Reasons for writing off computer equipment: examples

Our publication is devoted to the disposal of office equipment included in the OS, so we will add just a few words about how to write off a computer costing less than 40,000. Such equipment is usually included in the inventory and is written off as costs during commissioning.

The main criterion for writing off OS is the loss of necessary useful qualities used for production purposes. The classic reasons for such a loss are physical and moral wear and tear, as well as breakdown or damage that cannot be eliminated. Legislators have approved very short useful lives (USL) for depreciation calculations for office equipment - 3 - 5 years. We will not dwell on physical wear and tear, since it is associated with an understandable situation when the SPI of office equipment has expired and write-off is carried out legally. Let's talk about obsolescence.

Office equipment, to a much greater extent than other groups of operating systems, is subject to rapid obsolescence. This is due to the rapid development of computer technology and often leads to the fact that the company’s fleet of working computers requires modernization or complete renewal in order to make production profitable. And periodically repeated modernization of equipment does not always satisfy the increasing requirements of new software products, so we can talk about obsolescence of the object.

Reasons and formulations

A common reason why furniture in an organization is scrapped is usually because chairs, tables and other interior furnishings lose much of their useful features. As a result, their further exploitation becomes impossible. However, when drawing up documents for write-off, more specific characteristics and wording are required.

How to reflect in accounting the purchase of furniture accounted for as part of the inventory?

Considering the issue of writing off furniture further, let us turn to the rationale for these actions:

- Write-off due to breakdown or wear and tear. At the same time, financial and labor costs for repairs, elimination of breakdowns, and replacement of spare parts are close to the cost of a similar product on the market or even exceed it. It is clear that in such conditions it is more profitable to write off a piece of furniture and, possibly, dispose of the usable spare parts remaining after liquidation (for example, from an office chair).

- Write-off due to “obsolescence”, when property becomes obsolete when more modern models of similar property appear on the market, with more efficient performance characteristics. In relation to furniture, we can talk about the desire of management to find a new design solution for an office or workspace and complement the new design with appropriate furniture.

Here are the formulations that can be used when drawing up a write-off act in a particular case. Note that defects related to physical wear and tear (clause 1) can be divided into defects that prevent further operation and defects in appearance.

to reflect the write-off of furniture in accounting ?

Appearance defects:

- abrasions, faded areas, other color defects;

- defects in external coatings: mechanical damage to the upholstery, tears, damage to the paint layer of the surface;

- indelible stains.

Mechanical defects and damage:

- changes in the original shape of the product, surface deformations;

- breakdowns of mechanical parts of furniture that make this product unsuitable for use (mechanisms of office chairs, cabinets);

- breakdowns and loss of individual parts and main structures that impede further operation (handles, drawers, walls).

Operation with them present is impossible.

Important! All of the above reasons must be indicated in detail in the write-off act.

Examples of wording in the act:

- destruction of the varnish layer, the appearance of light spots on the varnish layer due to thermal, chemical effects of household chemical products;

- swelling of wooden parts and chipboard parts;

- corrosion of metal parts and components;

- loosening and unsticking of joints of furniture parts, appearance of cracks and gaps in joints due to their wear;

- mold damage to upholstery, facing materials, furniture flooring;

- formation of cracks, swelling, delamination on parts and components of the product, etc.

If you want to purchase new furniture and replace old furniture that does not have obvious defects, you can refer in the act to government decree No. 720 dated June 16, 1997. This document contains a list of durable goods that over time may pose a threat to the consumer. The manufacturer is obliged to set a service life for them. After the specified period, the products must be written off.

The list contains not only the names of upholstered and office furniture, but also various plumbing fixtures, including furniture (sets) for sanitary purposes.

The reason can be formulated as follows: “Written off due to the expired service life established by the manufacturer. According to Decree No. 720 of 06/16/97, it poses a potential threat to the health of workers and the environment. A technical passport indicating the service life is attached to the act.”

How to determine aging equipment

But it's not that simple. The aging of a computer requires confirmation by facts, which may include the following:

- with normal processing of information volume in 1 hour, the computer does this for several hours;

- The purchased program cannot be installed on an existing computer due to its outdated parameters, etc.

