How are rights and responsibilities distributed when issuing a bank guarantee?

A bank guarantee is an obligation that a bank or any other credit organization issues as insurance for the fulfillment of contractual (agreement, procurement) conditions (Article 368 of the Civil Code of the Russian Federation). It is provided in both electronic and written form. If the contractor violates a number of conditions, the bank pays the customer organization a documented amount of money.

In relations related to the provision of a guarantee, three participants are involved:

- guarantor (bank) - an entity that, for a certain fee, assumes the obligation to issue a guarantee;

- principal (executor) - a participant who initiates the issuance of a bank guarantee and is a debtor in accordance with the terms of the agreement;

- beneficiary (customer) - a person whose interests are protected by a bank guarantee.

In this case, the beneficiary and the principal are parties to the agreement, as when concluding a government contract. They act strictly in accordance with current civil legislation (Article 420 of the Civil Code of the Russian Federation). Their mutual settlements are made outside the jurisdiction of the relationship established with a third party - the bank that provided the guarantee.

The parties interact taking into account the current bank guarantee agreement - a document defining the legal relationship of all three parties: the guarantor, the beneficiary and the principal. The agreement on the provision of a bank guarantee must indicate that the guarantor bank will pay the guarantee only if the supplier-principal cannot fulfill the obligations established by the government contract to the beneficiary customer. The bank guarantee agreement necessarily stipulates the circumstances due to which situations of payment of bank collateral occur.

Accounts for recording transactions with bank guarantees

Accounting for transactions for the provision of bank guarantees is carried out in accordance with the Regulation of the Bank of Russia dated March 26, 2007 No. 302-P “On the rules of accounting in credit institutions located on the territory of the Russian Federation.”

In the Chart of Accounts for Accounting in Credit Institutions, the following accounts are highlighted to reflect transactions on the provision of bank guarantees:

315хх, 316хх “Other raised funds of credit institutions”, “Other raised funds of non-resident banks” (passive accounts) - are used to account for the coverage transferred by the principal bank to the bank. Accounts are opened in the currency of the listed coverage and for each contract.

324хх “Overdue debt on provided interbank loans, deposits and other placed funds” (active account) - is used to account for overdue debt on provided interbank loans, deposits and other placed funds with the allocation of second-order accounts for borrowers - credit institutions and non-resident banks. Analytical accounting is carried out in the context of borrowers and contracts.

32403 “Reserves for possible losses” (passive account) - used to account for reserves for possible losses on overdue loans, deposits and other placed funds. Analytical accounting is carried out in the context of borrowers and contracts.

42309–42315, 42609–42615 “Other raised funds of individuals”, “Other raised funds of non-resident individuals” (passive accounts) - are used to account for the coverage accepted from the principal - an individual under guarantees issued by the guarantor bank. Accounts are opened in the currency of the coverage received and for each contract.

428хх–440хх “Other raised funds” (passive accounts) - are used to account for the coverage received from the principal, who is not a credit institution, under guarantees issued by the guarantor bank. Accounts are opened in the currency of the coverage received and for each contract.

458xx “Overdue on loans provided and other placed funds” (active account) - used to account for overdue debt on loans provided to customers and other placed funds. For second-order accounts, overdue debt is accounted for by groups of borrowers. Analytical accounting is carried out in the context of borrowers and contracts.

45818 “Reserves for possible losses” (passive account) - used to record reserves for possible losses on overdue loans and other placed funds. Analytical accounting is carried out in the context of borrowers and contracts.

47411 “Obligations to pay interest” (passive account) - used to account for interest accrued on accounts of coverage received. Accounts are opened in the currency of the coverage account and in the context of each agreement.

47423 “Claims for other operations” (active account) - used to record calculations of accrued commissions for issuing bank guarantees. Analytical accounting is carried out in the context of contracts.

47425 “Reserves for possible losses” (passive account) - used to account for reserves created in accordance with regulations of the Bank of Russia for possible losses under contingent credit obligations. Analytical accounting is carried out in the context of borrowers and contracts.

47426 “Bank's obligations to pay interest” (passive account) - used to account for interest accrued on the accounts of the coverage received. Accounts are opened in the currency of the coverage account and in the context of each agreement.

