Payment of taxes in cash by a legal entity

All taxpayers are required to pay taxes on time and correctly. Our state is interested in this, therefore the legislation provides for various legal mechanisms, thanks to which the taxpayer has the opportunity to fulfill his obligations to the budget.

Legal entities actually have the right to pay taxes in cash. According to paragraph 4 of Art. 58 of the Tax Code of the Russian Federation, payment of taxes is possible both by non-cash method and in cash . In this case, any person can act as a payer (Article 45 of the Tax Code of the Russian Federation), that is, he may not even be legally connected with the legal entity for which the payment is made. But, of course, it is still necessary that there is some kind of connection between the person paying taxes and the organization for which the payment is made. For example, its director or chief accountant can pay taxes for a company. In some cases, taxes may be paid by the company’s debtors and its counterparties. At the same time, payment schemes can be completely different, the main thing is that they do not run counter to current legislation.

Important! An individual must act as a tax payer, and legal entities must make settlements with anyone through their bank account.

Based on the above, legal entities cannot act as tax payers in cash and as an independent subject of legal relations . Even if payment in cash on behalf of a legal entity was possible, this procedure had to be carried out by a person. Accordingly, only an individual can pay taxes in cash (

What happens if an error is made when filling out a payment order?

If an error is made when filling out a payment order, the fine will not be paid. The organization will lose money

- After 20 days, the discount for paying the fine expires. It can be restored if a copy of the decision on the violation did not arrive by mail on time. If a copy arrived, but the organization made a mistake when filling out the payment, the fine will not be paid. As a result, you will have to pay the full amount.

- After 60 days, the deadline for paying the fine expires. The traffic police issues a double fine under Article 20.25 of the Code of Administrative Offenses of the Russian Federation. Such a fine can be canceled only through an appeal to the traffic police or court.

- When the payment deadline expires, the traffic police transfers the fine to the bailiffs. They impose an enforcement fee on the debtor. For legal entities it is 7% of the fine amount, but not less than 10 thousand rubles.

In case of large debts, bailiffs forcibly write off money from the debtor and block his accounts until the debt is paid in full. In addition, they can impose a ban on registration actions, then a car with fines cannot be re-registered to another person or organization.

To avoid risks, you need to check the status of fine payment in the GIS GMP. This is the only way to ensure that the payment has gone through and the organization will not be subject to additional penalties.

Check fines for free

Reasons for paying tax in cash

All legal entities make their payments through their current accounts. But in practice, situations arise when the company cannot pay from the account. These include the following situations:

- The company's current account was blocked for some reason (for example, the bank's license was revoked).

- The deadlines for paying taxes and fees have already arrived, and the company has not yet managed to open a current account (applies to those taxes, the obligation to pay which does not depend on the fact of receiving income, for example, transport tax or UTII).

- Access to the current account has been lost, and taxes need to be paid urgently. Responsible persons of the company, for example, the chief accountant or other persons with access to the current account, may lose access. One of the options is also possible temporary deactivation of the digital signature, as a result of which it was impossible to use the bank account. In addition, the company may experience technical problems such as internet outages.

Important! This list is not exhaustive. The current account may become unavailable to the organization for other reasons. The above are just some of the most common cases.

Another option for paying tax in cash may be forced collection by bailiffs using a writ of execution. In this case, it does not matter to the regulatory authorities exactly how the tax debt will be paid. The legislation provides for various methods of payment and with any assets of the company: money, property (movable or immovable), through accounts receivable.

Repayment of tax debt in enforcement proceedings is a procedure that is carried out in accordance with legislative norms. Thus, paying taxes by a legal entity in cash is possible, and any individual can do this. But this must be done correctly and subject to certain conditions.

Procedure for paying tax by an individual through a bank

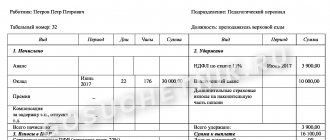

In order to pay tax in cash, you first need to fill out the correct receipt (approved by Regulation 383-P). In this receipt, the legal entity must indicate the following information:

- TIN of the company for which the tax is paid;

- company checkpoint;

- Full name of the individual who pays the tax;

- TIN of the individual, name of the company for which the tax is paid (indicated in the “Purpose of payment”);

- indicate code 101 in “Taxpayer Status”.

Other details (payment amount, period for which the tax is paid, order of payment) are indicated as usual, that is, as if the payment order was filled out by the company through its current account. When paying taxes in cash, this procedure must be followed by the tax authority.

Also, some tax requirements when processing a payment slip filled out by a company for cash payment are also fulfilled by the banks to which orders are sent. Institutions that make tax payments in cash may include branches of the Russian Post and local administrations. You can contact them if there are credit institutions on their territory.