However, the impossibility of modernization must be proven. The argument here may be the fact that the production of components compatible with the existing computer configuration has ended. In addition, when the service life of the unit specified by the manufacturer expires, its failure can cause significant harm to production.

Requirements for recycling PCs and equipment for companies and individual entrepreneurs

Failed, obsolete electronic equipment is a separate type of waste that is prohibited from being buried in landfills from January 1, 2022. Such waste includes computer, electronic, and optical equipment.

Computer equipment that is subject to recycling means:

- monitors;

- keyboards;

- controllers;

- Acustic systems;

- printers;

- copiers;

- scanners;

- projectors;

- microphones;

- routers;

- graphics tablets;

- MFP, etc.

The order of the Russian Ministry of Natural Resources on the recycling of electronic equipment came into force on March 1, 2022. It clearly states the obligation for legal entities to transfer such waste to companies that, on the basis of a license, carry out activities for the collection, transportation, processing, processing, neutralization and storage of waste classified as “Computer, electronic, optical equipment that has lost its consumer properties.”

A company that processes waste electronic equipment must have an appropriate license, which confirms that it has the capacity for transportation, processing, storage, and disposal.

The company is obliged to transfer old and unnecessary equipment for disposal within 11 months from the date of formation.

Reasons for computer breakdown for write-off

The inability to use the unit due to breakdown also becomes a reason for write-off. This could result in a failure:

- expensive components of the system unit, the reason for which was a power surge or ingress of water, dust, etc.;

- microcircuits due to electrolyte spillage from a depressurized Bios battery, or due to a stabilizer failure;

- body blocks due to deformation, etc.

In case of such malfunctions, writing off computer equipment is possible if repairs are unrealistic or their cost is similar to the cost of purchasing a new unit. The write-off procedure begins with the preparation of a conclusion about the presence of a malfunction in office equipment. We will present the write-off algorithm below.

System unit malfunctions for write-off

Online cash register: who can take the time to buy a cash register Individual business representatives may not use online cash register until 07/01/2019.

However, for the application of this deferment there are a number of conditions (tax regime, type of activity, presence/absence of employees). So who has the right to work without a cash register until the middle of next year?

The main causes of failures of system unit devices

Depressurization of the Bios battery and, as a result, the pouring of electrolyte onto the Bios4 chip. Cracking of the multilayer fiberglass laminate of the multilayer motherboard 5. Combustion due to a voltage surge in the connection Power supply - processor - Memory - motherboard Monitors + 1.

Attention Damage to the line transformer as a result of conductive dust entering the monitor. As a result, 15,000 volts pass through the monitor microcircuits. 2. Damage to the retardation line in the color block.

The deceleration line cracked, and the fragment damaged the CRT, resulting in depressurization - color rendering disturbance and geometric distortion - failure of the video signal generation and processing unit - the power supply died, as a result of damage to other modules, the monitor burned out and cannot be repaired, Monitors1 . Moisture getting into the monitor while it is running2.

Reasons for decommissioning computers

It is important As an individual entrepreneur on PSN, confirm that he does not operate and may not pay contributions. As a general rule, individual entrepreneurs are required to pay “medical” and “pension” contributions for themselves from the moment of registration until deregistration as an entrepreneur.

However, there are certain periods during which you do not have to pay contributions for yourself if there is no business activity.

However, these reporting forms are list-based, i.e. contain information about all employees.

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

PC malfunctions for write-off

Old “profitable” errors can sometimes be corrected in the current period. If an organization discovers that in one of the previous reporting (tax) periods an error was made when calculating income tax, it can be corrected in the current period only if two conditions are met.

So, for such persons you need to take both SZV-M and SZV-STAZH!

But be careful: the procedure for paying for “children’s” sick leave remains the same!

Recycling of computer equipment

Examples of malfunctions include:

- burnout of several expensive components of the system unit due to a power surge (moisture, dust, etc.),

- physical deformation of the system unit case, leading to breakage of the elements located inside it,

- depressurization of the Bios battery and spilling of electrolyte onto the microcircuits,

- failure of the voltage stabilizer, leading to burnout of microcircuits, etc.

