In order to pay for an employee’s sick leave as required by law, an accountant must take into account many factors, including accurately calculating the employee’s length of service. This calculation itself is not as easy as it might seem at first glance. It, like all other sections of accounting, has its own subtleties.

The easiest way to calculate length of service is to use the length of service calculator for sick leave.

What types of experience exist?

An ignorant person may think that there is only one type of work experience - general. This is wrong. In fact, experience is divided into several types:

- Actually the total work experience . Here it is necessary to count all periods of a person’s work, including under contract agreements and employment contracts. It is calculated based on the contracts in hand and entries in the work book;

- Special experience . Here we consider work that was carried out in special conditions (for example, in hazardous industries, in the north, etc.);

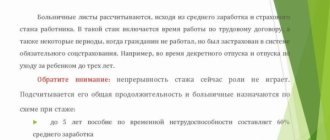

- Continuous experience . The main distinguishing feature of this type of work experience is the total period of work in one or several organizations without interruption. However, since 2007 it is not taken into account when calculating payments for temporary disability;

- Insurance experience . It is this type of experience that is taken to calculate sick leave. It includes all periods of work with mandatory insurance transfers, as well as civil service and military service.

Payment of sick leave in 2022

The benefit is paid for calendar days, that is, for the entire period of incapacity for which the sick leave was issued. There are several exceptions; their full list is contained in paragraph 1 of Article 9 No. 255-FZ of December 29, 2006. The amount of the benefit depends on the employee’s insurance length:

- if the length of service is less than 6 months, the amount of benefit for a full calendar month is equal to the amount of the minimum wage, taking into account regional coefficients established in the region or locality;

- if the length of service is less than 5 years, the benefit amount is 60% of average earnings;

- if the employee’s work experience is from 5 to 8 years, the amount of sick leave is 80% of average earnings;

- if the length of service exceeds 8 years, the amount of sick leave is 100% of average earnings.

If an employee stops working for the organization, but within 30 days after dismissal he becomes unable to work due to injury or illness, he must be paid 60% of his average earnings. For information on the dependence of the amount of benefits on length of service in different cases, see Art. 7 No. 255-FZ dated December 29, 2006.

Calculate your length of service according to your work record book. It includes work under an employment contract; state civil, municipal, military and other service; activities of individual entrepreneurs and other activities during which the person was insured in case of temporary disability or maternity.

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army military service .

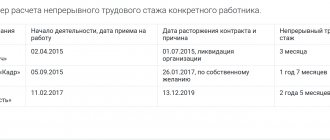

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example , the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following total: 8 years + 1 year 2 months + 1 month 5 days = 9 years 3 months and 5 days.

For your information! There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

Attention! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

How to calculate the insurance period for sick leave

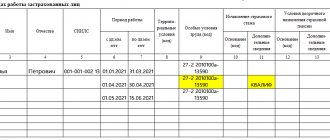

In general, the insurance period for calculating sick leave benefits is determined on the basis of the work book (paper and (or) electronic). But if the data in it is inaccurate, partially missing, or there is no work book at all, other documents should be used to calculate the insurance period. These include:

- written employment contracts;

- certificates issued by employers or relevant state (municipal) bodies;

- extracts from orders;

- personal accounts and payroll statements.

Prepare personnel documents and all personnel reports in a special program Try for free

The insurance experience of individual entrepreneurs and other “private owners” (for periods since January 2003) can be confirmed by a certificate of payment of contributions issued by the territorial branch of the Social Insurance Fund. The insurance period of persons working for citizens (nannies, housekeepers, etc.) is an agreement between the employee and the employer registered with the trade union organization, as well as the employer’s document on the transfer of social insurance payments. All documents confirming the insurance period of certain categories of workers are listed in Section II of the Rules.

ATTENTION . When hiring a new employee, the employer should not require documents confirming the transfer of contributions to the previous place of work. To determine the insurance period, it is enough to have a work book (paper and (or) electronic), employment contracts and other papers listed above.

Amount of payments depending on length of service

By law, the final amount of sick pay directly depends on the employee’s insurance coverage. That is, if:

- If the length of service is less than 5 years, then the employee receives 60% of the income for one working day missed due to illness;

- experience from 5 to 8 years, then the amount already reaches 80%;

- 8 years of experience or more - a person can count on 100% payment.

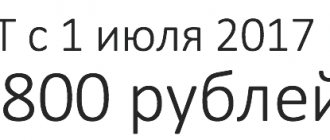

In situations where the length of service is less than six months, payments come from the state budget. The amount for the certificate of incapacity for work is calculated based on the minimum wage (minimum wage) for one month (according to the calendar).

The average daily minimum wage can be calculated using the following formula:

Minimum wage × 24 months / 730 days

Important! If an illness or injury occurs to an employee at the workplace while he is performing his job duties, then sick leave payments will be made to him in the amount of 100%.

Nuance! When calculating payment for sick leave, do not forget that payment for one month cannot be higher than four monthly insurance payments.

Social insurance experience

The periods of payment of social insurance contributions form the main part of the insurance period taken into account when calculating benefits:

- Maternity benefit.

If a woman’s work experience is less than six months, the amount of the monthly benefit cannot be more than the minimum wage (Article 11 of the Federal Law of December 29, 2006 No. 255-FZ), which from 2022 is 12,792 rubles. If the period worked is greater than or equal to one half a year, payments will be calculated based on 100% of average earnings.

Calculate the amount of the benefit in the maternity calculator.

- Temporary disability benefit.

Depending on the length of the insurance period, the amount of benefits is determined:

- up to 5 years of experience - the benefit is determined as 60% of average earnings;

- experience from 5 to 8 years - 80% of average earnings;

- 8 years of experience or more - 100% of average earnings.

