An order for bonuses is a document issued by the management of an enterprise if it is necessary to reward subordinates. The reason for issuing an order can be a variety of reasons: exceeding the plan and production standards, high labor results, quality of work performed, etc.

An important clarification: bonuses do not at all mean rewarding an outstanding employee or group of employees with monetary amounts only. The bonus can be a written thank you from management, a certificate, or some other type of material incentive.

It is difficult to overestimate the role of bonuses: this form of recognition of employees’ services to the organization is a powerful incentive for their further fruitful and effective work.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Basic rules for placing an order

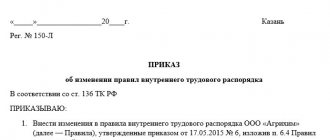

As the current law states, an order for bonuses can be issued in a free form. However, many enterprises and organizations continue to actively use previously approved and generally applicable

- Form T-11 (if one employee is nominated for a bonus)

- or form T-11a (if bonuses are intended to be given to a group of employees).

Both of these forms are quite similar in both structure and content.

The adherence to the “old” forms is quite understandable: they include all the necessary data, including information about the employer and the employees being awarded, information about the reason for the bonus and the award itself, etc.

The order can be issued in two versions: either in writing, by hand, or in printed form. But no matter which one is chosen, it must always contain the original signature of the manager and the signatures of the awarded employees.

A document is drawn up in a single copy , which serves as the basis for further actions in relation to the awarded employees.

After registration, the order must be registered in the internal document register, then transferred first to the accounting department, and then for storage in the company’s archive.

Orders in form T-11 and T-11a

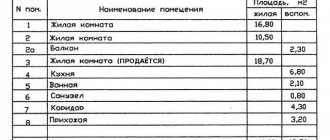

The administrative document is drawn up either according to the standard form T-11, approved by the State Statistics Committee, or in free form. The unified form is currently not mandatory for use; the Organization has the right to develop its own sample. For convenience, standard forms are often used. There are two of them. Form T-11 is used if one employee needs to receive a bonus. This is what it looks like:

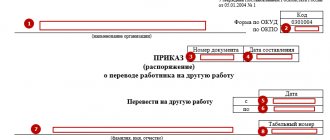

And if several employees are worthy of a bonus, then use the T-11a form. Here is an example of how to reward employees using such an administrative act:

It must be remembered that when issuing a collective order, there is a problem in familiarizing employees with it. Because by getting acquainted with the data about their bonus, they will inevitably gain access to the personal data of other people.

IMPORTANT!

According to Roskomnadzor, the amount of remuneration is personal data (Roskomnadzor letter No. 08KM-3681 dated 02/07/2014). The employer does not have the right to inform a third party without the written consent of the employee himself (Article 88 of the Labor Code of the Russian Federation; Articles 3, 7 of Law No. 152-FZ).

Which exit? If the bonuses are monthly, then in practice they are not familiar with such documents at all. Systems of additional payments and bonuses of an incentive nature are prescribed in collective agreements and labor regulations (Article 135 of the Labor Code of the Russian Federation). An employee is introduced to them when hired (Article 68 of the Labor Code of the Russian Federation). Additionally, it is not necessary to familiarize each time with the administrative act on the payment of bonuses, which is part of the remuneration system.

Such orders are drawn up according to the main activity, and not according to personnel, and the executor (chief accountant) is indicated in them. He is introduced to the document and signed.

Another question is when the rewards are one-time, which do not relate to regular payments. To avoid problems with regulatory authorities, it is preferable to issue personal orders rather than collective ones. But if the team is huge, and it is problematic to issue separate orders for everyone, it is necessary to provide a procedure for familiarizing the LNA with the procedure for transferring personal data of employees.

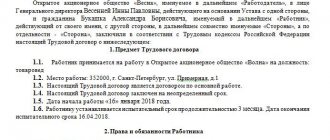

If we talk about an arbitrary type of document, then they compose it according to the following structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, be sure to put a mark on the employee’s familiarization).