60315 “Amounts paid under provided guarantees and sureties” (active account) - used to record amounts paid by the guarantor bank to the beneficiary under the issued guarantee. Accounts are opened in the currency of payment under the guarantee and in the context of each issued guarantee.

60324 “Provisions for possible losses” - is used to account for reserves for possible losses for amounts paid to the beneficiary under issued guarantees. Accounts are opened in the context of guarantees for which guaranteed payments have been made.

70601 “Income” (passive account), on which personal accounts are opened:

70601 (12301) “Commission received for issuing a guarantee” to account for the commission received from the principal for issuing a guarantee;

70601 (16305) “Income from the restoration of reserves for possible losses”;

70601 (17202) “Income of previous years, identified in the reporting year, from other banking operations and transactions.”

70606 “Expenses” (active account), on which personal accounts are opened:

70606 (214хх) “Interest paid on other borrowed funds”;

70606 (217хх) “Interest paid on other raised funds of individual clients”, which reflects interest paid on accounts of other raised funds, which takes into account the coverage of guarantees issued by the bank;

70606 (25302) “Other operating expenses for contributions to reserves for possible losses.”

91315 “Issued guarantees and sureties” (passive account) - used to record the obligations of a credit institution under issued guarantees. Analytical accounting is carried out in the context of issued guarantees.

91311 “Securities accepted as collateral for placed funds” (passive account) - used to account for securities accepted as collateral under an issued guarantee. Analytical accounting is carried out in the context of each pledge agreement.

91312 “Property accepted as collateral for placed funds” (passive account) - used to account for property (except for securities) accepted as collateral under an issued guarantee. Analytical accounting is carried out in the context of each pledge agreement.

91414 “Received guarantees and guarantees” (active account) - used to account for received guarantees or guarantees for issued guarantees. Analytical accounting is carried out in the context of each guarantee/surety agreement.

91801 “Debt on interbank loans, deposits and other placed funds, written off from reserves for possible losses.”

91802 “Debt on loans and other placed funds provided to clients (except interbank), written off from reserves for possible losses” (active accounts) - used to account for the principal’s debt written off from the reserve for guaranteed payments made by the guarantor bank. Analytical accounting is carried out for each contract.

Documents and grounds for accounting of bank guarantees

Bank guarantee transactions are regulated by civil and banking legislation. In the same regulatory legal acts one can find the answer to the question of whether a bank guarantee is registered.

In the Civil Code, the provisions regulating such a financial obligation are spelled out in Chapter 23 (paragraph 6, Articles 168, 169, 374 - 379, Article 429 of the Civil Code of the Russian Federation). The issuance of a bank guarantee by credit institutions relates to bank operations (clause 8, part 1, article 5 of the Federal Law of December 2, 1990 No. 395-1).

When concluding a supply agreement, it is not allowed to indicate a condition on a bank guarantee if there is no reason to assume that the guarantee obligations will be received from the guarantor under certain conditions (Determination of the RF Armed Forces in case No. 305-ES16-14210 of January 30, 2017). But when it comes to public procurement in accordance with the regulations of the Federal Contract System Law, the provision of a guarantee issued as security for the performance of the contract is mandatory. This is stated in Art. 96 44-FZ. The customer is obliged to include in the procurement documentation, notice of order, invitation to participate in the selection of a supplier in a closed way a requirement to ensure the execution of the contract (Part 1 of Article 96 44-FZ). The exception is the situations defined in Part 2 of Art. 96 44-FZ.

In Part 3 of Art. 96 states that such contract performance security is provided in the form of a bank guarantee. It must meet the requirements established in Art. 45 44-FZ. The supplier has the opportunity to provide a bank guarantee as security for the execution of a government contract and in the form of funds by transferring the required amount to the settlement (personal) account specified by the customer organization. The method of guaranteeing its obligations is determined by the procurement participant himself.

IMPORTANT!

From July 1, 2019, procurement participants will be able to provide a bank guarantee as security for the application.

