The basis of accounting is the primary documents used to document any business transactions. Depending on what the individual entrepreneur does - provides services, performs work or sells goods - he formalizes his relationships with buyers and clients. Also, in most cases, he himself acts as a buyer of goods and services that he uses in his business activities. Relationships with suppliers and contractors must be formalized accordingly. We'll talk about all this in today's material.

Document types

It must be said that there are many different types of primary documents . But first of all, the individual entrepreneur needs to remember the following:

- Agreement.

- An invoice for payment.

- Cash receipt or other payment document (BSO, sales receipt).

- Packing list.

- Certificate of work performed, services provided.

- Invoice.

- Universal transfer document.

It is not at all necessary that an entrepreneur will use all these documents in his work. For example, if an individual entrepreneur provides services to legal entities and other entrepreneurs using the simplified tax system, then he will enter into contracts, issue invoices for payment, and sign certificates of services rendered . But he will not deal with documents such as invoices and cash receipts.

Let's look at each of these documents in more detail.

IP main document

The main document for an entrepreneur in 2022 is the Unified State Register of Entrepreneurs (USRIP), which began to be issued over the last few years. Until 2022, registration of an individual entrepreneur was confirmed by a certificate on stamp paper. All issued certificates retain their legal force to this day.

The form of the Unified State Register of Individual Entrepreneurs record No. R60009 was approved by Order of the Federal Tax Service dated September 12, 2016 No. ММВ-7-14/ [email protected] The document is sent to the registered individual entrepreneur in electronic form. You can print it and use it in your activities. If you wish, upon request you can also obtain from the Federal Tax Service a paper version with the inspection seal.

The first entry sheet, which is issued after registering an individual entrepreneur, contains the following information:

- full name of the entrepreneur;

- registration number – OGRNIP;

- number and date of entry in the register;

- confirmation of the entrepreneur’s tax registration;

- name of the registration authority;

- date of issue of the document, name and signature of the official.

Agreement

An agreement is the first document signed by the parties to a transaction. The agreement in its classic form is drawn up on paper in 2 copies and signed by both parties indicating their details. In the contract, the parties stipulate important points of their cooperation :

- The subject, that is, the thing in relation to which the transaction is concluded. For example, an agreement for the sale of a certain product or for the provision of a service.

- The cost of the subject of the contract and the payment procedure.

- Rights, obligations and responsibilities of the seller and buyer.

- The procedure according to which the parties can make changes to the contract, terminate it and resolve any disagreements that have arisen.

The contract does not necessarily have to be in writing. For example, if an individual entrepreneur is engaged in the retail sale of goods, then he, in fact, enters into an oral agreement with each of his customers. The object of this contract is the offered product, the price is its value on the price tag. If the buyer pays for this product, it means he accepts the proposed conditions. The fact of concluding such an agreement is confirmed by issuing to the buyer a cash receipt or a document replacing it.

One of the forms of agreement is an offer - this is a proposal to conclude a transaction sent to an unlimited number of persons. The offer is most often posted publicly, for example, on a website. The fact of payment is considered acceptance of the terms of the contract - acceptance of the offer.

Contracts that are legally binding

By its legal nature, an agreement is a voluntary expression of will of two or more parties.

There are exceptions when a binding contract is required by law. This requirement is established for participants in a transaction by Article 455 of the Civil Code of the Russian Federation. The document is drawn up in the form of an additional agreement or contract. Article 445 of the Civil Code of the Russian Federation does not establish a specific list; the norm is reference. Here are some examples of binding contracts:

- Agreement on additional payment or reimbursement of insurance premium due to an increase (decrease) in insurance risk - Part 9 of Art. 11 Federal Law dated June 14, 2012 No. 67-FZ.

- Government defense contracts. The mandatory nature of its conclusion is established by Part 6 of Art. 6 of the Federal Law of December 29, 2012 No. 275-FZ.

- The party to the agreement is a participant in a natural monopoly; such entities do not have the right to refuse to conclude a transaction in the event of a consumer request. The requirement is established by clause 1 of Art. 8 of the Federal Law of August 17, 1995 No. 147-FZ.

