Decoding KBK 182 10213 160

KBK is encrypted information about the purpose of the payment, its administrator, recipient, and so on. In fact, the KBK is the main detail according to which the tax office will distribute your money to pay certain payments. A complete list of all KBK operating in 2022 was approved by Order of the Ministry of Finance of the Russian Federation dated 06/08/2020 No. 99N.

The decoding of KBK 182 10213 160 looks like this:

- 182 - denotes the payment administrator, in this case it is the Federal Tax Service;

- 102 - tax income in the form of contributions to compulsory social insurance;

- 02101 - denotes the item and subitem of income, in our case this is receipt in the form of payments for compulsory medical insurance;

- 08 - the recipient is the Compulsory Medical Insurance Fund, and not the Pension Fund or the Social Insurance Fund;

- 2013 - means that the money was transferred to pay penalties, and not fines or compulsory medical insurance contributions themselves, which arose from January 1, 2022;

- 160 - income category: insurance premiums.

Decoding KBK 18210202140061100160

All CBCs matter. Groups of numbers in them help the recipient see who to transfer the money to, what kind of payment it is, what budget revenues it generates. The list of KBK with decoding was approved by the Ministry of Finance in order No. 99n dated 06/08/2020, which is periodically updated.

Code 182 10200 160 means that the money under the payment order will be transferred to the Federal Tax Service and will generate tax revenue in the form of contributions to compulsory social insurance, namely contributions to pension insurance.

From the transcript of the KBK given in the order of the Ministry of Finance, you can find out that:

- KBK is intended for payment of fixed payments by individual entrepreneurs to the Pension Fund;

- Payment according to the code forms the future insurance pension;

- KBK is only suitable for payments for billing periods before January 1, 2022.

This means that if you transfer a payment using this BCC that does not meet the specified conditions, the money will not reach its destination.

How to calculate penalties on contributions

For late payment of compulsory medical insurance contributions, the tax office will charge a penalty. The calculation formula is as follows:

Penalty = Days of delay * Arrears * Interest rate, where

- days of delay - the difference in days between the day of actual payment of the fee and the day when it had to be paid by law;

- arrears - the amount of the compulsory medical insurance contribution that was not paid on time;

- interest rate - for calculations, the key rate of the Central Bank of the Russian Federation valid at the time of delay is used (Article 75 of the Tax Code of the Russian Federation); The current rate can be found on the official website of the Bank of Russia.

The rate also depends on the number of days of delay:

- from 1 to 30 days inclusive - the penalty will be calculated based on 1/300 of the rate of the Central Bank of the Russian Federation for each day of delay;

- from 31 days or more - based on 1/150 of the rate of the Central Bank of the Russian Federation for each day of delay.

Important! For individual entrepreneurs with employees, penalties will always be calculated based on 1/300 of the rate of the Central Bank of the Russian Federation, regardless of the number of days of delay (clause 4 of Article 75 of the Tax Code of the Russian Federation).

The Federal Tax Service will charge penalties until the employer pays compulsory medical insurance contributions. But the maximum amount of the penalty cannot exceed the amount of the arrears itself (clause 3 of Article 75 of the Tax Code of the Russian Federation). However, this rule does not apply to arrears that arose before December 27, 2022.

KBK 18210202101082013160: what does the 2022 tax mean?

The code is used to pay penalties on insurance premiums for compulsory health insurance, credited to the Federal Compulsory Health Insurance Fund, for periods starting from January 1, 2022. KBK 18210202101082013160 must be indicated in field “104” of the payment order.

Contributions to the Compulsory Medical Insurance Fund are calculated by employers (organizations, individual entrepreneurs, individuals) who use hired labor from the amounts of employee income. The due date for payment of contributions is no later than the 15th day of the month following the accrual period. If payment is late, the Federal Tax Service will impose financial sanctions in the form of penalties, which you can calculate and transfer yourself.

Penalty amount

Let us remind you that for organizations and individuals, penalties are accrued differently from October 1, 2017 (clause 4 of Article 75 of the Tax Code). Formula for calculating penalties:

Pe = N x St x D, where

Pe - fine;

N – amount of unpaid tax or fee;

D – number of calendar days of delay.

St - refinancing rate (key rate of the Central Bank), which is multiplied by the corresponding coefficient (for individual entrepreneurs and individuals it is equal to 1/300 of the refinancing rate in force during the period of delay in payment; for organizations - the first 30 days of delay 1/300 of the refinancing rate, from 31 days of delay payment - 1/150).

Financial sanctions in the form of penalties are not applied if:

- tax authorities seized property (clause 3 of article 75 of the Tax Code);

- the court suspended transactions on the accounts as an interim measure (clause 3 of Article 75 of the Tax Code);

- the arrears arose as a result of the implementation of written explanations from the Federal Tax Service or another authorized government agency on the procedure for calculating and paying contributions and taxes (clause 8 of Article 75 of the Tax Code).

An example of calculating penalties for insurance premiums for compulsory medical insurance

For example, Bravo LLC had to pay insurance premiums for compulsory medical insurance for May 2022 by June 15, 2022. In fact, the arrears of 100,000 rubles were repaid only on July 23, 2021.