Normative base

A bank guarantee is an insurance obligation that serves as a guarantor of fulfillment of contractual terms. It can be electronic and written. If one party to the contract violates the terms, the banking institution transfers compensation to the second party. The following participants appear within the BG:

- Guarantee. This is a banking institution that undertakes the corresponding obligation. At the same time, other participants pay him a reward.

- Principal. This is the performer who purchases the guarantee.

- Beneficiary. This is a customer whose rights are protected by a bank guarantee.

Question: Is Art. 269 of the Tax Code of the Russian Federation when taking into account in expenses the remuneration for issuing a bank guarantee (clause 25, clause 1, article 264, clause 15, clause 1, article 265, article 269 of the Tax Code of the Russian Federation)? View answer

The relationship between all these parties is governed by civil and banking regulations. Let's take a closer look at the legislation relating to bank guarantees:

- Chapter 23 of the Civil Code of the Russian Federation (Articles 168, 169, 374-379, Article 429).

- Clause 8 of Part 1 of Article 5 of Federal Law No. 395-1 “On Banks” of December 2, 1990.

The reflection of bank guarantees in accounting depends on the specific obligation for which the guarantor is provided.

How to take into account a bank guarantee for income tax purposes ?

How to reflect receipt and issue from the principal and beneficiary

The reflection of a bank guarantee in accounting is directly dependent on the type of financial obligation for which it was issued. There are a number of situations for which a guarantee is required:

- To ensure compliance with the terms of payment for acquired assets and property (MPS and fixed assets).

- To insure the fulfillment of loans, borrowings and other debt obligations.

- For guaranteeing the return of the advance payment, since many performers stipulate that an advance payment must be provided.

- To ensure the fulfillment of other responsibilities.

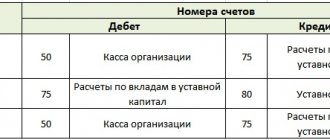

Postings for a bank guarantee in accounting are formed based on a complex system of legal relationships between the principal and the beneficiary. Postings are prepared for legal relations:

- issuance and use of a guarantee;

- entering into an agreement that is not legally binding but is secured by a guarantee.

Accounting for the guarantee by the beneficiary

When the beneficiary has received a bank guarantee, he himself decides how to use it. The customer's choice whether to apply or write off bank collateral depends on whether the supplier principal has fulfilled its obligations.

Settlements between the customer and the supplier are regulated by the contract. The beneficiary receives a separate benefit when providing a bank guarantee, since the guarantor determines its payment obligations to the organization until mutual settlements are fully completed (clause 1 of Article 378 of the Civil Code of the Russian Federation). That is why for accounting purposes they use off-balance sheet account 008 “Securities for obligations and payments received.” The collateral is written off from the balance sheet if the parties fulfill their obligations. Analytics is carried out for each received collateral.

Accounting for guarantees under government contracts

If a bank guarantee is used to ensure the fulfillment of obligations under a government contract, then accounting entries are made in the same way:

- Dt 76 Kt 51 – warranty fee is taken into account;

- Dt 91/2 Kt 76 - the commission is included in other expenses.

If the warranty is long-term (for example, 1 year), then the wiring will look like this:

- Dt 76 Kt – commission paid;

- Dt 97 Kt 76 - the commission is accepted against future expenses.

Every month an accounting entry is made for an amount equal to 1/12 of the commission:

Dt 44 Kt 97 - the amount of the commission attributed to the expenses of the current month is written off.

Example of transactions with a beneficiary: receipt and write-off of a guarantee

For commercial and non-profit organizations, it is necessary to use corresponding postings. Let’s imagine that LLC “Ideal Customer” purchased products from LLC “Ideal Supplier” in the amount of 500,000.00 rubles. The table shows how to reflect the collateral provided by the bank in the beneficiary's accounting records.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 008 | — | 500 000,00 | Accounting for the received guarantee |

| 62 | 90 | 500 000,00 | Delivery of products to the customer |

Let's say the buyer is late in payment, and the supplier contacts the bank with a demand to pay the principal's debt in the amount specified in the guarantee. The accounting entries will be as follows:

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 51 | 76 | 500 000,00 | Receiving funds from the guarantor |

| 76 | 62 | 500 000,00 | Debt offset |

| — | 008 | 500 000,00 | Write-off of payment security from off-balance sheet |

If payment is made on time, the beneficiary does not need to contact the guarantor for debt reimbursement. Accounting records will be generated for the receipt and subsequent write-off of collateral on the 008 off-balance sheet account.