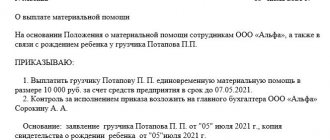

In the main part, they must indicate who exactly is being rewarded. It is necessary to indicate the full last name, first name and patronymic, personnel number, department and position held. Then they clarify what the bonus is for: the wording of the basis for the bonus in the order is of great importance, since the employee has the right to know why he receives the bonus. The wording used is an indication of specific achievements and merits. For example, phrases are often used: “in connection with the anniversary”, “for production successes”, “for professionalism and processing”, etc. The exact amount of the remuneration (if it is supposed to be paid in cash) or the procedure for determining it are indicated. Then the period for which the premium is made is specified.

Sample order to reward employees for good work (in any form):

| Limited Liability Company "Ppt.ru" Order No. 11 St. Petersburg February 10, 2022 About one-time bonus Based on the memo of the deputy director dated 02/08/2022, presentation, bonus regulations, I ORDER: 1. For the implementation of the plan, good work, achievement of high performance indicators at the end of January 2022, pay a one-time cash bonus in the amount of 10,000 (Ten thousand) rubles to lawyer Petr Petrovich Pepetashin. 2. I entrust control over the implementation of this Order to myself. CEO Petrov Petrov P. P. I have read the order: Pepetashin Pepetashin P.P. 10.02.2022 |

Example of filling out order T-11

Standard forms T-11 or T-11a are quite simple and understandable, so they should not cause any difficulties when filling out.

In the first part of document T-11, which was developed for bonuses for one employee, the full name of the company, OKPO code (in accordance with registration papers), as well as the order number for internal document flow and the date of preparation are indicated first.

Then in the form you need to enter the last name, first name, patronymic of the employee, his personnel number (if such records are kept at the enterprise), the name of the position and structural unit (site, workshop, team) in which the applicant for the award works.

In the second part of the order, you must indicate the motive, i.e. the reason for the award, then its type, and if it is a sum of money, then its exact amount (in words and figures).

In the line “ Base ”, a specific document is written on the basis of which the bonus is awarded (its date and number, if one was assigned).

Finally, the order is signed by the head of the organization, dated, and then handed over to the awarded employee for review and signature.

Procedure for filling out an incentive order

The execution of the order begins with reflecting the name of the organization. The data must correspond to the constituent documents of the enterprise. In the example below, this is Forget-Me-Not LLC.

The document number can contain not only numbers, but also letters. The number in the example is 15. This document also indicates the last name, first name and patronymic of the rewarded employee. For us, this is Ivan Fedorovich Smirnov.

Information about the employee's position is displayed next. Then the department in which he works is indicated. If this information is missing, a dash is placed in this line. In our example, the department is the engineering and technical service, the employee’s position is mechanic.

Mandatory and basic information in the reward order is the employee’s motive for rewarding, which is given in the corresponding column. Here it is necessary to reflect the reason for encouraging the employee. How exactly he will be rewarded is indicated in the “Type of reward” column. In our example, the employee is given a bonus. The manager himself decides how to implement the incentive: write out a bonus, award a certificate, express gratitude, give a valuable gift.

See also “Calculation of bonuses to employees in different situations.”

When rewarding with money, the amount of the reward is entered in the appropriate column (amount in words, kopecks in numbers). Then the amount is indicated in numbers in another column. In our example, the remuneration amount was 10,000 rubles.

Next, you need to fill out the “Bases” column, i.e. provide documentary reasons for the award. This could be a long experience of an employee, a petition from the head of a department, etc. In the example, the petition from the head of the engineering and technical service, Vasily Viktorovich Petrov, is indicated as the basis.

The document is signed by the head of the enterprise, as well as by the awarded employee. In addition, a record of the promotion is made in the employee’s card and work book.

NOTE! When paying monthly premiums, an order on this form is not issued. It is intended for one-time incentives only.

Read about the taxation of premiums in the article “Are premiums subject to insurance contributions?” .

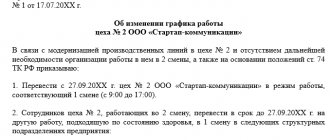

Example of filling out order T-11a

This order form is filled out when a group of employees is expected to receive bonuses.

The first part of form T-11a almost exactly repeats the contents of form T-11 and is also filled out in the same way. The difference is that the full name and department in which a particular employee works is not indicated here, but instead the incentive motive and its type are written.