- Organizations that occupy a leading position in the market (or whose production volume of defense orders exceeds 70%) do not have the right to refuse to conclude a government contract - Part 2 of Art. 110 Federal Law dated 04/05/2013 No. 44-FZ.

- In exceptional cases, the mandatory conclusion of an agreement is established by the government of the Russian Federation - clause 7 of Art. 3 of the Federal Law of December 13, 1994 No. 60-FZ.

The parties have the right to agree on the terms and conditions that they will accept for execution in the future. For this purpose, legal entities and individuals have the right to enter into a preliminary agreement. This situation applies to those when a person is obliged to enter into an agreement arising from preliminary obligations. By virtue of Art. 429 of the Civil Code of the Russian Federation, the form of such an agreement requires compliance with the main one. For example, a preliminary agreement for the purchase and sale of a vehicle is drawn up in writing and does not require state registration or notarization.

An invoice for payment

In fact an invoice for payment is more of a convenience document than a document necessary for accounting. It contains information about the quantity/volume and cost of goods or services to be paid. Typically, an invoice is sent to the buyer - a legal entity or individual entrepreneur - for payment by “non-cash” payment, that is, through a bank.

The invoice form can be developed by the entrepreneur independently. Below is one of the possible forms, which is quite often used by business entities.

Download Invoice for payment

Sample invoice

By the way, there is a document that combines an agreement and an invoice for payment. That's what it's called - an invoice agreement . In essence, this is an account in which the mandatory terms of the contract are entered (they are called essential). A sample of it is presented below.

Download the invoice for the supply of goods

Download the service agreement invoice

Sample invoice agreement

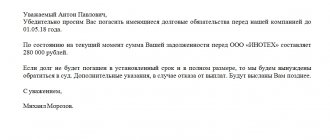

Arbitrage practice

In practice, there are situations in which the parties enter into a preliminary agreement, but subsequently refuse to execute it. When resolving a dispute, the conclusion of an agreement in court is carried out by filing a claim for compulsion. Based on the results of its consideration, the court makes a decision. This provision is established by paragraph 38 of the resolution of the plenum of the Supreme Court of the Russian Federation dated December 25, 2018 No. 49. At the time of consideration of the dispute, the court is obliged to check the agreement underlying the claim for essential conditions. For purchase and sale, such conditions include the item (name, identification data, address, brand, model). In the case of conditions on the subject, the transaction is recognized as not concluded and does not give rise to rights and obligations. At the time of the preliminary meeting, it is established in which cases the conclusion of an agreement is mandatory and whether all conditions are met. The court checks the agreement on the above grounds, even if there is no position of the defendant on this issue (resolution of the Eleventh Arbitration Court of Appeal dated 07/08/2019 No. 11AP-6684/19). Article 445 of the Civil Code of the Russian Federation provides for the possibility of recovering losses caused by ignoring the fulfillment of established conditions. To minimize financial losses, you have the right to provide for penalties. Penalty for the purpose of ensuring the fulfillment of obligations - Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/08/2014 No. 16973/13 in case No. A40-118038/12-105-1100.

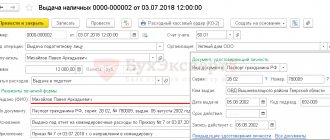

Payment documents

There are several such documents, and the choice is made not at will, but depending on the working conditions.

Important! The only case when an individual entrepreneur should not give anything to the buyer when receiving funds from him is when he receives payment directly to a bank account . In this case, the buyer remains in possession of a document from the bank, which will confirm that he has made the payment.

Typically, legal entities and entrepreneurs pay each other through a bank. But settlements with buyers—individuals—must be supported by business entities with documents. This is necessary when accepting payment in cash, bank cards or electronic means of payment (Qiwi wallets, Yandex.Money and others). The document remains with the buyer and serves as confirmation of payment.

In most cases, an individual entrepreneur is deprived of the right to choose which document to draw up - everything is regulated by law. So, if an entrepreneur uses OSNO or the simplified tax system and trades at retail, then he is required to use a cash register. Accordingly, the buyer must be issued a cash receipt .