The current rate of the Central Bank of the Russian Federation for a given time interval is 5.5%. We calculate the penalties:

( 30 days * 100,000 rub. * 1/300 * 5.5% ) + ( 8 days * 100,000 rub. * 1/150 * 5.5%) = 843 rub. 33 kopecks

Important! Starting from December 28, 2022, the Day of Repayment of Arrears is considered a day of delay (Clause 3, 7, Article 75 of the Tax Code of the Russian Federation). Before this date, the day of repayment of the debt was not considered a day of delay (letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 No. 03-02-07/2/39318, Federal Tax Service of the Russian Federation dated December 6, 2017 No. ZN-3-22 / [email protected] ).

To calculate penalties for taxes and contributions, we recommend a calculator on the Kontur.Accounting website.

KBK-insurance premiums (old periods)

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for compulsory health insurance in a fixed amount, incl. 1% contributions* *Order of the Ministry of Finance dated 02/28/2018 No. 35n abolished the separate BCC for payment of 1% contributions, previously introduced by Order of the Ministry of Finance dated 12/27/2017 N 255n. Those who have already transferred 1% to a separate KBK will most likely have to clarify the payment | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

| Type of insurance premium | KBK (for contribution) | KBK (for penalties) | KBK (for a fine |

| Insurance premiums for OPS | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for VNiM | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0211 160 | 182 1 0211 160 | 182 1 0211 160 |

| Insurance premiums for compulsory health insurance in a fixed amount | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (1% contributions) | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0211 160 | 182 1 0211 160 | 182 1 0211 160 |

True, the BCC for additional contributions to compulsory pension insurance for periods expired before 01/01/2017 is the same as for periods starting from 01/01/2017.

BCC options for contributions to the Compulsory Medical Insurance Fund

KBK 182 10213 160 is only suitable for paying penalties. To transfer the contributions themselves or fines associated with payments to the Compulsory Medical Insurance Fund, you need to use other BCCs:

- contributions - 18210202101081013160;

- fines - 18210202101083013160.

Individual entrepreneurs also pay insurance premiums for compulsory medical insurance “for themselves.” These payments also have their own BCCs:

- individual entrepreneur contributions “for himself” - 182 1 02 02103 08 1013 160;

- penalties on individual entrepreneur contributions “for oneself” - 182 1 02 02103 08 2013 160;

- fines on individual entrepreneur contributions “for oneself” - 182 1 02 02103 08 3013 160.

Payment with an incorrect BCC will result in an overpayment for one code and a debt for another. For example, instead of the contribution itself, you can accidentally pay “non-existent” fines for compulsory medical insurance contributions. At the same time, arrears will arise on the contributions, on which penalties will begin to be charged.

Important! If you notice an error in the KBK, immediately write a letter to the Federal Tax Service to clarify the details of the payment order. Then the payment will be credited to the correct BCC, provided that the main details (recipient, treasury account number, etc.) are indicated correctly.

KBK for paying penalties on insurance premiums to the Pension Fund for individual entrepreneurs for themselves

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance in the Pension Fund of the Russian Federation for individual entrepreneurs for themselves (fixed amount, based on the minimum wage) | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

| Penalties and fines on insurance contributions for pension insurance to the Pension Fund for individual entrepreneurs for themselves on income exceeding 300 thousand rubles. | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

In FFOMS

Filling out a payment order with KBK 182 10213 160

The payment for the penalty will be slightly different from the payment for compulsory medical insurance contributions. You can make a payment on paper or electronically. The second option is much faster and more popular. When filling out, pay attention to several points:

- field 101 - for legal entities we indicate the code “01”, and for individual entrepreneurs - “09” (from October 1, 2022 - “13”);

- field 104 - to pay penalties we enter KBK 182 10213 160, if we pay the fees ourselves, then 182 10213 160, and if fines - 182 10213 160;

- field 105 - enter OKTMO;

- field 106 - for the contributions themselves we indicate “TP” (current payments), but with penalties the story is different, depending on the situation, you can use three designations: “ZD” - when paying off penalties voluntarily;

- “TR” - payment of penalties at the request of the Federal Tax Service;

- “AP” - payment of penalties according to the inspection report;

- “ZD” - set 0 or indicate a specific month if the penalty was accrued for a specific month;

- “ZD” - set to 0;

- “ZD” - set to 0;

In the purpose of payment, you can indicate: “Penalties on insurance premiums for compulsory health insurance.”

KBK taxes: for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK taxes: for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of CFC profits | 182 1 0100 110 |

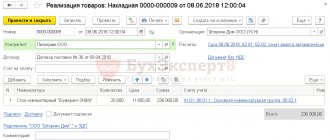

An example of filling out a payment order for KBK 182 102 02101 08 2013 160

Below is an example of a payment order for the voluntary payment of penalties on insurance premiums to the Compulsory Medical Insurance Fund.

To fill out payment orders, we recommend the cloud service Kontur.Accounting. The recipients' details will be automatically saved in the system; you just need to write them down once. The program will not allow you to create a payment slip if you forgot to fill out any field. And created orders can be uploaded directly to the client bank. We give all newbies a free trial period of 14 days.