In the second part of the document, first there is a table in which the full name of each bonused employee, his personnel number, as well as the structural unit to which he belongs are entered in order (it should be noted that employees may belong to different departments of the enterprise). Then the position of the employees and the amount of bonus due to each of them is indicated (the amount of the bonus may vary).

Next, in the line below the basis , with reference to the date and document number, and the signature of the manager is also affixed. After the order is approved by the director, it is handed over to each employee for review, who must put his signature in the appropriate table opposite his last name.

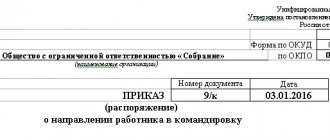

Order on monthly bonuses

Sometimes an employer, when determining the method of remuneration for labor at an enterprise, opts for a salary-bonus system. In this case, a general administrative document is issued in the form of an order to accrue bonuses for the month to all employees, which sets out the conditions for paying bonuses. To determine the grounds and procedure for awarding bonuses to employees, the employer has the right to adopt a separate local regulation. The regulations on bonuses define the grounds: a memo, a report, data on the implementation of the plan, describes the publication of an administrative act and other nuances, right down to the wording of how to write: to reward an employee with a cash bonus or to pay bonuses, etc.

What kind of incentives can there be?

A person's conscientious performance of his job duties may become a reason for the employer to award him incentives (Article 191 of the Labor Code of the Russian Federation). In this case, such incentives can be:

- By degree of regularity:

- regular - appointed with one frequency or another (based on the results of the month, quarter, year);

- irregular - appointed at the discretion of management at one time or another (for example, in the case of successful implementation of a project).

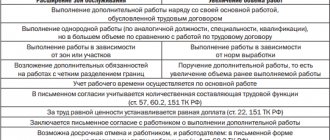

- The nature:

- material (in the form of a bonus, gift);

- moral (in the form of gratitude, certificate of honor).

- According to the degree of connection with the wage system:

- related to the payment system (incentives for production results);

- unrelated (incentives before the holidays).

Drawing up an award order

The form of the order for awarding a diploma of honor is not established by law. Therefore, the document is drawn up in free form. However, it must contain the following mandatory information:

- Full name and position of the awarded employee.

- Reasons for awarding (for example, completion of complex work, conscientious work over a long period of time).

- Documents on the basis of which the procedure is carried out (for example, presentation).

The order may also contain additional information. For example, you can appoint persons responsible for awarding.

Drawing up promotion documentation

The grounds for incentives are collective agreements, labor agreements and internal regulations of the enterprise. This form of remuneration may be provided:

- in labor rules;

- wage regulations;

- a separate award document.

The documentation setting out the rules of the incentive system must contain the following information:

- types of awards;

- conditions, procedure and indicators for issuing the additional amount;

- bonus amounts;

- payment procedure;

- the frequency with which additional payments may occur;

- a list of cases of reduction in the amount of the bonus or its deprivation.

Also see “Deprivation of bonuses for employees: approaches and design.”

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

Results

An order to reward an employee is drawn up in the usual manner, indicating the name of the company, number, date and title of the order, as well as the signature of the manager.

It contains personal data about the employees being encouraged, the reason and type of incentive, and in cases of bonus incentives, it contains an indication of the amount of monetary reward as a percentage of the salary or in a fixed amount.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Regulatory rationale

Article 135 of the Labor Code states that a standard salary includes salary, allowances and additional payments. Bonuses are not mandatory payments. They are calculated on the basis of internal documentation. In any case, bonuses are considered personal income, so they are subject to taxes. For this reason, it is especially important to accompany the issuance of payments with documents:

- The bonus regulations will allow you to establish the amount of payments and the specifics of their calculation.

- An order from the manager must accompany the issuance of each bonus.

The employment contract may contain a provision that the bonus is an integral part of the employee’s salary. In this case, it is necessary to issue a bonus, regardless of the employee’s labor achievements. If the employment contract states that money is paid on the basis of the Bonus Regulations, the issuance of bonuses will depend on labor success and execution of the work plan.

IMPORTANT! If the obligation to pay bonuses (regardless of labor achievements) is stipulated in the employment contract, there is no need to issue an order every month. An order from the manager will be required if payments depend on performance results.