In the presence of such faults, writing off computer equipment is feasible only in cases where repair is impossible or the cost of repair is comparable to the cost of purchasing similar new equipment. An organization can draw up a conclusion about the causes of the breakdown, as well as about the possibility of repair and its cost, if it has specialists on staff with the necessary qualifications.

We write off system units and CRT monitors

Cathode ray tube tube cracking (improper storage or temperature)3. Failure of the high-voltage protection of the line transformer, and as a result - combustion of all electronics.4.

Defocusing of the mixing system and, as a result, loss of phosphor glow (full or partial) Hub As a result of swelling and loss of capacity of the electrolytic capacitor of the power supply, the supply voltage increased 4 times (instead of 9 volts - 36 volts) which led to failure of the electronic filling of the Hub and as a result, to his inappropriate behavior. It cannot be repaired, since the element required for repair is not supplied by the manufacturer outside of finished products.” Klava You can also write it like this.”1. When storing the keyboard near a heat source, thermal deformation of the sensitive elements of the keyboard occurred. “Cheap keyboards have flexible contact groups inside.

Reasons for failure of system units

They become deformed due to temperature and no longer coincide with the contacts. This cannot be cured.2. When sweet liquid got into the keyboard, the contact groups stuck together.

Mechanical release is impossible due to damage to the contact groups. Soaking leads to corrosion of contact groups.3.

When there was a power surge in the 220-volt network, and due to the fact that the system unit used a cheap power supply that was not equipped with protection, a sudden voltage drop occurred, which resulted in the burnout of the peripheral controllers, namely the keyboard and mouse controller.

It is recommended to replace the power supply and write off burnt-out devices. Printer Printer heads are clogged due to the use of chemically incompatible ink. Printer heads are replaced along with the carriage.

The carriage along with the mechanism. The cost of repairs in this case is higher than the cost of a new printer. Xerox1.

System unit malfunctions for write-off

From all of the above, we can summarize that the most unreliable elements of a computer are power supplies, hard drives and motherboards with coolers. All these elements contain both power supply transistors and moving parts - fans, motors.

In 2006-2007, the analytical company Gartner published the results of a 4-year study, which show that, although in recent years personal computers, thanks to the efforts of manufacturing companies, have become more and more reliable, every twentieth desktop computer and every sixth laptop require repair within a year from the date of purchase.

As the elements wear out, the failure rate increases again, and the period of element aging begins (after 1 year of operation). Thus, it can be argued that if the device does not fail during the first weeks of operation, then it should work for a year, after which its aging will begin. The failure rate also depends on operating conditions. Elevated temperatures, dust, and vibrations have a negative impact on any equipment. According to statistics, the most unreliable computer components are those that contain mechanical connecting parts: connectors, switches, contacts, fans, motors (in particular hard drives and optical drives). Then transformers, power transistors and diodes (usually in power circuits), and electrolytic capacitors fail. The optical axis of the CRT monitor is bent3. The magnetic disk drive reader is demagnetized4. Destruction of the printed circuit board of RAM chips... PVOzerski © (2005-08-10 12:05) [6] Well, there’s something like “faulty motherboard”, “central processor”, “mathematical coprocessor”... Here it’s important to know 3 things: 1) how qualified are those who will read this; 2) how interested/not interested they are in writing off; 3) whether they will check whether what is written corresponds to reality. BTW, don’t forget to remove everything useful from your computer, including floppy drives, connecting cables and cables

Source: https://juristufa.ru/2018/04/19/neispravnosti-sistemnika-dlya-spisaniya/

Accessory equipment malfunctions

Monitors, keyboards, and mice also break down, and these faults may or may not be fixable.

The cause of monitor failure may be damage to the matrix or screen processor. The mouse and keyboard are most susceptible to breakdowns (due to burning, sticking or oxidation of contact groups, mechanical failures, etc.) and are replaced quite often. Often the result of breakdowns of auxiliary elements is the failure of the system unit.