When calculating sick leave payments, there is also a limitation of 6 months of insurance experience: less than this period, benefits are accrued in an amount not exceeding the minimum wage.

Calculate the benefit amount using the sick leave calculator.

The procedure for calculating length of service for determining maternity benefits and sick leave is established by Art. 16 of the Federal Law of December 29, 2006 No. 255-FZ and Order of the Ministry of Health and Social Development of Russia of February 6, 2007 No. 91. The period of contribution includes the periods of deduction of contributions, as well as other periods listed in Part I of the Order.

Unlike pension insurance, with social insurance the length of service does not include periods of work under the GPC. There are other discrepancies between these types of insurance experience. For example, social insurance does not take into account periods of official unemployment, unjustified detention, etc.

Self-calculation of sick leave payments

You can calculate sick pay yourself: The algorithm is as follows:

- we summarize earnings for the last two years of work, but only those from which the employer made insurance contributions;

- divide the result by 730 days;

- multiply the number of days spent on sick leave by the result obtained in the second paragraph. This figure will be the amount due on sick leave.

Example:

Ivanov P.S. has 7 years of insurance experience. He was on sick leave for 14 working days. His salary for the last two years totaled: 20,000 rubles x 24 months = 480,000 rubles. Further:

480,000: 730 days = 657.53 rubles (average daily earnings) 657.53 rubles x 14 days = 9205.42 rubles However, P.S. Ivanov’s insurance experience 7 years, which means he is entitled to only 80% of the average daily wage as sick leave. Therefore, in the end he will receive 9,205.42 rubles x 80% = 7,364.33 rubles.

Insurance experience - what is it?

The basis of the insurance period is the periods when contributions to the funds are transferred for the employee. In addition, according to the law, other periods may be included in it.

The procedure for calculating them in the amount of insurance experience for the Pension Fund of the Russian Federation and the Social Insurance Fund differs.

Is the period of study at a higher educational institution in the employee’s insurance record?

The Pension Fund of the Russian Federation takes into account (according to the text of Articles 11, 12 of the Federal Law-400 dated 12/28/13):

- transfer of contributions by the employer for the employee;

- child care up to 1.5 years;

- official status of unemployed;

- caring for a disabled person (group 1 or minor), a person over 80 years old;

- farming and individual entrepreneur status, subject to payment of contributions, etc.

What documents (information) confirm the insurance period for sick leave payment ?

The FSS takes into account (according to the text of Article 16, paragraph 1 of Federal Law-255 dated 12/29/06):

- work under the Labor Code of the Russian Federation for an employer;

- civil service or municipal service;

- other periods when the individual was insured with the Fund.

How to confirm the length of service to assign an insurance pension ?

In addition, the insurance period will include periods of military or other service in accordance with Federal Law-4468-1 dated 12/02/93.

On a note! Labor and insurance experience should not be confused. Work experience is taken into account until the date of 01/01/02 for calculating pensions. It is not taken into account in calculating FSS payments today.

Part-time workers: procedure for paying sick leave

Part-timers are a headache for many accountants. Young specialists in accounting departments do not always know how to pay sick leave for this category of workers. This is not surprising: there are some subtleties here too.

For example, if a person is officially employed at several enterprises at once, when receiving sick leave at the clinic, he should notify the attending physician or registrar about this. In this case, he is entitled to as many sick leaves as the number of companies he works for. However, it is important to make a note about which of their positions is the main one , since this is where he can count on additional material support .

Important! If an employee officially works in different places for more than one year, then each employer is obliged to pay for his sick leave.

How long can sick leave last?

Sometimes extremely unpleasant situations for the employer occur when an employee immediately goes from one sick leave to another. A reasonable question arises: how many people can be on sick leave without violating the Labor Code of the Russian Federation? By law, this period is strictly regulated and is limited to 12 months. However, it should be noted that the attending physician can issue a certificate of incapacity for work only for half a month, a dentist for 10 days, and if the employee is on sick leave for more than 15 days, then its extension is possible only by the decision of a specially convened medical commission.

Important! If an employee’s illness or injury occurs while he is at work and performing work tasks, then the duration of sick leave in this case is not limited by law in any way. Such certificates of incapacity for work are paid 100% by the Social Insurance Fund.

As can be seen from the above information, calculating length of service for paying sick leave has its own nuances. To correctly calculate sick leave, only the employee’s insurance record should be taken into account, since it is he who determines the final amount of payment for temporary disability.

What periods are included in the insurance period?

The insurance period does not include periods of unemployment, but in addition to work under employment contracts, it includes other periods (according to Federal Law No. 400 of December 28, 2013 “On insurance pensions”). An important condition: these periods must be preceded or followed by periods of work. If the periods coincide, then only one of them will be included in the length of service.

- The employee served in the military or served in law enforcement;

- the employee received compulsory social insurance benefits for temporary disability;

- the entrepreneur worked for himself and paid his own fees, the same applies to notaries, lawyers, detectives;

- the person worked as a deputy or clergyman, a member of a collective farm or production cooperative;

- mother or father cared for a child up to 3 years old (but no more than 6 years in total);

- the unemployed received benefits at the labor exchange, participated in paid public works, and traveled to another area for employment in the direction of the labor exchange;

- the employee was unjustifiably prosecuted, suspended from work and placed in custody;

- the convicted person worked in prison and fulfilled his quota; the employee cared for a disabled person of group 1, an elderly person over 80 years old or a disabled child;

- the spouse of a contract serviceman lived in an area where it was impossible to get a job (but not more than 5 years in total);

- for spouses of consuls and employees of diplomatic services and missions abroad - periods of residence in another country, but not more than 5 years.