Accounting for the principal

Accounting for guarantees in the principal’s accounting department is based on two positions:

- The bank guarantee should not be taken into account by the principal. The logic is this: the guarantee is intended not for the principal, but for the beneficiary, and is issued by a third party - the bank. That is, the guarantee obligations are obtained for the lender and issued by the lending institution, and not by the principal himself. Therefore, it makes no sense for the principal organization to reflect these obligations on off-balance sheet accounts 008 and 009.

- Warranty obligations must be recorded in accounting.

This is necessary in order to reflect a change in the creditor organization in the event of transfer of obligations to pay the debt to the guarantor. Reflection of collateral in accounting allows for further operations to apply penalties to the debtor.

From an analytical point of view, reflecting the guarantee collateral is necessary, as this makes financial and accounting reporting more transparent and allows you to view the resulting accounts payable of the principal in the context of analytical accounting.

Accounting for bank guarantees for public sector employees

Accounting for bank guarantees in a budgetary institution has its own peculiarities. When conducting competitive and auction procedures for the supply of goods, works or services, the customer organization establishes a mandatory requirement for securing applications. It can be transferred by the procurement participant either by depositing funds into the customer’s current (personal) account or by providing a bank guarantee. Based on clause 351 of Instruction No. 157n, accounting for a bank guarantee received as security for an application is carried out in off-balance sheet account 10 “Security for the fulfillment of an obligation.” The Letter of the Ministry of Finance dated July 27, 2014 No. 02-07-07/31342 states that funds received as security for participation in a competition or closed auction, as well as as security for the execution of a contract, do not need to be taken into account in off-balance sheet account 10.

In a budgetary institution, a bank guarantee is recorded in the accounting department strictly on the day the guarantee liability occurs. The amount must match the value of those obligations whose performance is guaranteed. On the day of termination of the guarantee and financial conditions, the established amount is reduced on account 10 of the off-balance sheet.

Advantages of a bank guarantee

The main advantages of a bank guarantee are:

its relatively low cost, since the amount of remuneration to the guarantor bank for its provision is significantly lower than the amount of any type of debt financing; the ability to effectively resolve the issue of paying obligations without releasing funds from circulation or directly borrowing them from credit institutions.

In addition, the presence of a bank guarantee is an additional incentive to fulfill the obligation under the contract, that is, to supply goods, perform work or provide a service.

Postings for budgetary institutions

Funds received from a credit institution (bank) allocated for execution must be reflected in the accounting of a budgetary institution with the following entries:

| Debit | Credit | Operation description |

| 2.201.11.510 | 2.205.41.660 | Funds received into the personal account of a budgetary institution (payment to the beneficiary of the amount for which the bank guarantee was issued) |

| 2.205.41.560 | 2.401.10.140 | Accrual of income in the amount of security under a bank guarantee in the event of its receipt at the disposal of a budgetary institution |

Accounting in government institutions

A bank guarantee and accounting in the accounting departments of government institutions are carried out differently. When funds are received into a current account, they are accounted for according to KFO 3, since they are received at temporary disposal and are required to be transferred to budget revenues. Accounting entries for transactions depend on the powers delegated to a particular government institution to administer budget funds.

Postings for accounting in a government institution are reflected in the table:

| Operation | Debit | Credit | Notes |

| Funds under the bank guarantee were received in accordance with the established procedure | KIF 3,201 11,510 | GKBK 3 304 01 730 | For PBS, RBS, GRBS and budget revenue administrators |

| Guarantee funds transferred to the budget | GKBK 3 304 01 830 | KIF 3,201 11,610 | |

| Accrued profit from receipt of funds to the budget | KDB 1 209 40 560 | KDB 1 401 10 140 | For budget administrators |

| Calculations by the administrator of budget revenues are reflected | KDB 1 304 04 140 | KDB 1 209 40 660 | For limited administrators only |

| The guarantee amount is credited to the budget | KDB 1 210 02 140 | KDB 1 209 40 660 | Only for administrators with full privileges |

Tax accounting

The guarantee from the bank must be reflected in both the accounting and tax records of the organization. Tax accounting of bank guarantees is carried out in accordance with the norms of the Tax Code of the Russian Federation. The remuneration is taken into account as part of other costs associated with the production and sale of various products, and as other expenses.

