterparty according to the Unified State Register of Legal Entities”

- In the Contract field, select the contract with the supplier. Attention! In the contract selection window, only those contracts that have the type of contract With a supplier are displayed.

- By clicking the Settlements hyperlink, you can change the accounts of settlements with counterparties and the rules for offsetting the advance.

- In the Invoice for payment field, you can select an invoice for payment to the supplier.

Filling out the tabular part of the document “Receipt of goods and services”:

- Click the Add button.

- In the Nomenclature field, select works (services) (in the “Nomenclature” directory, the name of incoming services should be entered in the “Services” folder).

- In the Accounts field, select the required account and its subaccount.

- Click the Post and Close button to save and post the document.

To perform the operation “VAT on work performed by the contractor is accepted for deduction” (see example table), you need to create the document Invoice received. As a result of this document, the corresponding transactions will be generated.

Attention! Before registering a supplier invoice, you must post the “Receipt of goods and services” document (Post button), otherwise the invoice will not be posted.

Creating the document “Invoice received”:

- To register an invoice received from a supplier, first fill in the Invoice No. and from fields, then click the Register button. In this case, the “Invoice received” document is automatically created, and a hyperlink to the created invoice appears in the form of the basis document.

- Open the document Invoice received for receipt. The document fields will be automatically filled with data from the “Receipt of goods and services” document.

- The Invoice No. and from fields reflect the number and date of the supplier's invoice.

- In the Received field, enter the date the customer actually received the invoice. Initially, the date of registration of the document “Receipt of goods and services” is entered.

- In the Base documents field, the base document is indicated. To enter an invoice based on several receipt documents, you can click on the “Change” hyperlink, click the Add button in the “List of base documents” and select the corresponding documents.

- Select the Reflect VAT deduction in the purchase book check box to reflect the VAT deduction on the invoice in the purchase book. If the checkbox is not checked, then the deduction is reflected in the regulatory document “Creating purchase ledger entries.”

- The Operation type code field is filled in automatically and corresponds to the code of the operation being carried out, which is displayed in column 4 of the log of received and issued invoices. In accordance with Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, goods (works, services) received correspond to a numeric transaction type code 01 - Goods, works, services received.

- Select the Receipt Method by selecting the radio button: On paper or In electronic form.

- Click the Save and Close button to save and post the document.

Material assets were capitalized after the liquidation of a fixed asset.

To perform operations: “Accounting for material assets remaining after the liquidation of fixed assets (ferrous scrap metal)”; “Accounting for material assets remaining after the liquidation of a fixed asset (spare part)” - you need to create a document Receipt of goods. As a result of posting the document, the corresponding postings will be generated.

Creating a document “Receipt of goods”:

- Call from the menu: Warehouse - Inventory - Receipt of goods.

- Click the Create button.

Filling out the header of the document “Receipt of goods”:

- In the From field, enter the date of the document.

- In the Warehouse field, select the warehouse to which materials from the Warehouses directory are sent.

- In the Income Item field, select the item that relates to account 91 “Other income and expenses.”

Filling out the tabular part of the document “Receipt of goods”:

- Click the Add button.

- In the Nomenclature field, select the materials that are received at the warehouse (in the “Nomenclature” directory, the name of incoming inventory items should be entered in the “Materials” folder).

- In the Quantity field, indicate the number of accepted goods and materials.

- In the Price field, indicate the cost of material assets, which is based on market value.

- In the Accounting account field, select the required account on which the materials will be accounted for.

- Click the Post and Close button to save and post the document.

Incorrect actions to record transactions with spare parts

Common mistakes in spare parts accounting

| Operation | Wrong position | Correct position |

| The cost of the fixed asset after replacing the spare part | Increases | The cost of the OS does not increase while the functions remain unchanged |

| Drawing up an installation certificate | Not compiled | Drawing up an act is mandatory to confirm expenses |

| Returning the replaced spare part to the warehouse | Not produced | A part replaced during repair must be returned to the warehouse |

The order of movement of materials follows the same principles, regardless of the size of the enterprise or the number of objects.