Types of bonuses for employees

There are two types of awards:

- A production bonus is included in the remuneration system and is paid regularly, for example, monthly. The size of the bonus depends on specific indicators and bonus conditions.

- A non-production bonus does not apply to wages. It is paid one-time, regardless of the economic result of the employee’s work.

The conditions for paying bonuses are prescribed in a local act, collective or employment agreement.

Terms of payment for the premium

The conditions under which bonuses can be assigned and paid vary depending on the type of payment. For general incentives, for example, for the founding day of a company, the conditions are significantly different than in the case of a one-time reward for the professional achievements of a specific employee.

The presence of such an item as the payment of one-time bonuses to employees among the company’s expenses directly depends on the interest of the employees themselves. It should be understood that such an action on the part of the employer means encouraging additional efforts by the recipient.

Receiving a one-time bonus is recognition of the value of an employee’s personal contribution to the company’s activities. At a minimum, the value of the employee's efforts must justify the company's expense in paying the incentive.

Otherwise, the payment of bonuses moves from being a way to stimulate employees to new achievements in their work to being unjustified costs.

Regulations on bonus payments to employees

The regulation on bonuses for employees is an act issued by the organization, which spells out everything related to bonuses:

- positions that are entitled to a bonus,

- bonus conditions: indicators, results,

- frequency of payments - monthly, quarterly, annually,

- bonus amount: scale, percentage, fixed amount. The maximum amount of the premium may be specified,

- grounds for reducing the premium. For example, for being late for work.

The Bonus Regulations can also list events upon the occurrence of which the employer will pay bonuses. For example, in connection with the employee reaching the anniversary age of 50, 60, 70 years.

An anniversary bonus is considered a production bonus, although it is not directly related to production.

The logic is this: since the remuneration is written down in the document, it affects the employee’s performance. When hired and during work, he can count on this bonus.

The same applies to bonuses for organization birthdays and professional holidays.

Other important nuances

Before charging a one-time bonus, the employer must take into account some significant features. These include:

- if a bonus is paid upon dismissal of an employee, then personal income tax is charged on it under general conditions;

- if funds are transferred for holidays or other significant events, then they are not related to the professional activities of employees, therefore such expenses cannot reduce the tax base for corporate income tax;

- Unified agricultural tax is not withheld from such remuneration.

Employers can pay one-time remunerations using different taxation systems. It is important to consider whether these payments reduce the tax base.

How to pay a premium

The organization itself determines how to control that the employee fulfills the bonus conditions. This could be, for example, a sales report, a memo, or the amount of revenue for the period.

According to the bonus regulations, when serving from 100 to 150 clients per month, the employee is entitled to a bonus of 5,000 rubles, when serving 151-200 clients - 10,000 rubles, when serving 201 or more clients - 15,000 rubles.

Master Leonova served 130 clients, which means she has the right to receive a bonus of 5,000 rubles. To receive it, Leonova must prepare a sales report and provide the manager with a customer log.

If an organization has several structural divisions, bonus indicators are often controlled by department heads. They also send memos to the manager or other documents justifying the payment of the bonus.

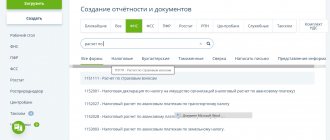

Based on these documents, the employer issues a bonus order. You can use the unified order form No. T-11, or develop your own.

How is the incentive amount calculated?

The specific amount of the one-time bonus is assigned based on the corresponding calculation. Its implementation is necessary because the payment is the employee’s income and is subject to taxation. The issuance of a one-time bonus is reflected in the reporting documentation of the company’s accounting department.

There are two main types of awards:

- fixed amount;

- an amount calculated as a percentage of the salary.

Important! The constant amount of the assigned bonus can be established on the basis of the provisions of one of the documents adopted by the company regulating payments to employees. Such bonuses are part of the company's system for accounting and issuing wages.

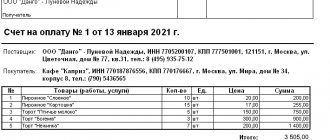

To calculate a premium assigned in a fixed amount of money, you must perform the following simple steps:

- add the fixed amount of the bonus and the employee’s monthly salary (10,000 (bonus) + 15,000 (salary) = 25,000);

- multiply the result obtained and the premium coefficient adopted for the given region (25000 * 0.15% (chelyabinsk region coefficient) = 3750);

- calculate personal income tax. To do this, the result obtained in paragraph 2 must be multiplied by 13% (for persons registered in the Russian Federation) or by 30% (for non-residents) (3750*0.13=488);

- subtract from the result obtained in paragraph 2 the tax calculated in paragraph 3 and the amount of the advance, if it was issued (3750-488 = 3260).

The result of the calculations will be the employee’s salary, taking into account the assigned bonus. (3260)

In the case of calculating a bonus set as a percentage of an employee’s salary, the first step is to calculate how much the percentage of the salary assigned by order will be and add it to his monthly salary. Further calculations are carried out similarly to calculations with a fixed premium amount.

We described in detail how the bonus is calculated and what its maximum size is in a separate article.

Labor Merit Award

An award for special merit or accomplishment of an important task is given to people working in law enforcement or military organizations.

Those working in “civilian” professions may be paid an incentive bonus for their labor merits. For example, for the proposal and implementation of successful sales or production technology.

In addition, as part of the incentive, such people may be nominated for the title of the best in their profession, they may be thanked, given a certificate or a valuable gift.

| An entry on the payment of a bonus as an incentive for labor merit must be made in the work book (clause 24 of the Decree of the Government of the Russian Federation “On work books” dated April 16, 2003 No. 225). |

What do employees' salaries consist of?

Salary may consist of the following parts:

- a fixed salary that covers basic needs;

- monthly bonuses based on key performance indicators;

- bonuses, the level of which depends on additional incentive systems. For example, an employee may receive bonuses for not giving negative feedback.

Financial incentives are often awarded to employees who effectively allocate resources, have extensive experience working in an online store, bring clients, and take part in promoting affiliate and other programs. The main recipients of bonuses are sales managers , because bonuses make up about 50-60% of their monthly income.

Is paying a bonus a right or an obligation of the employer?

Payment of bonuses can be both the right of the employer and his obligation. This depends on the wording in the employment contract and local regulations.

If the documents do not contain conditions for paying bonuses, then the employer will decide whether to give it to the employee or not.

If the employment contract or bonus regulations do not state that the bonus is guaranteed or that it is part of the salary, the employer is not obliged to pay it.

If the employment contract states that wages are salary + bonus, and the documents specify the conditions for payment of the bonus, then its payment becomes the responsibility of the employer. Of course, if the employee fulfills the listed conditions.

An employer who fails to fulfill the obligation to pay bonuses may be held liable under Art. 5.27 Code of Administrative Offences.