The Tax Code of the Russian Federation requires the submission of reports to the Federal Tax Service, including the costs of a bank guarantee during the period of its actual provision, and not according to the timing of payment of monetary amounts under it. In tax accounting, the date of receipt of a bank guarantee is considered the day of signing the agreement (main agreement) on the issuance of guarantee obligations to the client.

Tax accounting of bank guarantees has a number of nuances. The purchase of goods, works and services under a contract is subject to VAT, with the exception of products not subject to value added tax. Operations involving the use of bank guarantees are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation).

After receiving payment of the guarantee for the obligations not fulfilled by the supplier from the guarantor bank, the beneficiary-customer includes it in income in the same way as the payment of the principal would be taken into account without the use of a bank guarantee.

The principal has the right to take into account expenses under the guarantee (commission to the guarantor) for tax accounting purposes either as other expenses or as non-operating expenses. In any of these cases, costs are recognized throughout the entire validity period of the bank guarantee in equal parts (Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/4 dated 01/11/2011).

Accounting for a bank guarantee in 1C 8.3 - step-by-step instructions

Let's look at accounting for a bank guarantee in 1C using an example.

An organization renting office space turned to SBERBANK PJSC for a bank guarantee to ensure payment to the landlord. The rental period is 6 months.

The amount of the guarantor's remuneration is RUB 6,000.

According to the accounting policy, the costs of remuneration of the guarantor are recognized as other (indirect costs).

Transfer of remuneration to the guarantor

Reflect the payment of remuneration to the guarantor in the document Write-off from the current account transaction type Other settlements with the counterparty in the Main section - Bank statements.

Please indicate:

- The recipient is the guarantor;

- Amount - the amount of remuneration to the guarantor;

- Agreement - a document according to which settlements with the guarantor are carried out, Type of agreement - Other .

- Settlement account — 76.09.

Receipts and debits from the current account

Postings according to the document

The document generates transactions:

- Dt 76.09 Kt - transfer of remuneration to the guarantor.

Accounting for the costs of obtaining a bank guarantee

The costs of remuneration to the guarantor for providing a bank guarantee in 1C 8.3 Accounting are reflected in the document Transaction entered manually, transaction type Transaction in the Transactions section - Transactions entered manually.

In our example, costs are associated with remuneration under a bank guarantee to ensure payment of rent for 6 months, so account 97.21 is used.

Recognition of expenses under a bank guarantee

Expenses under a bank guarantee in 1C 8.3 will be recognized monthly during the term of the lease agreement or until a guarantee event occurs.

Run the procedure Closing the month operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings in the accounting of the principal in case of failure to fulfill an obligation

Situations often arise when the principal did not manage to fulfill his obligations under the contract, after which the beneficiary turns to the bank to receive the funds due to him under the contract from the guarantor. The guarantor notifies the principal about this and informs about the termination of the warranty obligations. The principal is obliged to reimburse the bank for the amount that it transferred to the beneficiary.

If the principal needs to recognize the bank’s regressive claim in accounting, then transactions in the event of failure to fulfill obligations are reflected in accounting entries:

| Debit | Credit | Operation description |

| 60 | 76 | Obtaining a guarantor's recourse claim |

| 76 | 51 | Repayment of debt to the bank |

In what cases is the bank guarantee terminated:

- payment to the beneficiary of the amount for which it was issued;

- the end of a certain period for which it was issued (If the guarantee period expires, the beneficiary loses the right to make a claim to the guarantor, and the period is not restored. In this regard, we recommend indicating in the guarantee a period longer than the period for final settlements under the main agreement.);

- due to the beneficiary's waiver of his rights under the guarantee and its return to the guarantor;

- a written statement by the beneficiary to release the guarantor from his obligations.