As for the provision of services to the population, regardless of the availability of employees and the applied taxation system, you can work without a cash register until July 1, 2022. However, instead of a cash receipt, the buyer must be given a strictly reporting form (SSR). And always, and not just on demand. BSO can be ordered/purchased at a printing house, generated through an automated system, including online through a special service.

Attention! It is impossible to generate BSOs on a regular computer - they will not be valid.

The Tax Code establishes that taxpayers under the patent system may not use online CTT, but instead issue a sales receipt (clause 2.1 of Article 2 of Federal Law No. 54-FZ). However, this benefit does not apply to the following types of activities on a patent:

- hairdressing and beauty services;

- repair and maintenance of household radio-electronic equipment, household

- cars and household appliances, watches, repair and manufacture of metal products;

- maintenance and repair of automobiles and motor vehicles, machines and

- equipment;

- provision of motor transport services;

- veterinary services;

- conducting physical education and sports classes;

- provision of water transportation services;

- management of hunting and hunting;

- engaging in medical or pharmaceutical activities;

- rental services;

- retail trade, catering services;

- production of dairy products;

- commercial and sport fishing and fish farming;

- repair of computers and communication equipment.

In all of the listed cases, the individual entrepreneur is obliged to use online cash register systems for any turnover, even if he has no employees. And any retail trade is included in this list. As the Ministry of Finance explained last year, an individual entrepreneur on a PSN is required to use a cash register, even if retail trade is not its main, but an additional activity (letter of the Ministry of Finance of the Russian Federation dated August 20, 2019 No. 03-01-15/63724). However, the law on cash registers lists situations when a cash register is not needed for trading in any case:

- trade in retail markets, fairs, exhibition complexes, as well as in other territories designated for trade, with the exception of shops, pavilions, kiosks, tents, auto shops, auto shops, vans, and container-type premises located in these places of trade;

- peddling trade in food and non-food products by hand, from hand carts, baskets and other special devices for display, ease of carrying and selling goods, including in passenger train cars and on board aircraft;

- trade in ice cream kiosks, as well as trade in bottling soft drinks, milk and drinking water;

- trade from tank trucks in kvass, milk, vegetable oil, live fish, kerosene, seasonal trade in vegetables, including potatoes, fruits and melons

- activities in remote and hard-to-reach areas;

- settlements with the agent.

These are exempt activities.

Finally, paragraph 2 of Article 2 of Federal Law 54-FZ lists the types of activities for which an online cash register for individual entrepreneurs is also not required. Here they are:

- trade in paper newspapers and magazines;

- sale of related products at newsstands and magazine kiosks, while the sale of newspapers and magazines must account for at least 50% of turnover (the range of related products is approved by the executive authority of the constituent entity of the Russian Federation);

- sale of securities;

- providing meals to students and employees of general education organizations during classes;

- trade in retail markets, fairs, exhibition complexes, as well as in other areas designated for trade.

Attention! Exceptions are shops, pavilions, kiosks, tents, auto shops, auto shops, etc. objects that ensure the display and safety of goods, as well as open counters inside the market when selling non-food products.

- peddling trade (with the exception of the sale of technically complex goods and food products that require certain conditions of storage and sale, goods subject to labeling) from hand, from hand carts, baskets, etc.;

- trade in ice cream kiosks, bottling sales of soft drinks, milk and drinking water;

- trade from tank trucks in kvass, milk, vegetable oil, live fish, kerosene;

- seasonal trade in vegetables, fruits and melons;

- acceptance of glassware and waste materials from the population (with the exception of scrap metal, precious metals and precious stones);

- shoe repair and painting;

- production and repair of metal haberdashery and keys;

- supervision and care of children, the sick, the elderly and disabled;

- sale of folk arts and crafts (if the individual entrepreneur makes them himself);

- plowing gardens;

- sawing firewood;

- porter services at railway, bus, air stations, airports, sea and river ports;

- leasing residential premises (including parking spaces) to individual entrepreneurs located in apartment buildings owned by him;

- retail sale of shoe covers.

If an individual entrepreneur uses machines that do not operate on the network and accept only coins to sell goods (these can be seen installed in stores that sell chewing gum, balls, small toys), then he can also do without an online cash register. In other cases, it is mandatory to use cash register equipment.

Why do you need to check a counterparty and how to conduct it?