The process of writing off components for office equipment is similar to writing off a system unit.

Mouse problems

- After loading Windows, the mouse does not work. Typically, most users check the cable connection. A possible reason is the “death” of the mouse after connecting to a switched on computer. This happens especially often with PS/2 mice. It would be a good idea to check the device connection in the BIOS, similar to the keyboard.

- Poor and unstable cursor movement or movement when the mouse is stationary. This often happens due to contamination of the LED or unevenness of the surface on which the mouse moves.

- If additional keys do not work, you can try reinstalling or updating the driver.

- For wireless mice, you should follow the same operating rules as in the case of a keyboard regarding the location of the device and sensors.

Write-off of office equipment and computers in commercial companies

So, in order for unused equipment not to be listed on the balance sheet, increasing the amount of wear and tear and not benefiting production, it must be written off.

The write-off rules for merchants are very simple. The legislator does not oblige them to involve specialists to assess the suitability of the equipment from outside, and in order to formalize the write-off of office equipment, a commission should be created from the company’s personnel and its conclusion on the write-off of the computer should be validated, which specifies the causes of breakdowns, the possibility and cost of repairs or the irrationality of its implementation . At the discretion of the head of the company, you can attract a specialized organization or a third-party appraiser if the company does not have such specialists.

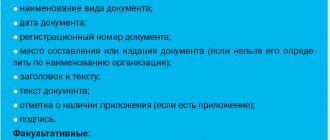

Based on the conclusion, they draw up an act of writing off computer equipment. There is a unified form No. OS-4b “Act on the write-off of groups of fixed assets”, which indicates all the technical characteristics of several objects, the initial and residual (if any) cost of each, the amount of accrued depreciation, the reasons for disposal and information on the presence of precious metals and transfer for recycling. Legislators do not oblige the use of an act of form No. OS-4b; companies have the right to develop their own document with the mandatory details, but practice has shown that the standard form of an act for writing off computer equipment is more often used, a sample of which can be downloaded below.

Reasons for writing off a mouse in the write-off act

Troubleshooting: The most common mouse problem is the scroll wheel not working. The reason may lie in the lack of drivers for the mouse, or in incorrect settings. In “Start”, open “Control Panel”, there is a “Mouse” item.

Let's check if everything is configured correctly. The main problem may be a broken wheel. This problem can be solved in a workshop by simply replacing the wheel. Or you can buy a new mouse: more beautiful and more convenient than the old one.

PS/2 or USB mouse does not respond. First, let's look at the older model of PS/2 mice. A common cause is a damaged connector. Check that all pins are intact. If the keyboard does not work along with the mouse, then the problem is broken PS/2 connectors. In this case, you should switch to a USB mouse and keyboard. Now let's disassemble the USB mouse. If the light at the bottom of the mouse does not light up (usually red), this means that the USB output is faulty.

Recycling of office equipment

Computer devices contain small amounts of precious metals and substances that are dangerous to others.

When purchasing and commissioning equipment, a company must take this circumstance into account. After the equipment is written off, it is sent to specialized enterprises for disposal. This rule must be observed by all organizations, and the procedure for carrying out the disposal procedure is approved in the set of documents for write-off. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Nuances of writing off office equipment for state employees

In order to write off computer equipment that is an object of fixed assets, the institution must organize a special permanent commission (clause 34 of the Unified Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n). Write-off of fixed assets is carried out on the basis of its decision.

At the same time, in order to make a decision to write off computer equipment that is an object of accounting for fixed assets, a budgetary organization must check compliance with several criteria (clause 46 of Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 257n), namely, that it:

- does not exercise control over the OS object being written off;

- does not incur expenses associated with its disposal (ownership and (or) use);

- does not have the right to receive economic benefits and benefit from the disposal (possession or use);

- does not participate in the disposal (ownership and (or) use) of a retired object registered on the register,

- does not use it to the extent envisaged upon its recognition;

- assessed the amount of income (expense) from disposal of the object;

- assessed the projected economic benefits or useful potential associated with the object, as well as the projected (incurred) costs (losses) associated with its disposal.