Paragraph 1 of Article 375 of the Civil Code of the Russian Federation contains a provision on certain obligations of the guarantor that arise upon receipt of a claim made in compliance with the rules of Art. 374 Civil Code. According to paragraph 1 of Article 375 of the Civil Code of the Russian Federation, upon receipt of the beneficiary's demand, the guarantor must immediately notify the principal about this and transfer to him copies of the demand with all documents related to it.

The peculiarity of terminating a bank guarantee, in comparison with the general procedure for terminating obligations, is that the guarantor must immediately notify the principal of the termination of the guarantee. Failure by the guarantor to comply with this requirement may be taken into account when the arbitration court determines the validity of the guarantor’s recourse claims against the principal (Article 379 of the Civil Code of the Russian Federation).

According to Art. 379 of the Civil Code of the Russian Federation, the basis for the emergence of the right to submit recourse claims is not the infliction of harm, but a violation, as a rule, of a contractual obligation secured by a bank guarantee, while the right of recourse claim is based on the agreement of the parties - the guarantor and the principal. Also, the agreement of the parties determines the amount of compensation by way of recourse within the amount paid by the guarantor to the beneficiary.

Accounting for payment of commission for issuing a guarantee

For the guarantor, the issuance of security under the contract is a source of income, therefore, the principal will have to pay a certain commission for the bank to issue the guarantee. Such a commission can be fixed, or calculated as a percentage of the contract amount or by other methods.

In the bank guarantee agreement, the bank has the right to stipulate various conditions for the payment of obligations. For example, an obligation may be established for the principal to make a one-time or evenly distributed payment over the entire period of validity of the guarantee.

Percentage or fixed

If the remuneration for providing a bank guarantee is set as a percentage.

For tax accounting purposes, interest is recognized as any previously declared (established) income, including in the form of a discount, received on a debt obligation of any type, regardless of the method of its execution (Clause 3 of Article 43 of the Tax Code of the Russian Federation).

According to paragraph 1 of Article 269 of the Tax Code of the Russian Federation, under debt obligations for the purposes of Ch. 25 of the Tax Code of the Russian Federation refers to credits, commodity and commercial loans, loans, bank deposits, bank accounts or other borrowings, regardless of the form of their execution. As you can see, bank guarantees are not classified as debt obligations. Bank guarantees are not recognized as debt obligations and are a way to secure obligations (clause 1 of Article 807 of the Civil Code of the Russian Federation, clause 1 of Article 369 of the Civil Code of the Russian Federation). Based on the above, the amount of remuneration for providing a bank guarantee for the purpose of calculating income tax is not an expense in the form of interest on debt obligations and can be taken into account in full without taking into account the provisions of Art. 269 of the Tax Code of the Russian Federation.

The Ministry of Finance of the Russian Federation in paragraph 1 of letter No. 03-03-06/1/7 dated January 16, 2008 expresses the opinion that the commission fee to the bank, established as a percentage of the amount of supplied products, is equal to expenses in the form of interest on debt obligations and is taken into account taking into account the specifics of Article 269 of the Tax Code of the Russian Federation. Taxpayers should choose the method of reflecting in expenses the fee for providing a bank guarantee, set as a percentage, taking into account their willingness to defend their point of view in disputes with the tax authorities.

Bank - non-resident

A bank guarantee can be provided to a Russian organization by a bank that is not a resident of the Russian Federation and does not have its representative office in the Russian Federation. Let's look at some tax features of this situation.

Value added tax

In this case, a Russian organization purchases services from a foreign bank - a non-resident of the Russian Federation. If the buyer of services operates on the territory of the Russian Federation, then the place of sale is the territory of the Russian Federation for the list of services specified in subparagraph 4 of paragraph 1 of Article 148 of the Tax Code of the Russian Federation. Banking services are not mentioned in this list.

The place of sale is the territory of Russia if the activities of the organization that provides services are carried out on the territory of the Russian Federation. Therefore, when attracting a bank guarantee from a non-resident bank of the Russian Federation, the territory of the Russian Federation is not recognized as the place of sale of services and the object of VAT taxation does not arise.