Verifying a counterparty is an exercise of due diligence.

Due diligence is a necessary part of any business. And the choice of a counterparty is based precisely on due diligence. Why are its manifestations required by regulatory authorities, including the tax inspectorate? Any LLC or JSC is a commercial organization whose goal is to make a profit. Therefore, the Federal Tax Service believes that a commercial company created for the sake of making a profit, and not as a cover for various “gray schemes”, “money laundering”, etc., a priori tries to be prudent, tries to predict possible risks and checks the counterparty. That is, checking the counterparty from the point of view of the Federal Tax Service is the correct behavior.

Incorrect behavior (including lack of verification of counterparties) can lead to the following adverse consequences:

- violation or failure to fulfill contractual obligations on the part of the counterparty;

- impossibility of real compensation for losses;

- increasing the risk of conducting an on-site inspection;

- increased risk of additional taxes if an unscrupulous counterparty does not provide counter documents (for example, an invoice from the seller, a report from an agent, etc.)

One of the ways to check the reliability of a counterparty is to request certain documents from him. The Federal Tax Service took care of the business and explained in detail exactly what documents were needed.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Important! What documents are needed can be established on the basis of letters from the Federal Tax Service (dated November 30, 2012 No. ED-4-3/ [email protected] , dated January 23, 2013 No. AS-4-2/ [email protected] , dated June 24, 2016 No. ED-19-15/104, dated March 23, 2017 No. ED-5-9/ [email protected] ), judicial practice and business customs.

In the Consultant Plus system you can find a ready-made solution for verifying a counterparty, based on these sources - its compliance will provide evidence of integrity.

They are presented in the form of duly certified copies. Next, we will consider such lists of documents in more detail, depending on the status of the counterparty.

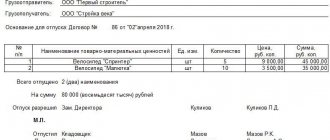

Packing list

Invoice is a document that the supplier issues to the buyer when shipping goods .

An invoice is used if an individual entrepreneur sells goods to another entrepreneur or legal entity. When selling to ordinary individuals (not individual entrepreneurs), this document is not issued. A consignment note is drawn up in 2 copies:

- one for the supplier as confirmation of the fact of shipment of the goods ;

- another for the buyer - through it he will receive this product.

Most often, the consignment note is drawn up in the form TORG-12, or its own developed unified form.

Download the Invoice in the form TORG-12

Sample invoice TORG-12

Acceptance certificate

An act of provision of services or completed work is a document that the customer and the contractor sign based on the results of the provision of services or completion of work .

Acceptance certificates are important primary documents. They confirm the fact that the service was performed (the work was completed), as well as the fact that the customer accepted them and has no claims against the contractor.

The act is drawn up in two copies and signed by both parties. If the cooperation is long-term and services are provided frequently, the act can be drawn up periodically. For example, the contract is concluded for a year, the service is provided once a week - in this case, the act can be drawn up once a month.

Download the Acceptance Certificate for work performed or services provided

Sample Certificate of completed work

Types of contracts

An individual entrepreneur has the right to enter into the following types of transactions (the list is not complete, the most common types are listed):

- lease (the lessor transfers property to the lessee for a certain period for a fee);

- contract (the contractor undertakes to perform the work, and the customer undertakes to accept and pay for it);

- agency agreement (to represent the interests of the client);

- provision of services (the contractor is obliged to provide the services described in the agreement, and the customer is obliged to accept and pay for them);

- delivery (the supplier undertakes to transfer the goods, and the buyer – to accept and pay for it).

Invoice

An invoice is an important document for VAT payers. This tax is paid by individual entrepreneurs (and companies) that apply the main tax regime. When applying UTII (the regime was canceled from 01/01/2021), the simplified tax system, the unified agricultural tax (until 2022) and the patent system, VAT is not paid (although there are exceptions to this rule). Therefore, if an individual entrepreneur uses one of the special modes, he should not generate an invoice. Moreover, if, at the buyer’s request, he issues an invoice and allocates the amount of VAT in it, he will be obliged to pay this tax to the budget and file a declaration .