Challenging a fine

If you disagree with the amount of your debt, you can challenge the fine.

Call us at the toll-free number listed in the upper right corner of your notice or letter, or write us a letter stating the reasons why we should reconsider the fine. Sign and return the letter, along with any supporting documents, to the address provided on the notice or letter.

Have the following information on hand when calling or sending an email:

- Notice or letter we sent you

- The fine you want us to review

- For each fine, an explanation of why you think we should cancel it

If you have not received a notification, use the telephone assistance service.

How to pay a fine without an organization's current account

Until recently, it was possible to pay the tax fine only through the company's current account. In this case, it was not even necessary to conclude an agreement with the bank for account servicing. It was possible to pay a fine or penalty for organizing without a current account only in exceptional cases.

Since 2022, there have been some changes in the legislation, thanks to which paying a fine in cash for an organization has become possible. The following persons can pay contributions to the tax office for an organization, even in the absence of a current account: the head of the company, any of the employees, and the company’s counterparties. This innovation allows legal entities to carry out their activities even if they do not have a current account.

The procedure for paying the fine for organizing will be as follows:

- The head of the company (another individual) fills out a receipt for the transfer of funds. In the “Purpose of payment” you should indicate the details of the organization for which the fine or penalty is paid.

- The receipt must be handed over to the bank employee at the bank branch cash desk.

- A bank employee will mark the payment receipt and after a few days you can contact the tax office to check whether this amount was taken into account in the system.

How to pay a fine through the terminal

Another way to pay the fine is at a terminal or ATM. This method has its advantages, for example, you will not need the Internet, you will not need to go to a bank branch and fill out a payment form for a fine. But there is also a minus, and a significant one: a commission is charged for paying through an ATM. Therefore, you will only need to take a plastic card or cash with you, taking into account the fact that you will have to pay more than what is written on the fine receipt.

The procedure is as follows:

- Insert your card and enter your PIN.

- In the menu that appears, find the item “Payment of taxes, duties, traffic police, budget payments.”

- Find and select the type of fine you need.

- Enter the details (this is done on the receipt, and it is better to double-check all the information).

- Manually enter the amount of the administrative fine.

- Check again that the data has been entered correctly and click on the confirmation button.

- Take a receipt that will confirm payment of the fine. Don't lose or throw it away.

The commission will be 2% of the payment amount. For comparison, if you deposit the entire amount of an administrative fine at the bank’s cash desk, the commission will be about 40-50 rubles for each paid receipt. You have the right to choose a more profitable option.

Payment of a fine without a current account upon liquidation of an organization

If a legal entity is being liquidated and its current account has already been closed, then the question may arise of how to pay the fine in this case. After all, a current account can be closed much earlier than the company needs it. At the same time, the tax authority assesses arrears, fines and additional taxes when conducting an audit. Previously, companies were even forced to open new current accounts so that they could pay off their budget in full.

However, changes in legislation make it possible to pay taxes, penalties or fines both on behalf of the manager and on behalf of other persons. That is, now, if a company goes through liquidation, it can pay penalties and fees from an individual. In this case, you will also need to correctly indicate the details of the company for which the funds are paid in the purpose of payment.

Important! A few days after the payment is made, you should contact the bank and find out whether the funds were credited correctly.

How to avoid penalties?

To protect yourself from financial risks, the taxpayer needs to monitor the deadlines for submitting reports and the formats for submitting them to the Federal Tax Service.

In the first case, you can maintain a special payment calendar, with the help of which you will control the timing of tax transfers, as well as the size of the required amounts of money.

In the second case, it is advisable to use modern accounting programs that will be updated in a timely manner in accordance with legal requirements. In such a situation, 1C company software is suitable, which allows you to automatically solve the problem of updating reporting documentation formats.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Answers to common questions

Question: The director of the LLC paid penalties for the company in cash through the bank cash desk. At the same time, an error was made in the “Payment Purpose” on the receipt. What can be done in this case? Will I have to pay the tax again?

Answer: You will not need to pay the tax again, but you will need to write an application to the tax office to clarify the payment. A receipt of payment will need to be attached to this application. In this case, clarification of the payment will be possible if the error did not lead to a complete cancellation of the payment. In this case, the application to the tax office is submitted on behalf of the company, and not from the individual who paid the tax.

Preventing a fine

You can avoid the penalty by filing and paying your tax by the due date. If you are unable to do so, you may be able to apply for a tax filing extension or payment program.

Apply for an extension of the deadline for filing a tax return

If you need more time to prepare your tax return, apply for a return filing extension. This does not entitle you to an extension of payment due date. A payment plan can help you pay over time.

Apply for the payment program

If you can't pay your full taxes or penalty on time, pay what you can now and apply for a payment program. You can reduce future fines by setting up a payment plan.