Postings to reflect the commission on a bank guarantee

The procedure for reflecting the commission depends on the moment of acquisition and registration of the acquired property.

If the commission is transferred to the bank before the purchased assets are registered and before the funds are transferred by the principal, then the credit institution’s remuneration is included in the expenses for the acquisition of property - in its cost (clause 6 of PBU 5/01, clause 8 of PBU 6/01 ).

Let's show it with an example. Zarya LLC acquires the building from Aktiv LLC. The cost of the property is 1,500,000.00 rubles. Zarya LLC provides the seller with a guarantee from the bank. The guarantor's commission is 3% of the value of the property - 45,000.00 rubles. The fee must be paid in one lump sum. The commitment is issued for a period of one month. The transaction was completed, all mutual settlements were made on time, no warranty obligations were applied.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 76 | 51 | 45 000,00 | Transfer of commission to the guarantor |

| 08 | 76 | 45 000,00 | The commission amount is included in the cost of construction |

| 08 | 60 | 1 500 000,00 | Reflection of the cost of construction as part of non-current assets |

| 01 | 08 | 1 545 000,00 | Reflection of the cost of construction as part of the principal's fixed assets |

If the guarantee obligations were provided after the value of the property asset was formed, then it is no longer possible to change the amount of the recorded asset by including the amount of remuneration to the guarantor in the initial cost of the property.

If the bank commission, which was paid before the initial cost of the asset was formed, is included in other expenses, this may affect the calculated property tax. In 2020, property tax is calculated according to new rules. All movable property is excluded from the base. This means that when purchasing a property, writing off bank fees for other expenses may lead to a distortion of the tax base.

The accounting entries will be as follows: Dt 91.2 Kt 76 - accounting for the commission to the bank, the amount of which is not included in the initial cost of the purchased object.

Tax purposes

When preparing tax reporting, you should remember that VAT is not charged for transactions involving the use of bank guarantees. The rule does not apply to beneficiaries using SOS.

The possibility of working with VAT is possible if:

The bank's payment to the beneficiary is entered into the "income" section and is calculated on a general basis.

The principal classifies the expenses as other or non-operating expenses.

Which entries take into account the commission for issuing a bank guarantee. Even distribution of expenses

Much depends on the principal’s field of activity. Below is a list of codes:

- Inclusion of the guarantor's remuneration in deferred expenses immediately after the guarantee is issued: Dt 97, Kt 76 (commission amount);

- Part of the amount was written off according to the payment schedule: Dt 91.2 Kt 97 (part of the commission amount, calculated in proportion to the duration of the guarantee period)

Whether the commission is transferred in one payment or evenly split depends on the characteristics of the assets and depends on a number of criteria. The main dynamics of the ratio of income and expenses by reporting periods. You need to focus, first of all, on the characteristics of assets. If these are sequential supplies of raw materials and materials, the “uniform” approach in question is justified.

Features of accounting policies

The remuneration to the guarantor under the loan agreement must be reflected in the accounting policies of the organization. When concluding a loan agreement, one of the conditions of the agreement may be the mandatory execution of guarantee obligations. In such cases, the costs are borne by the borrower himself. The procedure is specified in PBU 15/2008 “Accounting for expenses and borrowings on loans.” The borrower is obliged to consolidate the chosen method in the accounting policy. Remuneration costs can be classified as other expenses (clause 7 of PBU 15/2008) or additional borrowing costs can be recognized evenly as part of other expenses (clause 8). This can only be done during the validity of the loan agreement itself. The correspondence of the accounting accounts will not change depending on the choice of cost distribution method and will be as follows:

| Posts | Operation description | |

| Debit | Credit | |

| 91.2 | 76 | Reflection of full or partial bank commission |

| 76 | 51 | Accounting for the amount of guarantor's remuneration paid |

The write-off methodology can be presented schematically:

Accounting for guarantor remuneration

It should be noted that the accounting of remuneration to the guarantor directly depends on the type of obligation to ensure the fulfillment of which the bank guarantee was issued.

Situation 1: A bank guarantee was received to ensure the fulfillment of obligations to pay for the purchased property.