Individual entrepreneurs - VAT payers are required to issue an invoice. This must be done no later than 5 days after shipment of the goods. The document is drawn up in 2 copies - one each for the buyer and the seller.

If an individual entrepreneur is a VAT payer, it is also important for him to receive invoices from his suppliers in a timely manner, since this document is the basis for his application of VAT deduction .

Download Invoice

Sample Invoice

conclusions

So, let us repeat once again what documents the individual entrepreneur receives after successful registration:

- USRIP record sheet in electronic form (if desired, you can also request a paper document);

- certificate of assignment of TIN, if it has not been received previously;

- a document confirming the transition to a preferential tax system, if the individual entrepreneur has made such a choice;

- notification of registration with the Pension Fund of the Russian Federation, as well as with the Social Insurance Fund (only employers are required to register with the Social Insurance Fund);

- statistics codes.

Well, if registration of an individual entrepreneur is refused, then the applicant will receive a decision on refusal from the tax authority indicating the reasons. If they are eliminated, you can contact the Federal Tax Service again. An exception is a ban on engaging in entrepreneurial activity or the bankruptcy of an individual entrepreneur that has already taken place. In this case, resubmission of registration documents is not possible.

Universal transfer document

UTD (universal transfer document) is a relatively new primary document that combines the functionality of an invoice and a delivery note/act. It will help significantly reduce paperwork. Individual entrepreneurs and legal entities have the right to apply the UTD in all tax regimes.

Based on the UPD, you will be able to conduct accounting, write off income tax expenses and claim a tax deduction for VAT. The logic of combining functions is that correctly filled out primary accounting documents are required, in addition to accounting, also for tax accounting.

You can use the new document to complete various operations:

- provision of services

- shipment of goods (including and not including transportation)

- shipment of goods (works, services) by the commission agent (agent) to the principal (principal)

- delivery of finished work results

- transfer of property rights, etc.

A universal transfer document can be used both as a primary accounting document and as a combined document (primary document and invoice).

Download UPD - universal transfer document

Sample Universal Transfer Document

UPD was developed to simplify the execution of transactions for the sale of goods, services and works: instead of two papers, one remains. UPD is recognized as the basis for tax charges and deductions , as well as confirmation of the seller’s income and the buyer’s expenses. Tax authorities check the document according to the same parameters as traditional forms of accounting documents. Don't worry about tax risks: they will not appear if you fill out the UPD correctly.

What to write in the contract

The usual wording in the head of the agreement looks like this: “... represented by _____________, acting on the basis of _________________...”.

Organizations here indicate the full name of the manager, and a document confirming his powers may be a charter, a decision/minutes of a general meeting, or an order to assume the powers of the sole executive officer (for the sole founder-manager).

What to write for an individual entrepreneur, on the basis of which document does the party act? After all, he has neither a charter nor a decision on the transfer of management powers. And an entrepreneur cannot appoint himself as a director either.

We have already found out above that the only official document that confirms the status of an individual entrepreneur is a registration certificate or a USRIP registration sheet. This is the answer to the question on what basis the individual entrepreneur acts in a transaction.

If the entrepreneur is registered before 2022, then the preamble refers to the registration certificate. Example: “IP Sergeev Oleg Vasilievich, acting on the basis of a certificate of state registration of an individual as an individual entrepreneur (series, number) dated …”.

For an individual entrepreneur registered later and who received not a certificate, but a USRIP entry sheet, the wording will be different. For example, like this: “IP Sergeev Oleg Vasilyevich, acting on the basis of the entry sheet of the Unified State Register of Individual Entrepreneurs dated …”.

Please note that you must refer to the very first sheet of the Unified State Register of Entrepreneurs, the date of issue of which corresponds to the date of registration of the entrepreneur. The fact is that the entry sheet is drawn up not only during registration, but also in the future when information in the state register changes.

Let’s assume that in 2022 the individual entrepreneur added OKVED codes, and this fact is confirmed by a record sheet issued also in 2022. At the same time, registration of the entrepreneur took place in 2022. If you refer to the last sheet of record, then the counterparty may have a question: “Why is the document on the basis of which the individual entrepreneur acts when concluding an agreement dated 2022, if he has been working since 2022?”