The commission's decision to write off a computer from budget accounting is formalized in an act on the write-off of non-financial assets (except for vehicles) (f. 0504104). The form of the act was approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n.

- The act must be agreed upon with the founder of the budgetary organization if the property being written off is attributed to particularly valuable property that is assigned by the owner to the budgetary institution or which was acquired by the budgetary institution at the expense of funds allocated by the owner for its acquisition (clause 3 of Article 298 of the Civil Code of the Russian Federation). Thus, the Ministry of Health of Russia, the Ministry of Labor of Russia, the Ministry of Sports of Russia, and Rosreestr of Russia included computers in the list of especially valuable movable property, regardless of its value. Therefore, if these structures have provided a budget institution with computers, then their write-off must be agreed upon with the founders.

- If particularly valuable movable property was acquired using funds received from income-generating activities, a budgetary institution has the right to dispose of it independently (letter of the Ministry of Finance of Russia dated September 26, 2012 No. 02-06-10/3912). Coordination of the write-off of such property with the founder is not required.

After the act is signed by the head of the budgetary organization, actions are taken to dismantle and liquidate the fixed assets, and only after this the write-off is reflected in accounting on the basis of the act (clause 52 of the Unified Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n).

Functions of the write-off commission

If a computer breakdown occurs, in order to write it off, you must contact the commission for write-off of fixed assets and inventory items.

The commission can be permanent or temporary. Her competence includes:

- inspection of computer equipment subject to write-off, using the necessary technical documentation and accounting data, as well as establishing suitability for further use;

- establishing the reasons for equipment write-off;

- the possibility of using individual components/parts/materials of the disposed object and their assessment based on the current market value;

- control over the removal of non-ferrous and precious metals from written-off computer equipment, determination of weight and delivery to the appropriate warehouse;

- drawing up an act for writing off an object (an organization can use the form of act No. OS-4 or a form developed independently and approved in the accounting policy).

Further, using a direct link from our website, you can freely order the appointment of a commission for writing off inventory and fixed assets.

SAMPLE ORDER FOR WRITTEN OFF COMPUTER EQUIPMENT

Replacing a computer mouse: how to reflect it in accounting

, there is no need to separately record the write-off of the old mouse . After all, the latter as a separate object was never taken into account. An old mouse (removed during repair) should be included in the balance sheet only if it can be used for repairs or in another way. Otherwise, if its use does not provide for the receipt of future economic benefits, it is not recognized as an asset, and therefore is not subject to crediting to the balance sheet ( clause 1, section II of the National Regulation (standard) of accounting in the public sector 123 “Inventories”, approved by order Ministry of Finance dated October 12, 2021 No. 1202

).

As for replacing such components of a computer system as a keyboard or mouse, this work should be considered as repair of a computer system. This is explained by the fact that the main purpose of such work is, first of all, to restore and maintain the operability of a fixed asset object. Moreover, replacing a mouse or keyboard, even with a more modern one, has virtually no effect on the initially assessed level of performance of the computer system and its usefulness potential. Taking this into account, the costs for the purchase of these components must be attributed to the expenses of the corresponding reporting period ( clause 2 of section III NP(S)BU 121

and

paragraph 4 section.

VI Method of recommendations ).

Accounting for personal computers in a government institution

From Instructions No. 180n, the wording in the comments to Article 340 “Increasing the cost of inventories” of KOSGU is relevant to the topic under discussion. According to it, Article 340 includes the costs of paying for contracts for the acquisition (manufacturing) of objects related to inventories, including spare and (or) components for machinery, equipment, office equipment, computer equipment, telecommunication systems and local computer networks , systems for transmitting and displaying information, protecting information of information and computing systems, communications, etc.

- based on documents, the submission of which to the OFK is mandatory, it is not always possible to control the choice of articles 310 or 340 of KOSGU;

- refusal to authorize the payment of a monetary obligation when there is doubt about the correct choice of Articles 310 or 340 of KOSGU, when there are no direct instructions in the legislation, is illegal.