If the buyer provides a bank guarantee to the seller of the property, then the remuneration to the guarantor is an expense directly related to the acquisition of such property.

According to clause 23 of the Regulations on accounting and financial reporting, the assessment of property acquired for a fee is carried out by summing up the actual costs incurred for its purchase.

The actual costs incurred include, in particular:

- costs of acquiring the property itself,

- interest paid on the commercial loan provided upon acquisition,

- markups (surcharges),

- commissions (cost of services) paid to supply, foreign trade and other organizations,

- customs duties and other payments,

- costs of transportation, storage and delivery carried out by third parties.

In accordance with clause 6 of PBU 5/01 and clause 8 of PBU 6/01, the actual cost of assets includes other costs directly related to the acquisition of inventories and fixed assets.

Thus, the amounts of remuneration to the guarantor are included in the actual cost of the acquired assets if the bank guarantee was issued before these assets were accepted for accounting.

In this case, the following transactions are made:

- Debit of the asset accounting account (01/07/08/10/41, etc.) Credit of account 76 “Settlements with various debtors and creditors” - reflects the amount of remuneration to the guarantor, included in the actual value of the asset.

- Debit of account 76 “Settlements with various debtors and creditors” Credit of account 51 “Settlement accounts” - reflects the payment of remuneration to the guarantor.

If the guarantee is issued after the actual value of the assets has been formed, then the amount of remuneration to the guarantor is taken into account as part of other expenses:

- Debit of account 91.2 “Other expenses” Credit of account 76 “Settlements with various debtors and creditors” - reflects the amount of remuneration to the guarantor, not included in the actual cost of the asset.

Situation 2: A bank guarantee was received to ensure the fulfillment of debt obligations (loans, credits, etc.).

If a bank guarantee is obtained by the borrower in order to obtain borrowed funds, then in accordance with clause 3 of PBU 15/2008, the costs of remuneration to the guarantor are included in other costs directly related to obtaining loans (credits).

Based on clause 7 of PBU 15/2008, borrowing costs are recognized as other expenses.

According to clause 8 of PBU 15/2008, additional borrowing costs can be included evenly as part of other expenses during the term of the loan (loan agreement).

Accordingly, the organization in its accounting policy for accounting purposes must establish a method for accounting for additional borrowing costs:

- Or at a time in the reporting period to which they relate (clause 6 of PBU 15/2008),

- Or evenly throughout the loan term (clause 8 of PBU 15/2008)*.

*Currently, in accordance with clause 65 of the Regulations on accounting and financial reporting, expenses incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type.

However, the costs of remuneration to the guarantor associated with obtaining borrowed funds do not relate to any specific assets, and therefore the organization must provide for this point in its accounting policies (such costs can be reflected as part of other current assets).

The following entries will need to be reflected in the accounting records:

- Debit of account 91.2 “Other expenses” Credit of account 76 “Settlements with various debtors and creditors” - reflects the amount (in whole or in part) of remuneration to the guarantor.

- Debit of account 76 “Settlements with various debtors and creditors” Credit of account 51 “Settlement accounts” - reflects the payment of remuneration to the guarantor.

Situation 3: A bank guarantee was received to ensure the fulfillment of other obligations.

The amounts of remuneration to the guarantor for guarantees related to other obligations (for example, with the conclusion of government contracts and the execution of government orders) are included in:

- expenses for ordinary activities,

- or as part of other expenses,

depending on the type of company's obligations secured by the guarantee.

If a bank guarantee is related to the fulfillment of obligations under an agreement, the receipt of income under which is expected over several reporting periods, the costs of remuneration of the guarantor should be reasonably distributed between reporting periods in accordance with clause 19 of PBU 10/99.

Otherwise, the guarantor's remuneration is taken into account in the reporting period in which the expense was incurred.

In accounting, the guarantor's remuneration is reflected in the following entries:

- Debit of account 91.2 “Other expenses” Credit of account 76 “Settlements with various debtors and creditors” - reflects the amount (in whole or in part) of remuneration to the guarantor.

- Debit of account 76 “Settlements with various debtors and creditors” Credit of account 51 “Settlement accounts” - reflects the payment of remuneration to the guarantor.